WHEAT CONTINUES RALLY & BEANS BOUNCE BACK

Overview

Grains continue to do what they have essentially done the past week.

Wheat continues to run higher with their 6th green day in a row, led by purchases from China and fund short covering. Corn continues to follow behind wheat, slightly higher with short covering. While the soybean market continues to take it on the chin with fund repositioning amongst Brazil weather uncertainty as well as uncertainty ahead of Friday's USDA report.

However, beans did get a solid bounce today after initially trading a dime lower, closing nearly unchanged.

How have prices changed on this shift?

The wheat market is a massive +75 cents off of it's contract lows from exactly a week ago.

Corn is +20 cents off it's lows from last week, while soybeans are down -45 cents the past 4 days.

So why have prices done what they’ve done?

Most of this is fund repositioning. However, the wheat market has gotten a nice boost from purchases from China.

Yesterday they announced the largest purchase of wheat in over a decade. Today it was then announced they bought another near 200k tons. Bringing the weekly total to 638k.

We touched on this yesterday, but if China is buying. I’m not selling.

More on this later in today's update as well.

Beans have been getting hit because of Brazil weather uncertainty. Currently the forecasts are mixed. But our markets do NOT like uncertainty. Which can often lead to the funds positioning themselves in a place where they see the least risk.

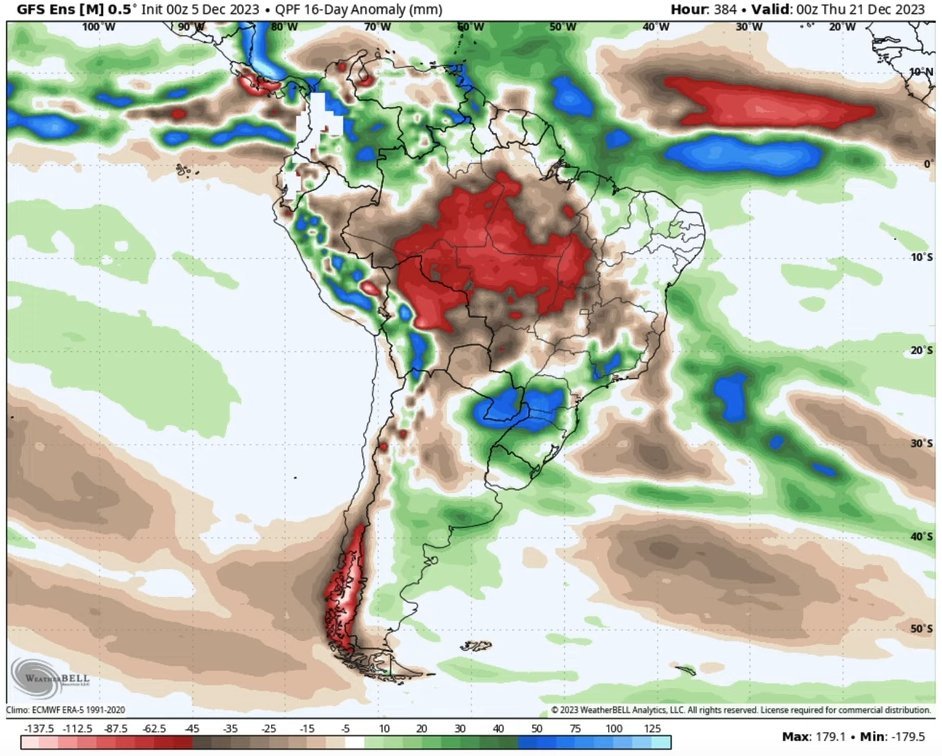

What does the Brazil outlook look like?

Still caught between two models. One is a lot drier than the other. Perhaps we will get something in the middle of these two, but neither look extremely promising in my opinion.

We also have the WASDE report on Friday, so perhaps the funds want to relieve some exposure ahead of the report in case we get some surprises.

Currently, the funds are still short nearly 200k contracts of corn and nearly 80k wheat. They are now only long around 30k to 40k beans but still long over 100k contracts of meal.

Until the report, there is a possibility that the funds continue to mitigate their risk and even out their positions.

Overall, aside from the China purchases there hasn’t been any real fresh news. So the next 2 days could largely be dictated by what the funds decide to do here.

Let's jump into today's update...

Diego Meuer, Brazil Producer:

"The largest group in Brazil announced it will replant 19 thousand hectare of soybeans, only then can you imagine the size of the problem in Mato Grosso, which the media and consultancies avoid showing."

Jason Britt, President of Central States Commodities:

The market just keeps kicking the can down the road. Reminds me of Argentina's situation last year and that didn’t turn out so good... (Talking about Brazil).

Mark Gold of Top Third:

"I think we are going to start seeing a continuation of lower Brazilian soybean production."

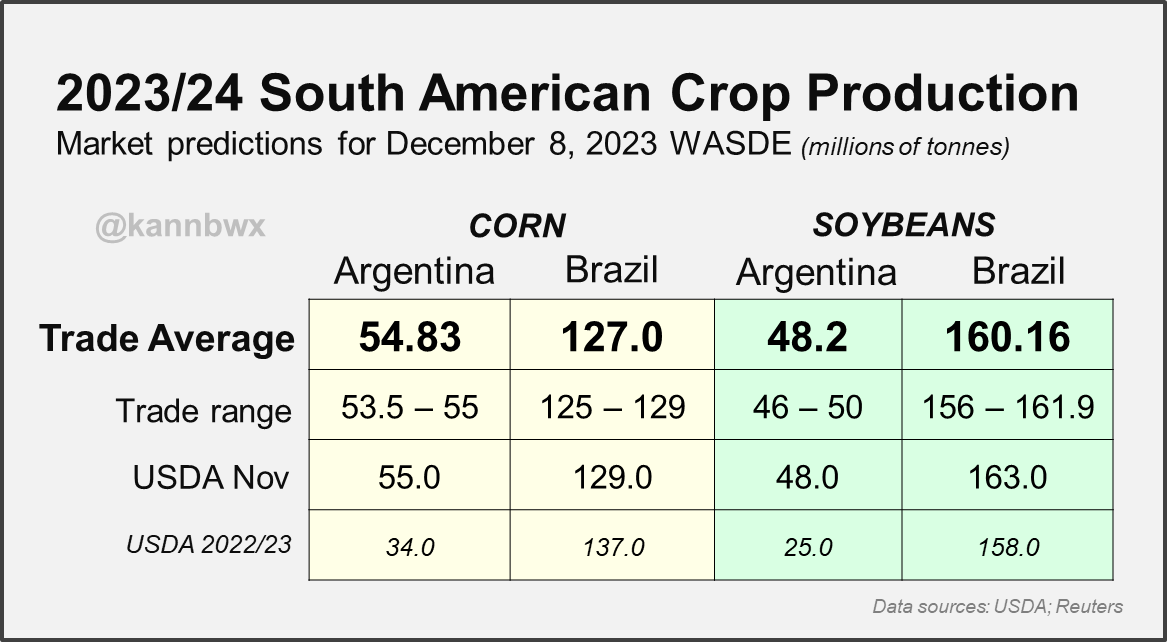

South America USDA Estimates:

We get the WASDE report Friday. Here is a chart from Karen Braun with the estimates.

The trade sees a lower Brazil corn and bean crop from last month, but bigger in comparison to last year.

Current Recommendations:

As far as marketing recommendations go,

For those who……

The rest of this is subscriber-only content. Please subscribe to continue reading & receive full access to every update.

IN TODAY’S UPDATE

Our recommendations for all the grains

Why the corn Brazil situation is underrated

Short & long term outlook for beans

Why we believe a bounce is coming for beans

Brazil production outlook

Why we don’t sell when China buys

Wheat & corn outlook

Technicals & levels

MISS OUR SALE? LAST CHANCE..

For those of you that missed our sale that ended yesterday. We are extending the offer for a limited time. Don’t miss the opportunity. Everything is 50% off.

Become a Price Maker.

NOT SURE? TRY 30 DAYS FREE

Try our daily updates completely free.

Check Out Our Price Maker Program

Become a price maker and take your marketing to the next level.

Want to Talk?

Our phones are open 24/7 for you guys if you ever need anything or want to discuss your operation.

Hedge Account

Interested in a hedge account? Use the link below to set up an account or shoot Jeremey a call at (605)295-3100 or Wade at (605)870-0091

Past Updates

12/4/23

IF CHINA IS BUYING, I’M NOT SELLING

Read More

12/1/23

BRAZIL, CHINA, FUNDS & SEASONALS

11/30/23

LOWS FINALLY IN OR ANOTHER SELLING OPPORTUNITY?

11/29/23

RISK & UPSIDE FACTORS

11/28/23

WHAT COULD CAUSE THE FUNDS TO COVER?

11/27/23

WHAT IS CORN BASIS CONTRACT DILEMMA TEACHING US?

11/24/23

POST THANKSGIVING MELT DOWN

11/22/23

WHAT’S THE BRAZIL STORY?

11/21/23

WHAT TO DO WITH YOUR CORN BASIS CONTRACTS

11/20/23

ARE YOU UTILIZING THE RIGHT STRATEGIES OR GETTING TAKEN ADVANTAGE OF?

11/17/23