BIGGEST 3 DAYS IN CORN SINCE AUGUST

Overview

Grains mixed as corn sees it's biggest 3-day swing since August, now sitting +20 cents off it's Monday lows.

Soybeans held their recent lows and closed +12 cents off their lows while the wheat market gave back all of yesterdays gains as lower European wheat prices are pressuring ours.

China has been in the news aggressively buying Ukraine corn and Brazil beans this week. This doesn’t help us, but is is supportive. As it shows strong demand from China and signals that they are in the market even if it's not for us.

The cotton market continues to roar higher, breaking 1.00 and making 2 year highs. There is some talk with the price difference that cotton could potentially pull away some corn acres down south.

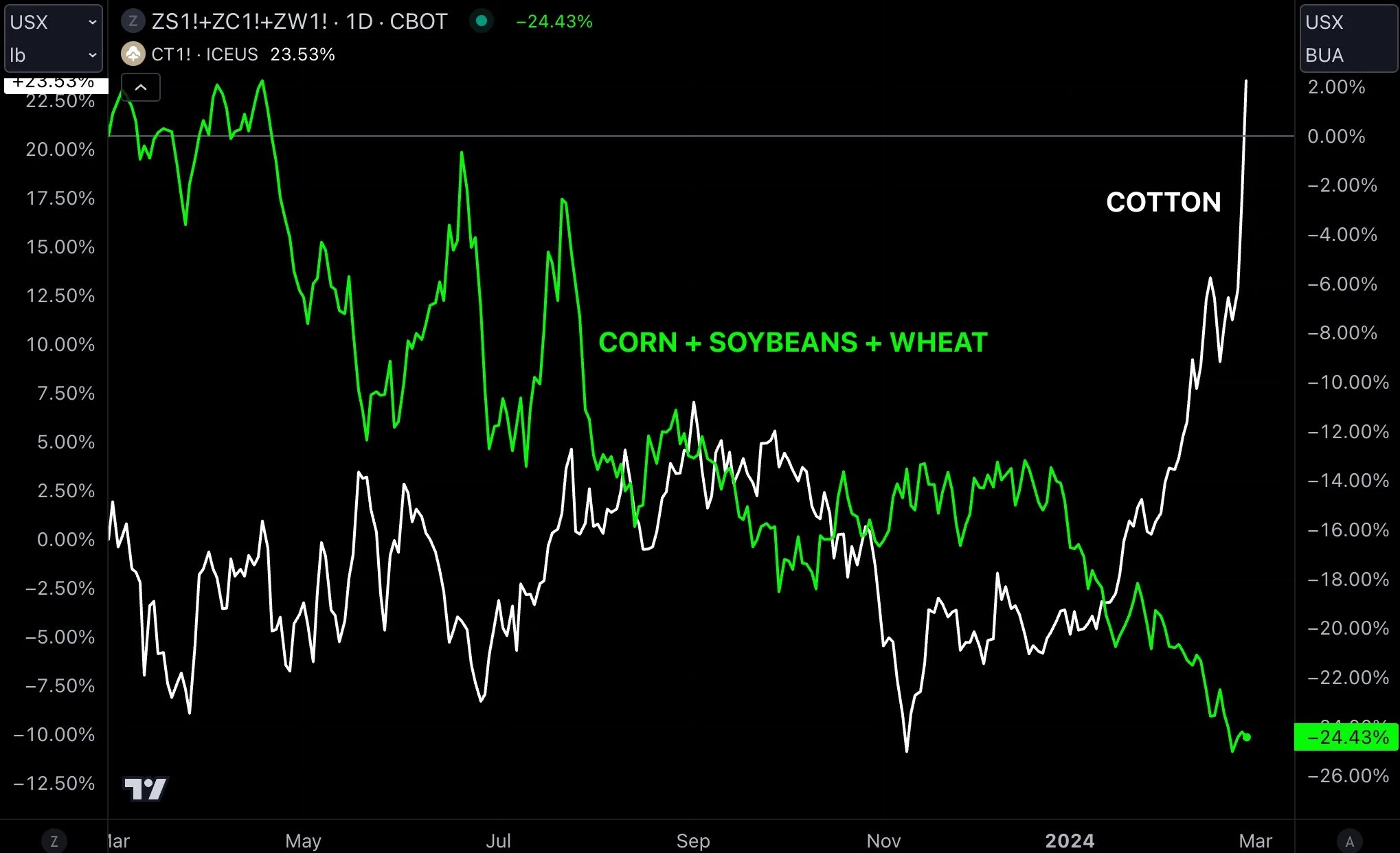

Here is a chart from Darin Fesler showing the 1 year performance difference between corn, beans, and wheat vs cotton. Not too hard to see why some may be swayed to add more cotton.

We continue to see analysts drop their Brazil estimates.

Today Abiove from Brazil lowered theirs from 156 to 153.8 citing lower yields.

We will have to see how the bean crop looks after harvest, but for right now it is moving along fast.

Typically a fast harvest means it is dry.

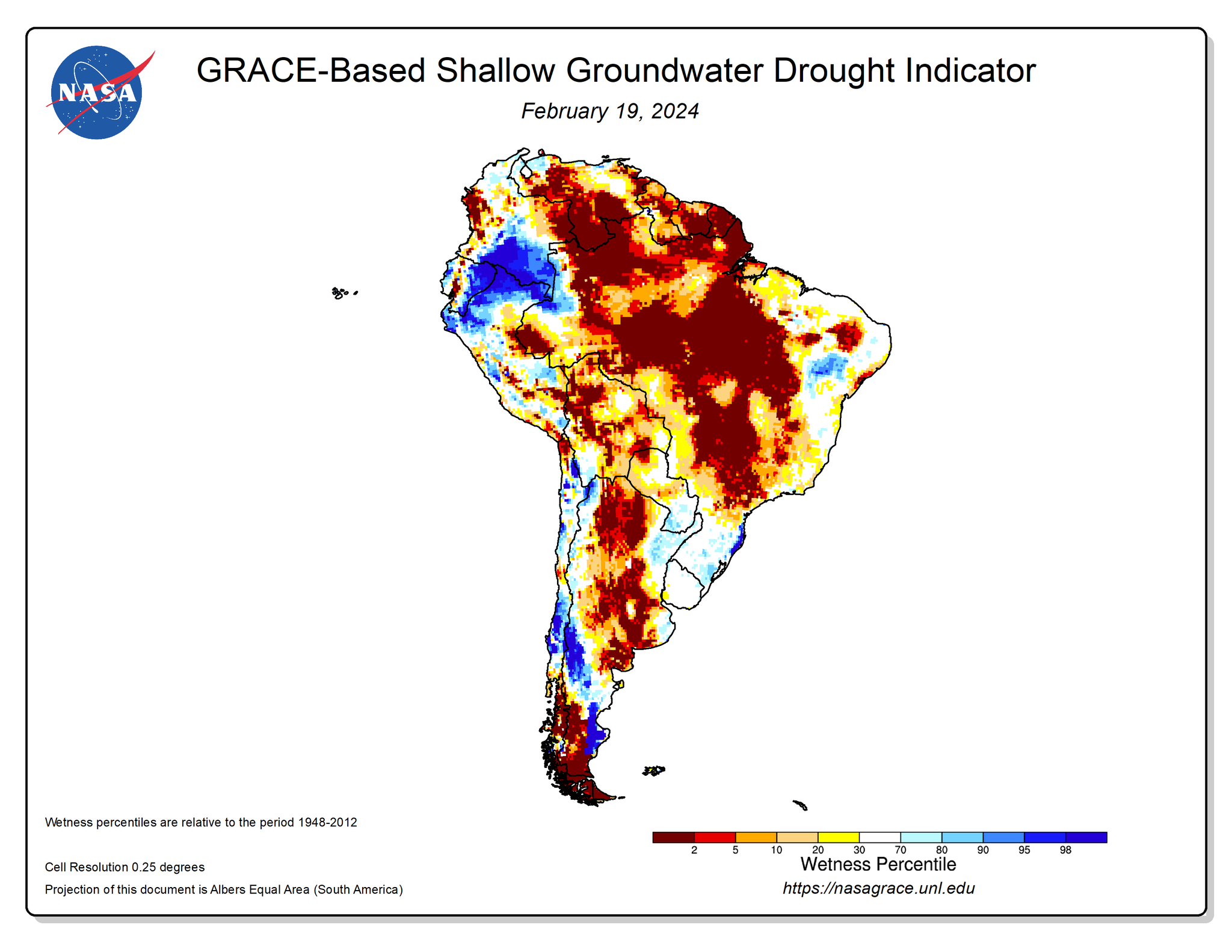

Dry weather in Brazil still has the potential to affect the second corn crop. This is even more important when you look at their lack of moisture they already face.

From 247 Ag:

"Brazil's soil moisture 1 meter done is the driest in history. Rainfall this monsoon season is just enough to keep the topsoil moist. Current trends tell us Brazil's Safrinha crop is in big trouble. We have been at 110 MMT million since January and we know we are too high. The USDA is at 127 MMT?"

"The trend calls for Brazil's monsoon season to fade quicker than usual. Which would be very bad for the Safrinha crop. This is what our models have been calling for."

"Dry is only good for a fast soybean harvest."

Weather in Brazil good or bad will continue to gain more attention the next month as March to early April is a crucial time frame for the development of that corn crop.

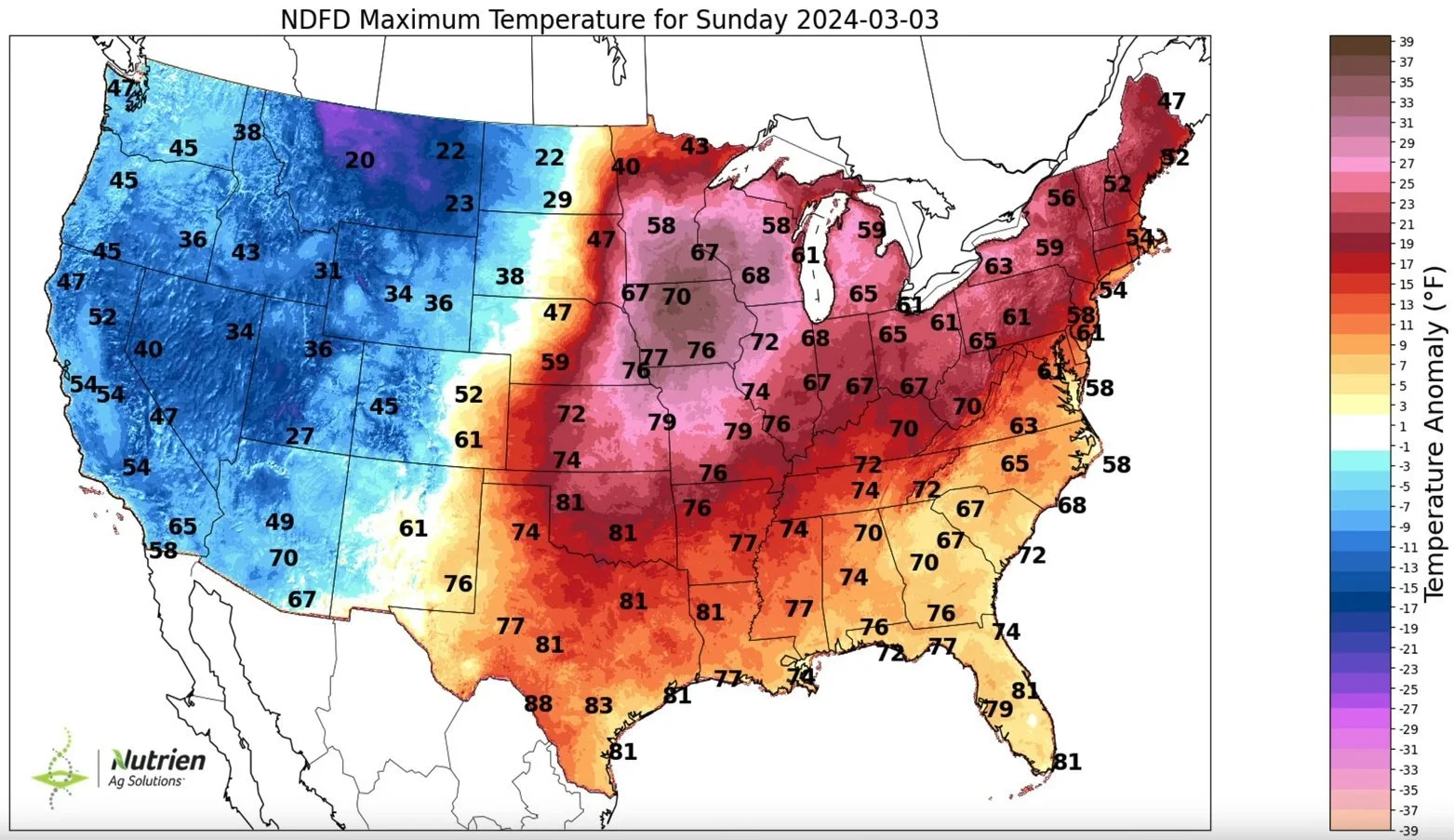

US weather has not had much of impact yet, but we have had some wild weather.

Take a look at this temperature change in Omaha. They lost 72 degrees in just 36 hours.

However, the roller coaster looks to continue. Back to far above normal temps this weekend.

As I have mentioned the past week, we are having the warmest winter ever.

Which will bring early planting. Early planting means we will not get a planting scare. Short term early planting could add pressure to this market.

Long term it will come down to the drought situation. We could very well get a drought scare. Keep in mind, this is a futures market. Even the thought of drought is often times enough to spark a little interest, whether it comes to frution or not.

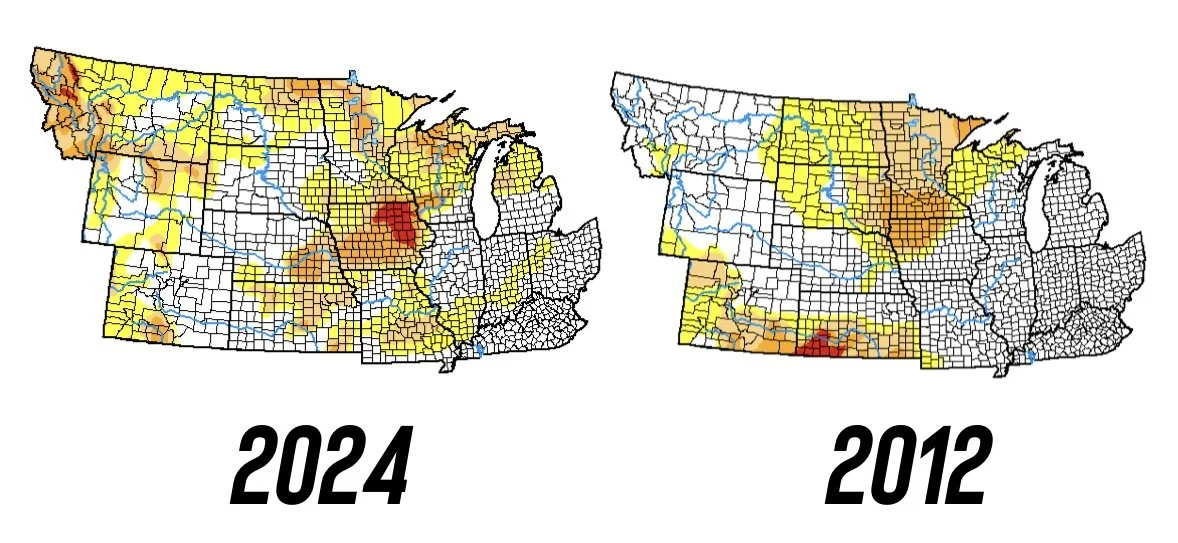

It is wayyy too early, but so far we are actually in a worse situation than we were in 2012 at this same time.

If the hot and dry pattern continues into summer, take a look at how poor our soil moisture situation already is with the lack of snow…….

The rest of this is subscriber-only. Subscribe to keep reading and get 1 on 1 grain marketing planning.

IN THE REST OF TODAYS UPDATE

2012 vs 2024?

How will we know the bottom is in?

Nearing key reversal to watch

Why we could go higher but see pressure come late March

What bulls and bears are looking at

Managing risk in cotton & cattle

TRY OUR DAILY UPDATES FREE

Let’s work 1 on 1 to help you develop a plan of attack. Comes with tailored recommendations specific to your situation. When prices are challenging, being proactive is all that more important.

Want to Talk?

Our phones are open 24/7 for you guys if you ever need anything or want to discuss your operation.

Hedge Account

Interested in a hedge account? Use the link below to set up an account or shoot Jeremey a call at (605)295-3100 or Wade at (605)870-0091

Check Out Past Updates

2/27/24

DID CHINA BUY CORN YESTERDAY?

2/26/24

EARLY PLANTING, DROUGHT, & FINDING YOUR GRAIN MARKETING STRATEGY

2/23/24

MORE DOOM & GLOOM AS CORN BREAKS BELOW $4.00

2/22/24

HAVING A PLAN & DEFINING RISK

2/21/24

LOWER LOWS & DROUGHT TALK

2/20/24

HOPE ISN’T A MARKETING PLAN BUT HISTORY REPEATS ITSELF

2/16/24

HAVE ENOUGH OF YOUR NEIGHBORS THROWN IN THE TOWEL SO WE CAN BOTTOM?

2/15/24

BASIS CONTRACTS & USDA OUTLOOK

Read More

2/14/24

SELL OFF AHEAD OF USDA OUTLOOK: STRATEGIES TO CONSIDER

2/13/24

LA NINA, FUNDS, & USDA OUTLOOK FORUM

2/12/24

WHAT TYPE OF GARBAGE USDA OUTLOOK REPORT IS ALREADY PRICED IN?

2/9/24

RECORD SHORT FUNDS, SOUTH AMERICA, & MANAGING RISK

2/8/24

CONAB VERY FRIENDLY. USDA NOT. FULL BREAKDOWN

2/7/24

NEW LOWS IN CORN & USDA PREVIEW

2/6/24

WHAT IS EXPECTED FROM USDA & WAYS TO GET COMFORTABLE

2/5/24

STILL NO CLEAR DIRECTIONS IN THE MARKETS

2/2/24

NEW BEAN LOWS.. HOW LOW CAN CORN GO?

2/1/24

NO CONFIRMATION OF HIGHER OR LOWER PRICES IN GRAINS

1/31/24

HOW SHOULD YOU BE SETTING YOUR TARGETS?

1/30/24

OUTSIDE UP DAY IN ALL THE GRAINS

1/29/24