FUNDS CONTINUE TO COVER & RALLY GRAINS

Overview

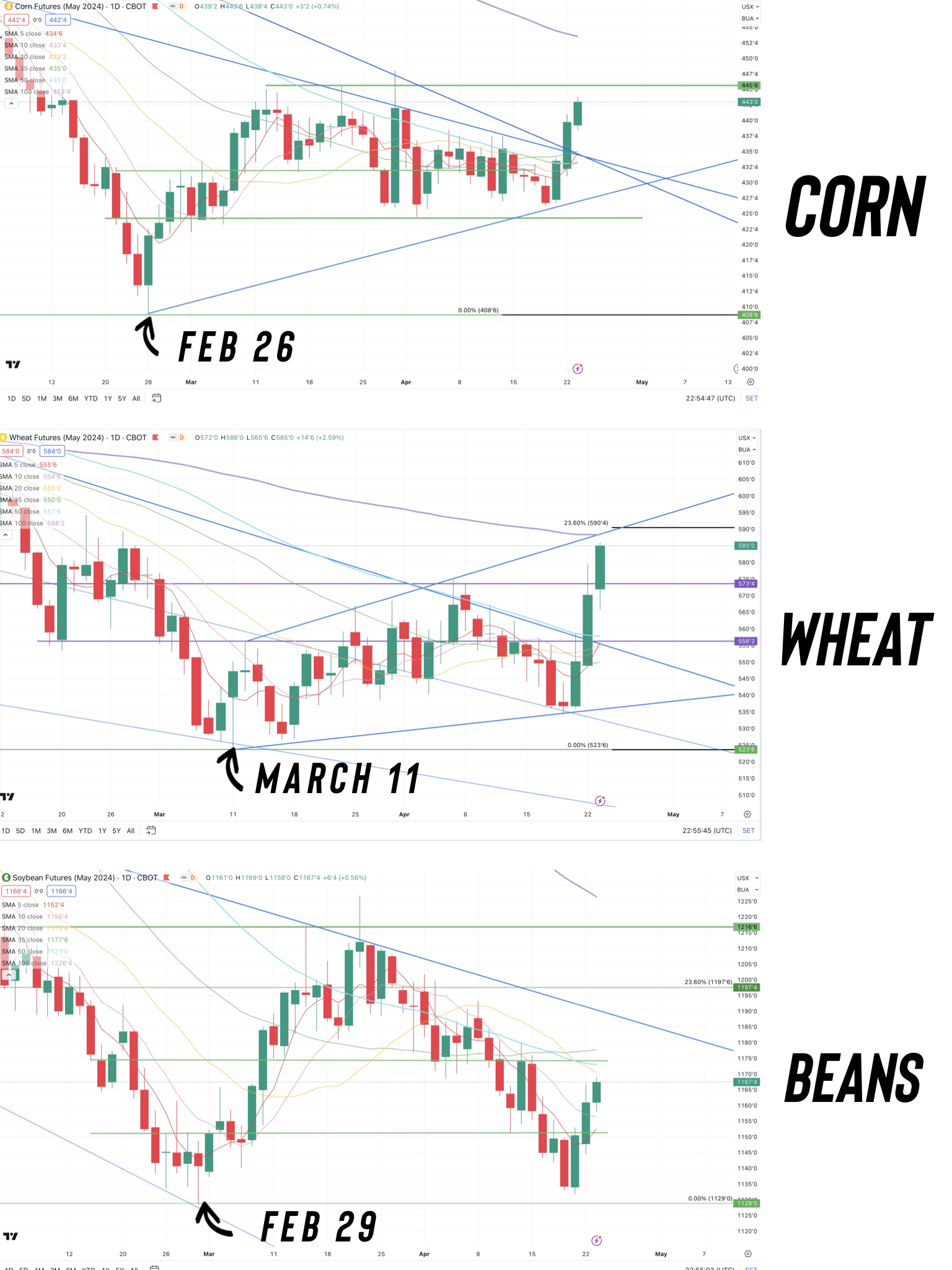

Grains strong yet again, extending the rally to 3 days led by wheat futures as Chicago wheat is up +50 cents the past three days and KC wheat is up +45 cents.

This strength has carried corn higher, up +16 cents the past three days while beans are up +33 cents.

Wheat continues to lead the rally off the back of short covering due to war headlines and worries about this winter wheat crop that has lacked moisture.

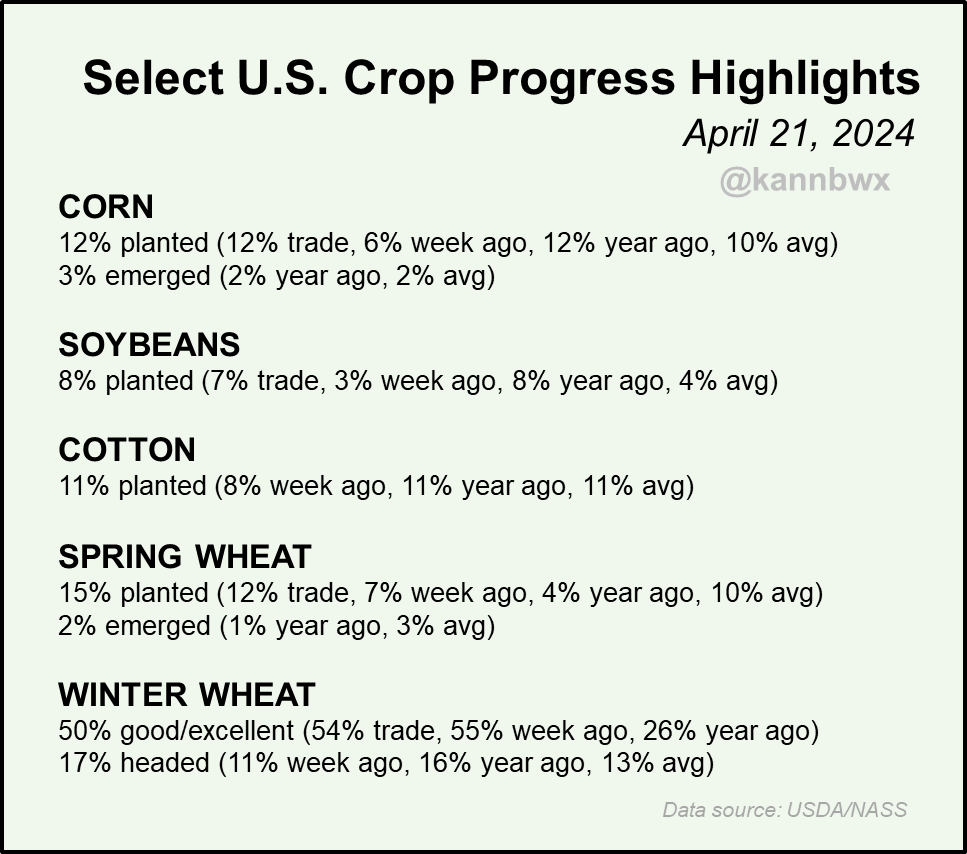

As yesterday winter wheat crop conditions surprised, coming in at 50% rated G/E. Down -5% from last week while the trade was expecting 54% G/E.

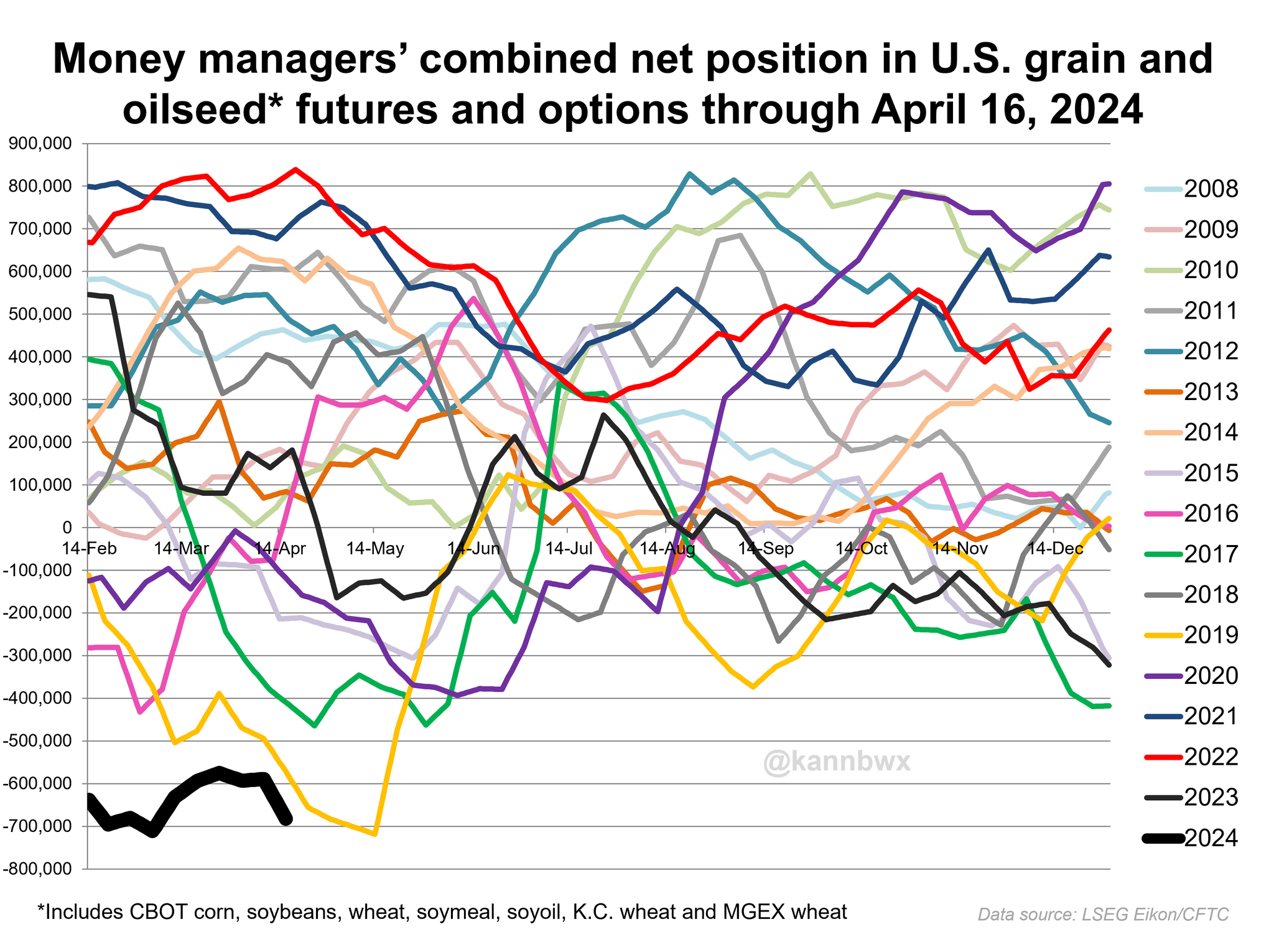

This has rallied the grains so much because the funds are scared. Which has led to a lot of short covering.

They were and are still holding massively short positions across the board.

If you look at the corn and wheat charts, they have chopped sideways to higher since late February. So the funds were holding on to this massive short position that hadn’t been performing great like it did last year. The funds don’t like holding losing positions.

All of this uncertainty should give them all the more reason to cover and reduce their exposure.

Soybeans are a slightly different story, as we traded lower for an entire month and nearly made new lows last week before bouncing.

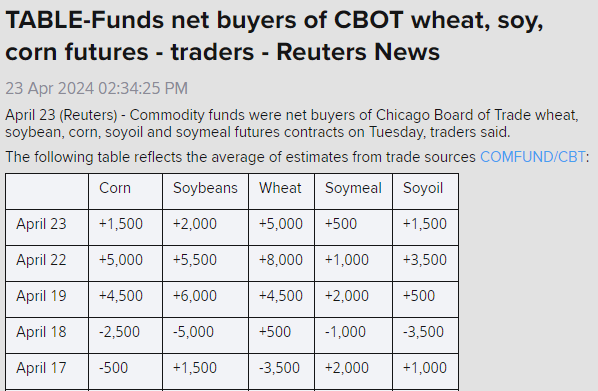

Take a look at how much the funds have covered the past 3 days.

Still plenty of room to cover across the entire grain complex.

Chart Credit: Karen Braun

Planting is going well so far. Nothing too crazy, as planting is slightly ahead of the average pace across the board.

Chart Credit: Karen Braun

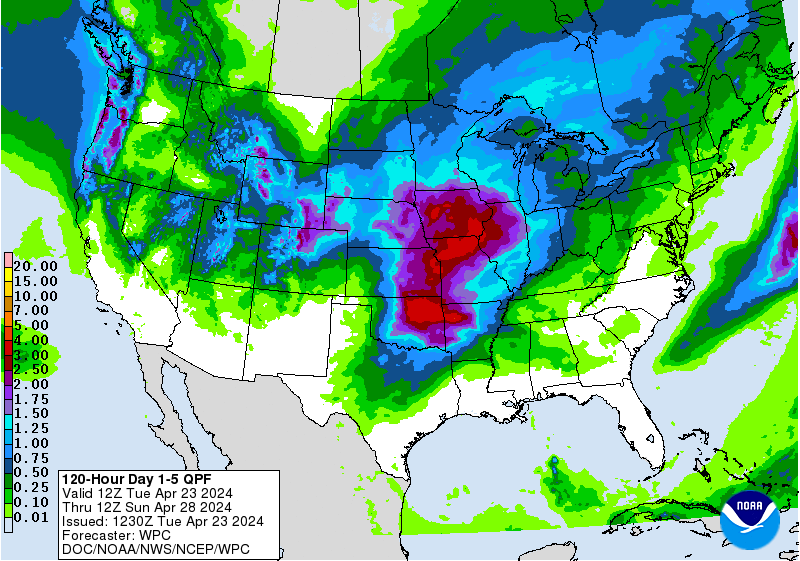

As for the future outlook of planting, it looks like we should get a good chunk done early this week in most areas but we have rains moving in later this week and into next which could slightly delay things.

No I do not think this will cause a major delay. Most of this rain is coming to areas that really needed it, like Iowa. Long term this rain will be viewed as beneficial unless it just randomly continues to rain and floods everyone out like 2019. But I don’t see this happening.

Most are expecting planting progress to come in pretty good on Monday again.

2-3 weeks from now, this rain will help the subsoil moisture look a lot better than it did in those areas that were super dry.

It also looks to get very warm, which should help guys get in the fields once this rain is over.

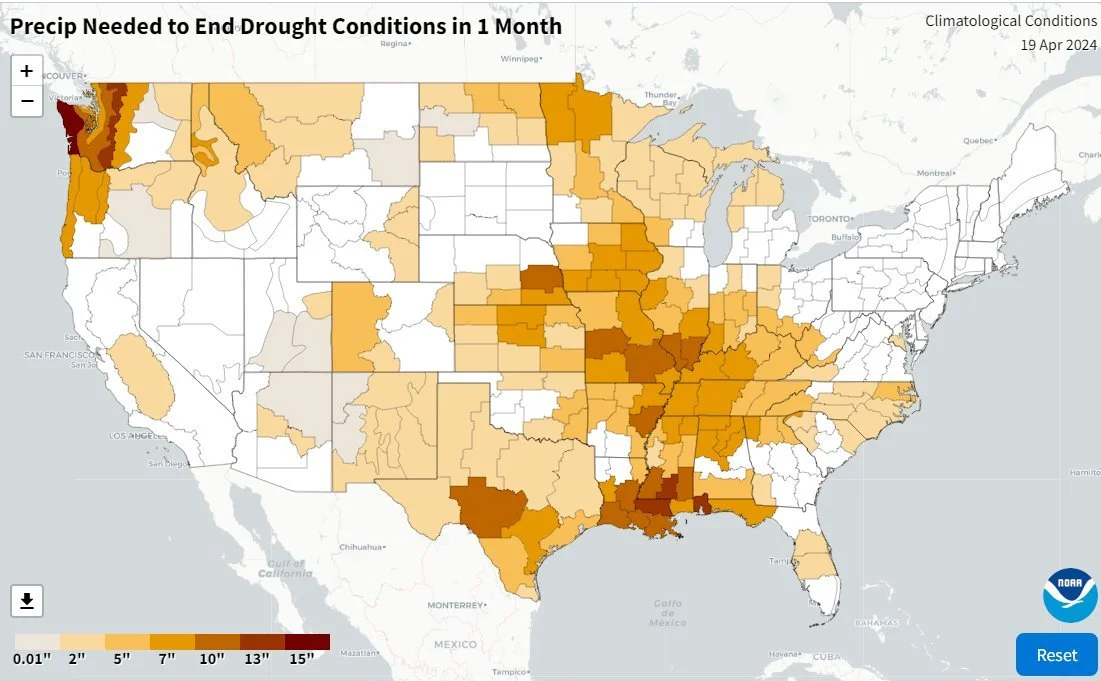

A lot of the areas that were in drought should be getting some good relief.

Next 5 Days Forecast

Precip Needed to End Drought

The two biggest things aside from weather that you need to be aware of is……..

The rest of this is subscriber-only. Please subscribe to keep reading & get every update along with tailored market plans.

IN TODAYS UPDATE

What to be aware of short term

Could corn struggle short term?

Why we typically make highs in June

What would happen if yield dropped

Why US growing season is THE #1 FACTOR

Sprinkle some wheat sales or not?

Wheat charts look very strong

Full breakdown of corn, beans & wheat

KEEP READING FOR FREE

Get our full daily updates & 1 on 1 market plans to prepare for these upcoming opportunities. Try 30 days completely free.

Want to Talk?

Our phones are open 24/7 for you guys if you ever need anything or want to discuss your operation.

Hedge Account

Interested in a hedge account? Use the link below to set up an account or shoot Jeremey a call at (605)295-3100 or Wade at (605)870-0091

Check Out Past Updates

4/22/24

GRAINS CONTINUE 2-DAY RALLY

Read More

4/19/24

ONE DAY WONDER? EXTREME VOLATILITY & RALLY

4/18/24

GRAINS WAITING FOR WEATHER MARKET

4/17/24

NOT IN THE WEATHER MARKET QUITE YET

Read More

4/16/24

CHOPPY TRADE IN GRAINS CONTINUES

4/15/24

PLANTING PROGRESS & BRUTAL CHOP

4/12/24

MARKET DOESN’T BELIEVE THE USDA

Read More

4/11/24

GARBAGE USDA REPORT THAT DIDN’T MEAN MUCH

4/10/24

USDA & CONAB TOMORROW

4/9/24

USDA IN 2 DAYS. THINGS TO WATCH & HOW TO BE PREPARED

Read More

4/8/24

USDA REPORT THIS WEEK. WHAT YOU SHOULD BE DOING

4/5/24

STRATEGIES ELEVATORS COULD BE OFFERING THAT YOU SHOULDN’T BE USING

4/4/24

WEATHER, BIG MONEY, CHOPPY TRADE

4/3/24

EXPECT BIG PRICE SWINGS & VOLATILITY

4/2/24

RISK OFF DAY

4/1/24

HOW BIG OR SMALL COULD CORN CARRYOUT GET?

3/28/24

WHAT THIS USDA REPORT MEANS MOVING FORWARD

3/27/24