MORNING MARKET UPDATE

Futures Prices 11:00am CT

Overview

Grains higher here Friday morning. The strength in the Dow Jones and crude oil both helping push prices higher. With the weaker dollar also helping support prices. As long as the outside markets work in our favor, we should see grains hold and stay higher throughout the end of the day. The biggest thing everyone is looking forward to is the report Monday. However, it's looking like the report might not be as wildly bullish as everyone was thinking just two weeks ago.

Today's Main Takeaways

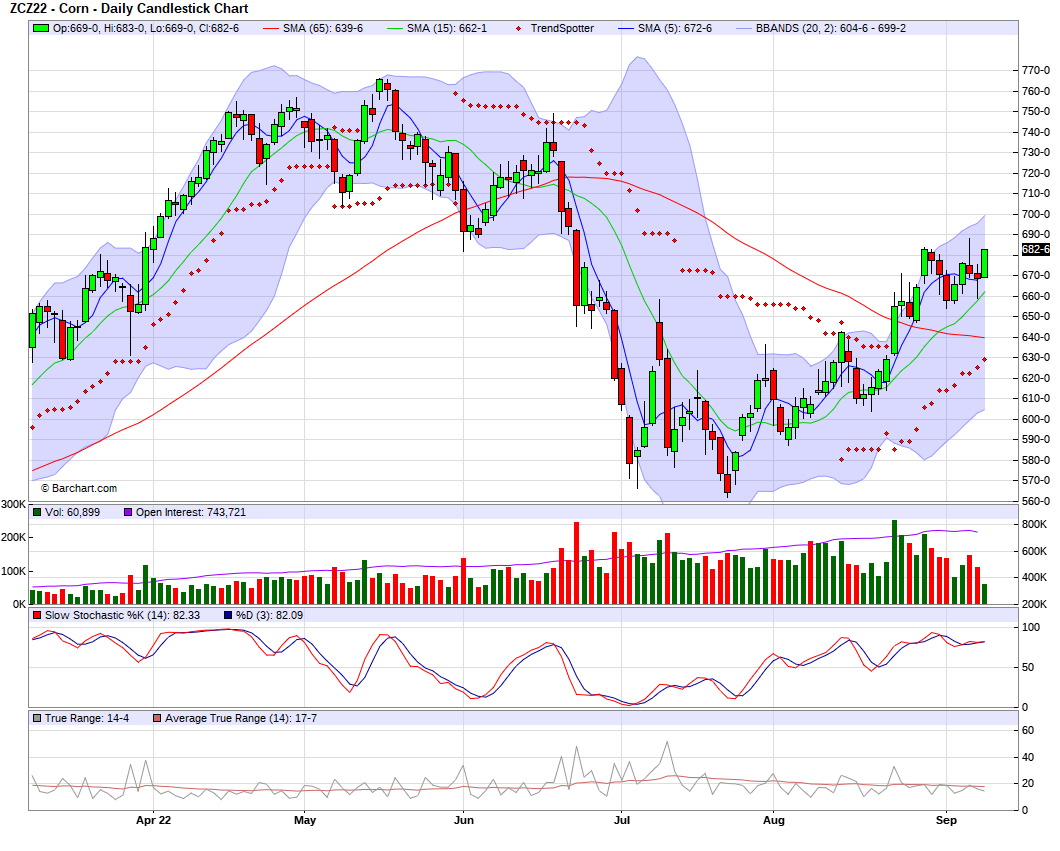

Corn

Corn higher here this morning. Dec still struggling to break above the 100-day moving average. USDA announced they would be giving an update to the planted and harvested acres for both corn and soybeans next Monday. There is the potential for us to see a wild card. There is also so skepticism to whether or not the USDA will make a large reduction in corn production right away, or perhaps they wait until they see more results. It may not be as big of a reduction as some are hoping.

Average estimates for the September WASDE:

Corn yield 172.5 bushels per acre vs 175.4 in August

Harvested acres 81.686 million

Production 14.088 billion bushels

2021/22 ending stocks 1.547 vs 1.53 billion in August

2022/23 ending stocks 1.217 billion vs 1.388 billion

The corn crop looks short. I think we continue to see corn push higher moving into harvest, given we don't see any bearish curve balls Monday. There is also the possibility of numbers not coming in as low as bulls might have hoped, which could put some pressure on prices to start next week.

Dec-22 (6 Month)

Soybeans

Soybeans also higher this morning along with corn and wheat. We still have questions surrounding Chinese demand and U.S. production. It appears that the trade is thinking we will see a cut to the USDA soybean yield come Monday. Most suggest we see a decrease from 51.9 down to 51.5 bushels per acre.

Taking a look at the demand side of things, we could see the USDA lower its exports, in an attempt to offset some of the yield loss. As mentioned above, we could see a total curve ball when the USDA releases their planted and harvested acres.

This week Argentina sold 3.2 million metric tons of soybeans. This is 5x that amount they sold last week. This is due to the new peso policy towards soybean farmers. They are getting 200 pesos to the dollar versus their original 140. Which is a 60% increase. The producers in Argentina are taking advantage of this. This isn't helping U.S. soybean demand, and China now has the ability to get beans from Argentina, instead of the U.S.

We did sell 104,000 MT of soybeans to Taiwan, which isn't anything crazy.

For August, Chinna imported -25% less soybeans than they did at this same time last year.

If we don't see any sort of weather to help out the markets, bulls will be looking for demand to keep prices afloat. This is tough, given the recent China/U.S. relations. As well as China’s continuous lockdowns not helping out demand. So to keep any optimism, we will need to see demand very strong going forward for the next few weeks.

Out of all the markets I’m most hesitant with soybeans. With plenty of bean crop, lockdowns in China, and a strong dollar. If China continues to see these problems it will likely cause a slip in bean prices.

Average estimates for September WASDE:

Soybean yield 51.5 bushels per acre vs 51.9 in August

Harvested acres 87.288 million

Production 4.496 billion bushels

2021/22 ending stocks 236 million bushels vs 225 million in August

2022/23 ending stocks 247 million bushels vs 245 million in August

Soymeal & Soyoil

Soymeal up +6.1 to 412

Soyoil uo +1.04 to 64.27

Soybeans Nov-22 (6 Month)

Wheat

Wheat leading the markets higher this morning. We have so many different headlines affecting the wheat market. First of all, we have the Ukraine situation. How much grain are we actually going to see come out of their ports. On top of that, we had Putin make a few statements as he is rethinking Russia's deal with Ukraine. His concern was that this wheat that is being exported is going to the wrong countries, and he believes he was somewhat fooled. As he claims he had the belief that this grain was going to the countries that most needed the grain.

On the other spectrum, we continue to see the U.S. fight inflation and recession. With the dollar getting stronger everyday now it seems like. As it recently hit 20-year highs. Not to mention crude oil trading over -25% lower the past three months. Yesterday fed chair Powell vowed to keep raising interest rates in attempts to stop inflation 'until the job is done'.

Next Monday, we get to see the corn and soybean updated acres and production. However, we do not get to see any updates to U.S. wheat production. We will typically see these in the report at the end of September.

There is news that Putin will visit Turkish president next week and talk about the Russia and Ukraine export agreement. I think its unlikely we see any changes made here. But there is the potential for them to not renew the deal after this six month period.

I think we finally see wheat break out from their lows and start an uptrend barring any crazy bearish headlines. Especially Chicago and KC. As wheat still has a lot of upside potential.

Average estimates for September WASDE:

2022/23 wheat ending stocks 618 million bushels vs 610 million in August

Other Markets

Crude oil up +2.58 to 86.12

DOW up +298

Cotton up +0.62 to 104.46

Dollar Index down -0.733 to 108.98

News

India restricts rice imports

Argentina will look to raise financing costs to soy farmers that hold onto stocks of more than 5% of their production

Putin will discuss the Russia and Ukraine agreement with Turkish president next week.

No weekly export sales data again this week

Fed chair Powell vows to raise interest rates until 'the job is finished'

Previous Newsletters

Here are our last 2 newsletters. Would love any feedback or things you would like to see.

September 8th, Audio Commentary - Listen Here

September 7th, Morning Market Update - Read Here

Social Media

Credit: All credit to users of posts

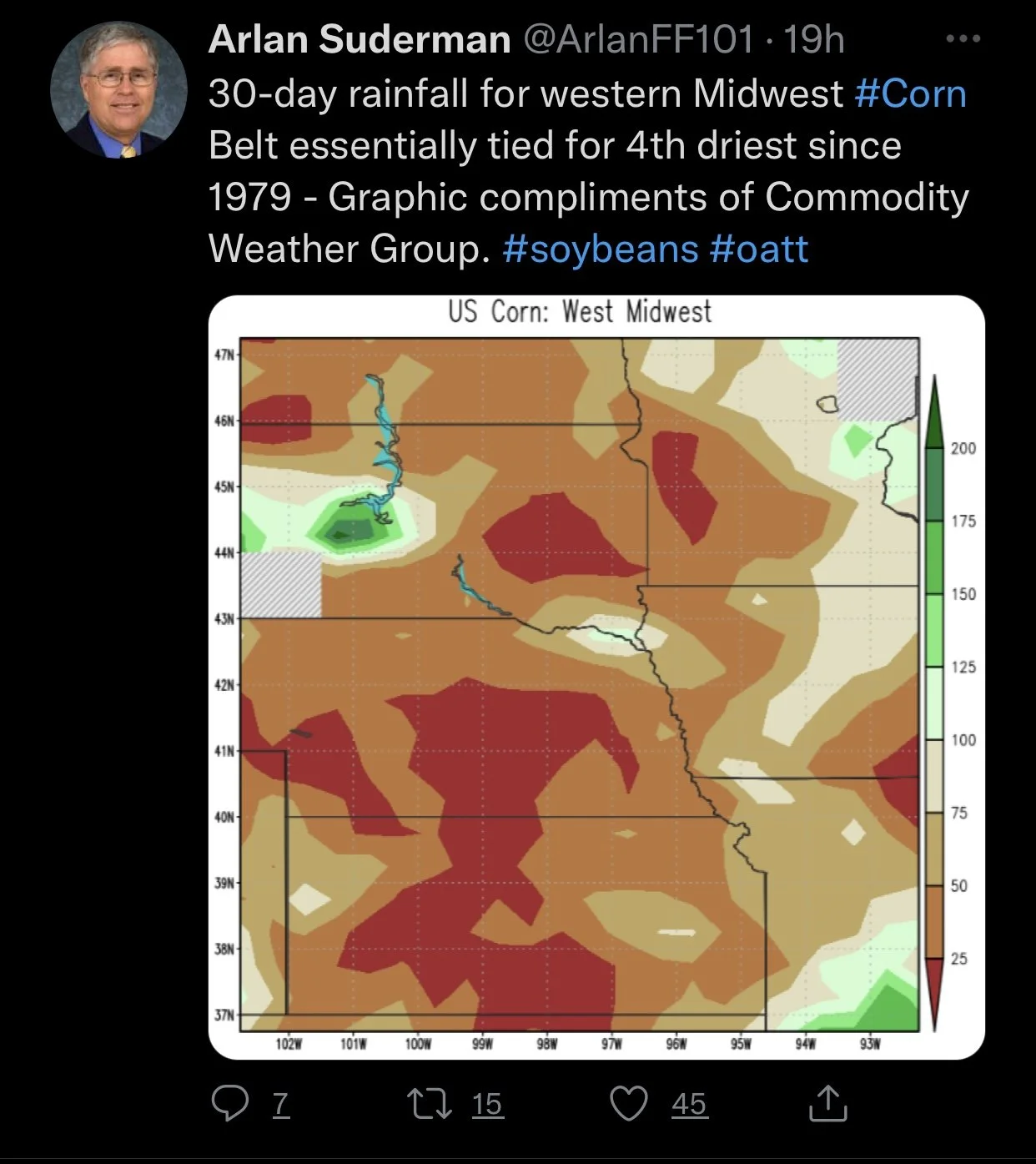

Precipitation Forecasts

Weather

Source: National Weather Service