MORNING MARKET UPDATE

Futures Prices 8:00am CT

Overview

Grains were sharply lower yesterday, and continued to slide, with the USDA crop conditions report coming in slightly more favorable than was originally expected. As well as Ukraine sent off its first shipment of grain yesterday morning.

As mentioned yesterday and you’ve probably heard, Ukraine had its first ship leave out of the port of Odessa. The shipment contained 26,000 metric tons of corn. It was made known that they also have multiple ships loaded and ready to leave.

World markets also saw a negative reaction to Nancy Pelosi's travel plans. As she led a group of Democratic legislators to Taiwan, despite threats from China. U.S. equity indexes reacted negatively and fell lower. With China being the biggest buyer, this was also a negative for the grains.

Crop Conditions Highlights

Corn

61% rated good/excellent (61% last week)

80% silking (85% average)

Soybeans

60% rated good/excellent (59% last week)

79% blooming (80% average)

44% setting pods (51% average)

Spring Wheat

70% rated good/excellent (68% last week)

97% headed (99% average)

Winter wheat

82% harvested (85% average)

Today's Main Takeaways

Corn

Corn was down yesterday, not nearly as drastic of a loss as soybeans. Dec-22 closed down 15 3/4 cents. Sliding lower in the overnight and into this morning. Corn actually held up fairly well given the extreme losses in corn. 2022 contracts finished yesterday in the middle of the trade range, while 2023 contracts finished in the upper range.

Most pressure coming from two sources. The first being the USDA leaving crop conditions from last week to this week unchanged at 61% rated good/excellent. When most expected to see a slight drop in ratings given the dry temps.

The second factor putting pressure on the markets would be the tensions between U.S. and China. Which is giving demand concerns, as China is the largest U.S. buyer.

We are also seeing some slightly improved U.S. weather for corn-growing areas. The weakness in crude oil also does not help corn futures.

Dec-22 has some short-term support around $5.97 with some nearby resistance now around $6.25. Key support has to be our upward gap last week, with support at $5.84 to $5.89 range. A break below that wouldn't very good.

Soybeans

Soybeans were sharply lower yesterday (-62 1/2 cents). Slipping lower overnight. However, soybean futures did bounce back after going to test the moving average and are far off last night's lows. Support still coming fro. the ongoing concerns with the dry and hot forecasts for the midwest.

Pressure coming from the same stories as corn. Improved crop condition ratings and China tensions. Soybean ratings came in 1% better than last week (60% compared to 59% last week).

There is a ton of uncertainty over this China situation. As China is the largest buyer of U.S. soybeans. There is some talks that China could respond in some violent ways. This news makes it kind of tough to get bullish on demand.

Nonetheless, we can expect a ton of volatility with all the stories. From Ukraine shipments, China tensions and demand, recession, and weather.

Soymeal & Soyoil

Soymeal up +1.2 to 400.5

Soyoil down -1.59 to 61.67

Fats & Oils and Grain Crushings Reports

June total U.S. soybean crush came in at 174.1 million bushels. Just lower than the trade estimate of 174.4 million. Below May's 180.9 million bushels, but still above last year's 161.7 million for June.

June soybean oil stocks totaled an estimated 2.316 billion pounds. Last month was 2.384. Last year was 2.101 billion.

Corn used for ethanol in June was down to 441.95 million bushels, from May's 446.60 million. Still above last year's June 439.53

Wheat

The main story surrounding corn has to be the story with Ukraine's exports. There are so many question marks surrounding the whole situation. How many ships do they actually have loaded? Are these ships as big as they say? Will they only be able to export a very small amount at a time?

Crop ratings weren’t favorable for wheat, similar to corn and soybeans. Spri g wheat came in 2% better than last from 68% last week to 70% this week. The fallout with China also putting on pressure.

Export Inspections

Inspections came in slightly higher than the previous week, but were still not great. Still fat below last years levels.

Corn

Inspections were up 4 million bushels to 33.7 million

Corn inspections are at 95.8% of 5-year avgerage

Soybeans

Came in up 6 million bushels to 20.4 million

Soybean inspections are at 100.4% of 5-year average

Wheat

Inspections were down 8 million bushels to 9.4 million

Wheat inspections are at 79.4% of 5-year average

Other Markets

Crude oil futures are much higher than their lows, after finding support at Mondays lows. Actually trading slightly higher this morning around $94.50, after sharp losses yesterday.

Cotton around 88 points lower at 93.18

Dollar index is slightly higher, recovering from last nights 1-month low overnight.

News

Turkey expects daily departures from Ukrainian ports

Indonesia lowers crude palm oil reference price for first half of August

Crop Consultant Dr. Micheal Cordonnier cuts his corn and soybean yield estimates. Estimates 174 bu. per acre for and 50.5 bu. per acre for soybeans.

Weather

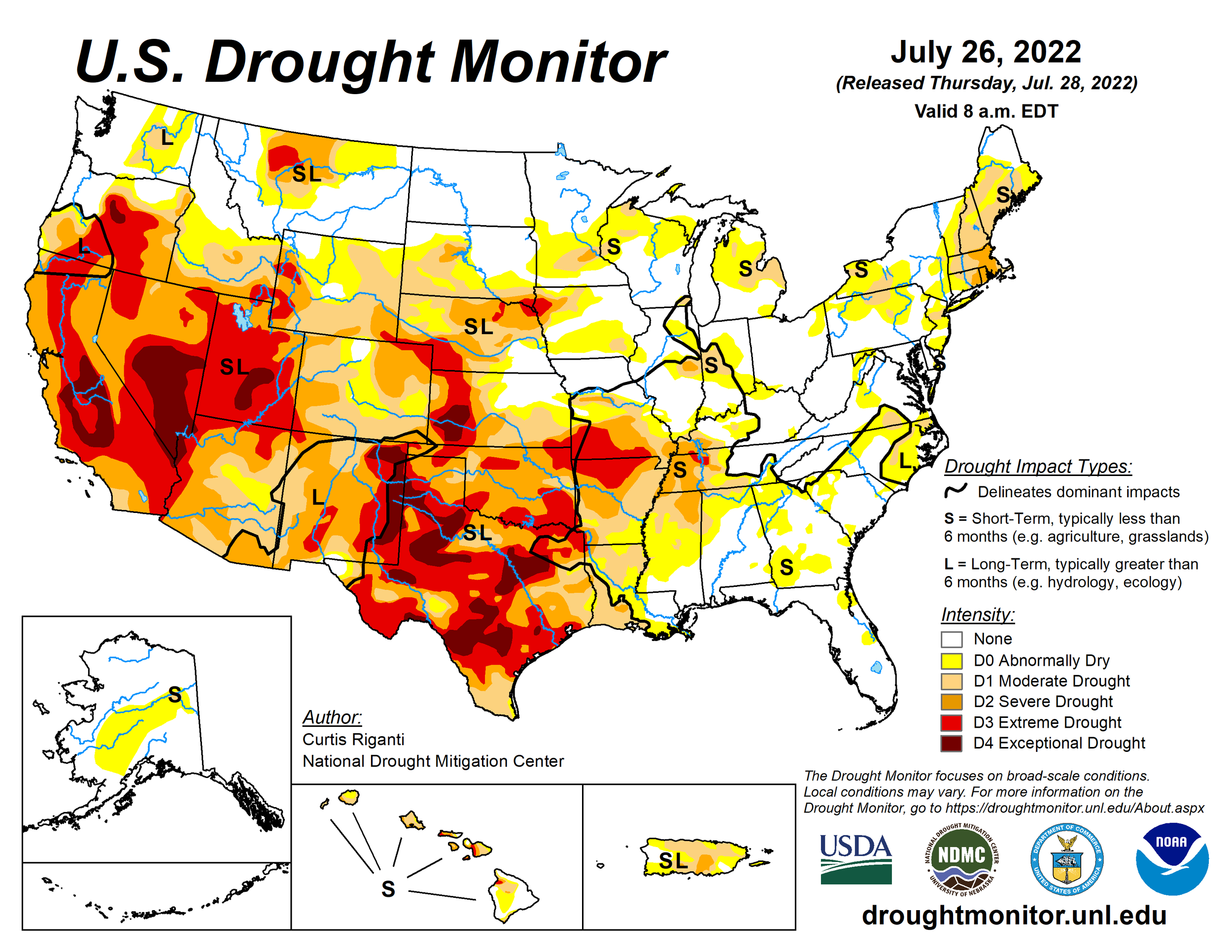

Forecasts for central and eastern midwest appear to not be too terrible over the next few weeks. The highest concerns still remain int he western Midwest, especially for soybean crops.

Source: National Weather Service