DEMAND, CHINA, POLITICAL PRESSURE, & TECHNICALS

Overview

Overall poor day for the grains as corn takes a hit. Soybeans led us higher. After being down double digits and posting a new low, they rallied back to close higher.

Grains saw some pressure surrounding the political news. Trump is probably going to win the election. As you all know he chose JD Vance as his VP. So this pick solidifies what he wants to do with tariffs.

Today JD Vance gave a speech in Milwaukee which added pressure to corn & beans.

In his speech he said that Biden supports normal trade relations with China and they disagree with that. Vance said he sees China as the biggest threat to the US. So grains see this as a negative due to the potential relationship issues with China it could bring. China is of course by far the biggest buyer of US grain.

Along with this, Vance does not want to continue funding Ukraine for their war and ag. The US has been a huge funder for both, helping Ukraine remain more competitive on the global corn & wheat market. So if we no longer fund them, it could be slightly friendly for demand but isn’t going to make a major difference immediately.

The other big news was China. Unknown (most likely China) FINALLY bought old crop US soybeans. 510k MT of new crop beans & 150k MT of new crop meal.

So this was friendly and probably part of the reason beans bounced back today. It is good that we are finding some demand at these lower prices.

However as you all know we currently have the worst new crop book of sales ever. But this means they can’t get worse from here. Until today China has bought virtually zero US beans. Something to keep in mind is that we do typically see China start to ramp up on sales from July and into August.

Looking at weather, it is still bearish.

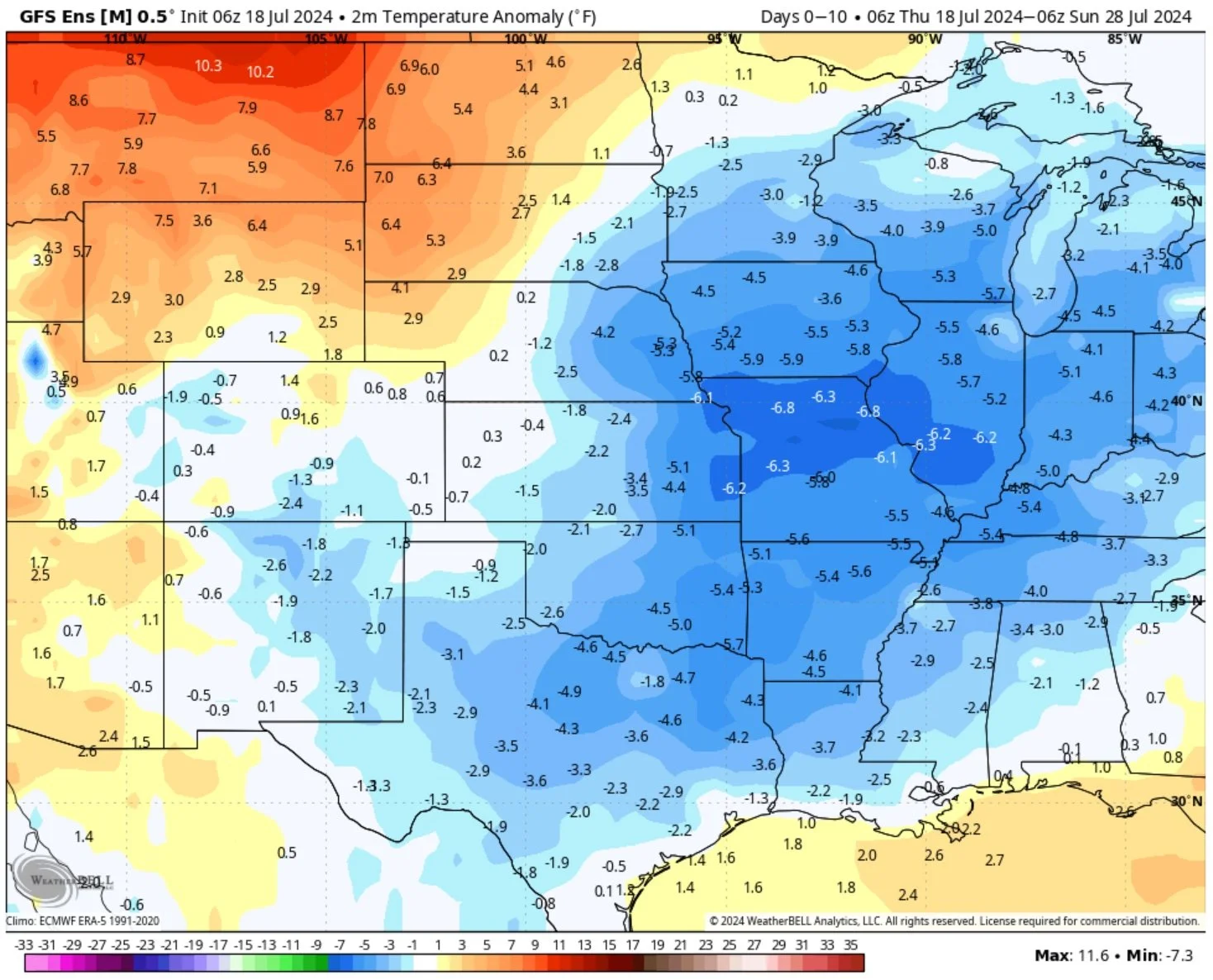

The next week lacks rain for the corn belt as most of it will be kept south, but it is suppose to be cooler than normal. So pretty much ideal for now.

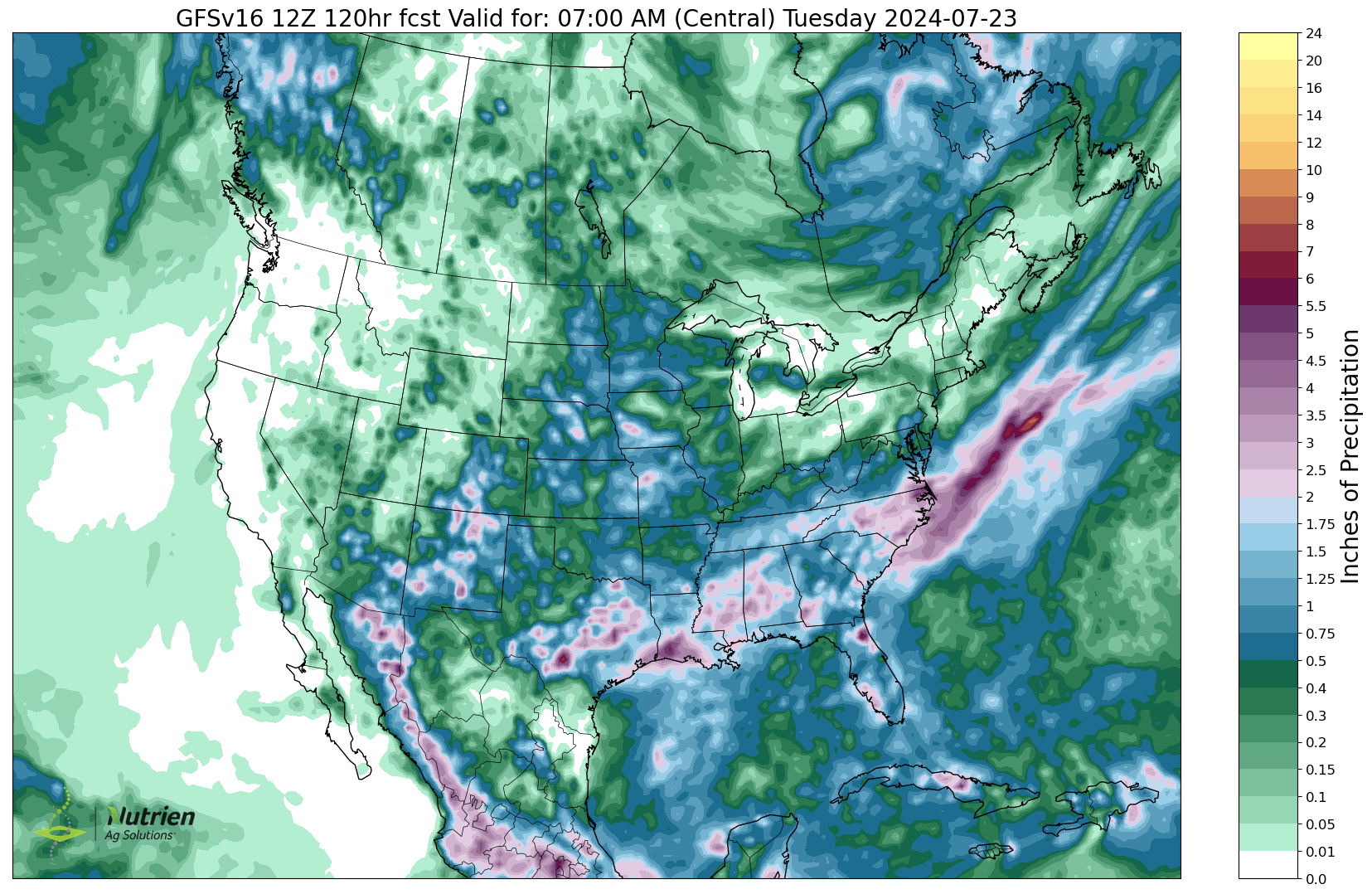

5-Day GFS Precip

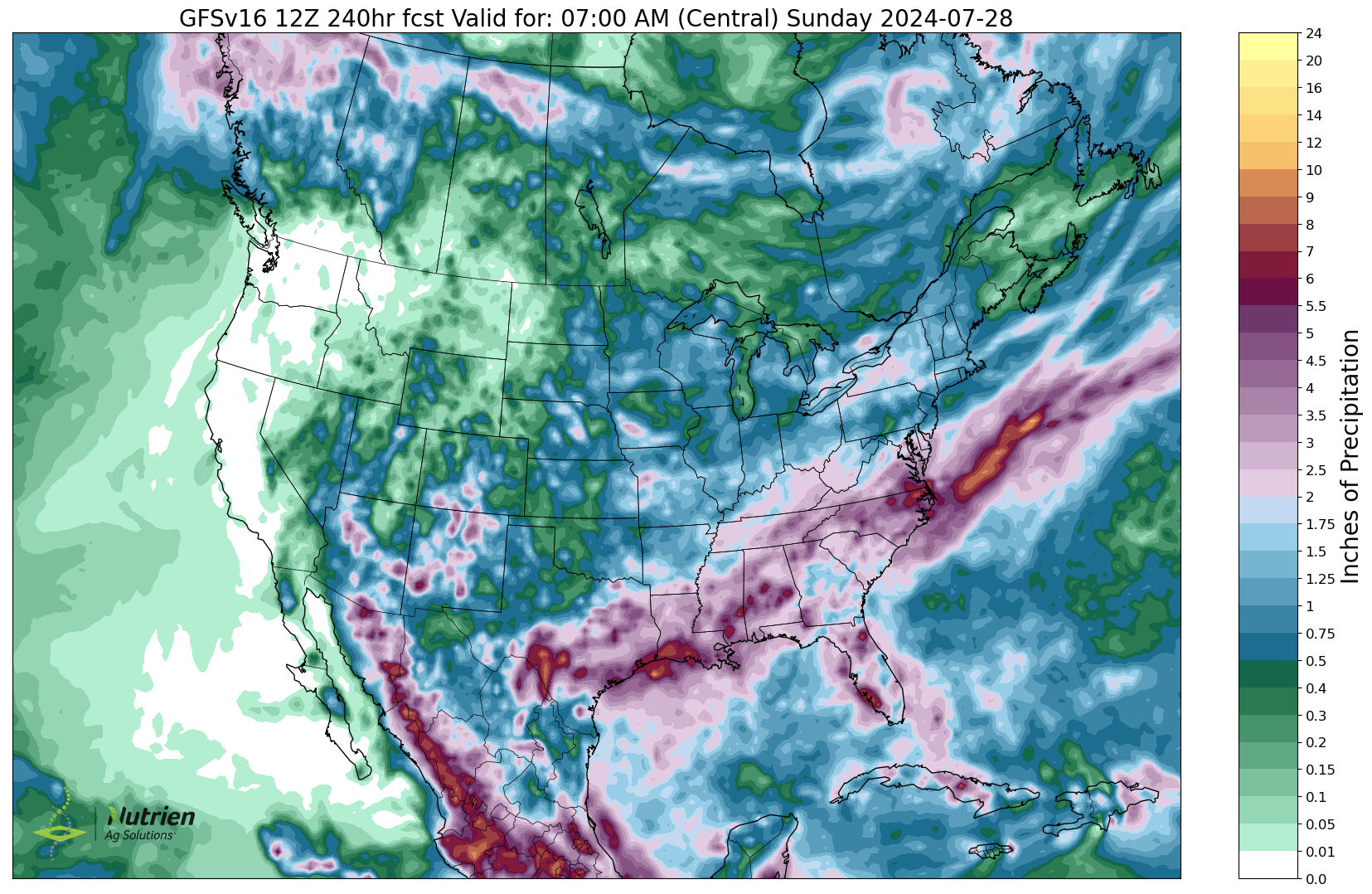

10-Day GFS Precip

10-Day Temp Anomaly

As I mentioned in my past updates, the normal weather market is gone. So we won’t go up or down on every little change we see in forecasts. So although it is bearish, it is not a major market mover anymore.

This also means we do not have a chance for a weather scare as I've mentioned before. Unless we get some crazy event in early August, beans could still potentially see a small scare. But the outlook for August looks ideal right now. So very doubtul.

Despite weather from now on not mattering much to the trade, the past weather we have seen still does. We still had the wet start, flooding, hail, derecho damage etc. However no one will know the extent of damage any of those events brought until at least fall.

Today's Main Takeaways

Corn

Weekly exports were weak. 437.8k MT, down -19% from last week and -10% below the average. So that didn’t help prices today.

As I mentioned, JD Vance's comments didn’t help corn prices either.

The weather is ideal, although turning into a non-factor for the most part.

Currently we are simply range bound, waiting for the technicals to flip one way or the other.

Let’s take a look at the exact levels to watch to confirm a bottom or more downside from here.

First we have…………….

The rest of this is subscriber-only. Subscribe to keep reading & get every update along with our signals & 1 on 1 market plans.

IN TODAYS UPDATE

Key levels to watch in corn

Levels we need to break in corn, beans, & wheat to confirm a bottom

2014 comp update

Seasonality favors lower prices but..

China buys beans

Pop coming in beans?

& More

KEEP READING FOR FREE

Our daily updates, signals, & 1 on 1 tailored market planning. Turn these challenging prices into more opportunities.

Try 30 days completely free

Want to Talk?

Our phones are open 24/7 for you guys if you ever need anything or want to discuss your operation.

Hedge Account

Interested in a hedge account? Use the link below to set up an account or shoot Jeremey a call at (605)295-3100 or Wade at (605)870-0091

Check Out Past Updates

7/17/24

DIFFERENT GRAIN MARKETING SCENARIOS YOU MIGHT BE IN

7/16/24

RELIEF BOUNCE FOR GRAINS

7/15/24

GRAINS HAMMERED. TRADE WAR FEAR

7/12/24

USDA REPORT: LOW PRICES CREATING DEMAND

7/11/24

USDA TOMORROW

7/10/24

GRAINS CONTINUE TO GET HAMMERED

7/9/24

RAINS, RECORD FUND SELLING & 2014 COMPS

7/8/24

PUKE SELLING, RAIN MAKES GRAIN & FUNDS RECORD SHORT

7/3/24

THIN HOLIDAY TRADE FOR GRAINS

7/2/24

BEARISH WEATHER, RECORD SHORTS, & CHINA

7/1/24

SUPPLY WILL BE THERE, BUT CAN DEMAND LEAD US HIGHER?

6/28/24

GARBAGE USDA REPORT

6/27/24

BIGGEST USDA REPORT OF YEAR TOMORROW

6/26/24

USDA PREVIEW & COUNTER SEASONAL RALLIES?

6/25/24

POSSIBLE RISKS & OUTCOMES THIS USDA REPORT COULD HAVE

6/24/24

VERY STRONG PRICE ACTION: RAINS & USDA KEY

6/21/24

DON’T PUKE SELL. ARE YOU COMFORTABLE RIDING THIS STORM?

6/20/24

RAIN OR NO RAIN FOR EAST CORN BELT?

6/18/24

WEATHER MARKET ENTERING FULL SWING

6/17/24

SELL OFF CONTINUES DESPITE FRIENDLY FORECASTS

6/15/24

EXACT GRAIN MARKETING SITUATION BREAKDOWNS & WHAT YOU SHOULD BE DOING

6/12/24

USDA SNOOZE: WHAT’S NEXT?

6/11/24

USDA TOMORROW

6/10/24

IS USDA OVERSTATING CROP CONDITIONS? DOES IT MATTER?

6/7/24

WEATHER & USDA NEXT WEEK

6/6/24

ARE GRAIN SPREADS TELLING US SOMETHING?

6/5/24

GRAINS NEARING BOTTOM? 7 DAYS OF RED

Read More

6/4/24

HIGH CORN RATINGS, SCORCHING SUMMER, & RUSSIA CONCERNS

Read More

6/3/24

5TH DAY OF THE SELL OFF. ARE YOU COMFORTABLE?

5/31/24

4 STRAIGHT DAYS OF LOSSES IN GRAINS

5/30/24

I DON’T THINK SEASONAL RALLY IS OVER. WHAT IS THE PLAN IF I’M WRONG?

5/29/24

PLANTING DELAY STORY VANISHES. BUT IS REAL STORY OVER?

5/28/24

GETTING COMFORTABLE WITH GRAIN MARKET VOLATILITY

5/24/24

WET SPRINGS DON’T CREATE RECORD YIELDS, DO THEY?

5/23/24

MANAGE RISK DESPITE STUPID PRICE POTENTIAL IN GRAINS

5/22/24

BEANS NEAR NEW HIGHS. WHAT TO DO WITH WHEAT?

5/21/24

BIG MONEY KEEPS DRIVING WHEAT HIGHER

Read More

5/20/24

ALGOS & BIG MONEY CONTINUE TO MOVE GRAIN PRICES

5/17/24

WEATHER MARKET VOLATILITY CONTINUES TO HEAT UP

5/16/24

SITUATIONAL GRAIN MARKETING

5/15/24

HEDGING VS GUESSING

5/14/24

CORRECTIONS ARE HEALTHY

5/13/24

FUNDS DON’T WANT TO BE SHORT GRAINS

5/10/24

PRICE ACTION TELLS DIFFERENT STORY FROM USDA REPORT

Read More

5/9/24

MARKET PRICING IN NEGATIVE REPORT. WHAT TO EXPECT FROM USDA

5/8/24

USDA IN 2 DAYS

5/7/24

WHO SHOULD WAIT FOR TRIGGERS NOT TARGETS

Read More

5/6/24

GRAINS HIGHEST IN 4 MONTHS

Read More

5/3/24

SEASONAL RALLY JUST BEGINNING OR BULL TRAP?

5/2/24

ARE THE TIDES STARTING TO TURN?

5/1/24