CORN BREAKS $4.00, FAVORABLE WEATHER & CHARTS

Overview

Grains mixed as corn posts a new contract low, with Dec corn closing below $4.00. Soybeans ended the day higher but traded to their lowest levels since October of 2020 approaching those "trade war levels".

Why do we continue to fall?

A few reasons.

First, the trade was expecting some pretty hot weather. Now that heat got removed. So that was a negative. We are also getting rain, as we have the entire growing season. A weather threat is essentially completely gone for now. The outlook for August looks crop friendly as well.

The trade is expecting record crops. Monday we saw corn ratings improve. Seasonally they start to go lower here. People are throwing out corn yields anywhere from 180 to as high as 188. I'm hearing talk of 52 to 55 yield beans. We likely have some damage from the wet start, excessive rain etc in some areas. But we won’t know how big of an impact it actually had until we get into the crops. A weather rally from here is unlikely.

US export inspections were strong this week, but we still have a lack of demand.

US corn is competitive on the export market, yet we haven’t seen much business. We did however get a flash sale of corn today that ended the dry spell of sales, but the market didn’t care.

The funds are record short but will need a reason to cover. Weather probably isn’t going to be the reason.

Let's take a look at the weather..

July Weather Recap

Look at just how ideal of weather July was for the corn belt.

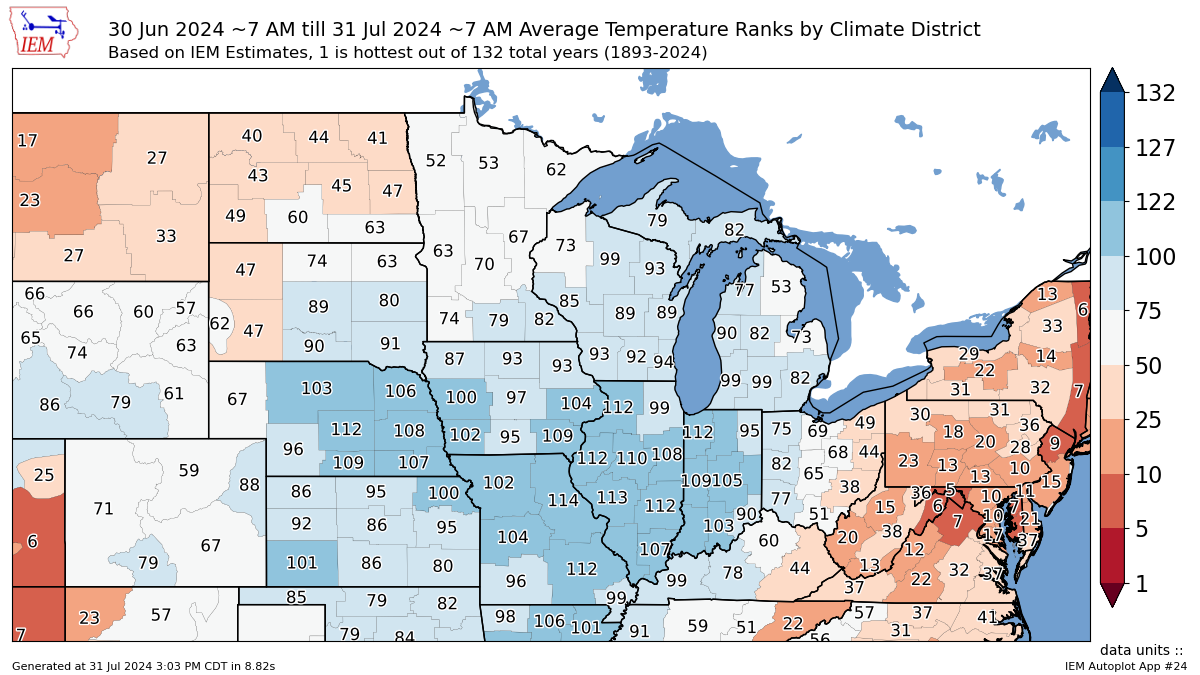

It was one of the coolest July's on record. Coolest top 20-30% for the entire corn belt.

July Temp Ranks

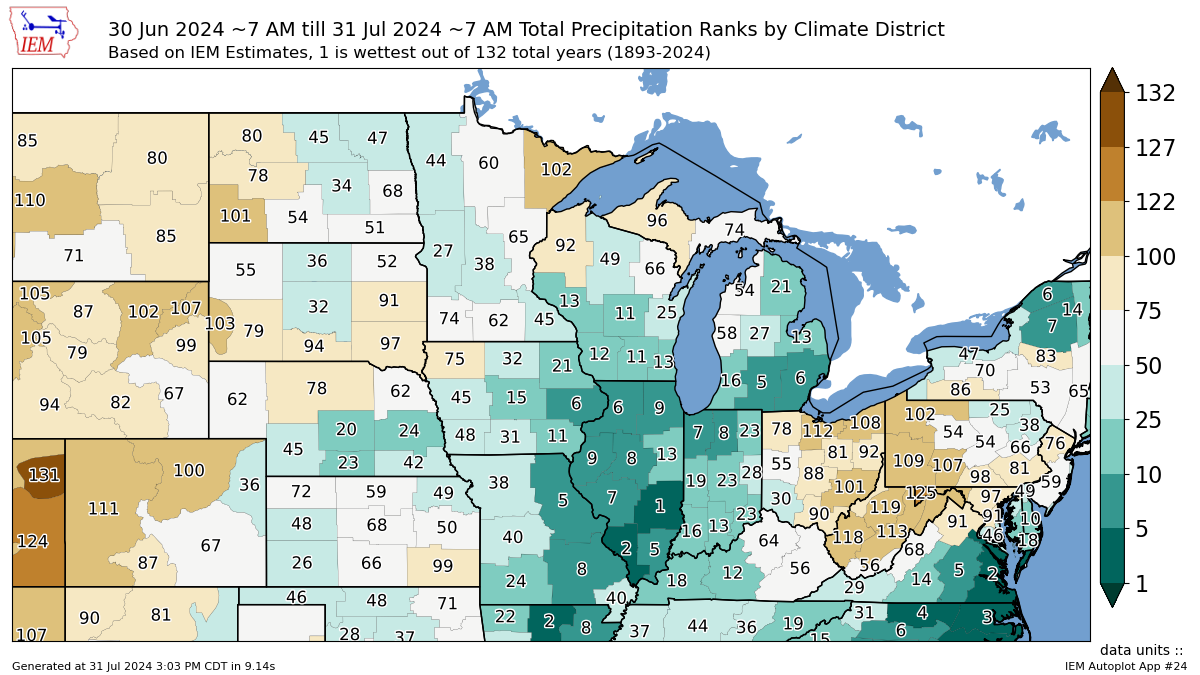

Precip has been decent for the majority of the corn belt as well, aside from very east areas such as Ohio. Parts of Iowa and Illinois amongst wettest on record.

July Precip Ranks

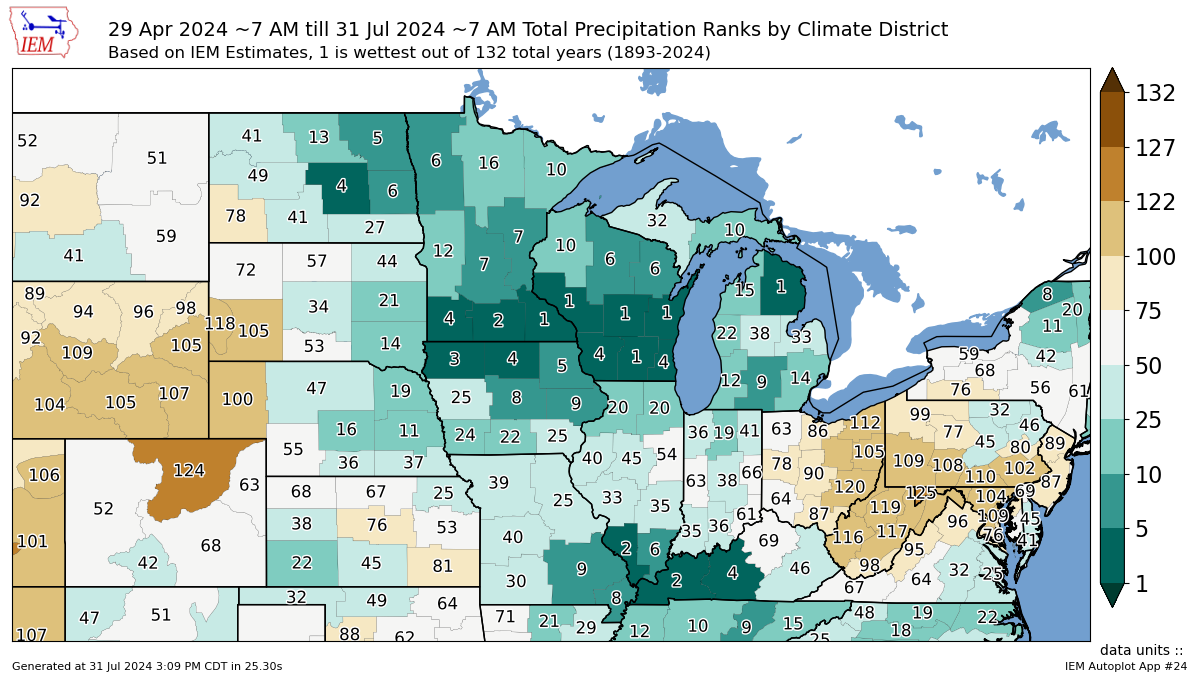

Looking at summer as a whole, those areas with a #1 are definitely going to see some negative effects to yield from being too wet. But many other areas received a perfect amount.

Very east such as Ohio has been too dry.

Overall Summer Precip Ranks

Forecasts Outlook

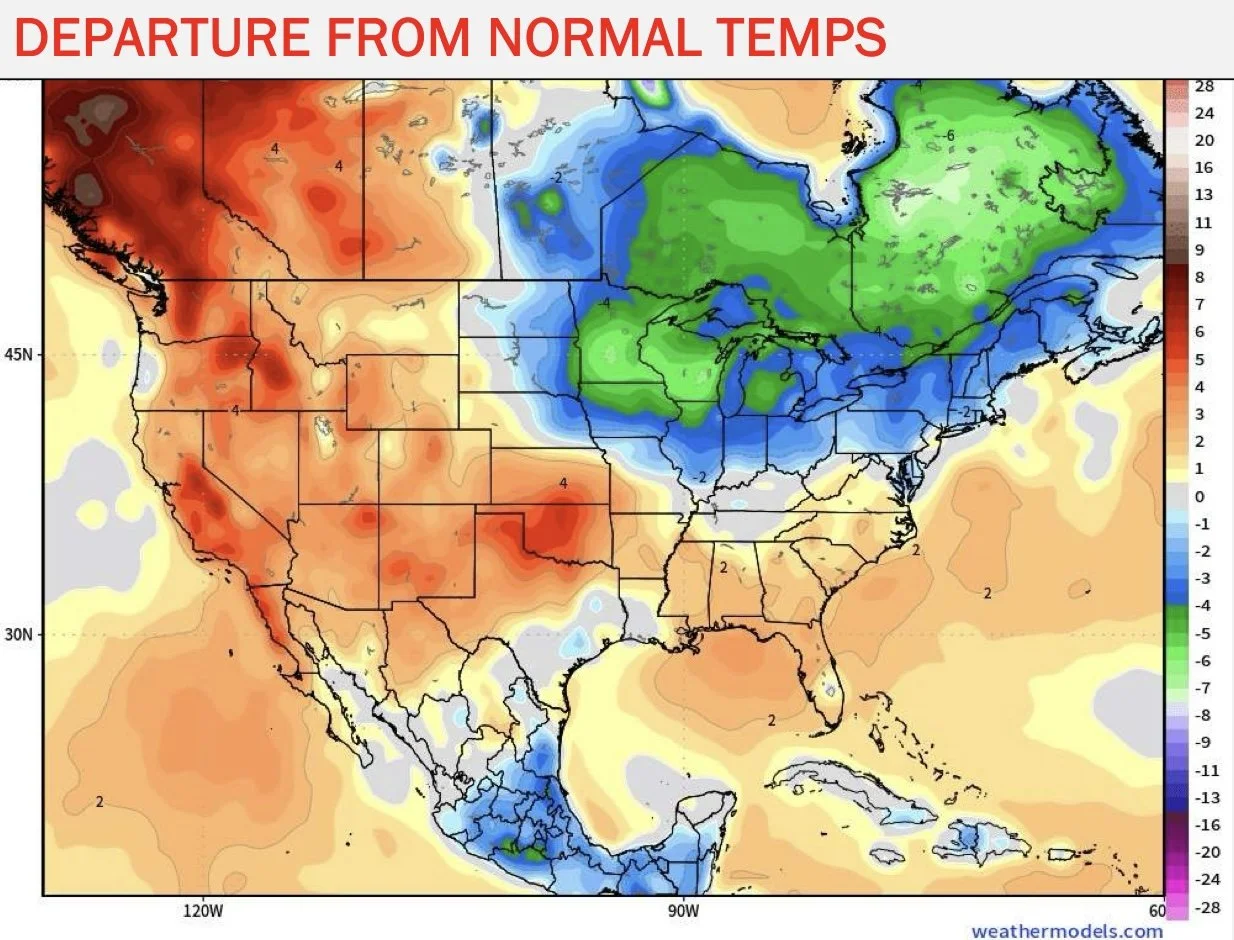

This is of the biggest reasons beans fell recently. The market had been anticipating some crazy heat. But the forecasts removed that heat.

If you take a look at the next week, it is still hotter than normal but only by a few degrees now. The original forecasts had temps +10 degrees above normal. The heat also shifted more south west away from the key growing regions.

If you take a look at week 2, temps start to fall to very cool for the entire corn belt.

Next 7 Days (July 31 - Aug 6)

Week 2 (Aug 7 - 13)

The corn belt will be getting rains but will remain a little drier in the plains.

Overall, weather is mainly ideal outside of some heat the next week out west. But overall our crops have plenty of soil moisture and the outlook looks favorable as well.

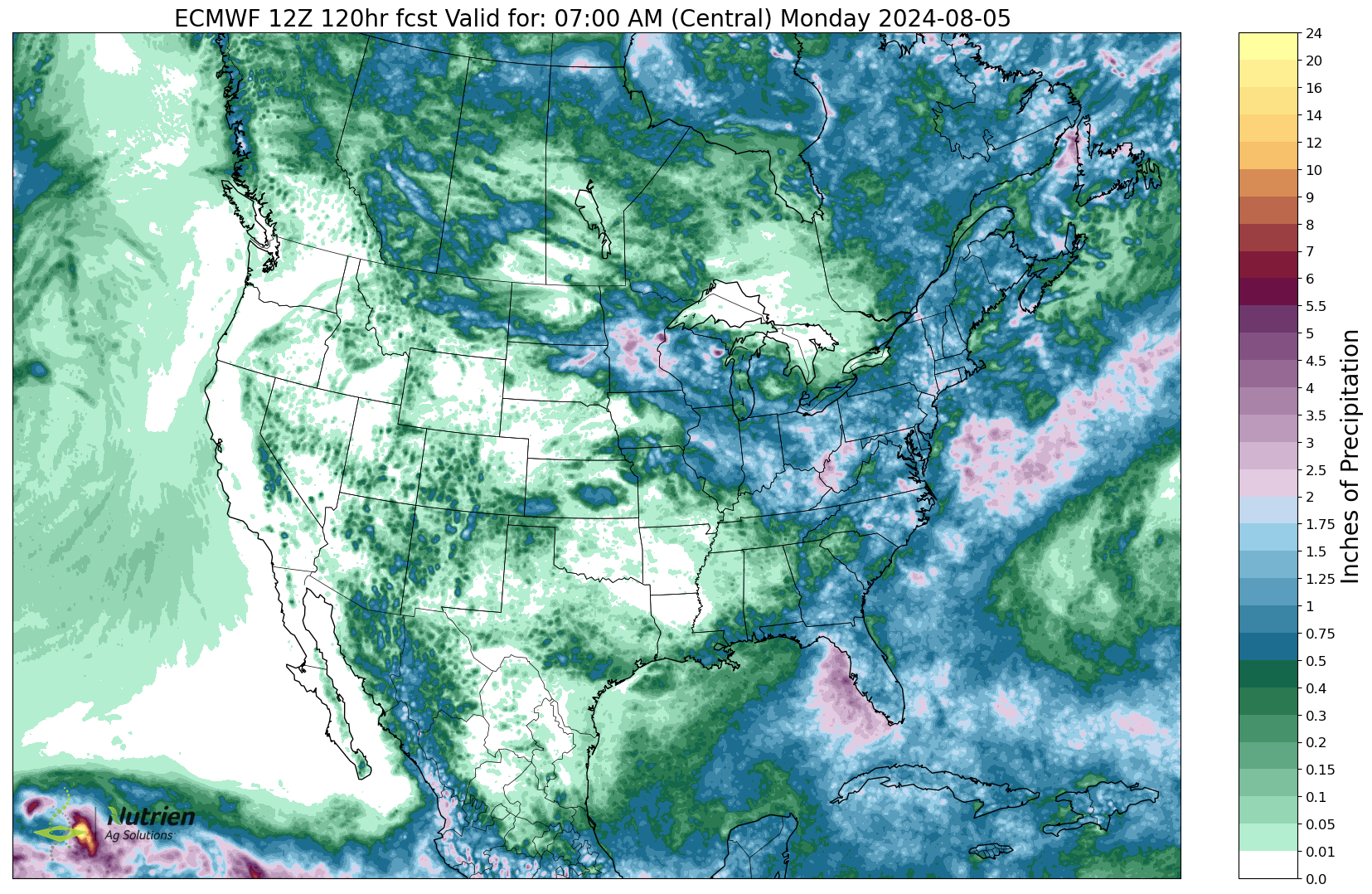

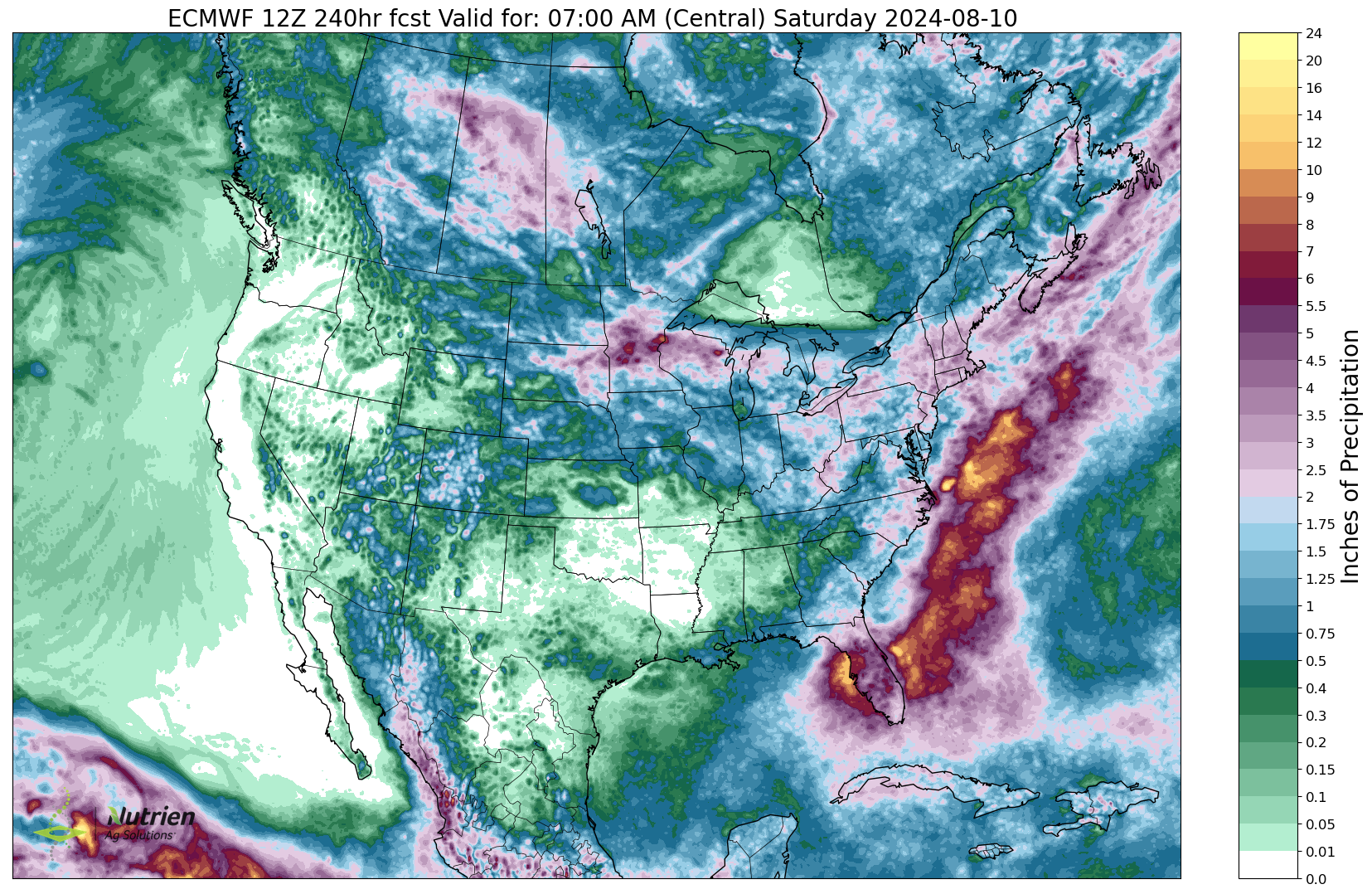

Euro 5-Day Precip

Euro 10-Day Precip

August Outlook

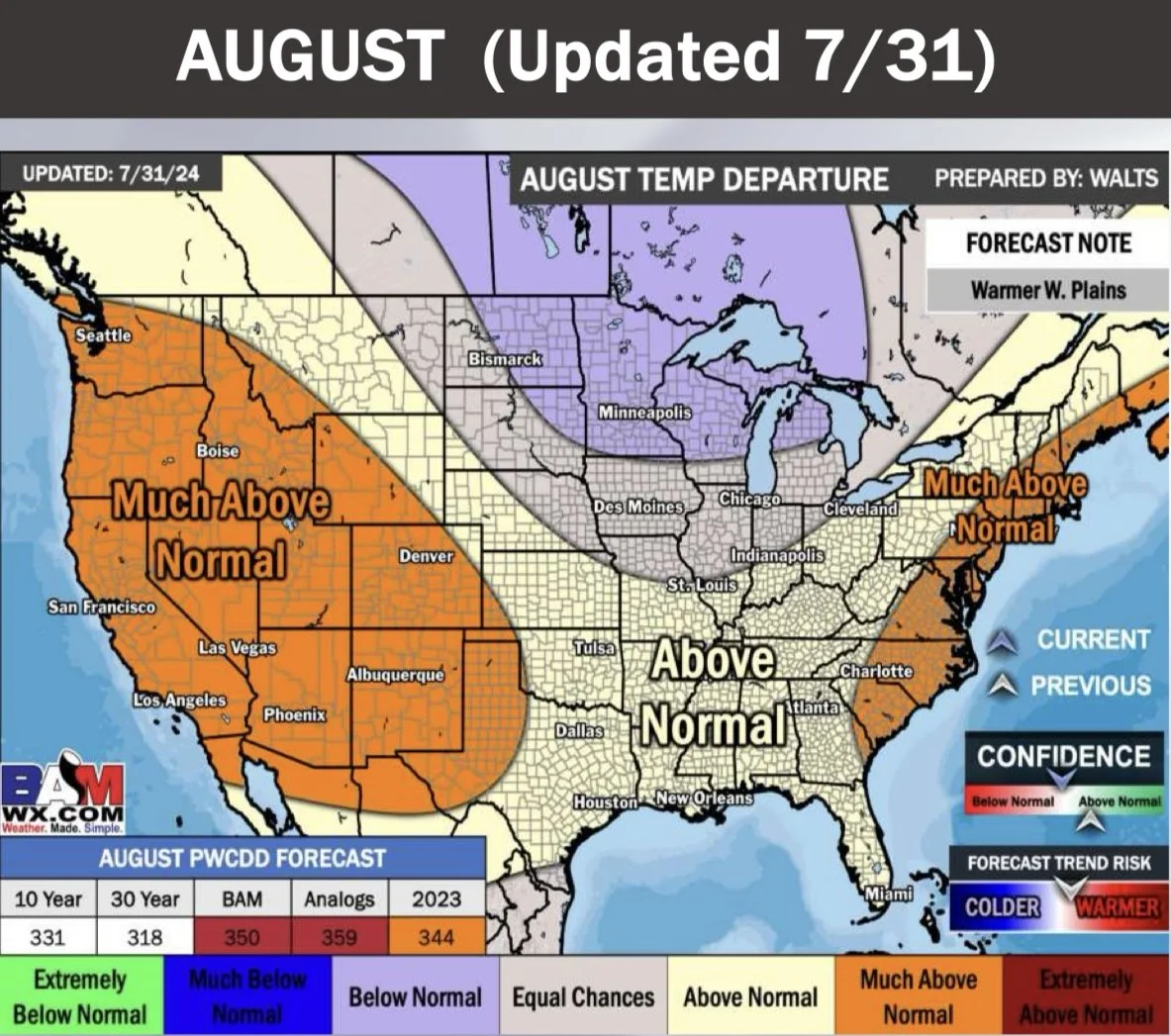

Orginally, the forecasts suggested we would be getting a hot and dry August..

However, the forecasts have shifted due to a polar vortex in the southern hemisphere according to BAM Weather.

Here is their August outlook. It is suppose to now be wetter than normal, with temps average to even cooler than normal.

So right now the outlook looks ideal for crops.

August Temps

August Precip

I have mentioned that weather from here on out will not be all that impactful to the prices of our markets. Not like they are in June & July. Especially to corn.

Yes, beans are made in August, so the crop can grow or shrink the next few weeks. But the market doesn’t gauge weather in August like it does June & July. Yes, if this forecast is wrong and we get some crazy drought in early August soybeans could get a small weather driven rally, but overall it shouldn’t be anything major. The outlook is also not supportive of prices currently………

The rest of this is subscriber only..

Below is a preview of what is in today’s update…

In today’s update we go over how low corn & beans could actually go. We also go over potential carry out situations. Demand. Technical charts & more..

Get the full thing & future ones free: HERE

PREVIEW

….I am only pointing this out to show you that yes corn could go lower from here. As a producer your risk is to the downside.

Right now the market thinks we have a 183 yield. How many of you think you have a record crop? I haven’t spoke to many who think they have a record crop. So it is a little hard for me to fathom we are 183 when our record is 177. The market would be extremely caught off guard if we are closer to 175 than 185. To go along with that, if demand increases our carryout will decrease all that more. The funds need a reason to cover, that could very well be one.

Personally, I think we are at levels that will create demand. Thus pushing prices higher. I think we could actually rally into harvest.

But until the charts confirm we are done going down, our risk is lower and the path of least resistance is also lower.

Take a look at this continuous corn chart.

We are currently in "bear market" territory.

In 2014 we didn’t bottom until $3.18. I do not think that happens this year. However $3.50 or so corn is possible if demand does not pick up and we wind up with this monster crop.

The continuous chart and that purple trendline suggests we might not find a bottom until the $3.40 area.(Yellow circle).

We found support at $3.40-$3.50 in several years during bear markets. (Dark purple line).

The only years we went lower than that were 2014, 2016, and 2020. Which means I think $3.40 is about the lowest we could possibly go. That is not my prediction, I just think that is worst case possible. We could bottom before, impossible to say until the charts confirm a bottom.

Taking a look at the daily chart.

We broke below $4.03 our key support.

Now this could either be a bear trap and we reverse right here (several weeks ago I said we could get a $3.99 print only to reverse), or we are going to go down to $3.80. Which is our implied downside target.

If we go all the way down to $3.80, we will probably bounce back up and test $4.00 again as that will be our new resistance.

Until the charts confirm a bottom, the risk is lower.

For me to believe we found a bottom, nothing has changed the past few weeks. I still need above $4.26 to say we are going higher.

So if you have unpriced grain, I still like protecting the downside until that $4.26 level is broken. I especially like protecting with puts if you have to move something off the combine.

I think we will get a demand led rally later this year or into next, but the hardest part is guessing where the bottom is first. So protect that risk.

Give us a call if you want to talk about what makes the most sense for your operation. (605)295-3100

Subscribe if you want to get our full update along with future ones, our signals & 1 on 1 tailored market plans…

TRY 30 DAYS FREE

Want to Talk?

Our phones are open 24/7 for you guys if you ever need anything or want to discuss your operation.

Hedge Account

Interested in a hedge account? Use the link below to set up an account or shoot Jeremey a call at (605)295-3100 or Wade at (605)870-0091

Check Out Past Updates

7/30/24

GRAINS FAIL REVERSAL BACK NEAR LOWS

7/29/24

GRAINS SHOW SIGNS OF REVERSALS

7/26/24

BLOOD BATH IN GRAINS: EPA REVERSAL & WEATHER

7/25/24

CHINA, DROUGHT, FUNDS & RISK

7/24/24

BEANS LOWER DESPITE DROUGHT TALK

7/23/24

BACK TO BACK GREEN DAYS FOR CORN & BEANS: MARKETING DECISIONS

7/22/24

BEST DAY FOR GRAINS IN A LONG TIME

7/19/24

DULL MARKETS: STRATEGIES TO USE IN GRAIN MARKETING

7/18/24

DEMAND, CHINA, POLITICAL PRESSURE, & TECHNICALS

7/17/24

DIFFERENT GRAIN MARKETING SCENARIOS YOU MIGHT BE IN

7/16/24

RELIEF BOUNCE FOR GRAINS

7/15/24

GRAINS HAMMERED. TRADE WAR FEAR

7/12/24

USDA REPORT: LOW PRICES CREATING DEMAND

7/11/24

USDA TOMORROW

7/10/24

GRAINS CONTINUE TO GET HAMMERED

7/9/24

RAINS, RECORD FUND SELLING & 2014 COMPS

7/8/24

PUKE SELLING, RAIN MAKES GRAIN & FUNDS RECORD SHORT

7/3/24

THIN HOLIDAY TRADE FOR GRAINS

7/2/24

BEARISH WEATHER, RECORD SHORTS, & CHINA

7/1/24

SUPPLY WILL BE THERE, BUT CAN DEMAND LEAD US HIGHER?

6/28/24

GARBAGE USDA REPORT

6/27/24

BIGGEST USDA REPORT OF YEAR TOMORROW

6/26/24

USDA PREVIEW & COUNTER SEASONAL RALLIES?

6/25/24

POSSIBLE RISKS & OUTCOMES THIS USDA REPORT COULD HAVE

6/24/24

VERY STRONG PRICE ACTION: RAINS & USDA KEY

6/21/24

DON’T PUKE SELL. ARE YOU COMFORTABLE RIDING THIS STORM?

6/20/24

RAIN OR NO RAIN FOR EAST CORN BELT?

6/18/24

WEATHER MARKET ENTERING FULL SWING

6/17/24

SELL-OFF CONTINUES DESPITE FRIENDLY FORECASTS

6/15/24

EXACT GRAIN MARKETING SITUATION BREAKDOWNS & WHAT YOU SHOULD BE DOING

6/12/24

USDA SNOOZE: WHAT’S NEXT?

6/11/24

USDA TOMORROW

6/10/24

IS USDA OVERSTATING CROP CONDITIONS? DOES IT MATTER?

6/7/24

WEATHER & USDA NEXT WEEK

6/6/24

ARE GRAIN SPREADS TELLING US SOMETHING?

6/5/24

GRAINS NEARING BOTTOM? 7 DAYS OF RED

Read More

6/4/24

HIGH CORN RATINGS, SCORCHING SUMMER, & RUSSIA CONCERNS

Read More

6/3/24

5TH DAY OF THE SELL OFF. ARE YOU COMFORTABLE?

5/31/24

4 STRAIGHT DAYS OF LOSSES IN GRAINS

5/30/24

I DON’T THINK SEASONAL RALLY IS OVER. WHAT IS THE PLAN IF I’M WRONG?

5/29/24

PLANTING DELAY STORY VANISHES. BUT IS REAL STORY OVER?

5/28/24