BUYING OPPORTUNITIES

Overview

Grains finish the day mostly higher, with corn leading the way up 6 cents, beans up 4/12, and Chicago wheat up almost a nickle.

This morning we saw another sale of 120k metric tons of beans to unknown. This was likely to China.

We have gotten some pretty good rains for the Midwest. Getting rain now is actually bullish and far from bearish. Bears point out that we need to raise the river levels. Rain isn’t going to improve crops here, we are passed that window. If anything it just slows down harvest, worries crushers, and allows the US to sell more beans to China.

Wheat a little stronger today on the idea that we may start to see an uptick in global demand. As it looks like Russian wheat may not be the cheapest on the market anymore. Long term this is friendly, but short term the US may not get a ton of the business.

StoneX's most recent yield estimates showed 175 corn and 50.1 beans. However, the Chief Commodities Economist, Arlan Suderman said that his yield models had corn dropping another 2 bushels this week, down to 171. His bean estimates were left unchanged at 50, however he said more yield loss was highly likely.

The highly respected Dr. Cordonnier has his estimates set at 173 for corn and 49.5 for beans, with a neutral to lower bias moving forward.

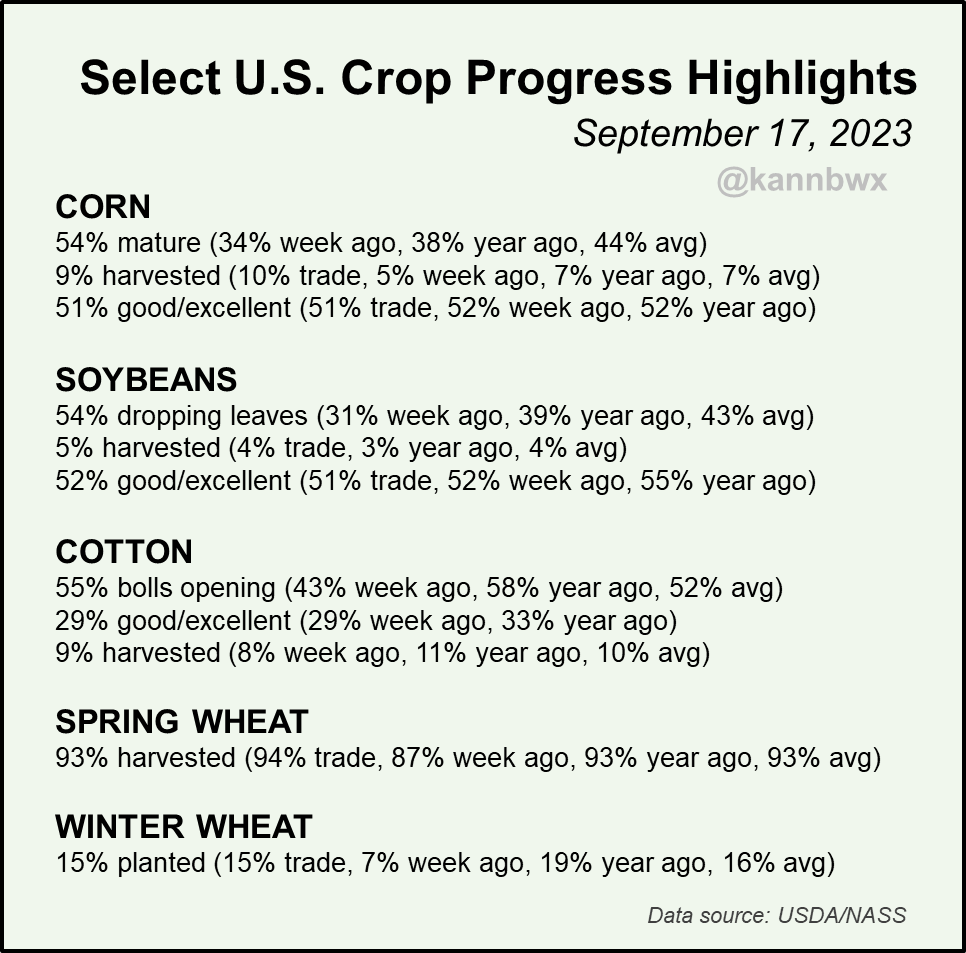

If we take a look at the crop progress report from Monday. Corn maturity is running 16% ahead of last year and 10% ahead of our average. While 54% of beans are dropping leaves compared to 39% last year. This confirms the brutal heat and dryness we saw to close out August and start September resulted in some early plant death, which helps speed up harvest.

Chart Credit: Karen Braun

Like we mentioned in yesterday's audio, the areas that are harvesting at a fast pace and showing some better results than normal, are the same areas who usually lack. The areas that were hit with that brutal heat and dryness are the areas that usually carry our yields, such as Iowa. So I’m expecting more disappointing results when the combines get rolling in those areas.

Looking short term here, we could be in for some more harvest pressure over the course of the next week or so. So currently I’m remaining patient as we will likely be getting a very good buying opportunity over the next 1 to 2 weeks.

Just a reminder that CBOT options expire this Friday. The day before and the day of option expiration often results in down days for futures. So keep that in mind and don’t be surprised to see a little bit of pressure to close out the week.

We also got yet another wild 2023 headline rumor. The rumor is that the government may be shutting down at midnight on September 30th, the end of their fiscal year. If that happens we may not get the USDA production and supply & demand report on October 12th. The markets usually don’t like uncertainty, so if this happens it could lead to uncertainty and a little more selling rather than buying. Just something to look out for.

The next big market mover is September 29th, 9 days from today. Where we get the USDA quarterly stocks report. Will have to see if we get any surprises.

Bottom line here, don’t be surprised if we see more pressure over the course of the next week or so. We will be getting some great buying opportunities very soon if they are not already there.

Now let's dive into today's update.

Today's Main Takeaways

Corn

Corn futures lead the way here today. Now up around 15 cents from yesterday's lows.

CONAB released it's first estimates for Brazil's new crop corn production. They see planted corn acres dropping by -5%, leading to next year's production dropping by -9% from this year.

The USDA currently has Brazil old crop production at an all time high of 137 MMT. With Brazil new crop production at 129 vs CONAB's recent 119.8 MMT. This is great for bulls, as bears are always seeming to point out South America taking export space and of course we have the poor demand. Brazil producing less is very friendly looking long term.

As we mentioned earlier, we haven’t yet got much results from the major players in terms of early yield results. The market knows the states down south have seen some strong early numbers, but just wait until they get into states like Iowa, Minnesota, etc.

I am hearing more and more people as well as experts agree that yield is likely below 170 bpa.

Only 1 time out of the past decade have the harvest lows not be made in August or September. That was in 2014 where we made our lows on October 1st.

Short term I’m expecting…..

The rest of this is subscriber only. Please subscribe to continue reading and receive every exclusive daily update. Scroll to check out ones you might’ve missed.

In today’s update we will be going over what we should be expecting short term and long term for all of the grains. Possible buying opportunities. Why beans have such a high long term upside. Takes from people across the Ag Industry and why beans are sub-50. The lows in wheat & more.

Want to get 50% OFF our updates? Subscribe Here

BECOME A PRICE MAKER

TRY 30 DAYS FREE

Updates You Might’ve Missed

9/19/23 - Audio Commentary

CAN WE FIND DEMAND?

9/18/23 - Market Update

HARVEST PRESSURE

9/15/23 - Audio

BECOMING COMFORTABLE IN THE MARKETS

9/14/23 - Market Update

YIELDS, DROUGHT, & CHINESE APPETITE

9/13/23 - Audio Commentary

$10 WHEAT/$6 CORN/$15 BEANS BY THE END OF THE YEAR?

Read More

9/12/23 - Audio & Report Recap

BEARISH REPORT, BUT SETS THE STAGE FOR HIGHER PRICES

9/11/23 - Audio Commentary

CHEAP PRICES CURE CHEAP PRICES

9/10/23 - Weekly Grain Newsletter

PREPARING FOR THE USDA REPORT

9/8/23 - Audio Commentary

WILL USDA REPORT BOOM OR BUST?

Read More

9/7/23 - Market Update

BEANS GIVE BACK GAINS, TRADE PREPARES FOR USDA

9/6/23 - Audio Commentary