POOR ACTION IN GRAINS POST FRIENDLY USDA

MARKET UPDATE

Video Version is Subscriber Only*

For Full Access: CLICK HERE

You can scroll to read the usual update as well.

Want to talk? (605)295-3100

Futures Prices Close

Overview

Grains down across the board following Friday's decently friendly USDA report.

Awful price action today in soybeans, as they closed -20 cents off their early highs. Finding resistance once again in that $10.30 to $10.44 level I had been mentioning.

The wheat market was the biggest loser today. Hitting 2-month lows, but rallied +14 cents off their lows. So decent close in wheat.

Why did wheat get hit so hard today?

There is 3 main reasons.

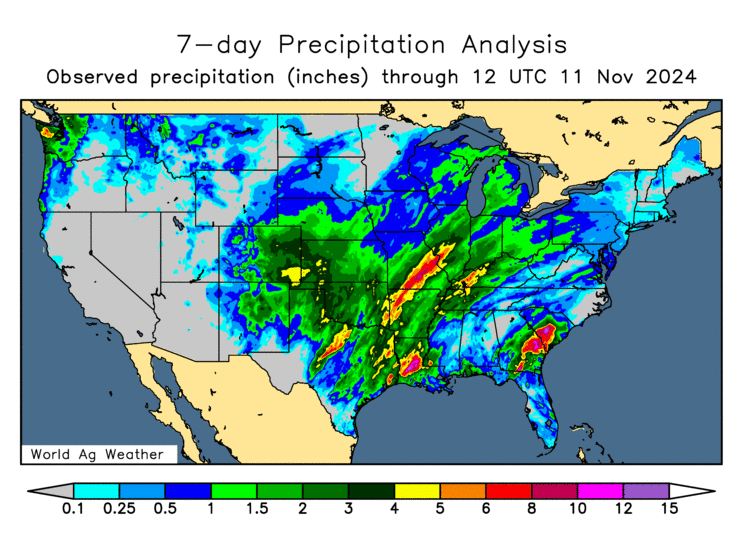

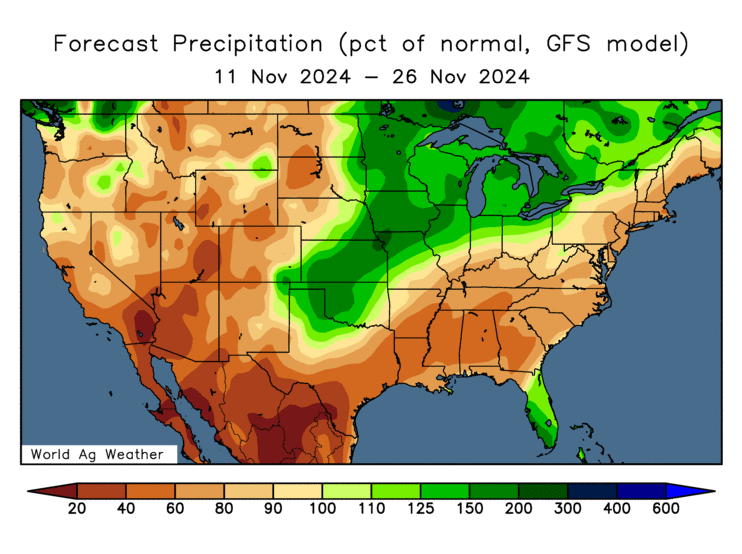

The first is rain in HRW regions. The plains have received good rain with more on the way. So a lot of those drought concerns are easing.

Past 7 Days Rain

Next 2 Weeks Rain

The 2nd reason is the massive rally in the US dollar.

As it continues to rally since Trump won the election.

Rallying to it's highest levels since June.

A rising dollar makes exports harder, as it makes us less competitive globally.

The 3rd reason is there is talk about Trump ending the war in Russia & Ukraine.

As Putin really respects Trump. Putin said he is very serious about Trump's plan to end the war.

But of course, the war headlines really aren’t much of a factor at all anymore. Long term ending the war is actually probably friendly for wheat.

How? Well we have sent a lot of money to help Ukraine with their agricultural issues. If we are no longer funding Ukraine then that leaves the potential for them to not be as competitive in the global market. War headlines rarely affect the market anymore anyways.

As for the USDA report. Here is how I would classify it:

Corn: Neutral to slightly friendly

Beans: Friendly

Wheat: Neutral

Here is the numbers:

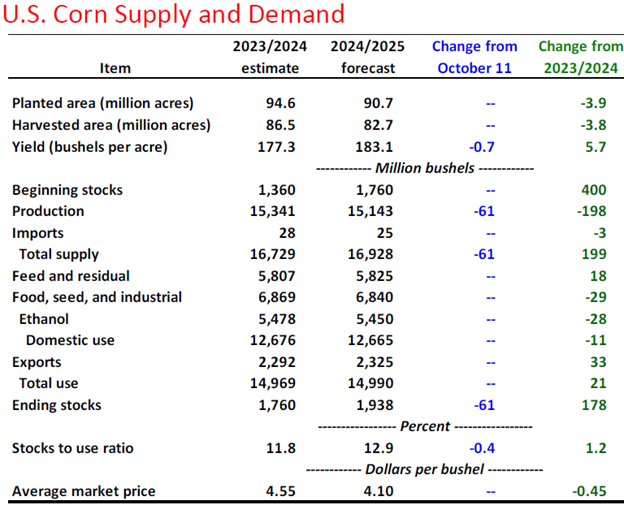

First corn.

They surprisingly dropped yield from 183.8 to 183.1

This dropped carryout from 1.999 to 1.938

Even though both exports & ethanol are running well ahead of pace, the USDA did not make any changes to the demand side of the balance sheet.

This was slightly disappointing, but this makes you wonder if it's going to show up in future reports. As them leaving demand unchanged does open the door for future bullish arguments to be made on the demand numbers.

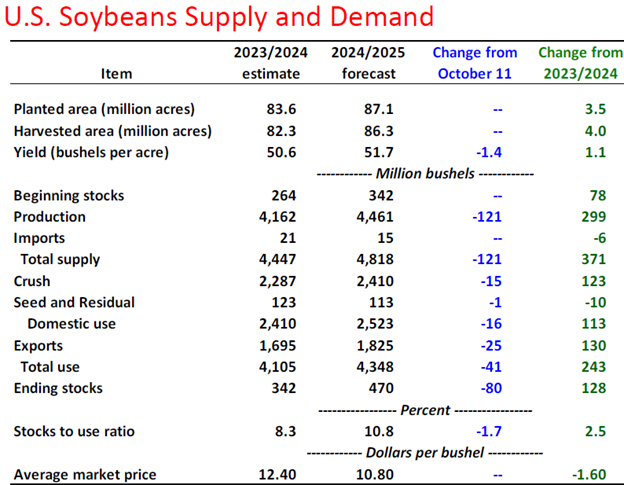

Soybeans saw the biggest surprise.

As yield fell from 53.1 to 51.7, which was below even the low end of the trade range estimates. (Trade Range: 52.1-53.8)

This was the largest Nov-Dec drop in yield in at least the past 30 years.

This led to carryout dropping from 550 to 470 million, nearly a 20% drop.

The drop in production was somewhat offset by cuts to demand. As the USDA dropped crush by 15 million and exports by 25 million.

Despite this, a 470 million carryout is not bullish by anymeans.

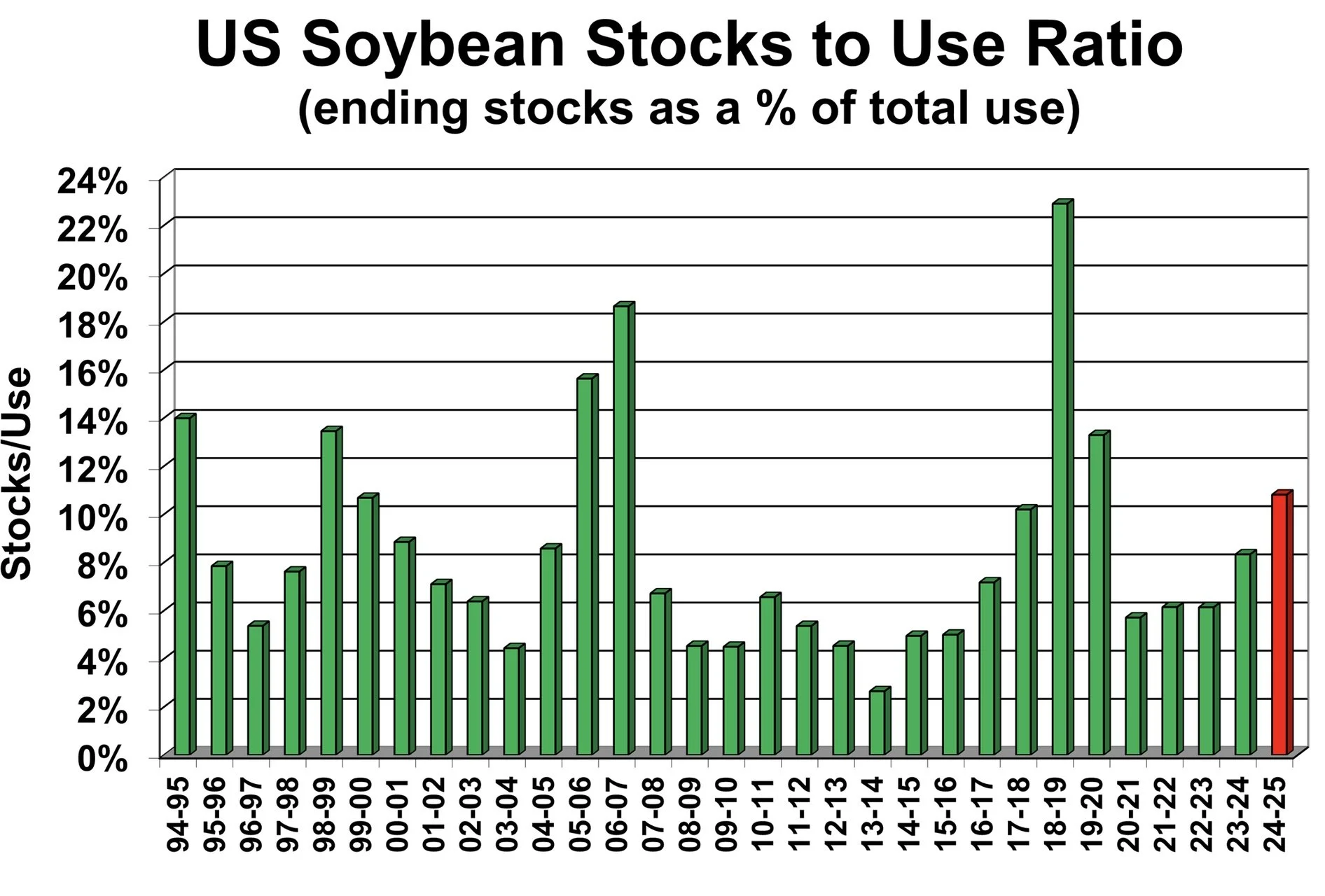

Here is the US stocks to use ratio.

It is not as high as it was during the trade war, but it is still on the large side.

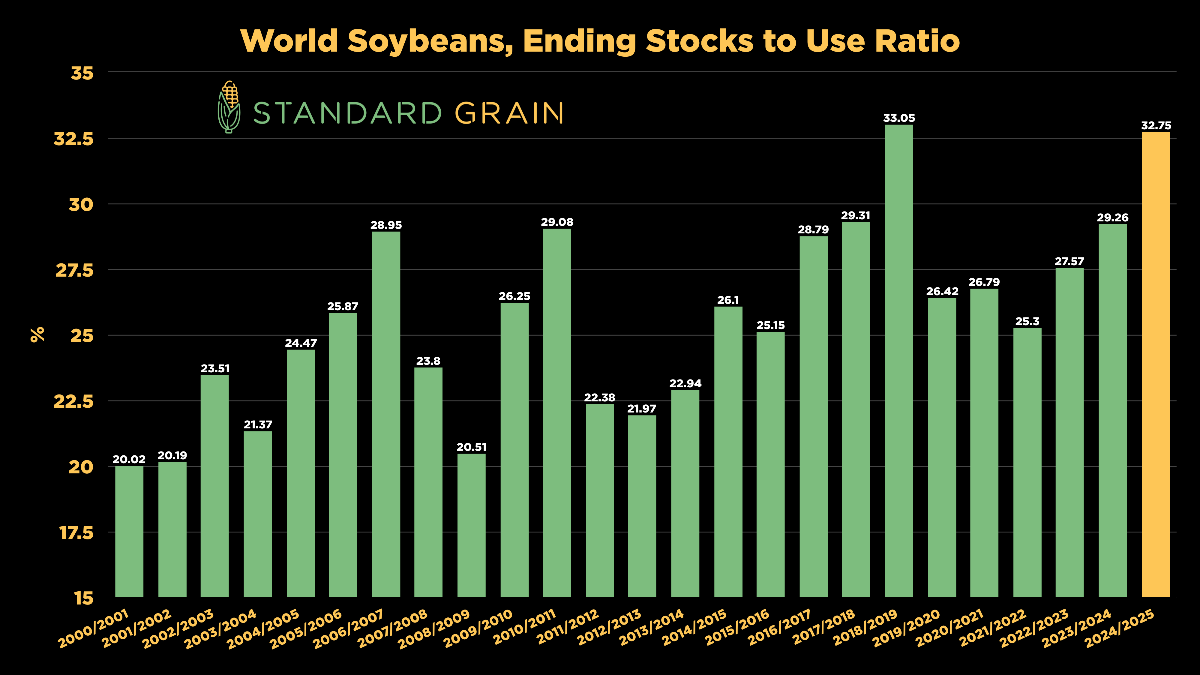

The biggest concern in soybeans is not the US balance sheet.

It is the global balance sheet.

Unlike corn, the US exports somewhere in the realm of 40% of it's soybeans.

Brazil is also the largest player in the bean market vs the US being king of corn.

We still have one of the most bearish global outlooks ever. As even with the decrease to US yield, it just didn’t make a major dent globally.

This is the outlook IF Brazil raises what the USDA thinks they will.

These numbers are not bullish. At all.

Chart from Standard Grain

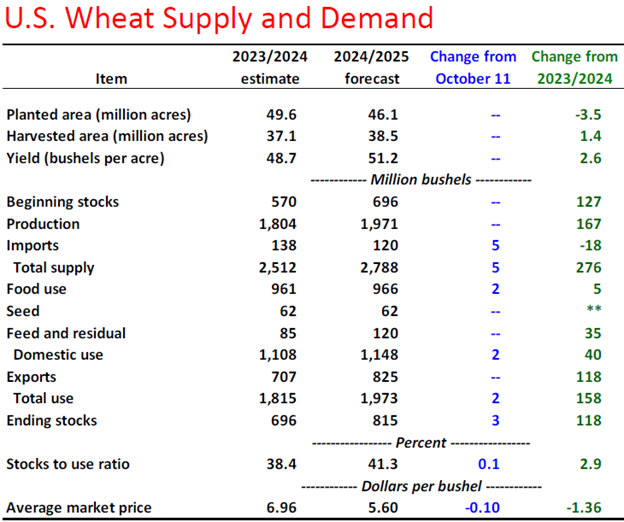

For wheat, the report was underwhelming.

We did not see any major changes. A non-event.

Today's Main Takeaways

Corn

The funds are NET LONG corn for the first time since August 2023.

In July they were short over -350k contracts. A record.

This means that………….

The rest of this is subscriber-only.. subscribe to keep reading.

TRY 30 DAYS FREE

IN TODAYS UPDATE

Targets to re-hedge or make corn sales

Corn exports & ethanol

Soybean chart breakdown

Levels to watch in wheat

& more

START YOUR FREE TRIAL

Comes with our daily updates, signals, & 1 on 1 market plans.

Past Sell or Protection Signals

We recently incorporated these. Here are our past signals.

Oct 2nd: 🌾

Wheat sell signal at $6.12 target

Sep 30th: 🌽

Corn protection signal at $4.23-26

Sep 27th: 🌱

Soybean sell & protection signal at $10.65

Sep 13th: 🌾

Wheat sell signal at $5.98

May 22nd: 🌾

Wheat sell signal when wheat traded +$7.00

Want to Talk?

Our phones are open 24/7 for you guys if you ever need anything or want to discuss your operation.

Hedge Account

Interested in a hedge account? Use the link below to set up an account or shoot Jeremey a call at (605)295-3100.

Check Out Past Updates

11/8/24

USDA FRIENDLY BUT GRAINS WELL OFF HIGHS

11/6/24

GRAINS STORM BACK POST TRADE WAR FEAR

11/5/24

ALL ABOUT THE ELECTION & VIDEO CHART UDPATE

11/4/24

ELECTION TOMORROW

11/1/24

GRAINS WAITING ON NEWS

10/31/24

ELECTION & USDA NEXT WEEK

10/30/24

SEASONALS, CORN DEMAND, BRAZIL REAL & MORE

10/29/24

WHAT’S NEXT AFTER HARVEST?

10/25/24

POOR PRICE ACTION & SPREADS WEAKEN

10/24/24

BIG BUYERS WANT CORN?

10/23/24

6TH STRAIGHT DAY OF CORN SALES

10/22/24

STRONG DEMAND & TECHNICAL BUYING FOR GRAINS

10/21/24

SPREADS, BASIS CONTRACTS, STRONG CORN, BIG SALES

10/18/24

BEANS & WHEAT HAMMERED

10/17/24

OPTIMISTIC PRICE ACTION IN GRAINS

10/16/24

BEANS CONTINUE DOWNFALL. CORN & WHEAT FIND SUPPORT

10/15/24

MORE PAIN FOR GRAINS

10/14/24

GRAINS SMACKED. BEANS BREAK $10.00

10/10/24

USDA TOMORROW

10/9/24

MARKETING STYLES, USDA RISK, & FEED NEEDS

10/8/24

BEANS FALL APART

10/7/24

FLOORS, RISKS, & POTENTIAL UPSIDE

10/4/24

HEDGE PRESSURE

10/3/24

GRAINS TAKE A STEP BACK

10/2/24

CORN & WHEAT CONTINUE RUN

10/1/24

CORN & WHEAT POST MULTI-MONTH HIGHS

9/30/24