BRAZIL, CHINA, FUNDS & SEASONALS

Overview

Grains mixed to close out the week as corn and wheat continue their rebound while soybeans get hit pretty hard today.

Despite the heavy selling today, beans only lost a nickel on the week while the wheat market rallied.

Here was the weekly price changes:

Weekly Price Changes

Why were beans lower today?

There were two reasons.

The first is fund repositioning. They are heavily short corn & wheat, while being long beans. So they are evening out their positions today buying corn & wheat, while selling beans.

The other reason is that there is some "expected" showers over the next few weeks on certain models for Brazil.

Often times the thought of something in the markets will move the market more than an actual confirmation. They are called "futures" markets after all.

This is the 3rd Friday in a row soybeans have broken. What the market is trying to do here is see if Brazil will get rains or not.

Are they going to get rain or not?

The truth is not even the weather forecasts can decide.

Here is the difference between the two models.

From Darren Frye of Water Street Solutions:

"We are going higher if rains don’t confirm in the next 2 weeks. Models keep rolling forward drier. Root zone soil moisture is getting tapped!"

From World Weather Inc:

Brazil rains for the next week seem a little weaker than advertised.

"There is still no sign of 'normal' monsoon pattern in Brazil for the next 2 weeks."

Diego Meurer (Producer in Mato Grosso):

"Producers are already preparing to plant cotton in January, disregarding the soybeans."

From Farms.com Risk Management

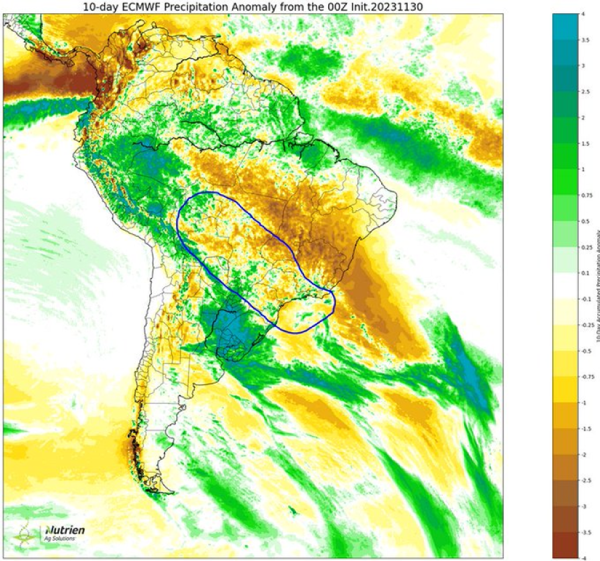

"The mid-day weather model had no serios changes through day 10 for Brazil and it increased the rains for Northeastern Brazil in the 11-15 day forecast but it remains too wet. The better chances of rain are again for a small region in Brazil the weather pattern does not look like its changing at all! (Please see chart below)"

Today's Main Takeaways

Corn

Corn trades higher for the 3rd day in a row, sitting 14 cents off those new lows from Wednesday.

The main reason for corn being higher these past few days is mainly the funds. As there wasn’t a ton of new news. More than anything it was just repositioning.

The funds are the shortest they have been since July of 2020. Sitting short over 200k contracts.

So what happened the last time the funds were this short?…….

The rest of this is subscriber only. Subscribe to keep reading and get every exclusive update.

IN TODAY’S UPDATE

What happened the last time funds were this short corn

Is the Brazil situation underrated for corn production

Our recommendations for corn

Utilizing seasonals & spreads to your advantage

What’s the Brazil bean situation?

Why did wheat rally +40 cents?

Are the lows in?

Levels to watch

BLACK FRIDAY SALE

Ends in 48 hours.

AUDIO & UPDATES

Lock in this offer. Could be the best investment you will ever make.

NOT SURE? TRY 30 DAYS FREE

Every exclusive update sent via text & email.

PRICE MAKER PROGRAM

One of a kind program. Limited spots.

Want to Talk?

Our phones are open 24/7 for you guys if you ever need anything or want to discuss your operation.

Past Updates

11/30/23

LOWS FINALLY IN OR ANOTHER SELLING OPPORTUNITY?

11/29/23

RISK & UPSIDE FACTORS

11/28/23

WHAT COULD CAUSE THE FUNDS TO COVER?

11/27/23

WHAT IS CORN BASIS CONTRACT DILEMMA TEACHING US?

11/24/23

POST THANKSGIVING MELT DOWN

11/22/23

WHAT’S THE BRAZIL STORY?

11/21/23

WHAT TO DO WITH YOUR CORN BASIS CONTRACTS

11/20/23

ARE YOU UTILIZING THE RIGHT STRATEGIES OR GETTING TAKEN ADVANTAGE OF?

11/17/23

DO THESE BRAZIL RAINS MATTER?

11/16/23

WAYS TO OUTPERFORM THE MARKET

11/15/23

FINDING THE RIGHT GAME PLAN

11/14/23