BIG WEEKEND CORRECTION

Overview

Grains see a sizeable correction to close out the week following our week long rally.

Today’s lower price action wasn’t a "rally buster" but we saw corn close back below $5 which wasn’t great. Beans did manage to hold that key $13 psychological support.

All of the grains also traded above yesterday’s highs while at the same time holding yesterday’s lows. So of course not great price action, but could’ve been worse as we did not put in an outside down day (negative indicator) for any of the grains. So really not much damage to the charts on today's break.

Beans and Chicago wheat had their highest weekly close since Friday September 15th. This came after beans posted 3-month lows last week and wheat posted multi-year lows 2 weeks ago. Corn had it's highest weekly close since August 4th.

Weekly Price Changes

From Jeff French, Futures Trader:

"Corn open interest increased 47,000 contracts on Thursday's 2-month high close. New money buying corn. Strong signal."

Sell Signals from Other Advisors

I noticed some other major advisors that follow sell signals based on RSI and stochastic had sell signals across the board today. For corn, beans, and Chicago wheat. This signal was to catch up on sales if you feel you are undersold, to cover immediate cash flow needs, or to sell what you do not want to pay to store.

If you want specific advise from us on what you should do, shoot us a call or text at (605)295-3100.

Today's Main Takeaways

Corn

Corn gives back a good portion of this week's gains. Yesterday we did however have our highest close since August 1st. With today's losses we only managed to end the week +2 1/4 cents higher.

History of Harvest Lows & Fall Rallies

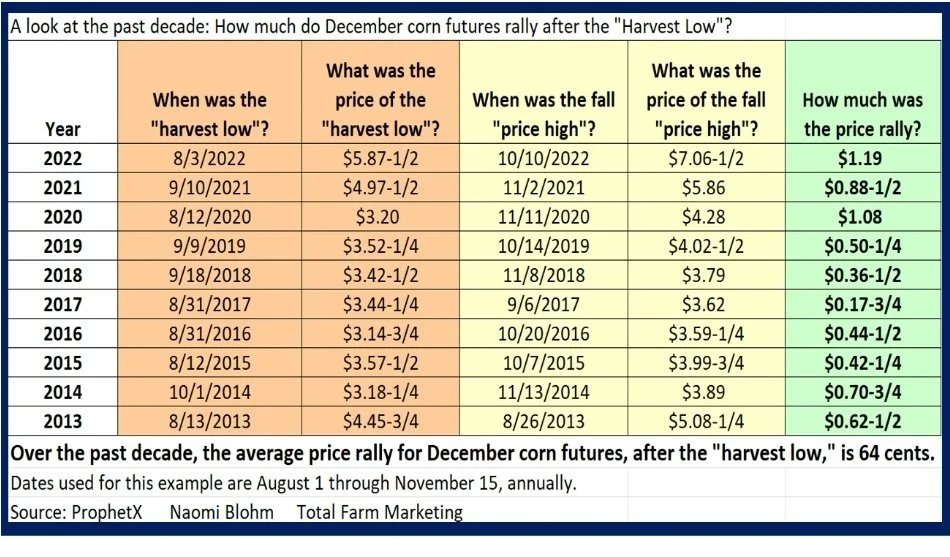

Remember this chart? It shows the harvest lows and how much December corn historically rallies in the fall after making a harvest low. (The dates used in the data are August 1st to November 15th.)

Now that we think we know where our harvest low was made, we can use history to get a somewhat good idea of what the limit for corn might be this fall.

The average fall rally over the past decade is $0.64 cents.

If we take our September of $4.68 and add $0.64 we get $5.32.

However, looking at just the average from the past 3 years alone, we see that number jump to $1.05 which would bring our fall highs to $5.73.

Now I’m saying we are going to be seeing $5.75 corn this fall. This is just food for thought. Personally, I think we could reasonably see prices crawl in the $5.40 to perhaps $5.50 range.

I think we should easily see $5.30, which is actually my first target if we can get a break past $5.09 and the 100-day moving average where we topped out today.

Now with all of this said, do not expect prices to just take off like a rocket ship out of nowhere. We have to keep in mind we have a huge 2 billion carry out, which will makes harder to rally. But I do believe we will slowly grind our way higher like we have done the past month.

Peter Brandt Technical

One of Twitters best technicians posted this:

"Dec Corn has now completed a rounding bottom. The Factor Prop Account is 100% long ZCZ23. Next target is 5.31"

Corn rejects right off our 100-day moving average which was my first target of $5.09.

Bulls would like to hold $4.90.

First target is that 100-day MA ($5.09). Next target is $5.30, our 38% retracement. Then perhaps we can reach that 50% retracement of $5.49 1/2.

Corn Dec-23

Renewable Diesel Demand - Implications to Bean Prices

For those of you are still harvesting, what type of local basis are you seeing? Has it firmed up or got weaker in the past couple weeks for corn and beans.

Are there factors in your area such as harvest nearly complete that should help lead to basis continuing to firm? If you believe basis will firm keep in mind that you lose a lot of negotiating once you have done HTA, placed in delayed price or price later storage, or locked in the basis. We feel that once you have done any of the above you have slipped into being a price taker. So make sure if you are in an area where basis should firm you don't give up ownership or negotiation power via utilizing tools that take away your opportunity to become a price maker.

If you believe basis will firm the way to protect prices is utilizing futures or puts. If you believe basis will weaken you lock in basis, or make cash sales.

Please give me a call if you have any questions. (605)295-3100

Soybeans

Beans get a big correction to close out the week. Beans were up +35 cents on the week before today's lower action. Ending the week up +22.

We managed to hold $13, which is a good sign for bulls. If we would’ve closed below $13 and yesterday's lows it would’ve been an outside down day on the charts which is often a negative indicator. But we didn’t.

The reason for lower prices today was profit taking as well as some better chances for rain in South America.

Soybeans have so much long term upside because…..

The rest of this is subscriber-only. Please subscribe to continue reading and receive every exclusive update via text & email.

Scroll to check out past updates you would’ve received.

GET 50% OFF

Use code “HARVEST” to get 50% off. Click the link below for the pre-applied discount link. Limited time only.

Become a Price Maker.

NOT SURE? TRY 30 DAYS FOR $1

Try 30 days for just $1. Get every exclusive update sent via text & email.

INCLUDED IN TODAY’S UPDATE

Why soybeans have so much long term potential

Our soybean recommendation based on local basis situations

Full breakdowns of the bean and wheat market

Check Out Past Updates

10/19/23

CORN BREAKS $5. IS WHEAT NEXT? - SOYBEAN RECCOMENDATION

10/18/23

BEANS BREAK $13. IS CORN NEXT?

10/17/23

DID BEANS CONFIRM REVERSAL?

10/16/23

CHOPPY BORING TRADE

10/13/23

POST USDA REPORT CORRECTION

10/12/23

BULLISH REACTION TO USDA REPORT

10/11/23

CAN THE USDA GIVE US A BULLISH SURPRISE?

10/10/23

BEANS BREAK THEN BOUNCE - USDA PREVIEW

10/9/23

WILL YOU BE FORCED TO SELL ANYTHING AT HARVEST?

10/6/23

CORN & WHEAT HOLD LAST WEEK’S LOWS

10/5/23

UPSIDE BREAKOUT IN CORN

10/4/23

ARE YOU A PRICE MAKER OR PRICE TAKER THIS HARVEST?

10/3/23

CHINA IS BUYING, ARE YOU?

10/2/23

WHY YOU SHOULD BE EXCITED ABOUT TODAY’S RALLY

10/1/23