BEANS NEAR NEW HIGHS. WHAT TO DO WITH WHEAT?

Overview

Wheat rallied to new highs, up +20 cents at one point. Touching that target of $7.16 we had last week. However we failed to hold the gains, closing -26 cents off the highs at $6.93. The losses were mainly seen as profit taking, as the big money has been the main driver of this rally.

Corn and soybeans however remained strong, as soybeans nearly made a new high. Closing at $12.46. We haven’t closed above $12.50 since mid-January. A break above could open the door to higher prices.

Planting progress came in faster than expected Monday. Corn was 70% planted. Yet we are still higher.

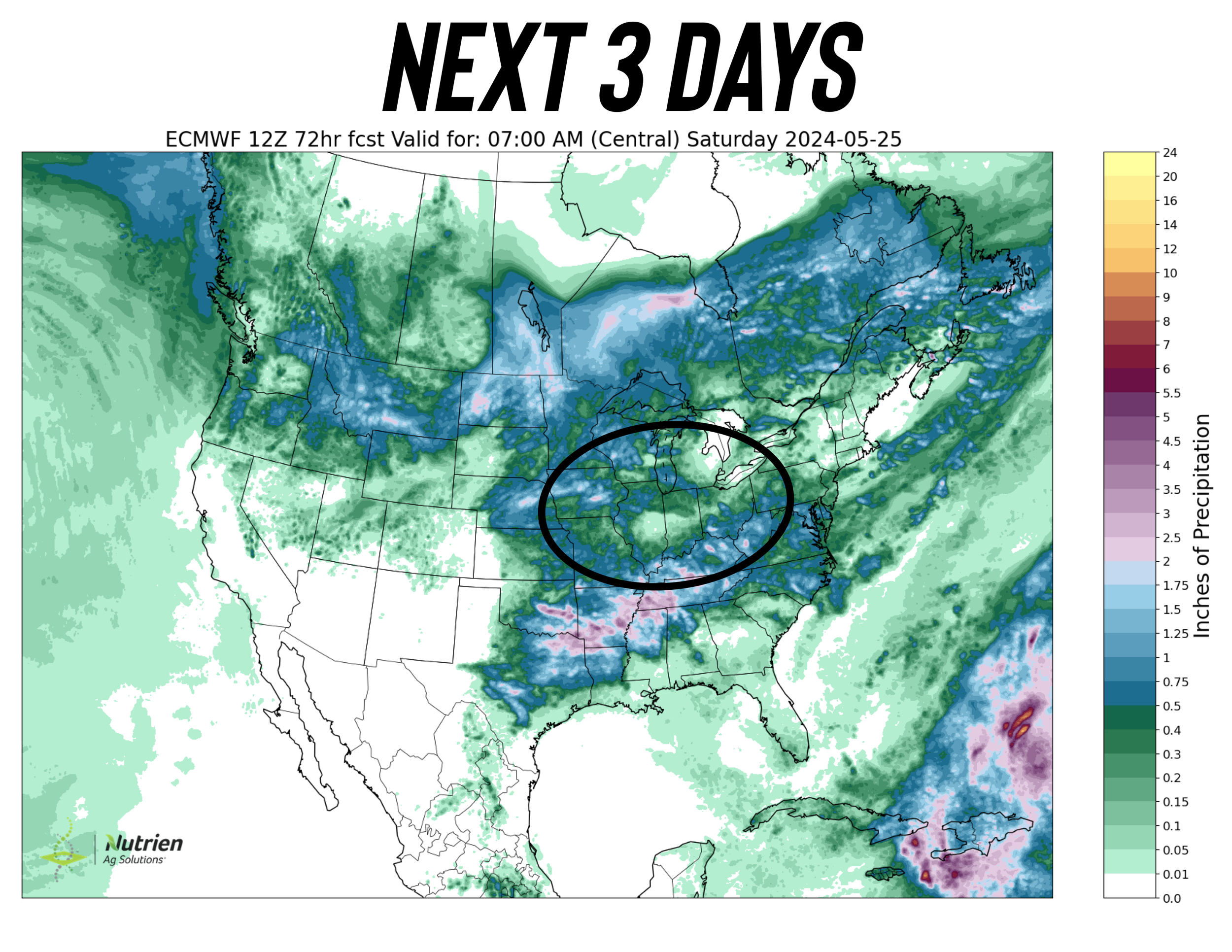

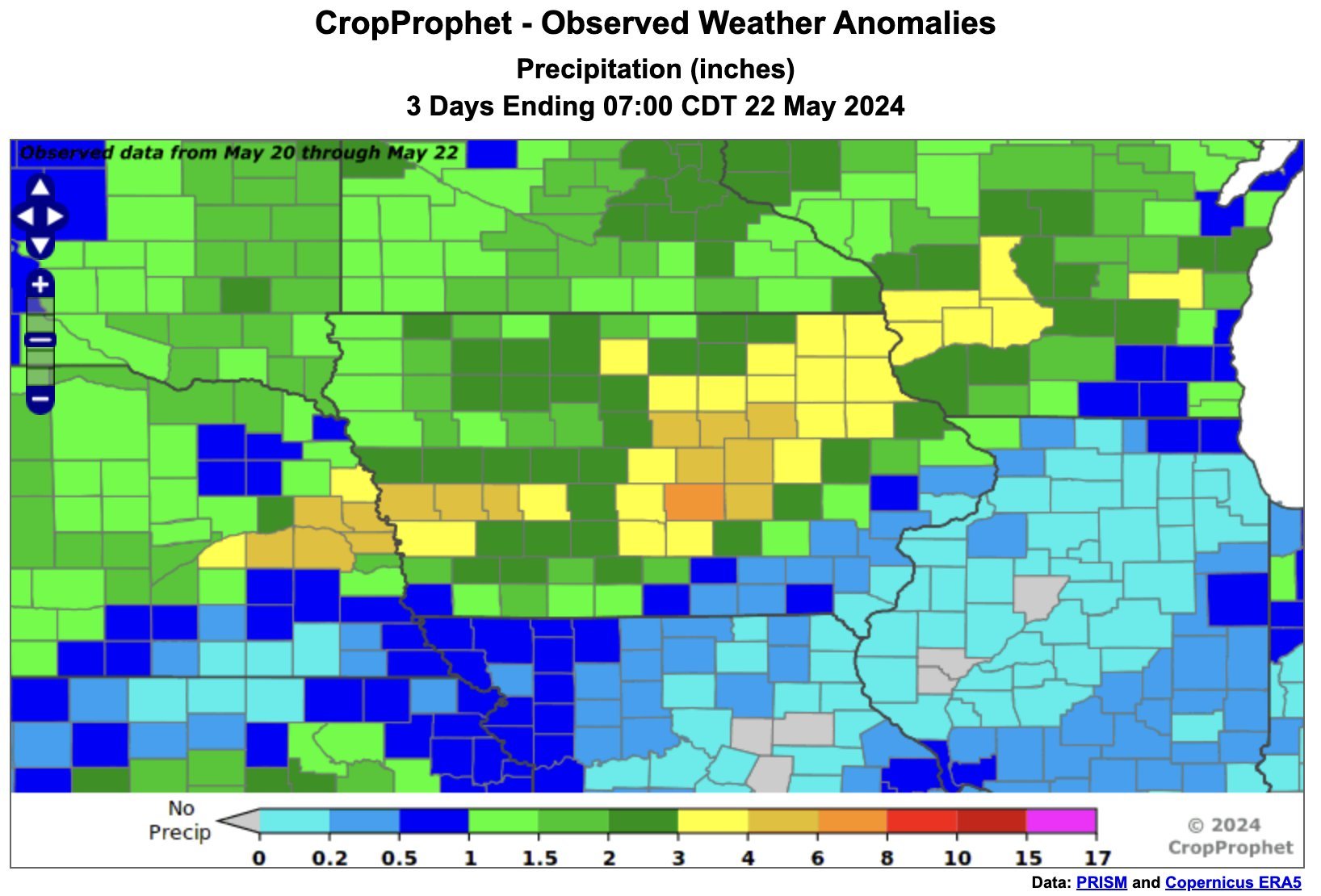

Future planting outlook is mixed. The eastern corn belt has been mainly dry the past few days, which should’ve offered a great window. The next few days should offer a window as well in the eastern belt.

However Iowa has had 3-8 inches of rain, with more on the way. This could be a drought buster for Iowa.

We have bred genetics that are able to handle a drought fairly well. Take last year for example. However, we can’t teach the crops to swim. Most would agree that a wet spring like this is far worse than a drought.

It's not so much the fact that we aren’t going to get the crops in. That isn’t really the concern. There is some concern about pushing the crop into a less favorable window, but we all know how quickly we can get things in the ground.

The biggest issue I see with this wet of a spring is mudding the crop in the ground. The compaction issues that come with that. Heavy rain springs require timely rain through out summer as well. Right now the summer outlook still points hot & dry with the La Nina.

Once crop conditions come out, Iowa is going to be looking at likely a sub 50% G/E for corn. When we get these conditions and they start coming in lower than last year, the market could get excited.

To go along with this, there is talk about potential prevent plant acres on corn.

Only part of this rally has been a "delayed planting rally". We have drought in central Brazil, flooding in the south. Cuts to Argy crop. The Russian wheat situation. And more than anything, this rally has been driven by the funds and technicals...

Let's jump into the rest of today's update...

Today's Main Takeaways

Corn

Good action in corn the past few days. Fast planting, yet we held in there.

As mentioned, delayed planting isn't the only factor I see driving this market.

You can’t mud a crop in then have a dry and hot summer…….

The rest of this is subscriber-only content. Subscribe to keep reading & get every update along with 1 on 1 market plans.

IN TODAYS UPDATE

Why I see corn higher a month from now

Is 2024 like 2014?

Targets for corn & beans

What level we need to break to see upside

Funds want to be long

Why wheat has so much potential

Is Russia situation a game changer?

Exactly what you should be doing for wheat. Sales, calls, puts, selling the carry & more.

KEEP READING FOR FREE

Try our daily updates & recommendations completely free for 30 days. Become a price maker.

SALE ENDS IN 4 DAYS

Ready to commit? Our Memorial Day sale ends Monday. Don’t miss the offer and these upcoming opportunities. Comes with 1 on 1 market plans.

Want to Talk?

Our phones are open 24/7 for you guys if you ever need anything or want to discuss your operation.

Hedge Account

Interested in a hedge account? Use the link below to set up an account or shoot Jeremey a call at (605)295-3100 or Wade at (605)870-0091

Check Out Past Updates

5/21/24

BIG MONEY KEEPS DRIVING WHEAT HIGHER

Read More

5/20/24

ALGOS & BIG MONEY CONTINUE TO MOVE GRAIN PRICES

5/17/24

WEATHER MARKET VOLATILITY CONTINUES TO HEAT UP

5/16/24

SITUATIONAL GRAIN MARKETING

5/15/24

HEDGING VS GUESSING

5/14/24

CORRECTIONS ARE HEALTHY

5/13/24

FUNDS DON’T WANT TO BE SHORT GRAINS

5/10/24

PRICE ACTION TELLS DIFFERENT STORY FROM USDA REPORT

Read More

5/9/24

MARKET PRICING IN NEGATIVE REPORT. WHAT TO EXPECT FROM USDA

5/8/24

USDA IN 2 DAYS

5/7/24

WHO SHOULD WAIT FOR TRIGGERS NOT TARGETS

Read More

5/6/24

GRAINS HIGHEST IN 4 MONTHS

Read More

5/3/24

SEASONAL RALLY JUST BEGINNING OR BULL TRAP?

5/2/24

ARE THE TIDES STARTING TO TURN?

5/1/24

BE PATIENT & READY FOR THESE OPPORTUNITIES

4/30/24

FIRST NOTICE DAY SELL OFF

4/29/24

WHEAT TAKES A BREATHER

Read More

4/26/24

SHOULD YOU REWARD WHEAT RALLY?

4/25/24

WILL FUNDS BE FORCED TO COVER?

4/24/24

WHEAT CONTINUES BULL RUN & CORN FAILS BREAK OUT

4/23/24

FUNDS CONTINUE TO COVER & RALLY GRAINS

4/22/24

GRAINS CONTINUE 2-DAY RALLY

Read More

4/19/24

ONE DAY WONDER? EXTREME VOLATILITY & RALLY

4/18/24

GRAINS WAITING FOR WEATHER MARKET

4/17/24

NOT IN THE WEATHER MARKET QUITE YET

Read More

4/16/24

CHOPPY TRADE IN GRAINS CONTINUES

4/15/24

PLANTING PROGRESS & BRUTAL CHOP

4/12/24

MARKET DOESN’T BELIEVE THE USDA

Read More

4/11/24

GARBAGE USDA REPORT THAT DIDN’T MEAN MUCH

4/10/24

USDA & CONAB TOMORROW

4/9/24

USDA IN 2 DAYS. THINGS TO WATCH & HOW TO BE PREPARED

Read More

4/8/24

USDA REPORT THIS WEEK. WHAT YOU SHOULD BE DOING

4/5/24

STRATEGIES ELEVATORS COULD BE OFFERING THAT YOU SHOULDN’T BE USING

4/4/24

WEATHER, BIG MONEY, CHOPPY TRADE

4/3/24

EXPECT BIG PRICE SWINGS & VOLATILITY

4/2/24

RISK OFF DAY

4/1/24