MARKET UPDATE

Futures Prices 11:15am CT

Overview

The war headlines and escalation over the weekend sent grains surging higher yesterday to start the week, as wheat was up around 6% at its highs. Yesterday we came back off our highs quite a bit and were lower overnight and into today giving back some of yesterday's gains. Outside of the war news, traders are looking forward to tomorrow's USDA report.

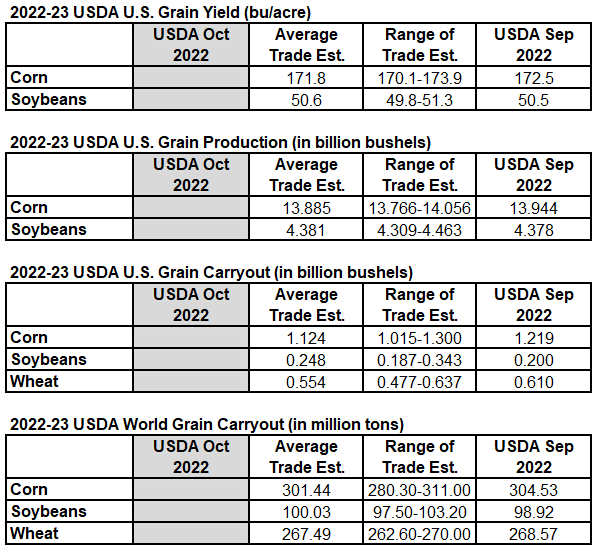

USDA Report Estimates

Chart Source: USDA, Bloomberg, StoneX

Today's Main Takeaways

Corn

Yesterday we saw corn follow wheat higher following the war news. As corn finally broke above the $7, however we weren't able to hold the $7 mark come close. Corn is currently down just a few cents here this morning.

Essentially all the war headlines were Russia sending a ton of missiles into several cities of Ukraine. Sparking further escalation of the war. There was also thoughts that maybe we do see Putin pull the grain agreement allowing grain to leave the Black Sea ports.

This afternoon we will see the USDAs crop conditions and harvest update. Its reasonable to think we see a rather large jump in harvest progress given the fair weather circumstances we've seen. Some suggest we might even see progress north of 35%.

Tomorrow the main focus for the majority is going to be the USDA Supply & Demand Report. From what it looks like, most are anticipating somewhat bullish numbers and are thinking we see ending stocks trimmed by a 100 million bushels or so.

Dec-22 (6 Month)

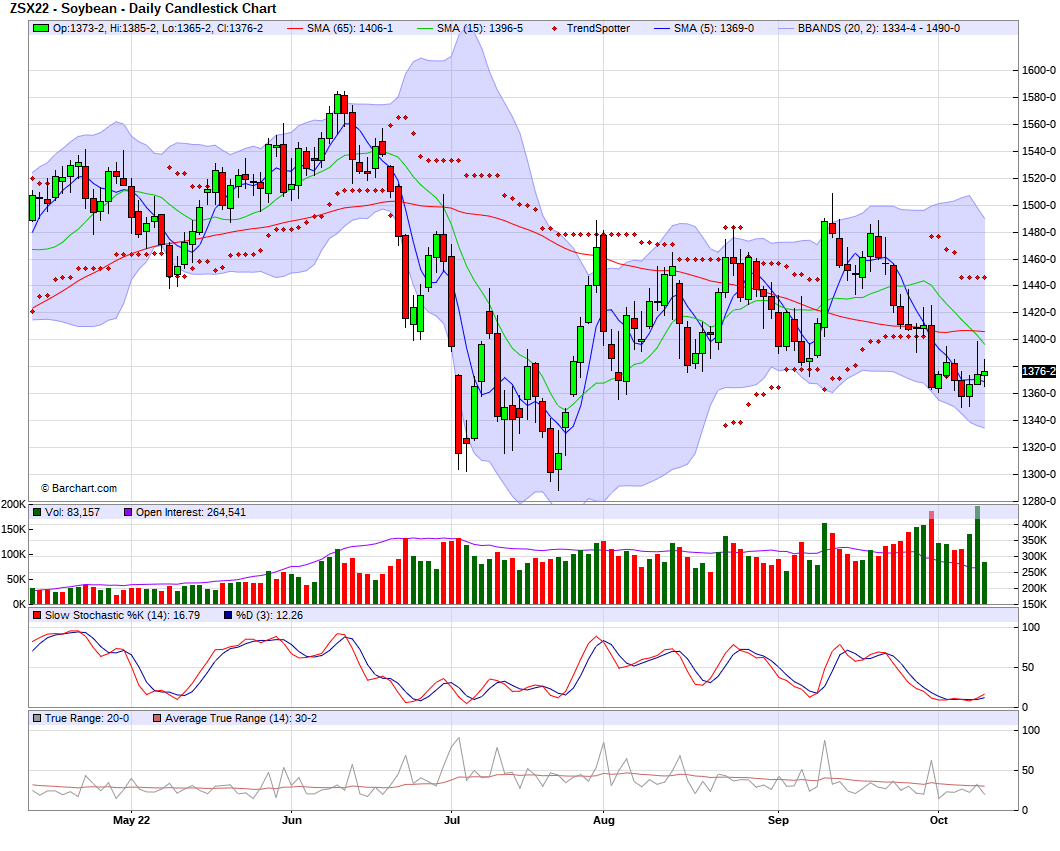

Soybeans

Soybeans rallied yesterday and were stopped around the $14 level which remains a strong resistance. After this they wound up giving back most of their gains they made on the day, as we couldn’t hold the higher prices. Soybeans were strong this morning trading as high as $13.85 but have given up early momentum, now trading around $13.76

With no real news of suggestions pointing to increased China demand, traders still look pretty worried about the soybean situation for right now. This afternoon we will get an update from the USDA on crop harvest. As last week we saw 22% harvested, most think we should expect a large jump this week as weather has remained cooperative so that will be something to keep your eyes on.

As for the USDA report tomorrow, its not looking like they are expecting any new crop yield changes, but there is talks that the USDA could possibly slightly raise their forecast which is set at 50.5 bpa. The main question surrounding the report is how much of an increase do we see ending stocks, which were previously at 200 million bushels.

Brazil Update

It's estimated that roughly 10% of Brazil's soybean crop has been planted as of last week. This is on pace with last year and ahead of the 5-year pace of 8%. We have not yet seen any planting for soybeans start in Argentina, as they are still faces dry weather conditions. If the weather remains dry would definitely see planting delayed.

Soymeal & Soyoil

Soymeal down -0.3 to 405.4

Soyoil down -0.83 to 65.23

Soybeans Nov-22 (6 Month)

Wheat

Wheat was the commodity everyone had their eyes on yesterday as the war news sparked a big rally in the wheat markets. We saw wheat prices climb to new highs, followed by lower prices before close. Wheat lower in the overnight and into today taking out a lot of yesterday's gains we saw, as some correction selling was likely after yesterday’s rally.

The news that Russia sent missiles to several Ukrainian cities is what escalated the war news and sent prices surging yesterday. With nearly 30% of the worlds wheat exports relying on the Black Sea ports staying open and exporting grain, we could definitely see wheat rally again if we see more headlines and things continue to escalate even further.

We also are seeing rumors fly around that Putin is considering pulling the grain agreement allowing exports from the Black Sea. And are curious as to whether or not we see Russia renew a new deal after the current one expires in a few weeks.

On the other side of things, the strong dollar continues to pressure wheat as well as the rest of the markets. We will see the USDA come out with its crop conditions and progress report later today, last week we saw winter wheat come in at 40% planted. Despite progress being okay, there is still come concerns of the dry conditions over in the plains.

Tomorrow most eyes will be on the USDA Supply & Demand Report, given that we don’t see anymore war headlines which could overtake traders focus. For the report, we know U.S. production will see a trim. Its looking like most are anticipating U.S. wheat ending stocks to fall below 600 million, maybe even into the 550 or lower area. If this did happen, most would look at this as a very bullish surprise.

Chicago Dec-22 (6 month)

KC Dec-22 (6 month)

MPLS Dec-22 (6 month)

Other Markets

Crude oil down -1.80 to 89.33

US officials ask Saudi Arabia to delay OPEC+ production cut for a month

Dow Jones up +173

Dollar Index down -0.451 to 112.620

News

The Mississippi river remains at historically low levels, but has reopened to barge traffic

Heavy rains damage Indian crops

China hogs jump by a record margin of 6% Monday with tight supplies

Russia is considering abolishing the grain export quota

Australian wheat crop is at risk due to heavy rains

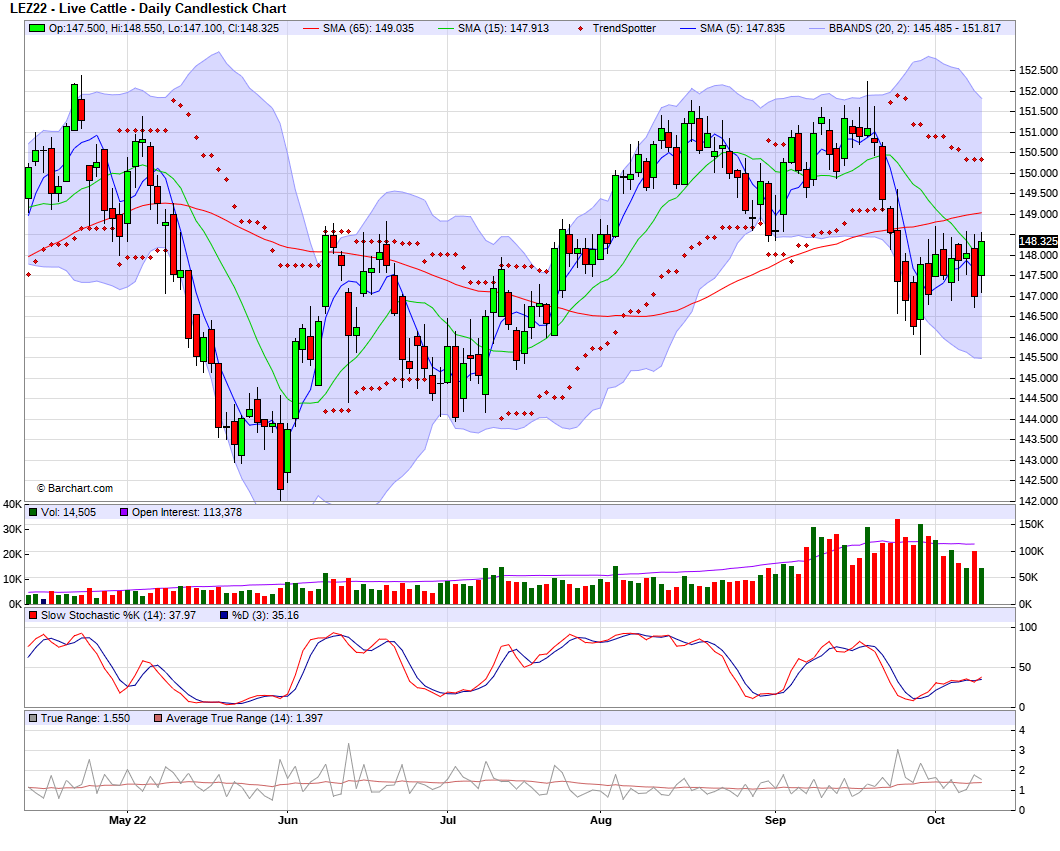

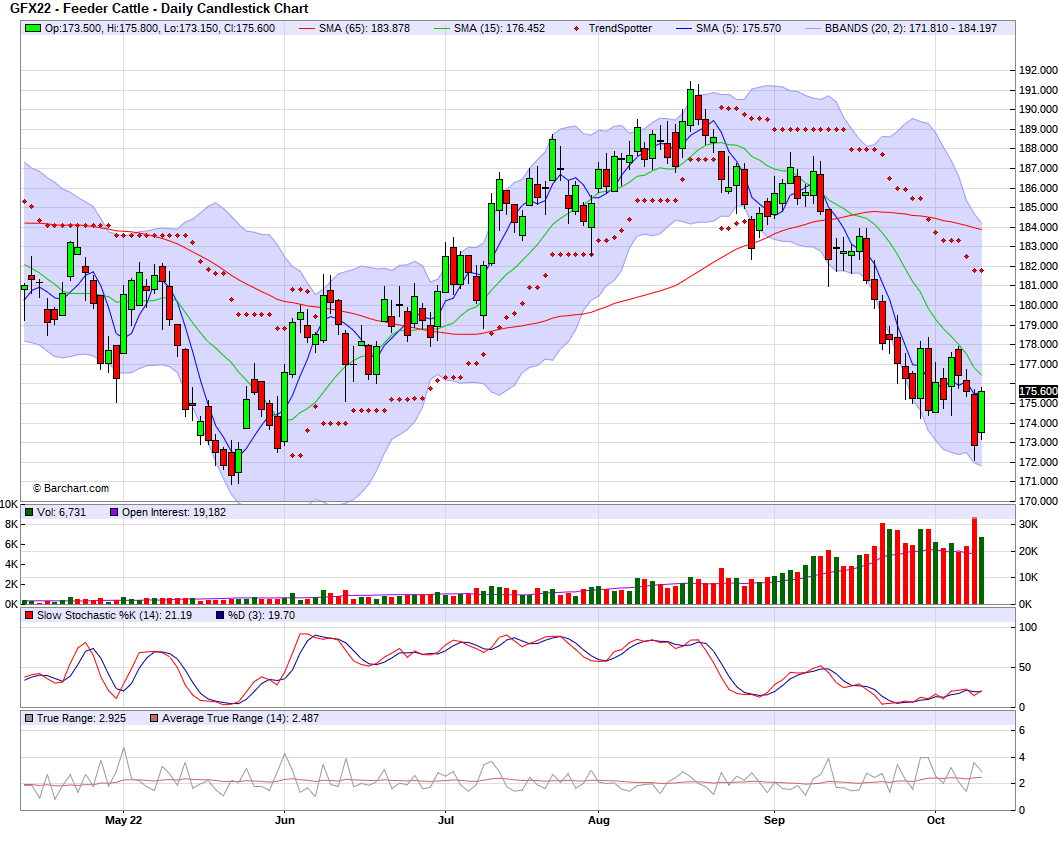

Livestock

Live Cattle up +1.100 to 148.100

Feeder Cattle up +2.250 to 175.125

Live Cattle (6 Month)

Feeder Cattle (6 month)

Previous Newsletters

Yesterday's Audio

This Weeks Weekly Newsletter

Social Media

Credit: All credit to users of posts

Precipitation Forecast 2-Day

Weather

Source: National Weather Service