MORNING MARKET UPDATE

Futures Prices 10:45am CT

Overview

Both corn and soybeans remain under pressure this morning following lower prices yesterday. Wheat initially saw a rebound and was higher this morning. However, has since then gave back all of its early gains and is trading lower. Harvest pressure is starting to take a toll on the grains, and progress is moving along quickly and is expected to continue to do so with forecasts remaining clear for the most part.

Today's Main Takeaways

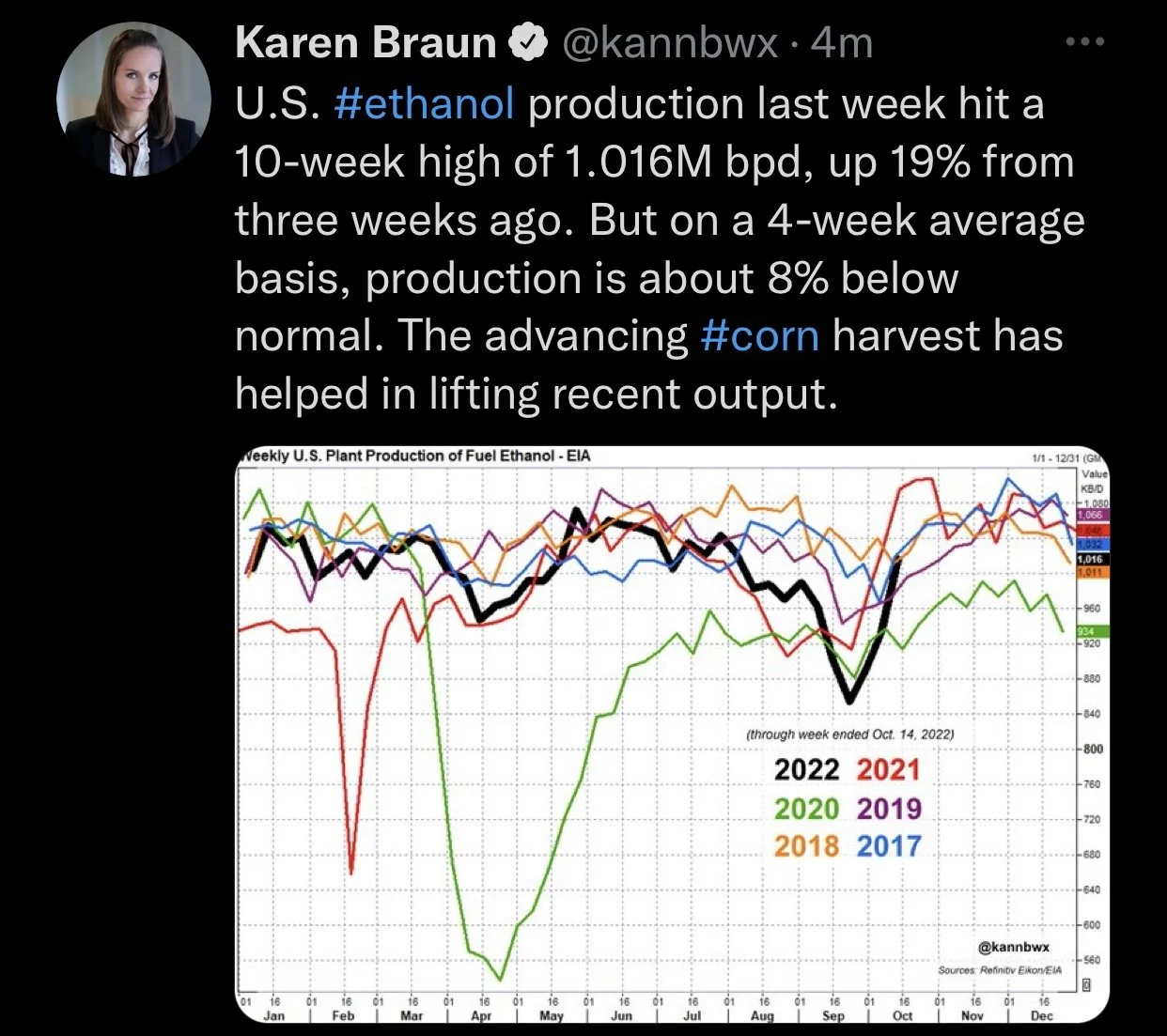

Corn

Corn is lower again this morning, falling back into right around its 20-day moving average. As this morning we are sitting at our overnight lows before open.

Harvest pressure is starting to put a lot of pressure on both corn and soybean prices. As U.S. harvest is moving past 50% complete. Expectations are that harvest will continue to move along quickly with the forecasts being favorable. There isn’t much of a weather scare left here.

Last month we saw the USDA lower its yield estimates from 172.5 to 171.9 bushels per acre. So I think the question everyone is asking themselves is, whether the USDA will again lower its yield on the USDA report scheduled for November 9. Some people think we might see a number below 170. However, some reports on the other hand claim their yield was actually better than expected.

As for the Russia and Ukraine situation. The rumor seems to be that talks with UN and Russia regarding renewing the export deal has Russia leaning towards taking the deal. However, there is also news that Russia claims they are ready to walk away from this deal at any moment. If we see this deal made it will likely add some additional pressure to both corn and wheat. Nonetheless this entire situation is likely far from over with Russia just launching missiles last week, causing a ton of problems in Ukraine.

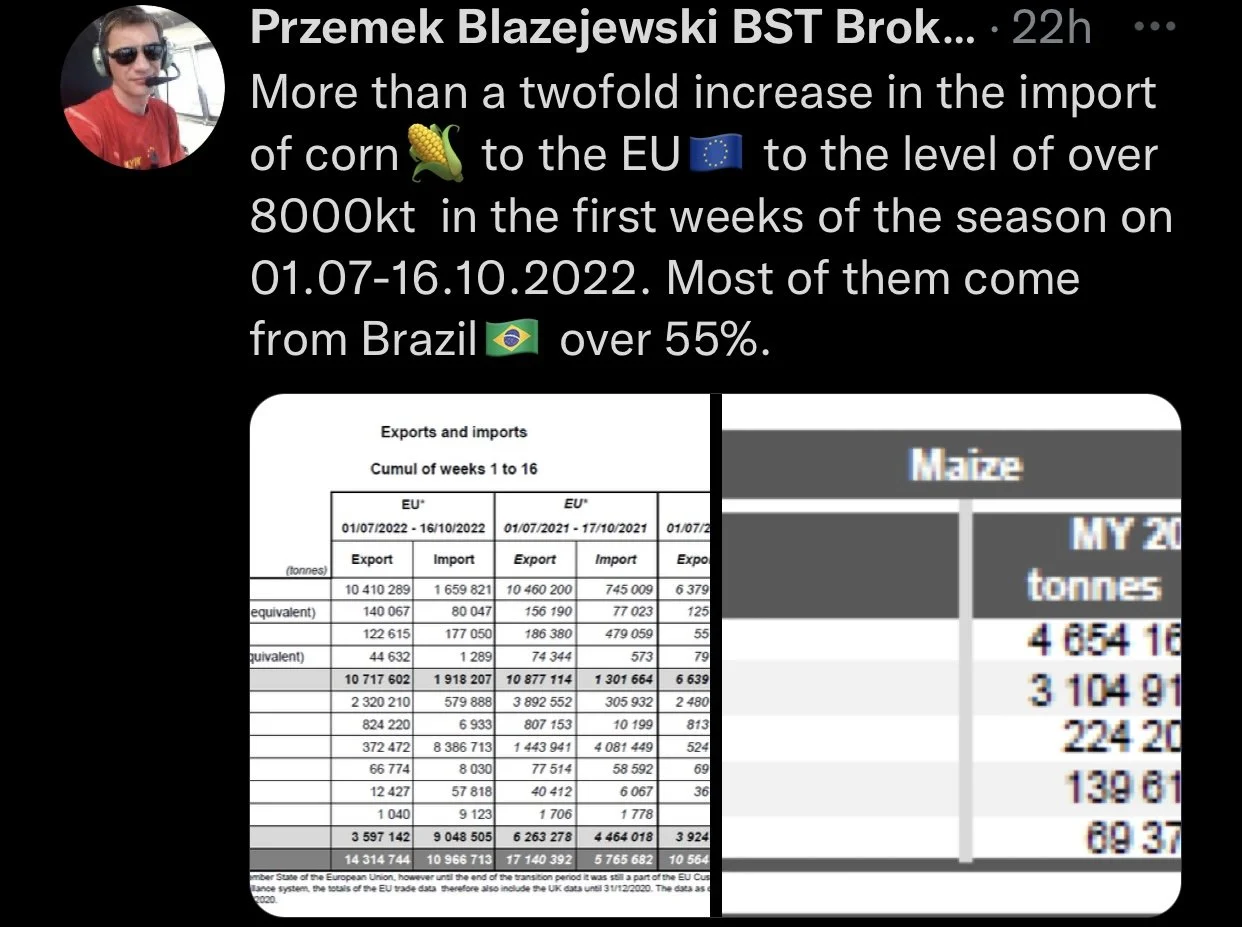

Outside of harvest pressure, the lack in demand is negatively affecting prices. With the low levels in the Mississippi causing backups. The river fell to a new record low just this Monday, breaking a record from 1988. On the other side of things we have the dollar still strong as ever and looks like we are going to be getting competition from Brazil.

Dec-22 (6 Month)

Soybeans

Soybeans also lower again here this morning. As soybeans have fell down past their 20-day moving average. Soymeal has recently followed beans lower, but soyoil on the other hand has seen a nice rally.

Looking globally, its still looking like Argentina is too dry, but the trade isn’t using this quiet yet. There has been rumors that Brazil has been getting too much rain which could cause quality concerns or delayed crops.

The soybean market is experiencing a lot of the same problems the corn market is. First we have harvest pressure, which looks like it should be a fairly smooth ride from here barring any weather issues. But the lack of demand headlines and news has left the bulls very little to chew on. With all the negative headlines such as the low river levels and the strong dollar. Chinese demand hasn't been there like one would like. Without the demand being there it makes it hard to justify higher prices. But who knows, maybe this headline could flip in the near future.

From a technical standpoint, soybeans are nearing a pretty critical support level which sits around the $13.50-60 mark. If we can’t find support there we may find ourselves taking another leg down and going back to test the $13 range.

Soymeal & Soyoil

Soymeal down -0.2 to 401.6

Soyoil up +0.15 to 68.89

Soybeans Nov-22 (6 Month)

Wheat

Wheat was higher here this morning, but has given back all of its gains since. With all three classes of wheat trading roughly -25 or so cents off their highs. We can’t ignore the fact that wheat prices are down about a $1 from their highs we saw last week Monday.

The biggest headline surrounding wheat continues to be the Russia and Ukraine situation, and whether we will see Russia partake in renewing the agreement or not. Nobody really knows what Putin will actually which makes this headline a wild card. If he renews it, its going to put pressure on prices. As it allows both Ukraine and Russia to export their goods. As one of Russias terms if they renewed the agreement was that they must be given the ability to freely export. If they walk away from the deal it will likely push prices higher.

We also have to point at export inspections for the U.S. coming in sub par once again. As well as expectations that we see a record Russian crop.

Winter wheat planting is going smooth for the most part. This week we saw winter wheat planting come in at 69% complete. Which was a 14% increase from the week prior, and just above the traditional pace.

Taking a look at Australia, it appears they are experiencing some problems due to flooding. Argentina continues to experience drought which has caused some issues, creating a smaller crop.

Chicago Dec-22 (6 month)

KC Dec-22 (6 month)

MPLS Dec-22 (6 month)

Other Markets

Crude oil up +0.86 to 82.93

Dow Jones up +70

Dollar Index up +0.619 (+0.56%)

Cotton down -2.97 to 79.32

News

Ukraine October grain exports return to near pre-war levels

Russian drones strike a Ukraine sunflower oil terminal

UK inflation remains at historic levels. With their latest CPI increasing 10.1% in September

Presdient Biden announced more oil will be released from the U.S. reserves. Helping push crude oil 1% higher overnight

The U.S. remains in a historic drought. With nearly 82% of the U.S. experiencing drought on some level

Livestock

Live Cattle +1.050 to 150.825

Feeder Cattle +0.850

Yesterday we saw feeder cattle futures rally triple digits, taking the Nov contract to a new high for October. Month to date the Nov feeder contracts are upover +$3.20 but nowhere near their August highs.

Live Cattle (6 Month)

Feeder Cattle (6 month)

Previous Newsletters

Yesterday's Market Audio

Sunday's Weekly Newsletter

Social Media

Credit: All credit to users of posts

Precipitation Forecast 2-Day

Weather

Source: National Weather Service