RELIEF BOUNCE FOR GRAINS

Overview

Decent action in the grains today following yet another beating yesterday where most grains posted fresh lows.

Today we saw front month corn & beans lead us higher, so those spreads firmed which is a friendly sign. For example August beans were up +12 today, Nov beans were only up +3. This usually indicates that there is less supply on hand than needed.

However, we closed well off our highs across the board which was disappointing. Notably Nov beans were -9 cents off their highs & Chicago wheat -7.

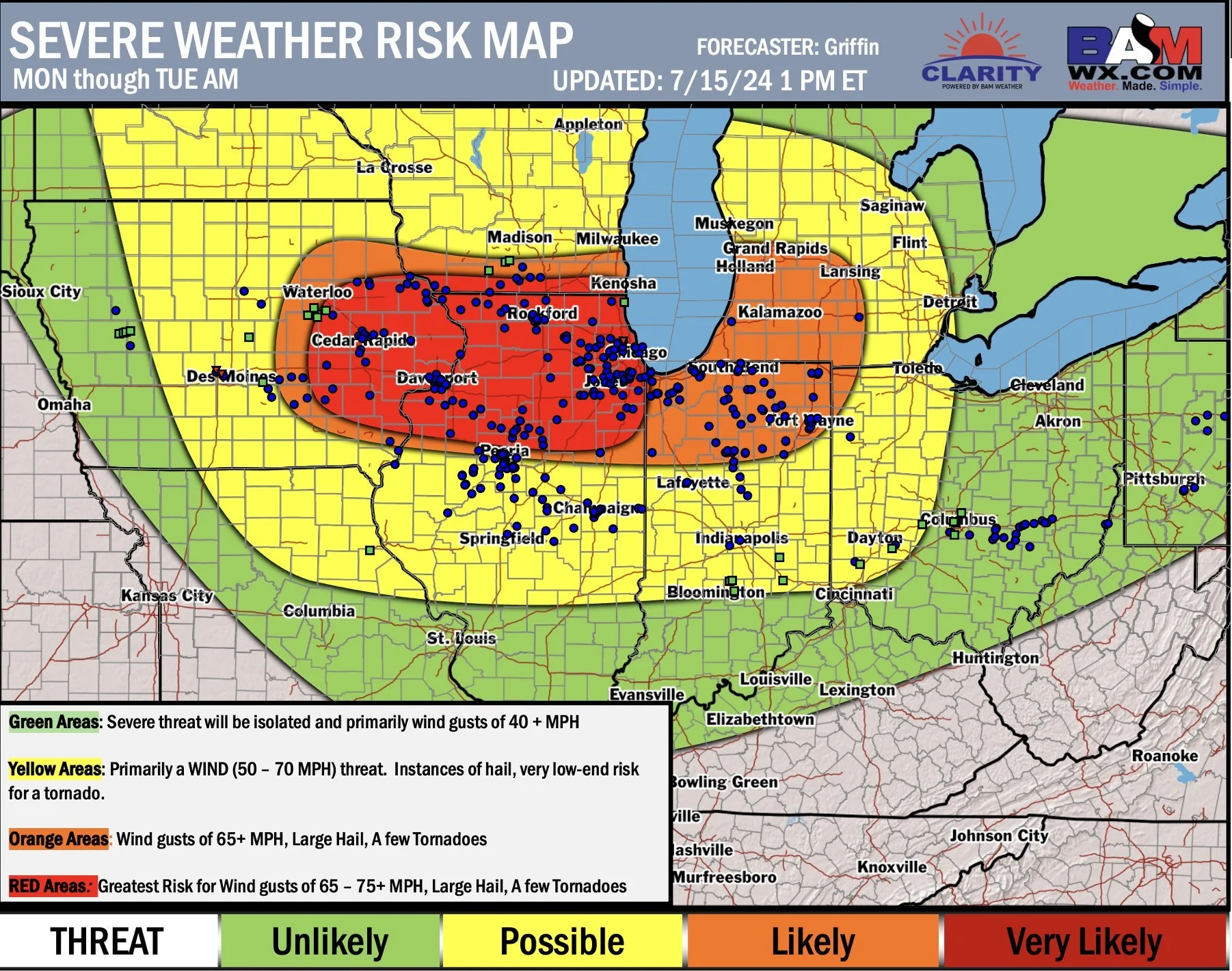

The news today was the severe weather in Illinois, Indiana, Iowa, & parts of Michican & Wisconsin.

The weather had winds of 100 mph in some areas. Included derechos & tornados.

There was likely some damage to fields and bins, but the extent of the damage will remain an unknown. Most do not think this was a big enough event to be a big market mover. But I guess we will see.

The last time we got a derecho event was 2020 and the start of the COVID rally that later saw huge Chinese demand. Last night’s derecho events were not nearly as massive as the one in August of 2020 however.

Severe Weather Areas from BAMWX

So far growing season weather has been pretty ideal in many areas with the hurricane bringing timely rain.

The current weather outlook is still fairly ideal for most of the corn belt.

The rains will be trapped more to the southern corn belt, so most of the corn belt will be drier. But we are getting past the point where dryness will make a huge impact on the markets.

Especially given that it is suppose to be very cool. Which will be very good for the crops. Virtually no heat stress to end the month.

Planting into wet conditions requires a lot more timely rain throughout the growing season than planting in dry conditions. But we have had nearly perfect weather outside of the few hiccups with wet planting, hail, floods etc.

But most think the areas that got perfect weather especially in the eastern belt will outweigh the areas that saw issues.

Forecasts

Crop Conditions

Crop conditions were a friendly boost to corn & bean prices today.

The market was expecting them to improve +1%, but both remained unchanged from last week.

Corn saw a lot of ratings drop in many states, but Illinois saw a huge +6% and North Dakota saw +7% increase which negated the small losses of other states. Every state besides Illinois & North Dakota saw no changes or was lower.

Soybean ratings were mixed. Some slightly higher, some lower. We saw decent improvements including a +7% increase to Illinois, but Iowa dropped -4% and Ohio dropped -9%.

Spring wheat was +2% better than expected. Which didn’t help prices today.

Crop conditions for both corn & soybeans are the best since 2020.

Now these ratings suggest trendline yield, but as I have mentioned before. Crop conditions are an eye test. They aren’t the most accurate especially in wet planting years. As problems from wettness aren’t always visible from the road like they are drought.

Crop Condition Maps from Darrin Fessler

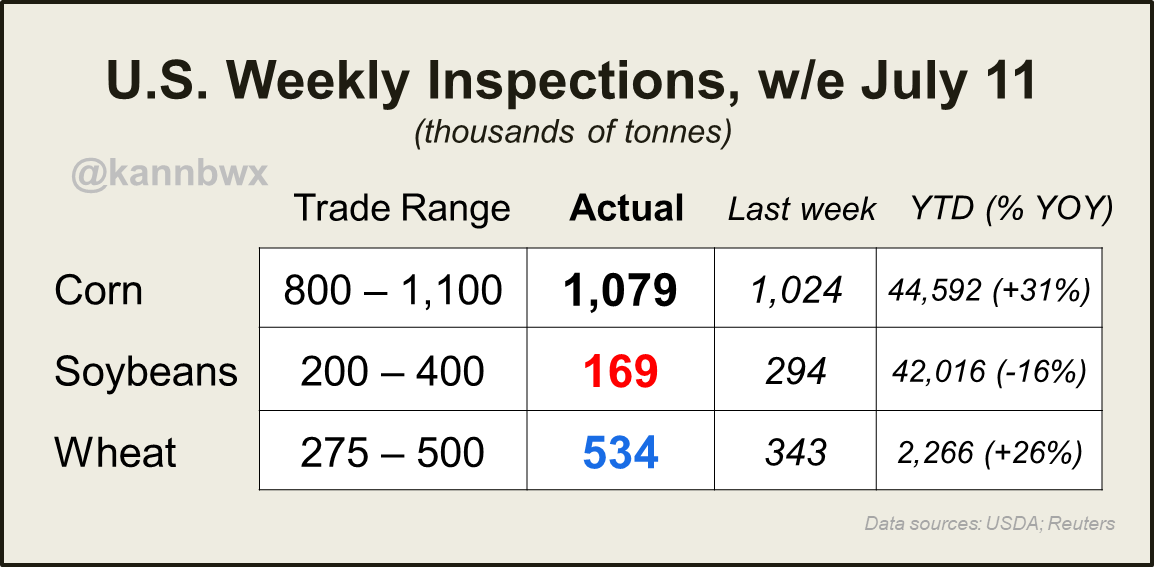

Export Inspections

Export inspections yesterday were pretty strong corn especially for this time of year. Up +5.4% from last week and a massive +157% better than last year.

Soybeans were awful as lack of demand continues. This was -43% worse than last week, but actually +4.8% better than last year.

Wheat was surprisingly strong. Up +55% from last week and +95% from last year.

Weekly Inspections Chart from Karen Braun

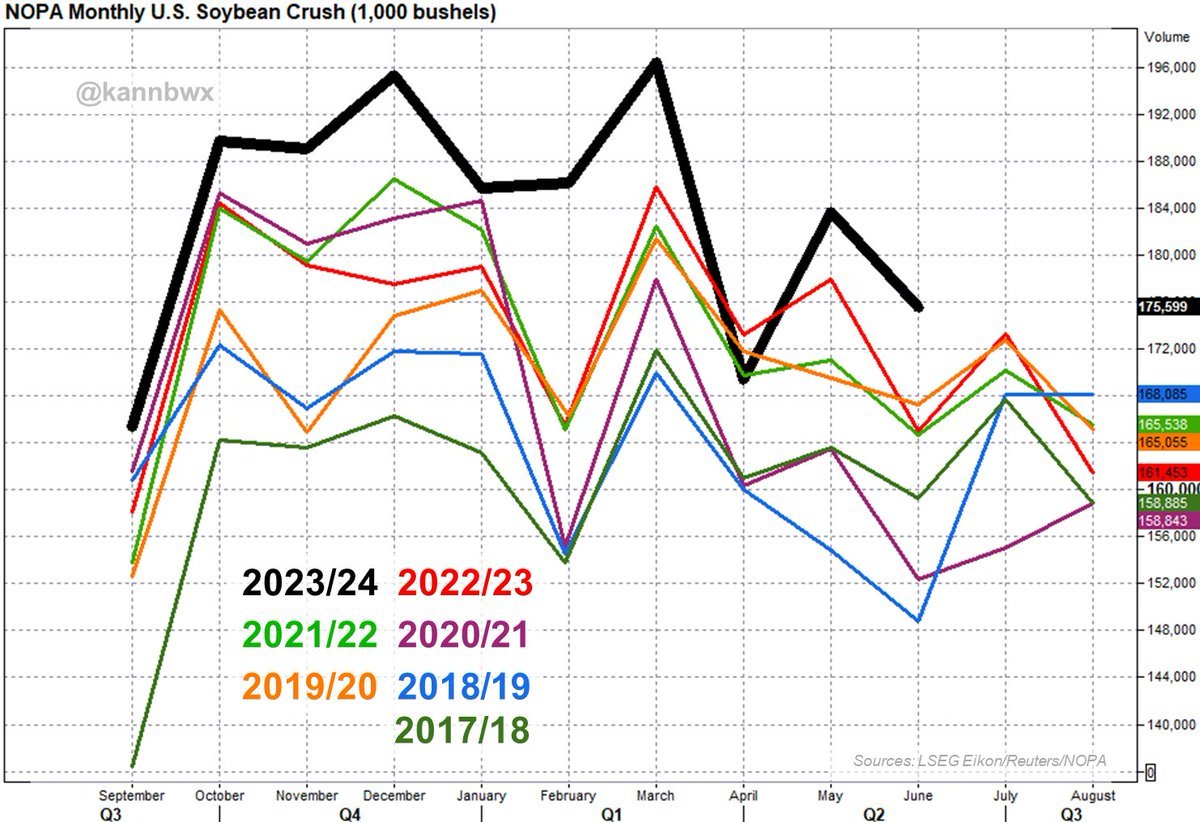

NOPA Crush

NOPA crush was smaller than the trade estimates, but was still a record for the month of June.

NOPA June: 175.599 million bushels

Trade Est: 177.936 million bushels

We should still easily meet if not exceed the USDA forecasts for crush.

So a slight miss on this report isn’t anything too concerning.

NOPA Crush Chart from Karen Braun

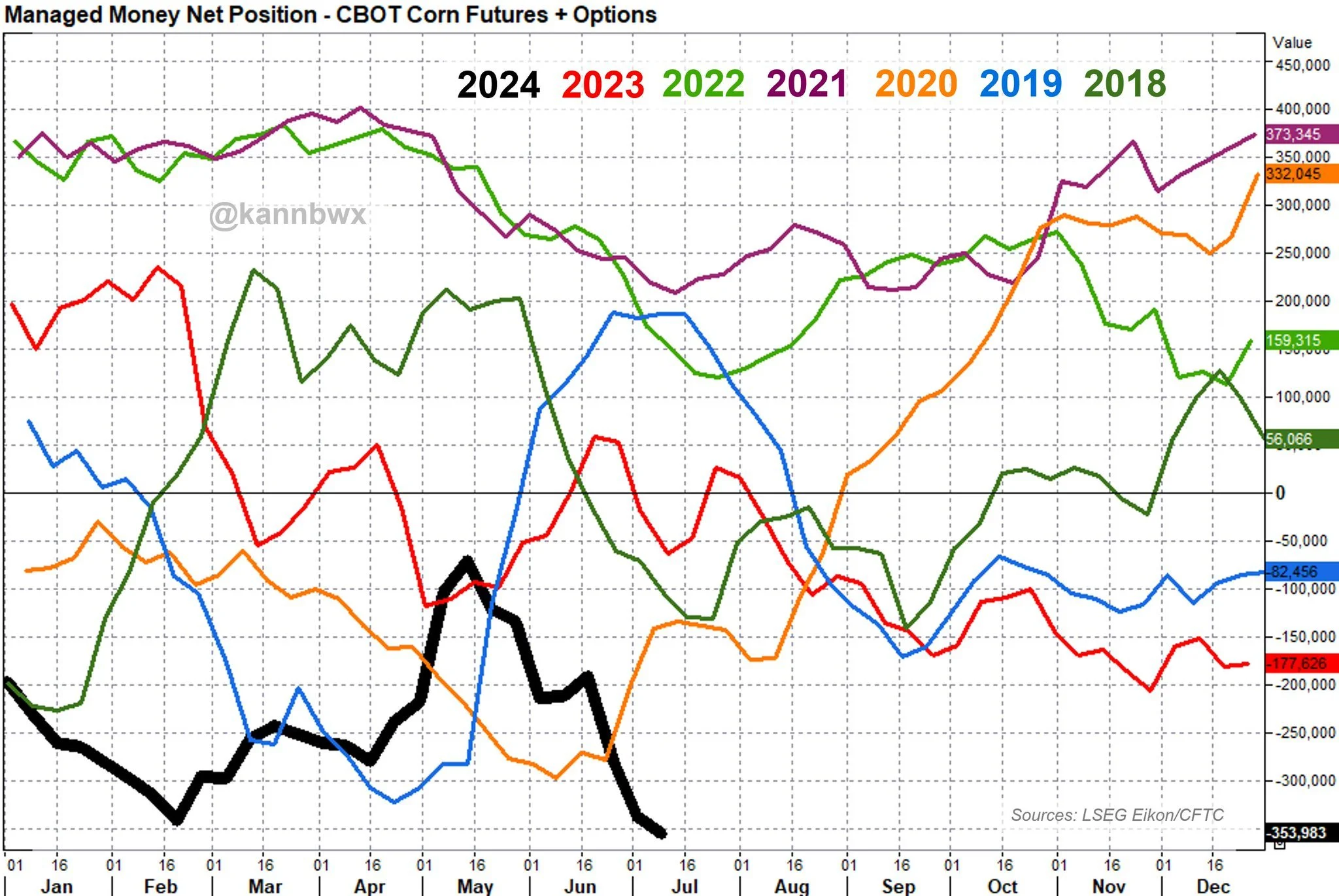

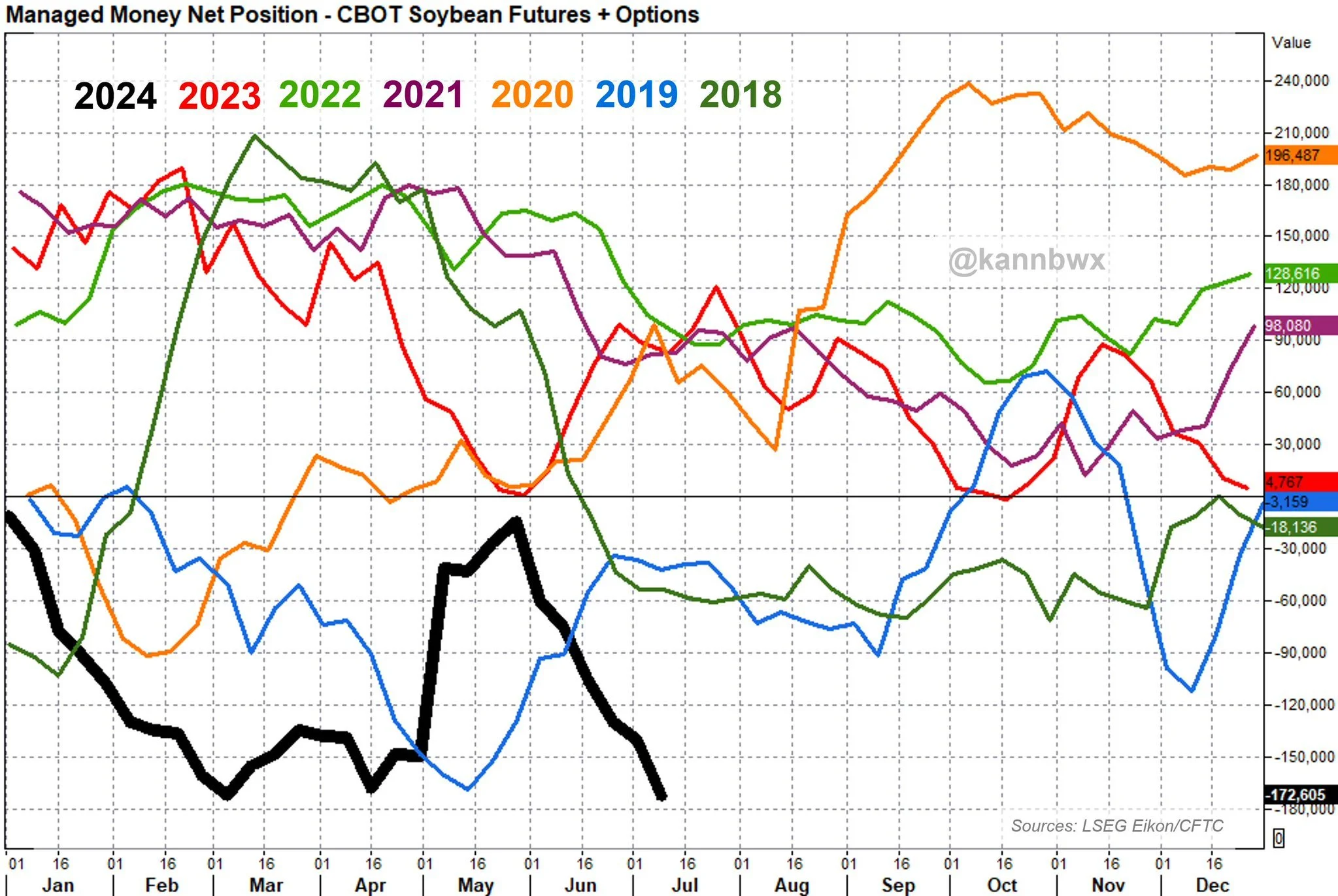

The Funds

COT data came out Friday.

They are short a RECORD amount in BOTH CORN & BEANS.

-357k contracts of corn.

-163k beans.

-69k wheat.

The funds do not yet have a reason to cover these massive shorts. But when they find one, it could wind up being a "rubber band" effect. Harder you pull, harder the snap back.

Corn Chart from Karen Braun

Soybeans Chart from Karen Braun

Today's Main Takeaways

Corn

Nothing crazy today. We were higher but only took back half of yesterdays losses.

However we have still been able to hold Friday's lows of $4.03

As for the severe weather event, there was some damage done. But it is hard to know just how much. I don’t think it was anything that is going to move this market in a big way. We will probably know more come Monday's crop conditions.

As mentioned, corn export inspections were strong. US corn is actually very competitive globally. Our FOB corn off the Gulf is some of the cheapest in the world, only more expensive than Argentina.

This should………….

The rest of this is subscriber-only content. Please subscribe to keep reading & get every single daily update along with our signals & 1 on 1 tailored market plans.

IN TODAYS UPDATE

Why we should see more corn demand

Why low prices cure low prices

Protect your risk

What price does corn need to trade to scare the funds?

Trade war talk effects

Soybeans cheapest & most oversold in world

Wheat continues to fall

TRY 30 DAYS FREE

Turn challenging price levels into opportunities with our 1 on 1 plans & daily updates.

Try completely free.

Want to Talk?

Our phones are open 24/7 for you guys if you ever need anything or want to discuss your operation.

Hedge Account

Interested in a hedge account? Use the link below to set up an account or shoot Jeremey a call at (605)295-3100 or Wade at (605)870-0091

Check Out Past Updates

7/15/24

GRAINS HAMMERED. TRADE WAR FEAR

7/12/24

USDA REPORT: LOW PRICES CREATING DEMAND

7/11/24

USDA TOMORROW

7/10/24

GRAINS CONTINUE TO GET HAMMERED

7/9/24

RAINS, RECORD FUND SELLING & 2014 COMPS

7/8/24

PUKE SELLING, RAIN MAKES GRAIN & FUNDS RECORD SHORT

7/3/24

THIN HOLIDAY TRADE FOR GRAINS

7/2/24

BEARISH WEATHER, RECORD SHORTS, & CHINA

7/1/24

SUPPLY WILL BE THERE, BUT CAN DEMAND LEAD US HIGHER?

6/28/24

GARBAGE USDA REPORT

6/27/24

BIGGEST USDA REPORT OF YEAR TOMORROW

6/26/24

USDA PREVIEW & COUNTER SEASONAL RALLIES?

6/25/24

POSSIBLE RISKS & OUTCOMES THIS USDA REPORT COULD HAVE

6/24/24

VERY STRONG PRICE ACTION: RAINS & USDA KEY

6/21/24

DON’T PUKE SELL. ARE YOU COMFORTABLE RIDING THIS STORM?

6/20/24

RAIN OR NO RAIN FOR EAST CORN BELT?

6/18/24

WEATHER MARKET ENTERING FULL SWING

6/17/24

SELL OFF CONTINUES DESPITE FRIENDLY FORECASTS

6/15/24

EXACT GRAIN MARKETING SITUATION BREAKDOWNS & WHAT YOU SHOULD BE DOING

6/12/24

USDA SNOOZE: WHAT’S NEXT?

6/11/24

USDA TOMORROW

6/10/24

IS USDA OVERSTATING CROP CONDITIONS? DOES IT MATTER?

6/7/24

WEATHER & USDA NEXT WEEK

6/6/24

ARE GRAIN SPREADS TELLING US SOMETHING?

6/5/24

GRAINS NEARING BOTTOM? 7 DAYS OF RED

Read More

6/4/24

HIGH CORN RATINGS, SCORCHING SUMMER, & RUSSIA CONCERNS

Read More

6/3/24

5TH DAY OF THE SELL OFF. ARE YOU COMFORTABLE?

5/31/24

4 STRAIGHT DAYS OF LOSSES IN GRAINS

5/30/24

I DON’T THINK SEASONAL RALLY IS OVER. WHAT IS THE PLAN IF I’M WRONG?

5/29/24

PLANTING DELAY STORY VANISHES. BUT IS REAL STORY OVER?

5/28/24

GETTING COMFORTABLE WITH GRAIN MARKET VOLATILITY

5/24/24

WET SPRINGS DON’T CREATE RECORD YIELDS, DO THEY?

5/23/24

MANAGE RISK DESPITE STUPID PRICE POTENTIAL IN GRAINS

5/22/24

BEANS NEAR NEW HIGHS. WHAT TO DO WITH WHEAT?

5/21/24

BIG MONEY KEEPS DRIVING WHEAT HIGHER

Read More

5/20/24

ALGOS & BIG MONEY CONTINUE TO MOVE GRAIN PRICES

5/17/24

WEATHER MARKET VOLATILITY CONTINUES TO HEAT UP

5/16/24

SITUATIONAL GRAIN MARKETING

5/15/24

HEDGING VS GUESSING

5/14/24

CORRECTIONS ARE HEALTHY

5/13/24

FUNDS DON’T WANT TO BE SHORT GRAINS

5/10/24

PRICE ACTION TELLS DIFFERENT STORY FROM USDA REPORT

Read More

5/9/24

MARKET PRICING IN NEGATIVE REPORT. WHAT TO EXPECT FROM USDA

5/8/24

USDA IN 2 DAYS

5/7/24

WHO SHOULD WAIT FOR TRIGGERS NOT TARGETS

Read More

5/6/24

GRAINS HIGHEST IN 4 MONTHS

Read More

5/3/24

SEASONAL RALLY JUST BEGINNING OR BULL TRAP?

5/2/24

ARE THE TIDES STARTING TO TURN?

5/1/24