MORNING MARKET UPDATE

Futures Prices 8:00am CT

Overview

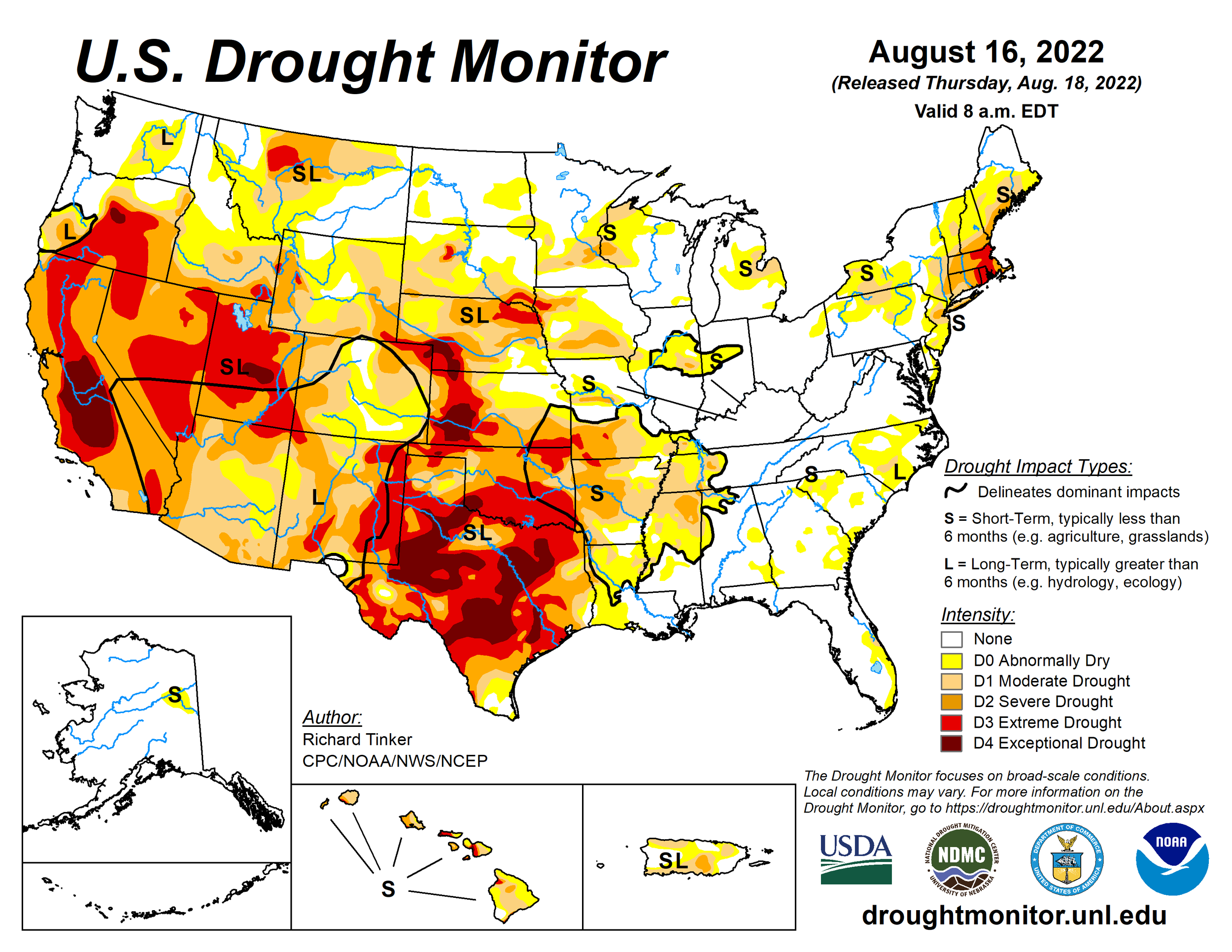

Grains are slightly lower this morning following yesterday's modest gains in corn and soybean futures. Yesterday we did see slighter warmer/drier forecasts for part of the corn belt for late August. But overall the outlook looks fairly cool with expected rainfall. A rebound in the U.S. dollar, as well as economic weakness, have been putting pressure on the markets as well.

Overall, the markets seem pretty nervous. We will need to see these crop tours at least come close to USDA estimates to prevent anymore panic.

Today's Main Takeaways

Corn

Corn is slightly lower this morning, as the weather continues to be a negative factor for the markets. As forecasts progress into being more cooperative, this likely means we will see crop ratings at the minimum stay at their levels rather than continue to fall. As the trade seems to believe that the cooler temps and added rainfall should be beneficial enough to stop any further decline. However, some would like to make the argument that much of the damage has already been done, and its too late even despite the recent forecasts.

Outside of the weather, the China and U.S. tensions continue to put a damper on the markets and demand. The downfall of crude oil continues to be a negative factor. As well as Ukrainian exports continuing to put pressure on these markets.

On the other hand, there are a few factors that could potentially help out prices. There are the obvious production setbacks we've seen in the EU, which could possibly help spark back some demand. Or maybe, we see the U.S. dollar stop its bull run, and work its way back down, and crude oil climbs out of the hole its recently put itself in. With the potential for global weather to be a concern.

Argentina's corn plantings are expected to be 3% lower than last year as their drought continues.

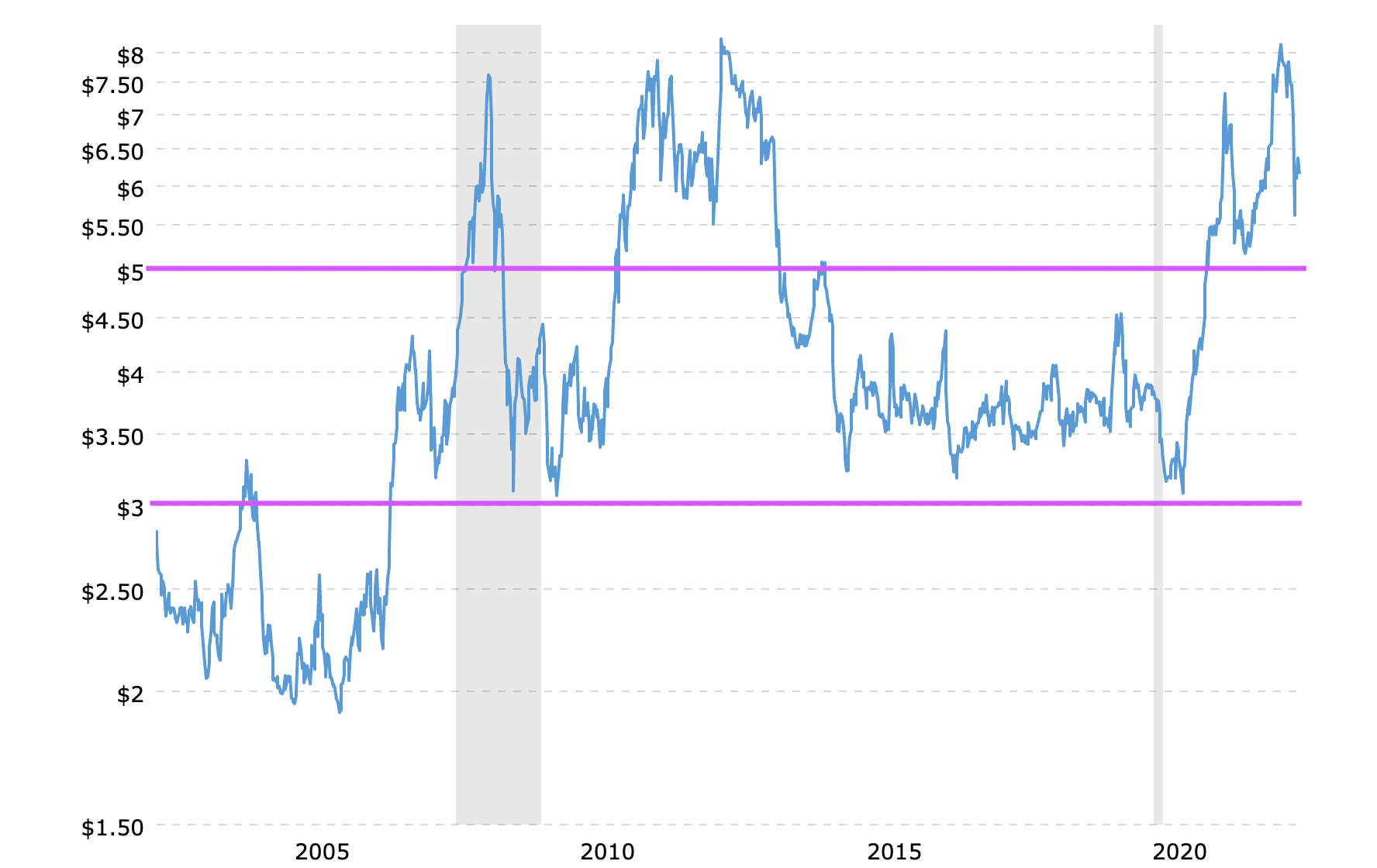

Dec-22 (6 Month)

20-Year Chart

Soybeans

Soybeans lower again this morning, with forecasts still putting pressure on the markets, as well as a lack of demand. Everyone is excited to see what the crop tours show next week.

Average U.S. yield is expected to be around the 50-52 range. The recent favorable weather forecasts will likely stop any further damage to the crop conditions. But there is that chance that a lot of the damage has already been done.

Since June we've seen overall crop condition ratings for soybeans drop from 20%. From 78% rated good/excellent, all the way down to 58%. Nearly every state seeing a rather large decline since then, with North Dakota being the lone state to actually see an increase in ratings.

The toughest story outside of weather for the soybeans remains to be the lack of global demand, as we haven't seen any real confirmation that Chinese demand will pick up. Yes, they have bought some small stuff here and there, however it hasn't been anything noteworthy.

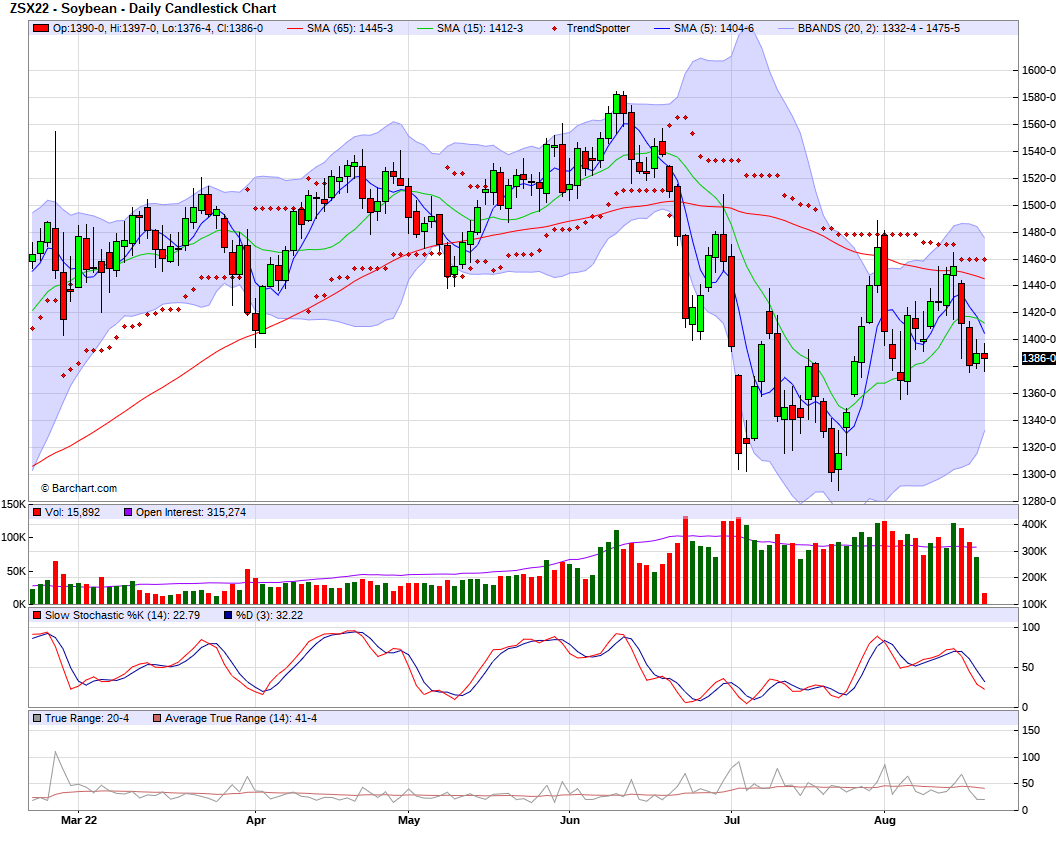

Nov-22 soybeans are trading far below their 100-day moving average, and slightly below their 200-day. So overall, the charts don't look amazing. If we want to see higher prices we will likely need to see a spark in Chinese demand or some other global headline to shake up the markets.

Soymeal & Soyoil

Soymeal up +2.3 to 402.9

Soyoil down -0.55 to 65.05

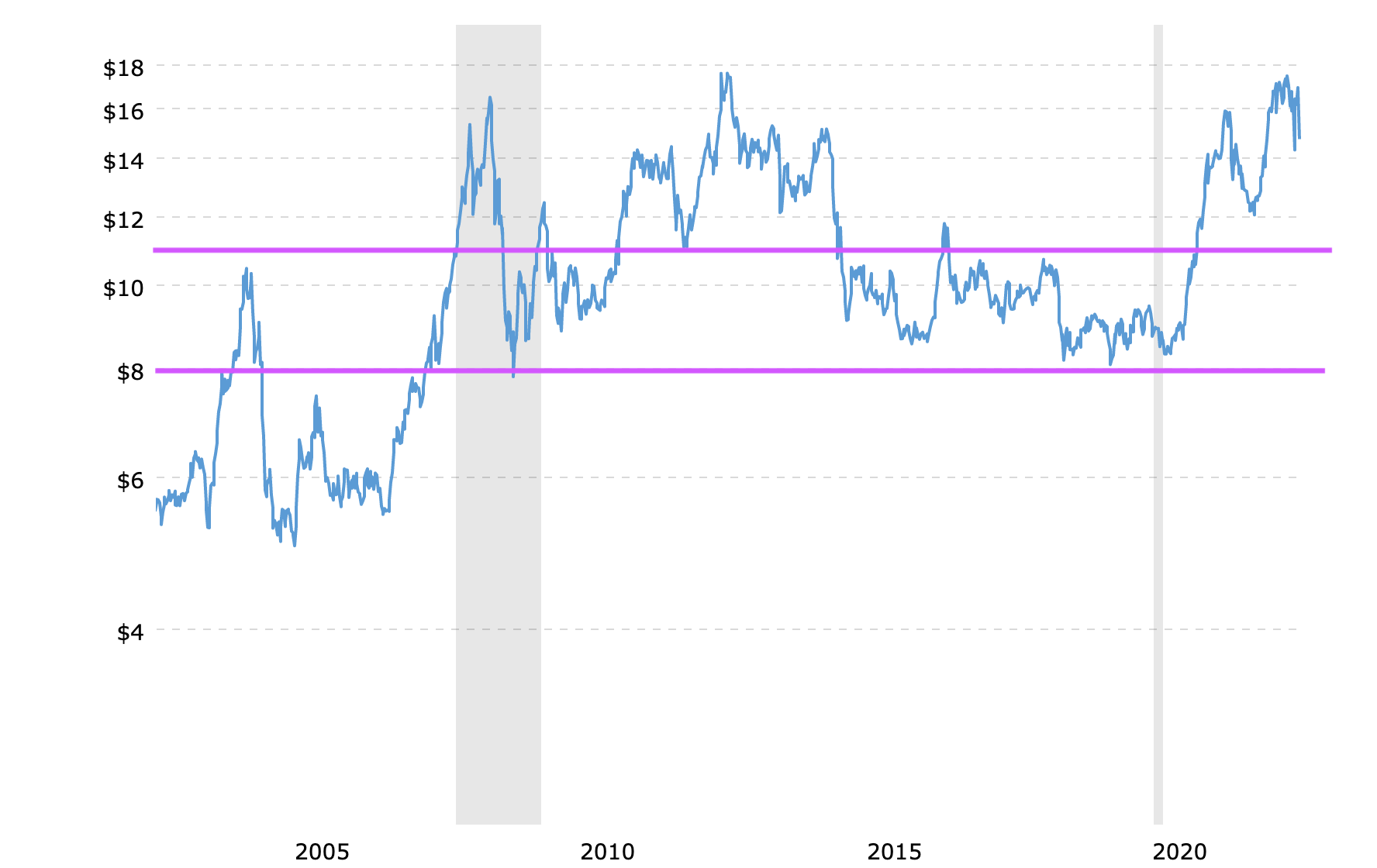

Nov-22 (6 Month)

20-Year Chart

Wheat

Wheat sharply lower again this morning following yesterday's losses. Wheat is now at multi-month lows, as wheat continues to struggle as the shipments keep sailing out of Ukraine. The U.S. also committed to buying 5 or 6 MBU of their wheat harvest later this year.

India's Agricultural Ministry raised their 2022 crop by 430,000 metric tons, bringing them to 106.84 million metric tons, while USDA has them at 99 million metric tons. Keep in mind we did see world wheat prices skyrocket around 15% after they banned their wheat exports back in May.

Argentina's wheat production for the crop that will be harvested this late fall to early winter is expected to hit record large production numbers.

Overall, it's very tough to have a ton of optimism in the wheat market, and slightly disappointing where we are today after seeing all-time high prices earlier this year.

The Ukraine situation will continue to be a negative factor unless Russia pulls off something surprising or something goes wrong. Weather isn't helping prices either.

From a technical standpoint, we are getting awful close to a major support level. A clean break below that level could be really concerning, as we haven't seen prices below that level since last October.

Dec-22 Chicago (1 Year)

Other Markets

Crude oil

Weekly ethanol production fell below 1 million barrels per day, which hasn’t happened in quite a while.

DOW slightly lower

Cotton slightly up +0.18 to 113.72

Dollar Index up +0.114 to 106.600

China & Exports

The U.S. and Chinese political battle continues. If this continues it will likely be tough for U.S. exports to see much if any exponential growth. As conflict with our biggest buyer will hurt demand for U.S. products.

The U.S. and Taiwan agreed to start trade talks under a new initiative to reach agreements. It appears the first round of talks will take place in early fall. China’s foreign ministry said Beijing will take resolute measures to defend its territorial integrity, and they suggested that the U.S. not make any wrong judgment regarding Taiwan.

News

China's major manufacturing providence Sichuan was shut down in an effort to reduce the electric power shortage.

Appears that China will be sending troops to Russia for a joint military exercise.

Eurozone consumer inflation reaches another record, as it rose a 8.9% annualized rate in July.

China's pork imports were unchanged in July but still far below a year ago.

Another ship leaves the Ukrainian ports. This time out of the Chornomorsk. This now brings their total to 25 ships that have left.

Weather

We did see a slight shift for certain regions now expecting less rain as well as warmer temps, but for the most part, the U.S. forecasts are still pretty bearish for prices.

We did see Europe now have a better chance for rain, while Argentina remains in their drought. World weather is a mixed bag, maybe even on the slightly bullish side.

Source: National Weather Service