BULLISH & BEARISH FACTORS DRIVING GRAINS

Overview

Great close today in the grains as both corn and beans close higher.

Soybeans rallied +15 cents off their lows after trading down double digits to start the day and posted a new high close for this move.

Wheat on the other hand continues to struggle, nearly posting a new low close.

Weekly Price Changes:

Corn: -4 cents

Beans: +12 1/4 cents

Chicago Wheat: -9 1/2 cents

KC Wheat: -23 3/4 cents

MPLS Wheat: -17 cents

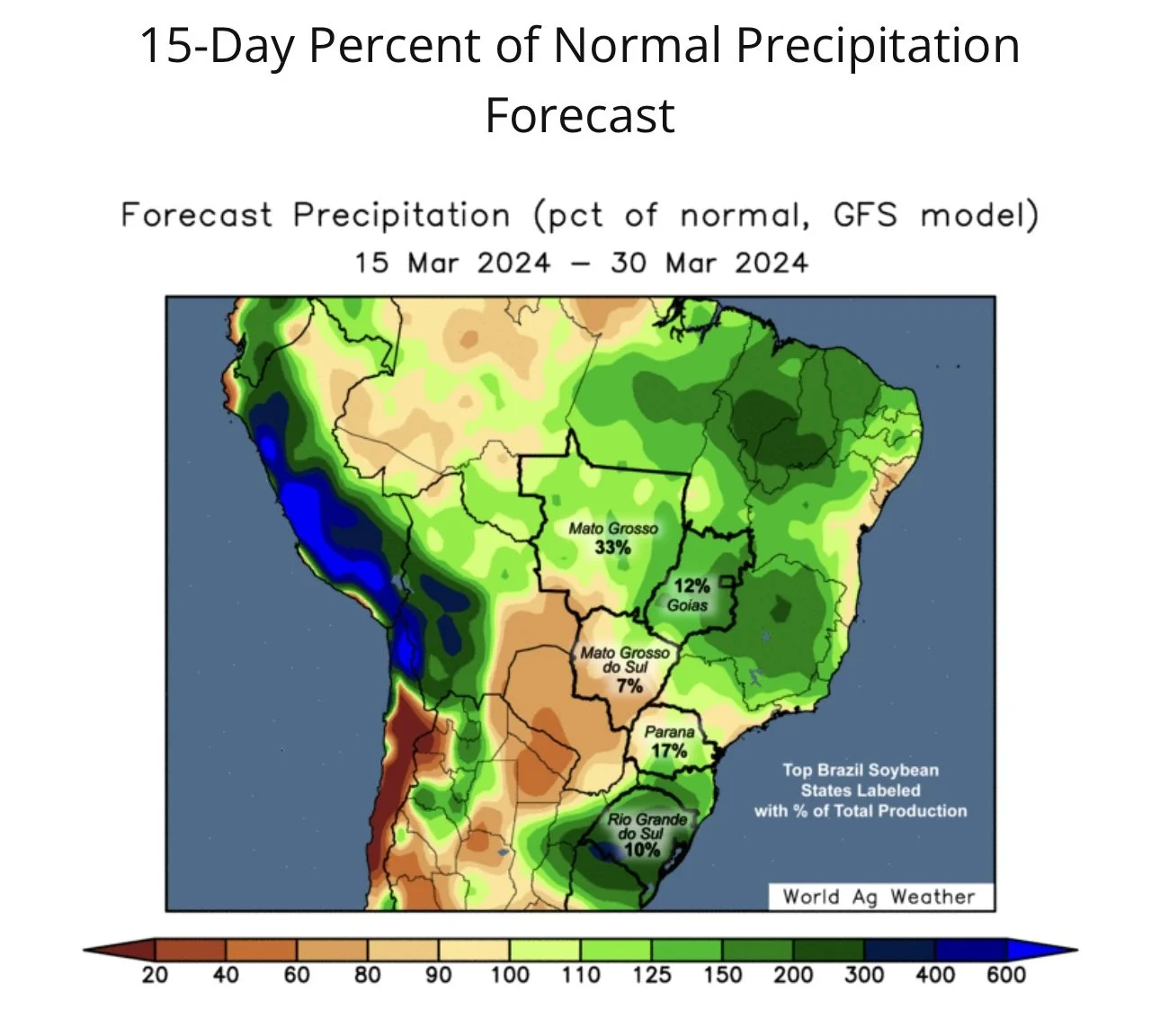

Initially corn and beans saw pressure from some recent Brazil rain that is expected to fall into the weekend.

Corn got a little boost from a USDA flash sale of 125k MT to unknown this morning. This adds on to yesterday's 100k MT sale to Mexico yesterday.

The NOPA crush report today was huge and sharply higher than expected. A record for the month. Coming in at 186.19 million bushels, far above the 178.1 estimates. A +12.6% increase from last year's 165.4.

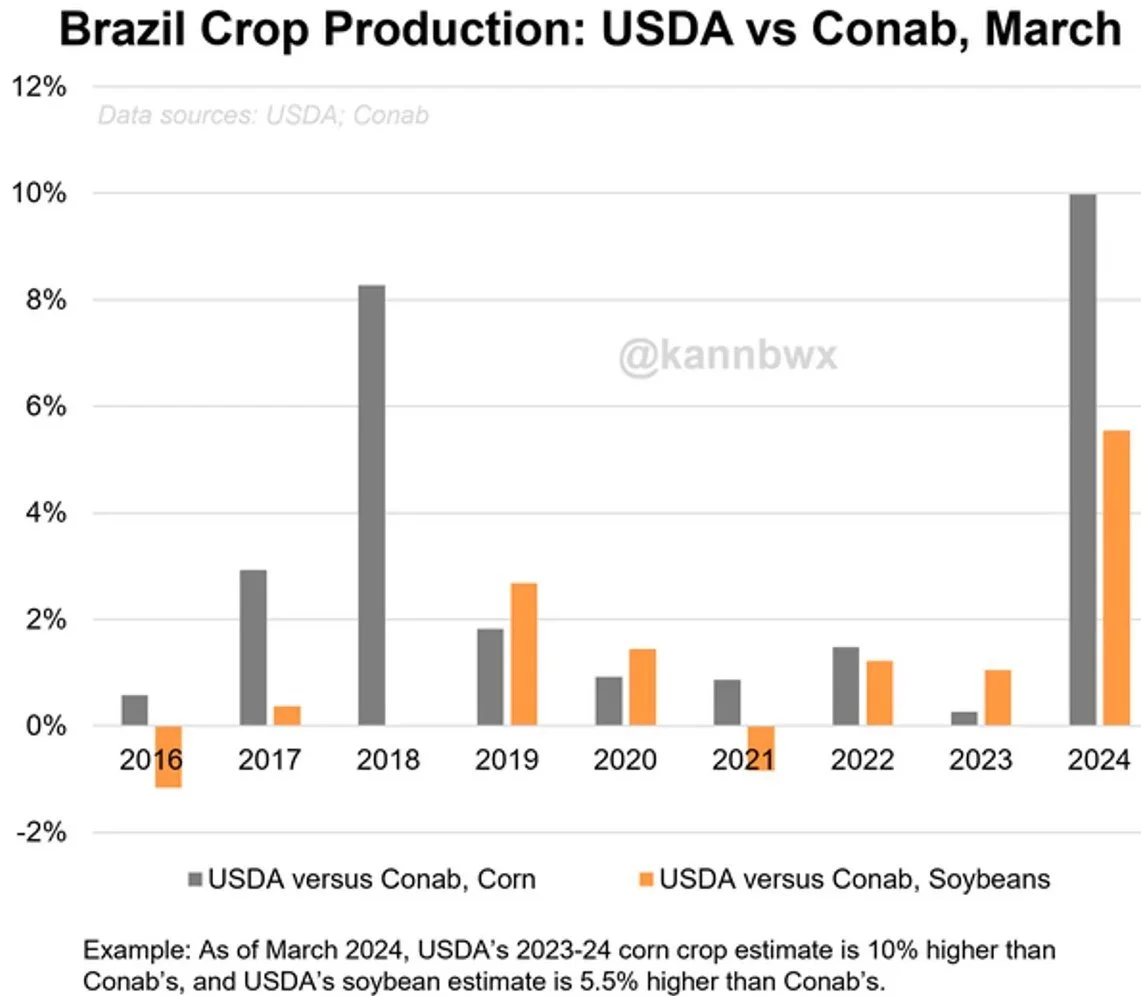

Chart Credit: Karen Braun

After this warmest winter on record that came along with very little precipitation, the Midwest is expected too see some cooler temps along with some rain over the next two weeks.

Allendale released their farmer survey for US plantings:

Corn: 93.5 million acres. Down -1.2% from 2023. The USDA has 91 million.

Soybeans: 85.8 million acres. Up 2.7% from last year. The USDA has 87.5 million.

Wheat: 47.6 million acres. Down -3.9% from last year. The USDA has 47 million.

In two weeks on March 28th we get that big report that includes the stocks report and acreage report. There is some talk that the acres could be high.

Today's Main Takeaways

Corn

A decent day for corn, as we clawed back some of the losses from yesterday. Ending the week down just a few cents. Still sitting nearly +30 cents off the first notice day lows.

Yesterday's losses was mostly technical selling and was simply this rally taking a breather in my opinion. These markets do not go straight up unless it is a supply or weather scare driven rally.

Corn Factors:

Bullish 📈

1.) Brazil Second Crop Corn

Below is a chart of the historical difference between the USDA and CONAB numbers.

The current numbers have the largest difference ever.

A massive 10% swing.

Chart Credit: Karen Braun

So perhaps the USDA is late to the game, or maybe they never wind up coming close to the CONAB numbers. Either way, this crop is getting smaller not bigger and the trend shows that.

The forecasts do however show rain in the next two weeks now.

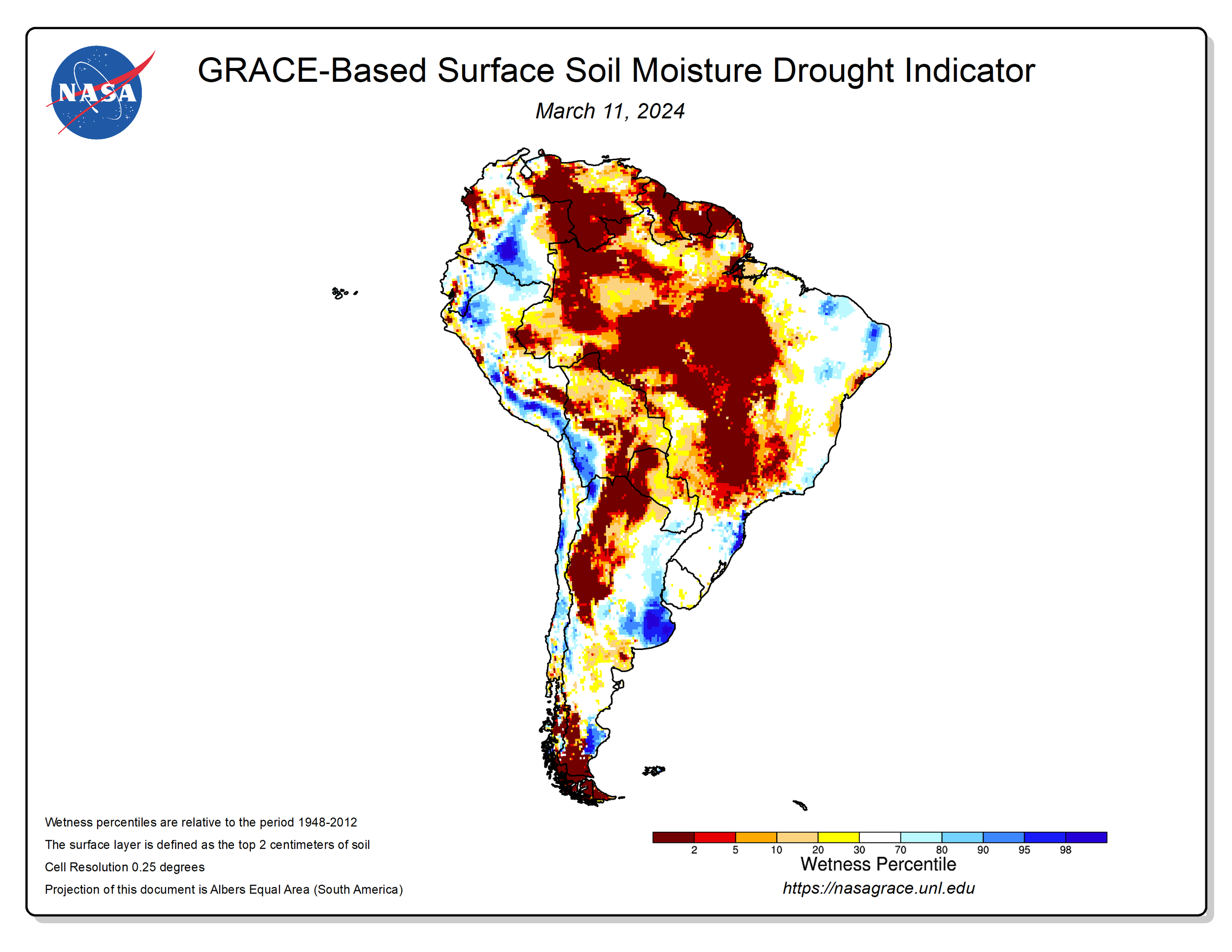

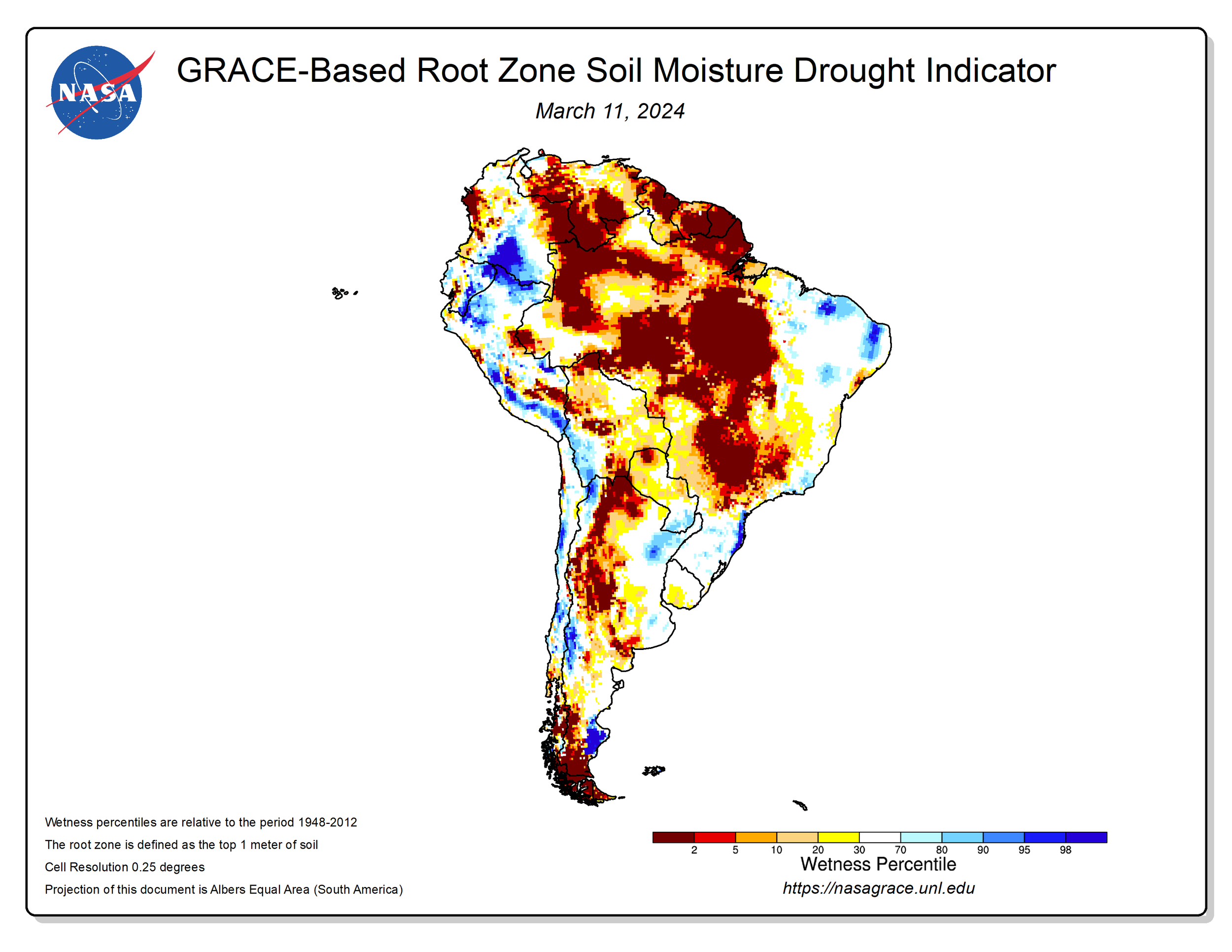

But will it be enough to make up for their already very poor soil moisture?

From 247 Ag:

"Brazil's monsoon season is forecasted to end 4-weeks early. That would be a death blow to the Safrinha crop."

Personally, I think this corn crop is a lot smaller than the USDA currently suggests.

Here is their soil moisture:

Remember in 2016, the last time Brazil faced a drought.

The market did not come to realization until April. As we made our lows in April before rallying nearly $1.00

I am not saying we will rally a dollar. No two years are the same. But there is definitely potential for this to have a positive impact on prices.

2.) Heavily Short Funds

The funds are still short around -250k contracts or more of corn.

More shorts means more room to cover. It is kind of like a rubber band.. the harder you pull, the more it snaps back.

Bearish 🐻

1.) Potential Early Planting

This has been something that………

The rest of this is subscriber only. Please subscribe to keep reading and get every update along with 1 on 1 marketing planning. In today’s update we go over every factor happening in each of the grains and what they mean.

KEEP READING FOR FREE

Try our daily updates completely free.

Want to Talk?

Our phones are open 24/7 for you guys if you ever need anything or want to discuss your operation.

Hedge Account

Interested in a hedge account? Use the link below to set up an account or shoot Jeremey a call at (605)295-3100 or Wade at (605)870-0091

Check Out Past Updates

3/14/24

ARE YOU COMFORTABLE WITH THIS VOLATILITY?

3/13/24

RALLY TAKES A PAUSE

3/12/24

CONAB A LOT SMARTER & SMALLER THAN USDA

3/11/24

CORN 4TH DAY HIGHER & KEY REVERSAL IN WHEAT

3/8/24

USDA RECAP: POOR REPORT, GREAT REACTION

3/7/24

CORN TECHNICALS TURNING BULLISH. PREPARING FOR USDA REPORT

3/6/24

CHINA CANCELS WHEAT? RUSSIA SELLING WHEAT TO FUND WAR

3/5/24

NEW LOWS IN WHEAT & USDA BRAZIL ESTIMATES

3/4/24

IS CHINA HUNGRY FOR CHEAP GRAIN?

3/1/24

FIRST HIGHER WEEK IN MONTHS

2/29/24

HOW TO USE TARGETS VS TRIGGERS

2/28/24

BIGGEST 3 DAYS IN CORN SINCE AUGUST

2/27/24

DID CHINA BUY CORN YESTERDAY?

2/26/24