MORNING MARKET UPDATE

Futures Prices 10:30am CT

Overview

Wheat futures surged overnight, helping push both corn and soybeans higher. This is despite crude oil getting smacked in the face. Crop conditions came in unchanged for the most part.

Crop Conditions Highlights

Corn

54% rated G/E (Last week 54%) unchanged

92% dough (93% average)

63% dented (67% average)

15% mature (18% average)

Soybeans

57% rated G/E (Last week 57%) unchanged

94% setting pods (96% average)

10% dropping leaves (14% average)

Spring Wheat

71% harvested (83% average)

Winter Wheat

3% planted (3% average)

Cotton

35% rated G/E (Last week 34%)

97% setting bolls (96% average)

39% bolls opening (32% average)

Today's Main Takeaways

Corn

Corn is higher this morning along with the rest of the markets. The crop condition ratings for corn came in unchanged. However, many expected us to see a 1% decrease which didn't happen. This weeks 54% rated G/E compared to last year's 59% at this time. Many are thinking we may see conditions at the very least stabilize here. As we don't have much for weather scares left in the picture.

The USDA will update it's actual harvested and planted acres for both corn and soybeans in their WASDE report. Which is scheduled for next Monday, the 12th. We typically don't see this until October. So we could see some surprises.

We saw some analysts update their corn yield projections as well as production estimates

The current USDA estimates are 175.5 bushels per acre for corn yield, and 51.9 bushels an acre for their soybeans.

Stone X has their corn yield at 173.2 bushels per acre. With their soybeans at 51.7 bushels an acre.

IHS Markit has their corn yield at 171.6 bushels per acre, and soybeans at 51.3 bushels an acre. They also reduced their total corn production from 14.497 billion bushels down to 14.040 billion.

Allendale has their corn yield at 172.4 bushels per acre.

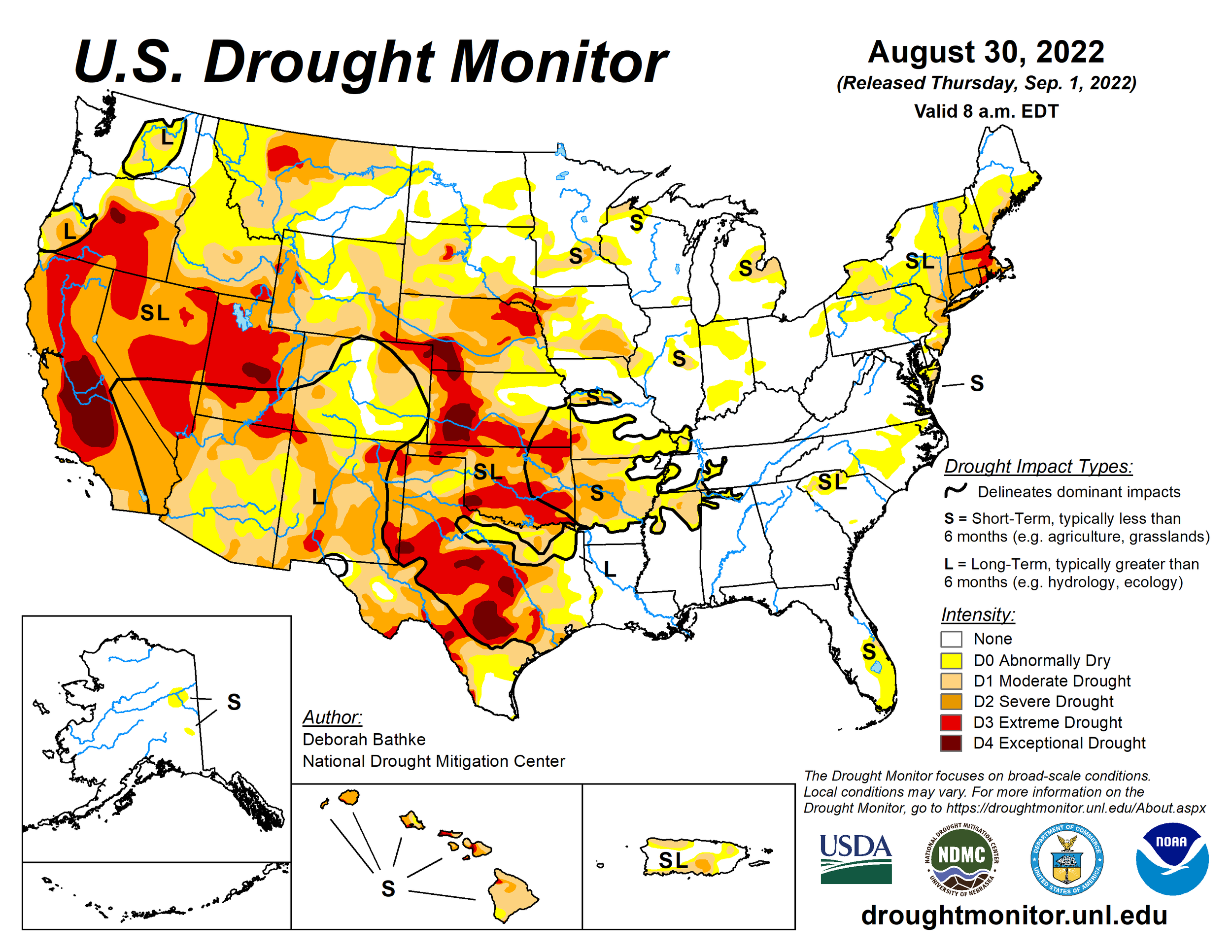

Many are wondering whether we will see corn conditions further deteriorate, as we still have pretty dry conditions in areas such as the western corn belt.

We still have demand uncertainty surrounding the global recession fears and a very strong U.S. dollar

Technically, we have resistance at the $6.80 to $7 range as we've struggled to push past the $6.80 area. Nearby support currently sitting around $6.40 or so. With a very heavy psychological level at the $6 mark.

Dec-22 (6 Month)

Soybeans

Soybeans orginally got pretty hammered amongst the news that Argentina's government encourages producers to send more supplies to exporters, as they try to motivate their producers to sell their soybeans by offering a better exchange rate through out the month of September.

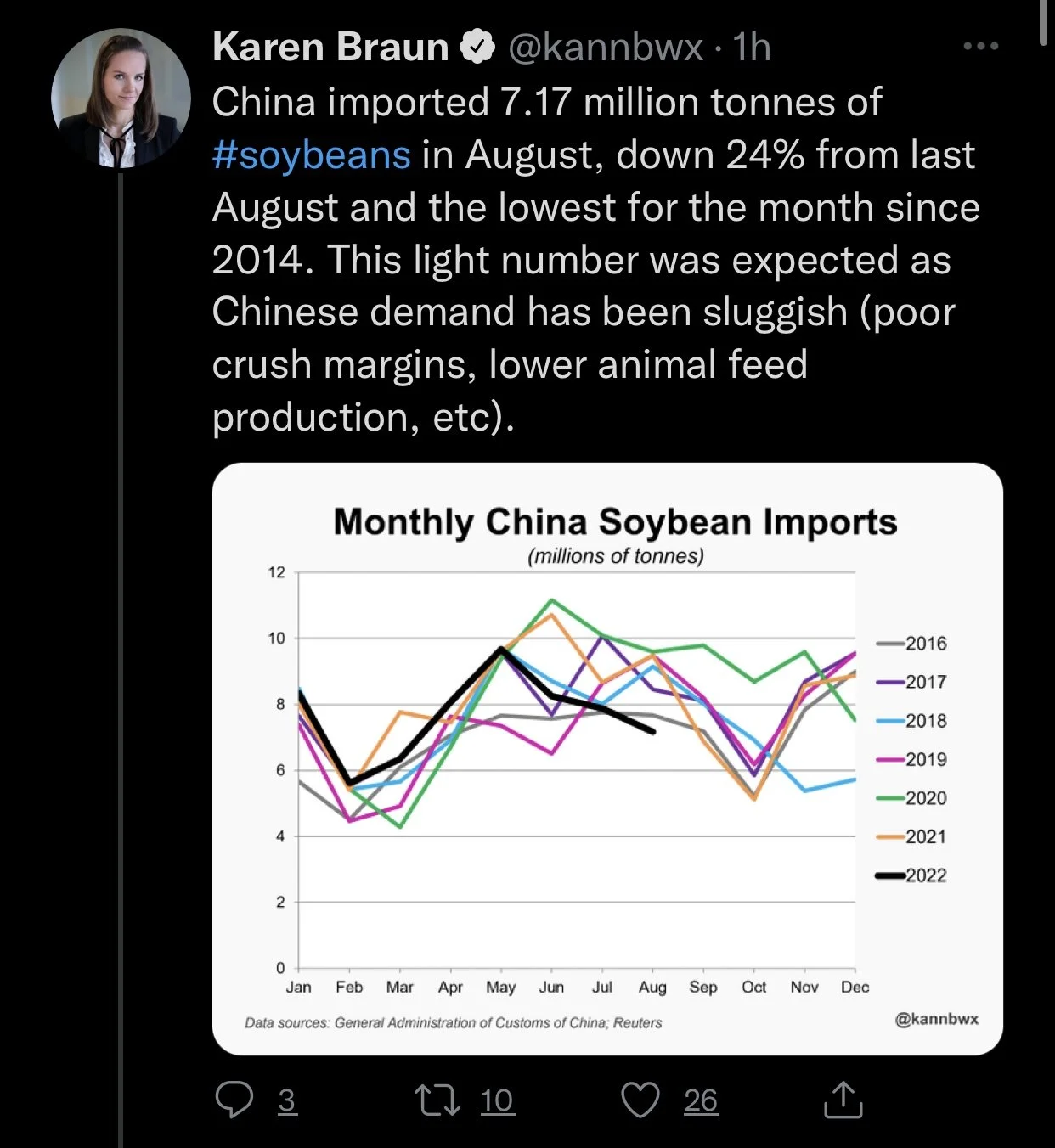

We also have pressure coming from the COVID lockdowns in China. With China being the largest soybean purchaser. Despite both these headlines, soybeans have made a turnaround here this morning, sitting firmly green.

Similar to corn, crop conditions for soybeans came in unchanged from last week. We mentioned this above, but IHS Markit lowered their soybean yield estimate to 51.3 bushels per acre, down from 51.8 bushels an acre.

We are also seeing some forecasts for large production in new crop soybeans out of Brazil.

Argentina is going to give producers 200 pesos versus their normal 140 they get per dollar. That is over a 42% increase. That would be equivalent to the U.S. farmer getting nearly $6 a bushel more than their present value. This added pressure with soybeans and soyoil being down sharply yesterday.

We saw 800,000 mt of soybean sales Monday. This is the highest daily volume we've seen since 2017. With 700,000 traded yesterday.

India's palm oil imports in August, we up +94% from July. After the export restrictions of palm oil were removed by Indonesia and Malaysia.

We currently seem to have resistance at the $14.40+ range, with nearby support in the $13.60 or so range.

The big question mark surrounding Chinese demand still remains. One would think that China will have to purchase U.S. soybeans. As demand will play a large part in the strength we see from soybeans, as a major weather scare seems to be out of the picture.

Soymeal & Soyoil

Soymeal up +10.4 to 417.2

Soyoil down -0.55 to 62.73

Soybeans Nov-22 (6 Month)

Wheat

Wheat futures soared overnight and still remain very strong this morning. Strength came after the news that Russia is rethinking the Ukraine grain export deal. This news also helped pull soybeans and corn higher along with the wheat market.

Putin he believes Russia was cheated under the Ukraine grain export deal. He said they will be looking to revise its terms to limit the countries that can receive shipments. He said that the grain is not going to the worlds poorest countries as the deal had originally intended. He said "It's just a scam". "What we see is a brazen deception".. "A deception by the international community of our partners in Africa, and other countries that are in dire need for food". So essentially he feels deceived that most of these exports have been going to European Union countries, and not the countries who need it the most.

We may finally see us break up through this recent choppy sideways action. As we have mentioned a few times before, even before this recent news, there was always the skepticism that the exports were being overly estimated to begin with.

We saw spring wheat harvest come in at 71% harvested. This is better than was expected, but still far below the 5-year average of 83%.

If we continue to see drought remain a concern, this could help out prices even further.

Other Markets

Crude oil down -3.40 to 83.48

DOW up +227

Cotton down -1.05 to 102.50

Dollar Index down -0.05 to 110.15

News

The USDA will update its actual harvested and planted acre for both corn and soybeans in their WASDE report. Which is scheduled for next Monday, the 12th. Typically we see this done in October, but they claimed that their data is complete enough.

World food prices fell further in August, making it the 5th month in a row off its all time highs earlier this year.

Argentina offers a better exchange rate in an attempt to boost soy exports. We touched on this above in the soybeans section.

India’s August palm oil imports hit an 11-month high in August. Nearly doubling from the month prior.

Brazil mills limit wheat imports due to rising prices and inflation

China's August soybean imports remain weak. Coming in at 7.17 million metric tons, down -9% from July, and down -24.5% from a year ago.

Millet Market

Currently a bullish supply/fear market. Remains solidly firm. Yields have been very disappointing. Buyers are panicking a little bit. We expect this market to remain very volatile. Make sure to give Jeremey or Wade a call with offers. As this market could make you look like a fool or make you look like a genius as it falls out of bed. Call Jeremey at 605-295-3100 or give Wade a call at 605-870-0091.

Previous Newsletters

Here are our last 2 newsletters. Would love any feedback or things you would like to see.

September 6th, Audio Commentary - Listen Here

September 5th, Weekly Newsletter - Read Here

Social Media

Credit: All credit to users of posts

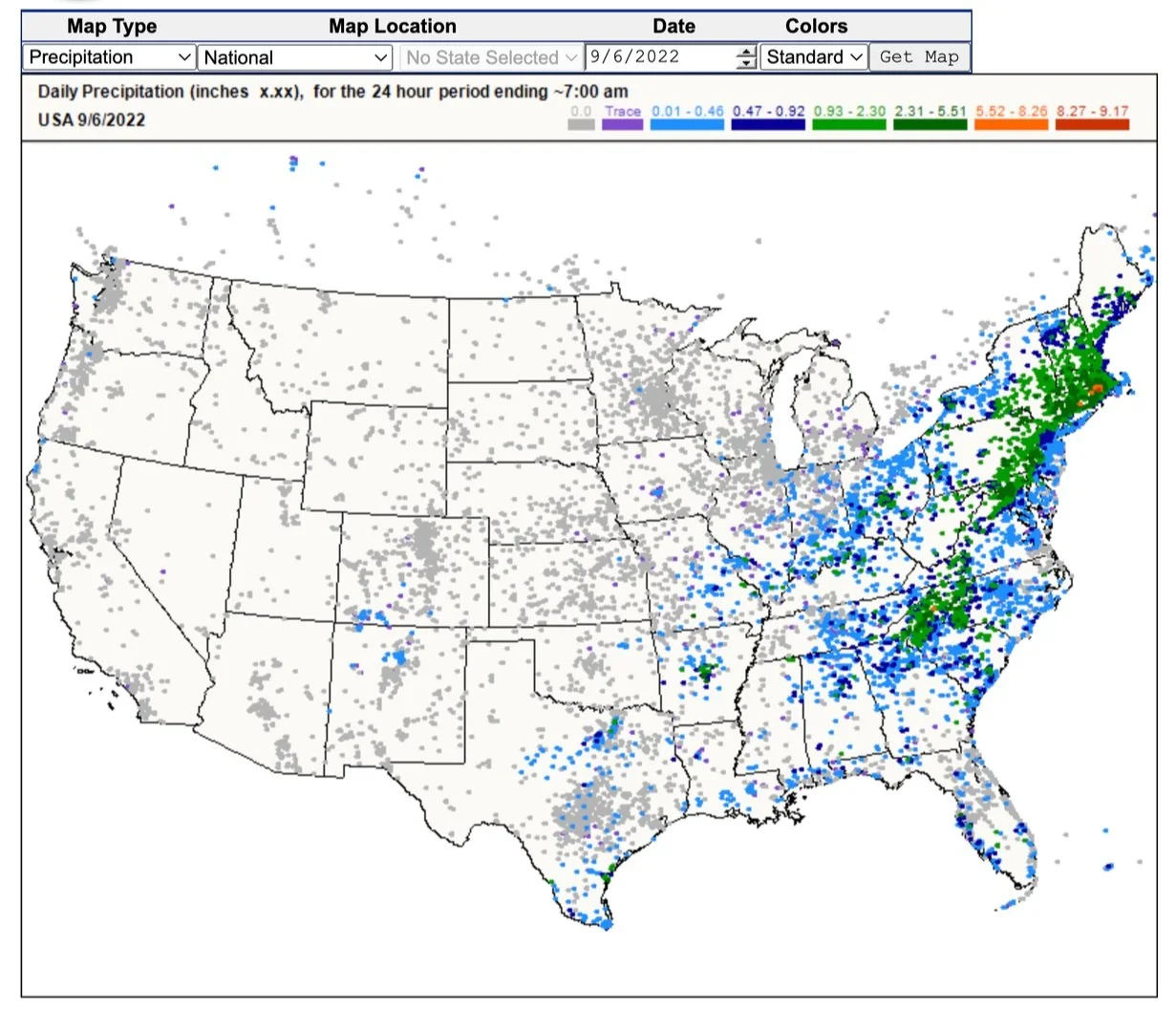

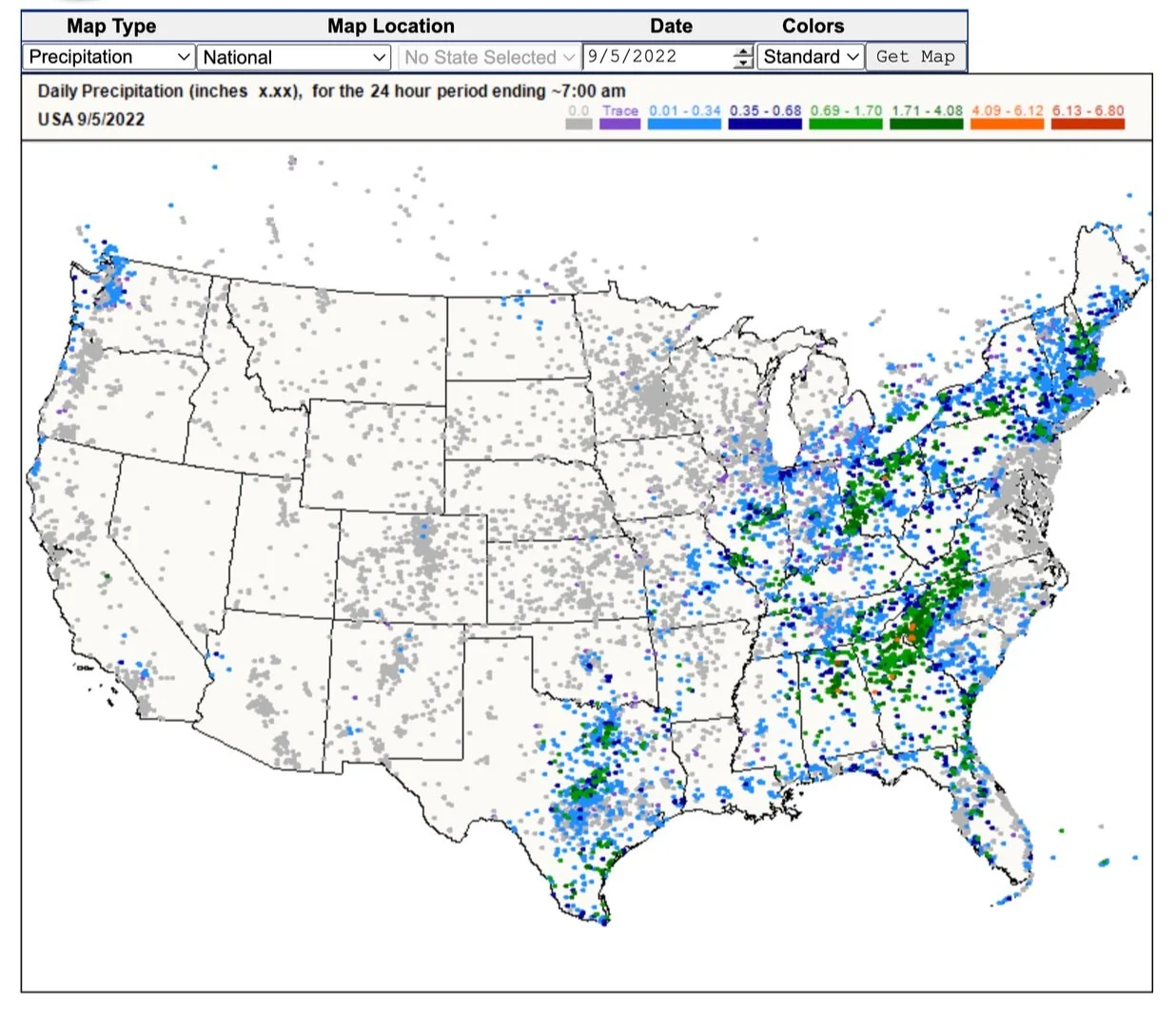

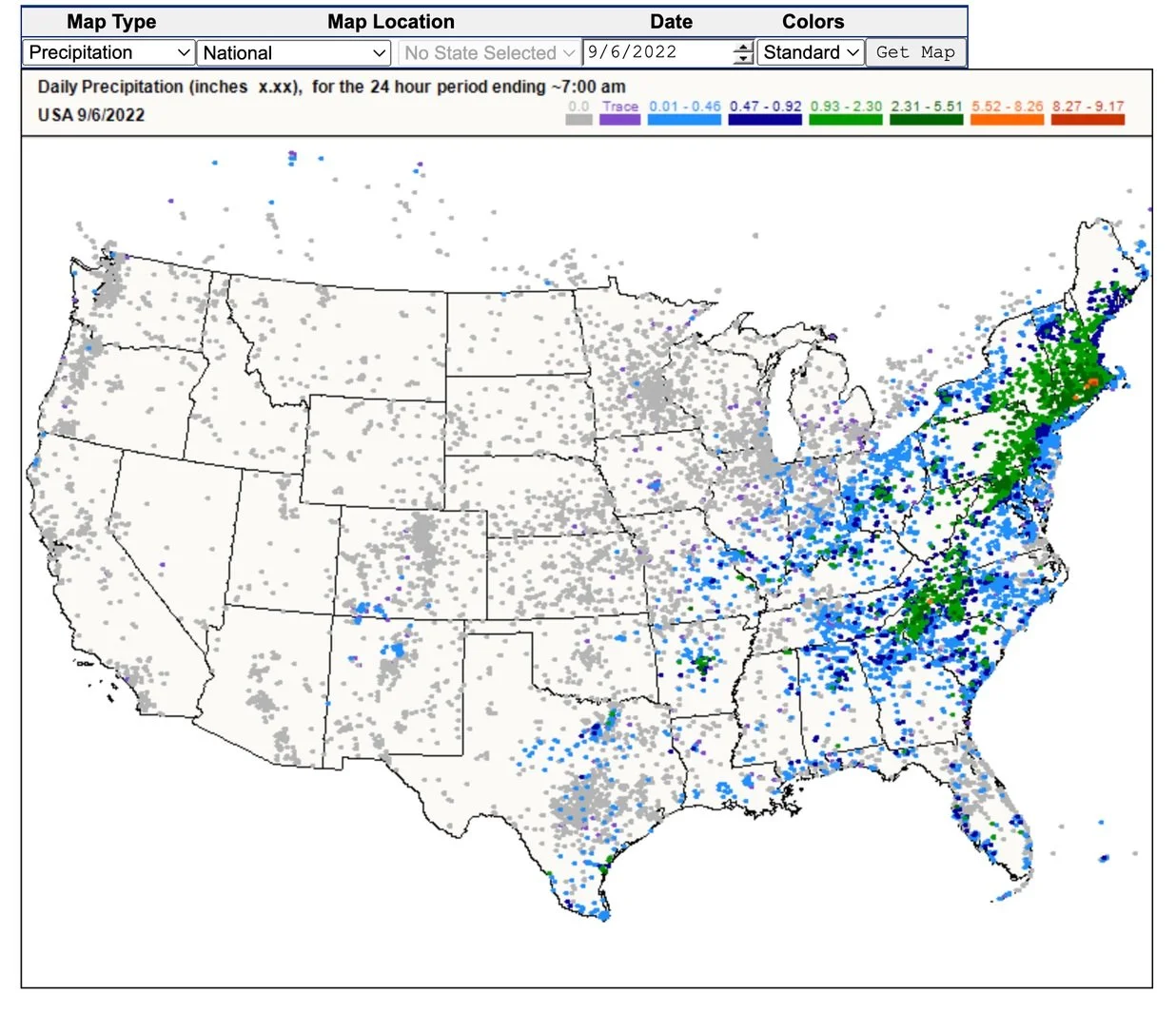

Daily Precipitation

Sep. 4

Sep. 5

Sep. 6

Precipitation Forecasts

Weather

Source: National Weather Service