MOTHER NATURE & SEASONAL TRENDS

AUDIO COMMENTARY

Will we see seasonal trends continue and lead to higher prices

Mother Nature & volatility in the markets

Will the markets continue to add weather premium

Fed pivots and money flow into grains

Getting ready for risk management

Listen to today’s audio below

ENJOY OUR STUFF? TRY A FREE TRIAL

30-days completely free.

Every update sent via text & email.

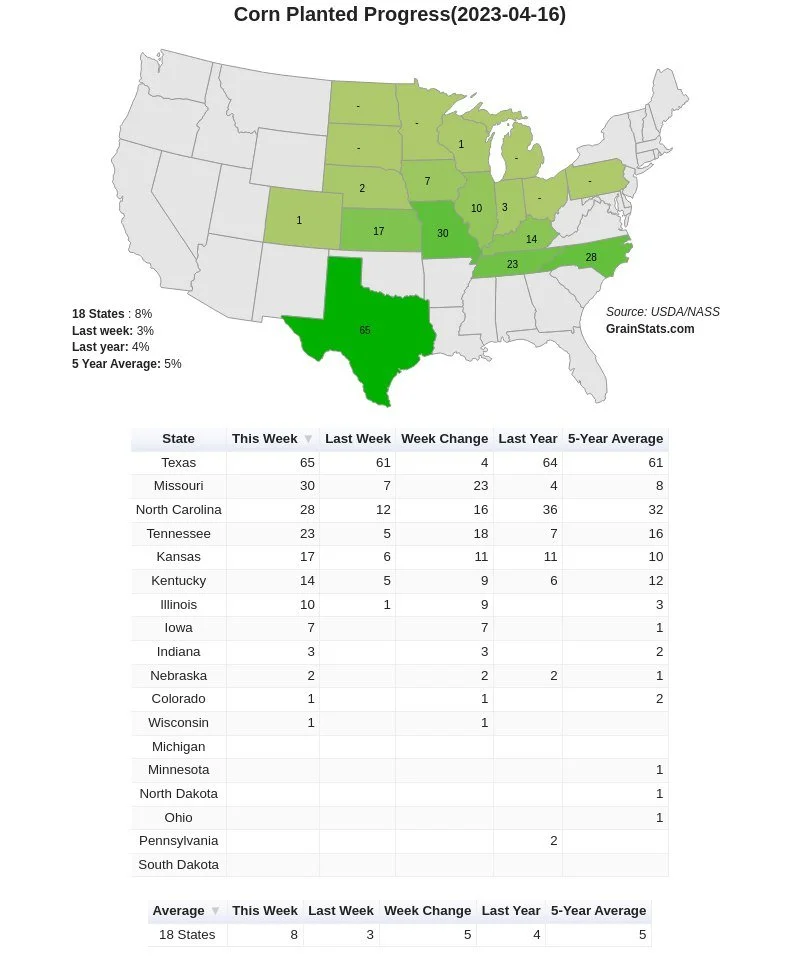

PLANTING PROGRESS

Corn 🌽

Planted: 8%

Last Week: 3%

Last Year: 4%

Avg: 5%

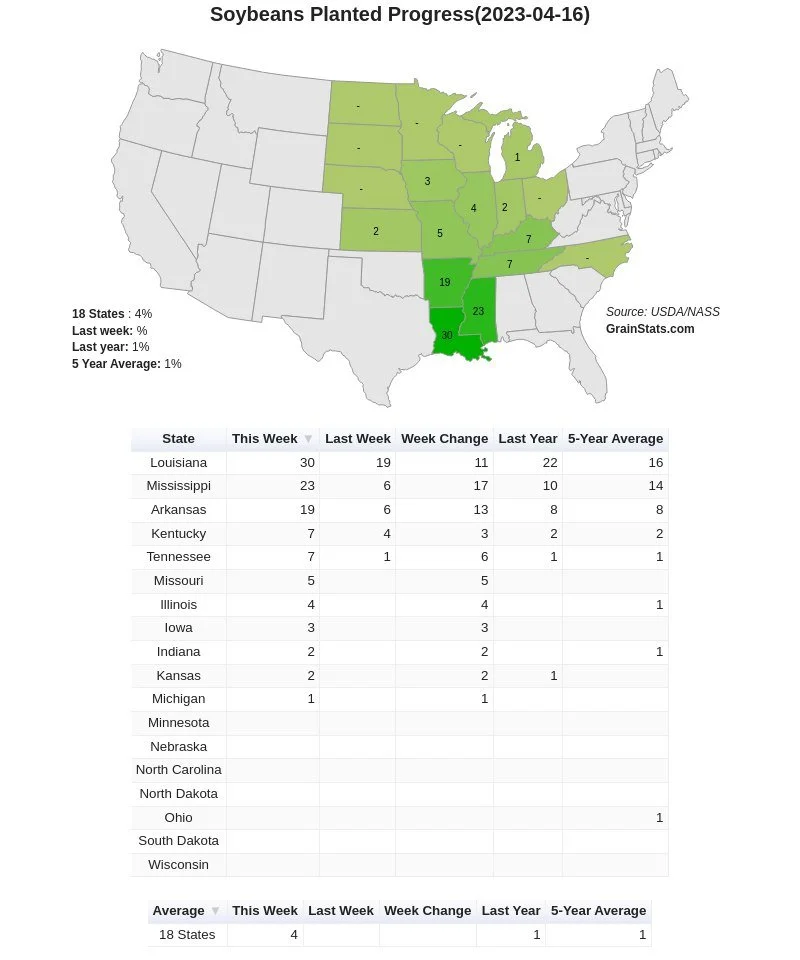

Soybeans 🌱

Planted: 4%

Last Year: 1%

Avg: 1%

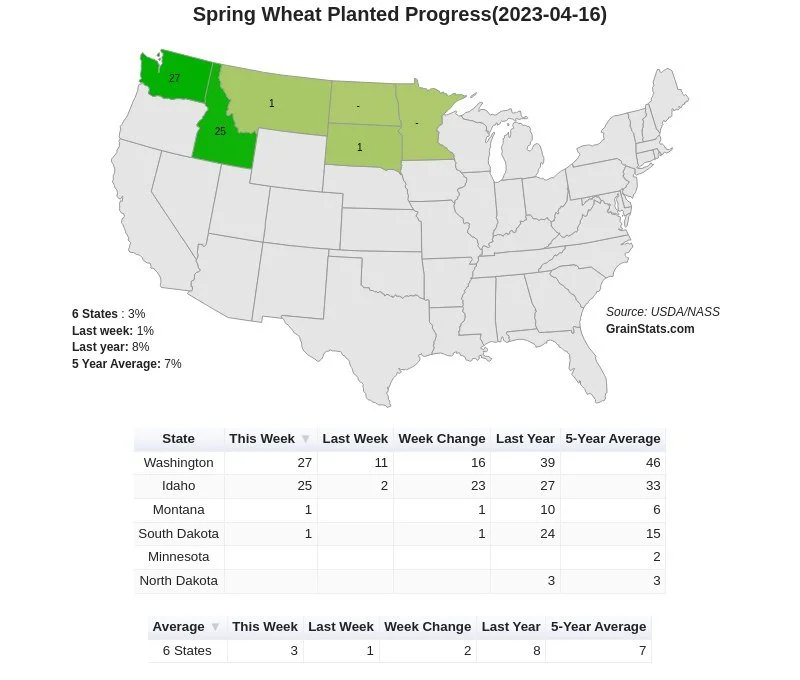

Spring Wheat 🌾

Planted: 3%

Last Week: 1%

Last Year: 8%

Avg: 7%

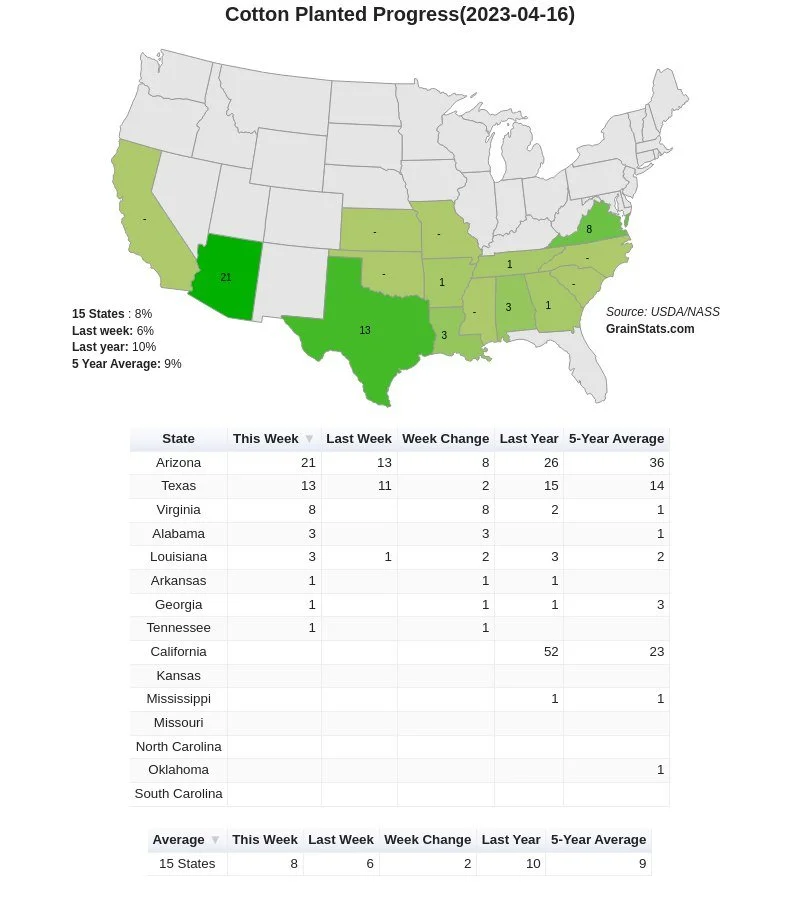

Cotton ☁️

Planted: 8%

Last Week: 6%

Last Year: 10%

Avg: 9%

THE CHARTS

Corn 🌽

July corn keeps moving well of its lows, creating a solid uptrend from our lows in March. Bulls would like to break that long term down trend from October. Next upside target is our 100 & 200 day moving averages, after that we look to test that long term downtrend.

Soybeans 🌱

July beans find resistance at the $15 level. However, we are testing that short term downtrend as we got a close slightly above. Bulls would like to hold this level, get a push past $15 and retest our recent highs from February.

Chicago Wheat 🌾

July Chicago moving higher again, now over 40 cents off our April lows. We created an inverse head and shoulders, bulls are hoping this reversal holds and that was indeed our bottom. Next upside target would be that long term downtrend from October and our 100-day MA.

CHECK OUT PAST UPDATES

4/17/23 - Audio & Market Update

MONEY FLOWING INTO GRAINS?

4/16/23 - Weekly Gran Newsletter

WHY WE COULD SEE NEW ALL-TIME HIGHS

4/14/23 - Market Update

FUNDS COVER WHEAT SHORTS

4/13/23 - Audio Commentary

PLANTING - IS IT WET OR DRY?

4/12/23 - Market Update

GRAINS STRONG DESPITE BEARISH REPORT YESTERDAY

4/11/23 - Audio Commentary & Report Recap

USDA KICKS CAN DOWN THE ROAD

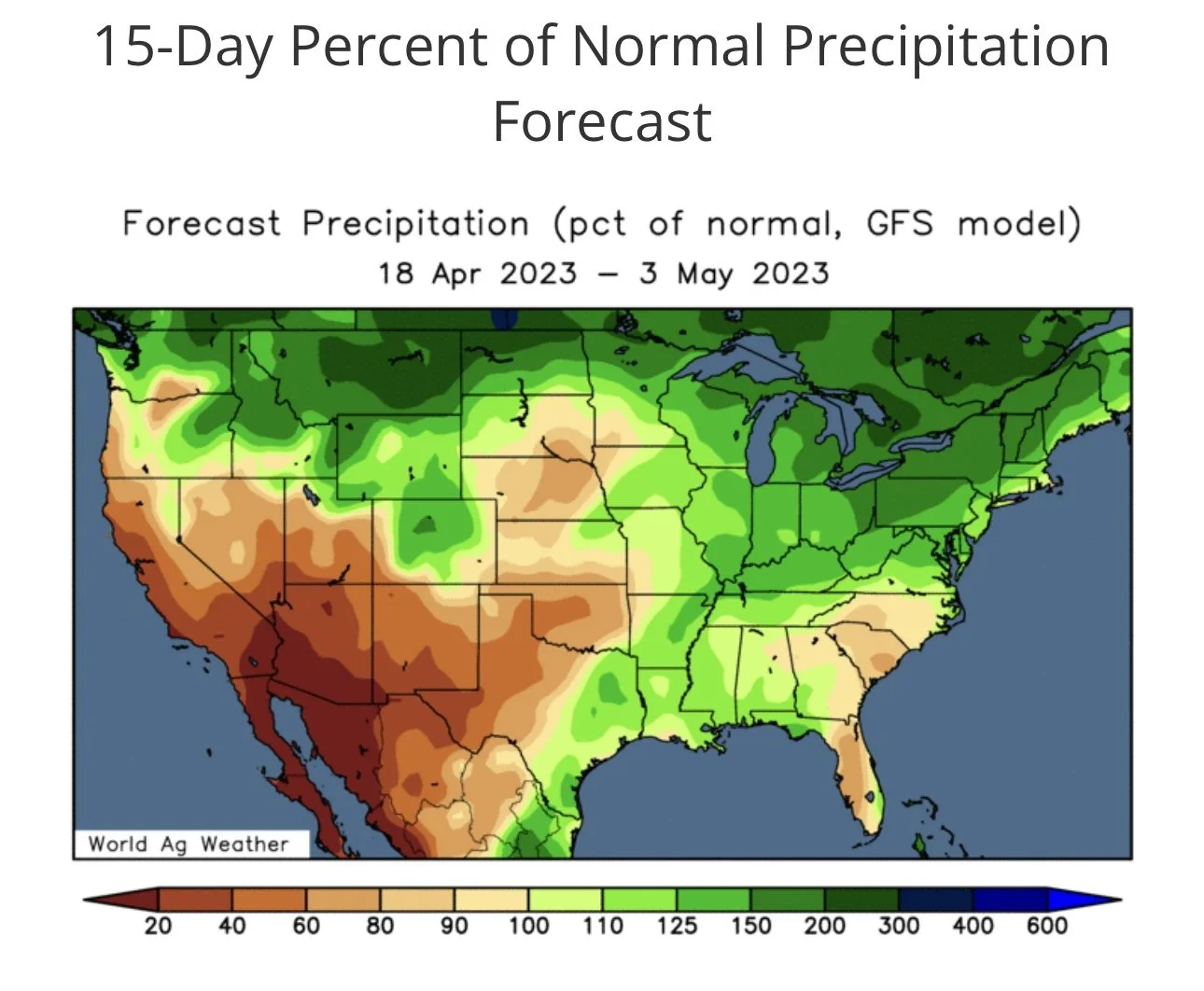

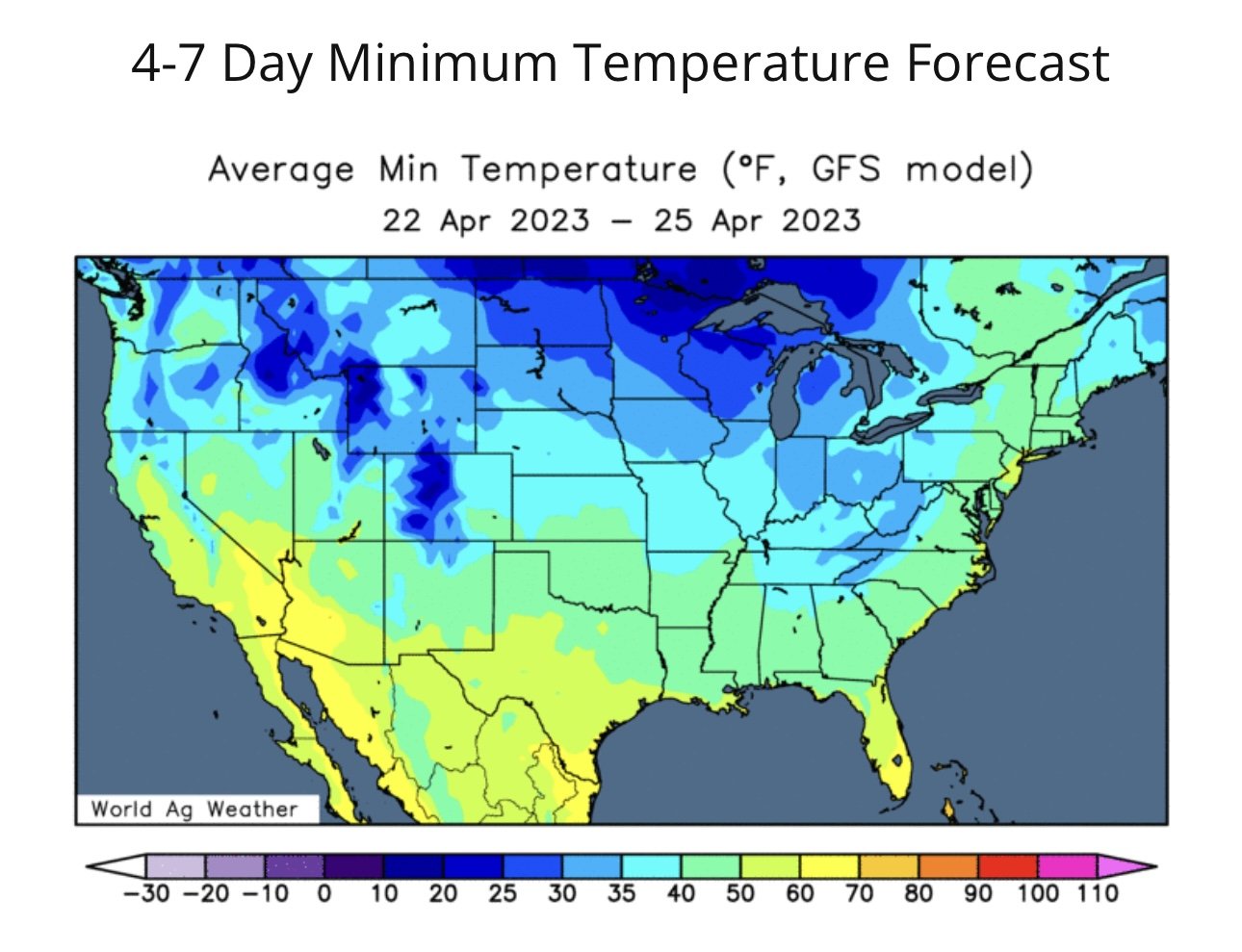

U.S. WEATHER

Weather here in the U.S. is looking colder than usual. Especially given last week’s cooperative weather. If forecasts stay cold we could get some support in the grains and see a lot of last week’s planting progress slow down.