MARKET UPDATE

Futures Prices 11:30am CT

Overview

Grains were intially trading firmly higher this morning after a choppy overnight trade, but have since gave back some of their gains. The main factors to watch are the Russia & Ukraine headlines, South American weather, and China relations. We also have the recession concerns being cooled by a lower dollar, as it is at its lowest level in a month.

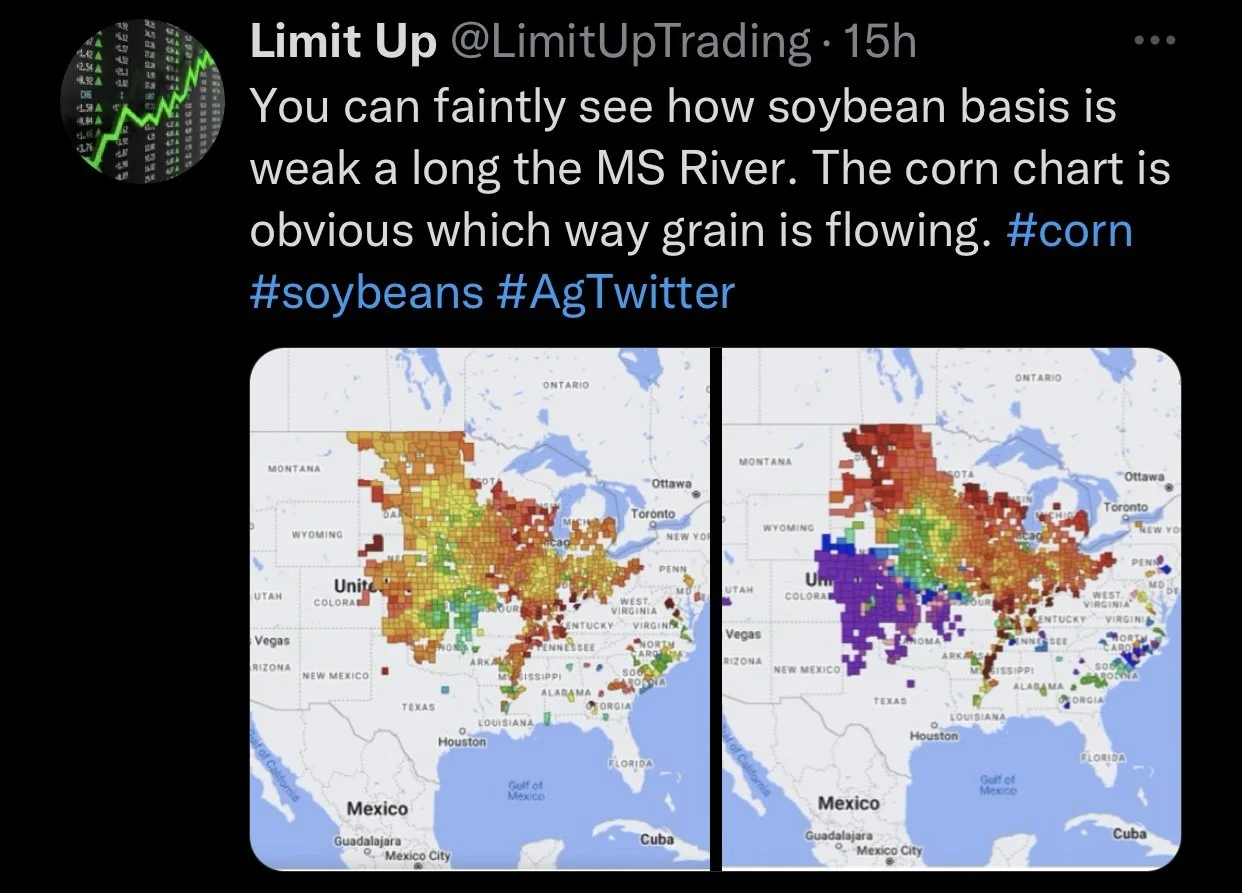

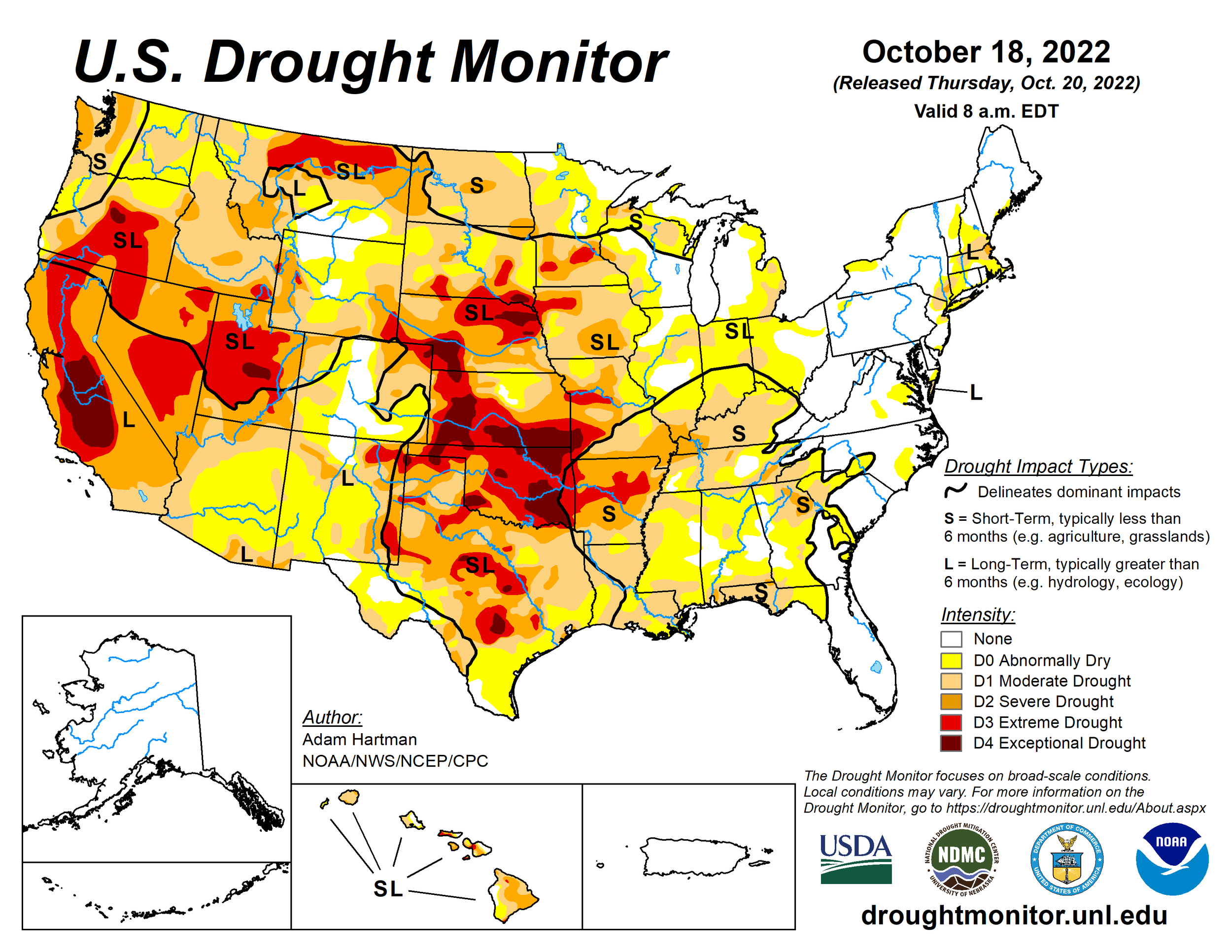

We also have the water levels in the Mississippi continue to cause barges being backed up. This could put a damper in exports. There likely won't be any major improvements made unless we see several rain falls.

Today's Main Takeaways

Corn

Corn is slightly lower this morning, trading in a fairly tight range this morning. Overnight we saw corn touch their highest level in a week. Corn has continued to bounce around in the $6.60 to $7 range for quiet some time now. As we haven’t had a close outside this range in two months. Currently we are sitting towards the middle of that range at $6.85 as bulls continue to look for that $7 break to the upside.

It appears as harvest is still moving along nicely, and expectations are that we see roughly 70% harvested or so this week. So we are still seeing some harvest pressure. As for South America, there aren’t really any major updates or changes currently. But of course, this is subject to change as this will be a topic everyone will watch closely as we near the end of the year.

Today we will get a new look at the updated ethanol production numbers. With demand remaining on the weak side, numbers upwards of 1 million plus could be beneficial for demand. The strong dollar remains a concern, but the dollar is now trading at its lowest level in a month, so some are suggesting the dollar rally is over. However, it's tough to think that we continue to see the dollar continuing to fall lower, as the recession concerns are still in full swing.

Corn inspections remain very poor. China imported 18.5 million metric tons of corn for the first 9 months of 2022. This is a -26% decline from last year. While September alone was -42% lower.

Dec-22 (6 Month)

Soybeans

Soybeans were very strong again this morning, but have since cooled off giving back 10 cents of their early gains. Currently trading +4 cents higher, with the Jan-23 contract finally breaking up past $14 this morning before seeing prices decline off their highs.

The dollar is showing some weakness once again, trading at its lowest levels in a month. Making some question if we saw the top or not. Im not too entirely optimistic on the idea that the dollar has peaked, but if it has it opens the door to create a bigger demand story as it should give a boost to exports.

It’s looking like roughly 90% of the U.S. soybean crop will be harvested. Brazil is looking at 40% planted, and stories are that the crop is in really good condition. Additionally, Argentina is finally getting their much-needed rain for their crops after their historic drought. So currently the weather isn’t looking to support the soybean markets, but this could always change on short notice.

Export inspections yesterday came in at 2.88 million metric tons. Last week was the first of the 22/23 where inspections of U.S. soybeans came in above average for the date. So there is now some optimism surrounding the soybean market and a possible uptick in demand.

Soymeal and soyoil have been relatively strong, further supporting the soybean market. Meal however took a sharp dive today following its recent rebound from its last dip.

Soymeal & Soyoil

Soymeal down -7.8 to 407.8

Soyoil up +1.36 to 73.64

Soybeans Nov-22 (6 Month)

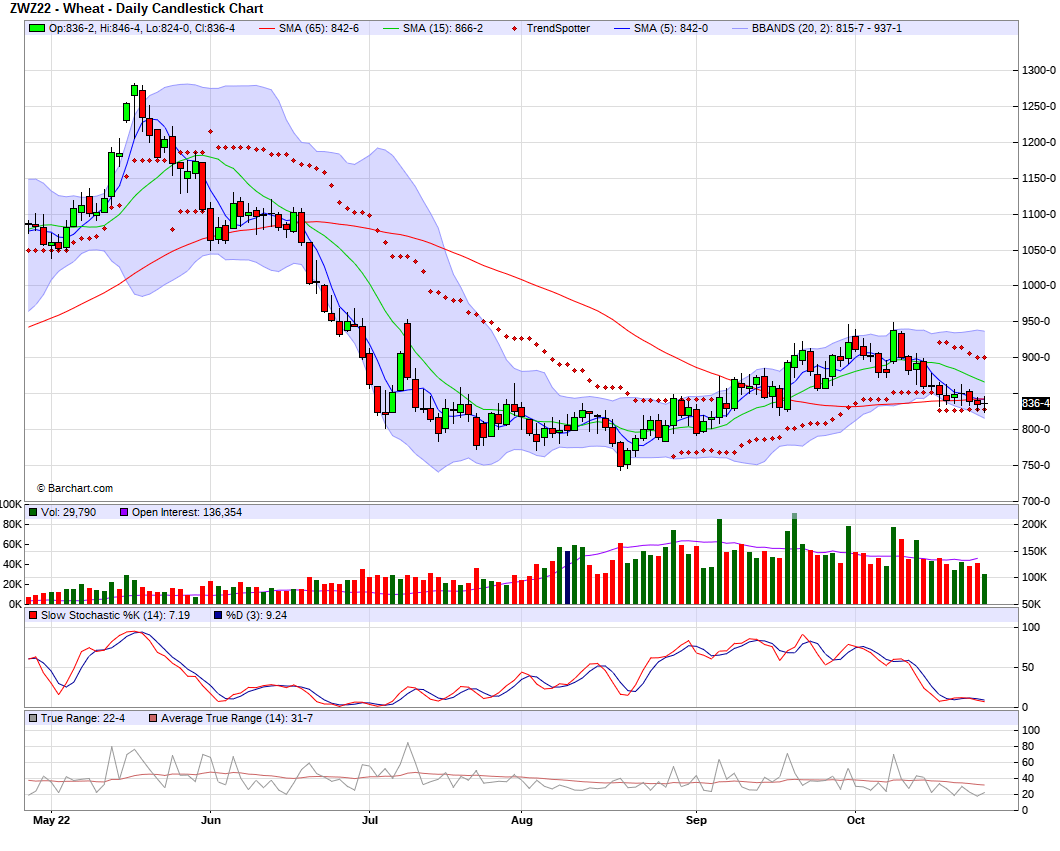

Wheat

Wheat is mixed here this morning, trading in a very wide range. We are roughly +10 cents off our early lows and a wide overnight trade range, but also about 10 cents off our highs. Wheat has continued to trade in a wide sideways range for the most part recently. Yesterday we saw both KC and MPLS wheat post their lowest close since September.

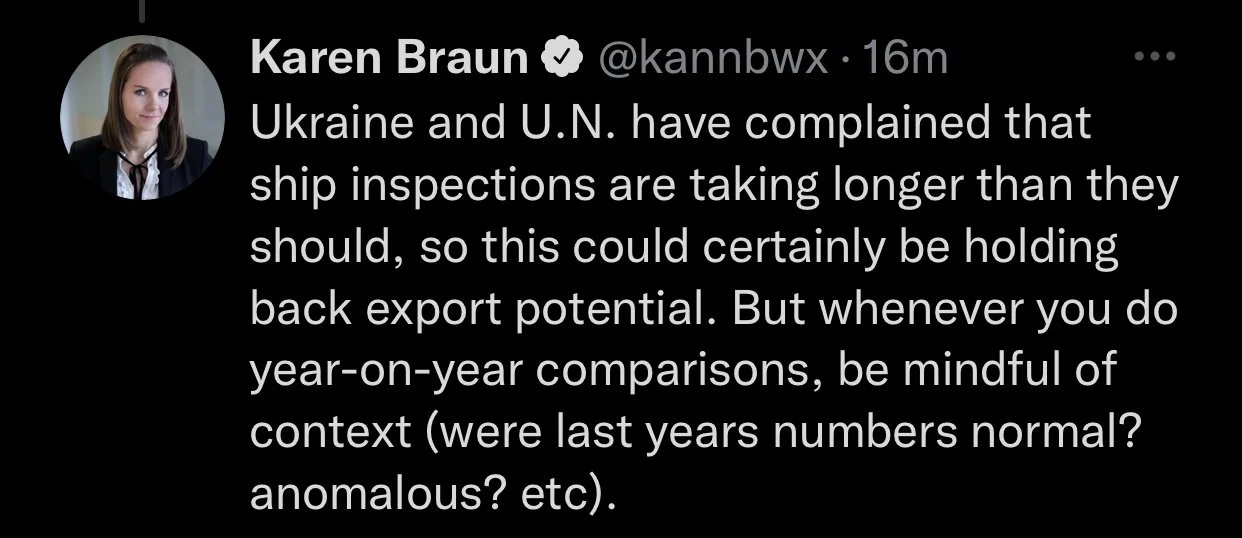

We continue to see Russia and Ukraine headlines as they attempt to near an export agreement. The chaos of headlines will continue one of the largest factors in dictating which way we see wheat go. If war escalates prices likely rise, if war talks die down and agreements are made we could see prices slip.

Another major factor will weather. Not only in the U.S. but globally, as Agrentina finally is seeing some rain its been looking for, as well as Europe seeing some increases in their conditions. If we see any type of weather scare prices will likely take advantage, and vice versa.

The weekly export inspection numbers were poor for wheat this week. As we saw inspected volume fall to a marketing year low, also making this week the second week in a row with poor inspections. Despite the poor exports, wheat is still far ahead of their USDA annual forecast pace.

Argentina's wheat production estimate was revised lower again for the third week in a row, down to 15.2 million tons for 2022/23. Due to their weather problems involved their drought and frost damage. 52% of their unharvested crop in in bad conditions, 37% average, and only 11% sitting in good conditions.

Monday we signaled a wheat buy signal. If you want to check out the full audio commentary you can do so here.

Chicago Dec-22 (6 month)

KC Dec-22 (6 month)

MPLS Dec-22 (6 month)

Other Markets

Crude oil up +2.89 to 88.21

Dow Jones +300

Dollar Index down -1.195 to 109.635

Cotton down -0.13 to 78.34

News

China announced it would continue its zero covid policy tolerance

Dollar lowers to a five week low

Belarus is expecting a record grain crop of 11 MMT

U.S. 30 year mortgage rates hit 7%, the highest since 2001

U.S. nitrogen exports hit multi-year high

Livestock

Live Cattle up +0.050 to 153.350

Feeder Cattle up +0.800 to 181.050

Live Cattle (6 Month)

Feeder Cattle (6 month)

Previous Newsletters

Monday's Market Audio - Wheat Buy Signal

Sunday's Weekly Newsletter

Social Media

Credit: All credit to users of posts

Precipitation Forecast 2-Day

Weather

Source: National Weather Service