PREPARING FOR THE USDA REPORT

WEEKLY GRAIN NEWSLETTER

Here are some not so fearless comments for www.dailymarketminute.com

A rather quiet week for the grain markets as some of the volatility comes out of the markets. It appears that the weather card has been put on hold or maybe even done for corn and beans while it appears that wheat is attempting to put in a rounding bottom on the charts.

The weather card done doesn’t mean that we really know what damage was done or not done with the heat, nor is the weather card in SAM yet to get played. How important the weather card in South America will really be determined by what we find out once the combines in the US start to roll.

On Tuesday we will get a USDA update to bean and corn production while typically wheat production numbers won't get updated until the end of the month report with the small grain production and quarterly stocks. As for what the USDA will print it is hard to think that the USDA will print a super bullish number, as we really don’t know what damage was or wasn’t done to the yields on the latest heat that we had.

There is such a huge range of opinions on what our final corn/soybean yields will be. It is nearly crazy, but very few indicate that they believe there is a big risk of a number that the USDA will print something shocking. There are smart people that believe we will see some corn yields sub 170, with some even sub 165 or less. But I just don’t see the USDA having enough evidence to print those types of yields at least not yet, if they did the market would shoot straight up. Options are not pricing in a big move, so perhaps that is an opportunity as we do want to buy low and sell high.

So our recommendation is that if you believe longer term our corn and soybean crop will be something well below what the average estimate is for this coming report then make sure you have your hedge account open and buy those call options sooner than later. If you believe strongly that yields are not there, don't wait for the market to agree with you, buy those calls when they are cheap. Not after the USDA tells you that you are right. If you need help with a hedge account you can give me a call at (605) 295-3100.

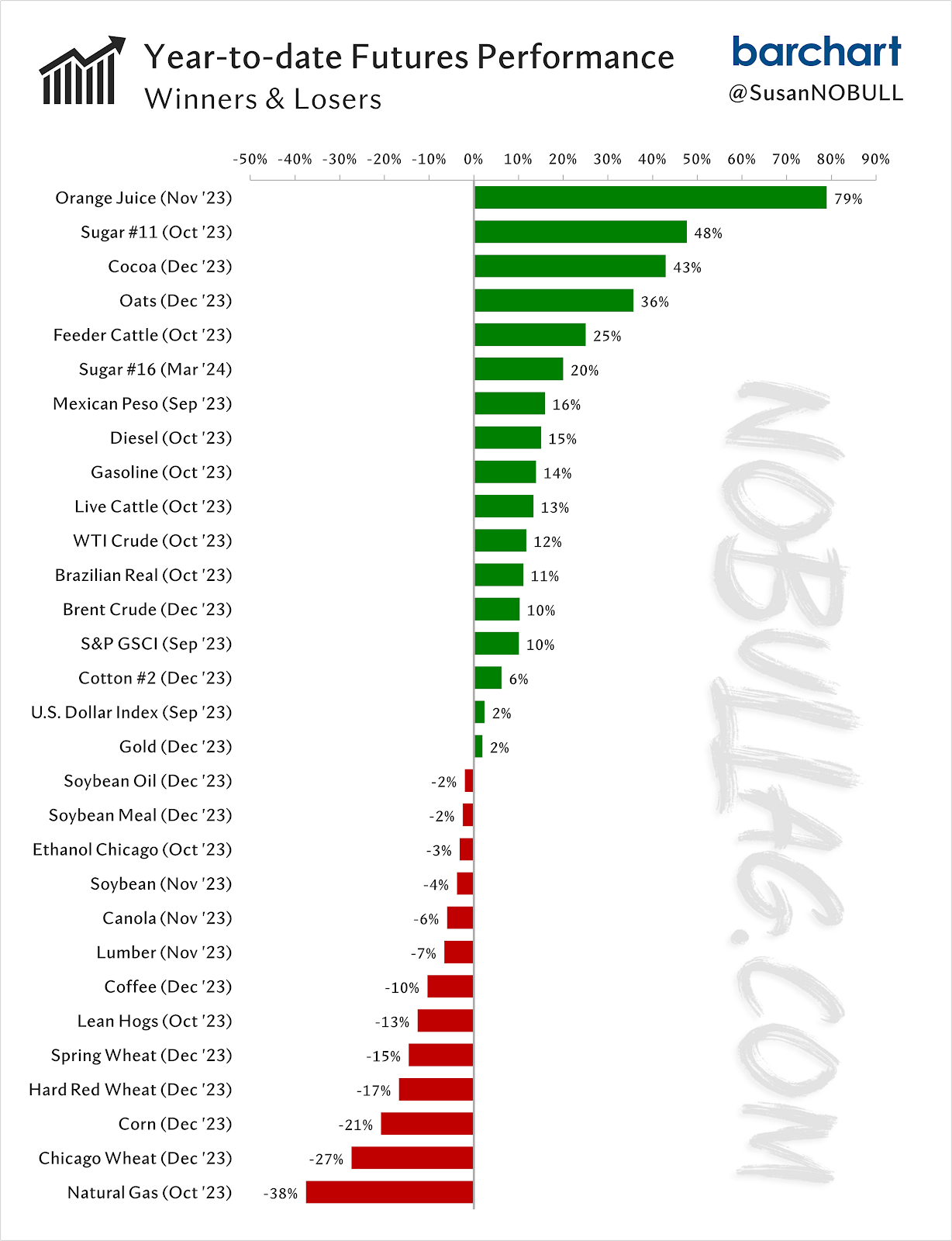

Below is a good graph to help keep things in perspective, it is just showing winners and losers year to date for various futures contracts. From Susan at NoBullAg.com

Our markets have always and will always be very volatile. I want to buy low and sell high. The headlines typically will make those in the green look to be attractive to the public, but soon after the public gets interested in a commodity it is all but over. The ones that have value are the ones in the red.

What do I do with all of my grain if I don’t have enough room to hold it all? My first answer is build more bins or work to be more proactive for your situation in the future.

Before I give a better answer let’s look at the market structure for corn, beans, and the three wheats.

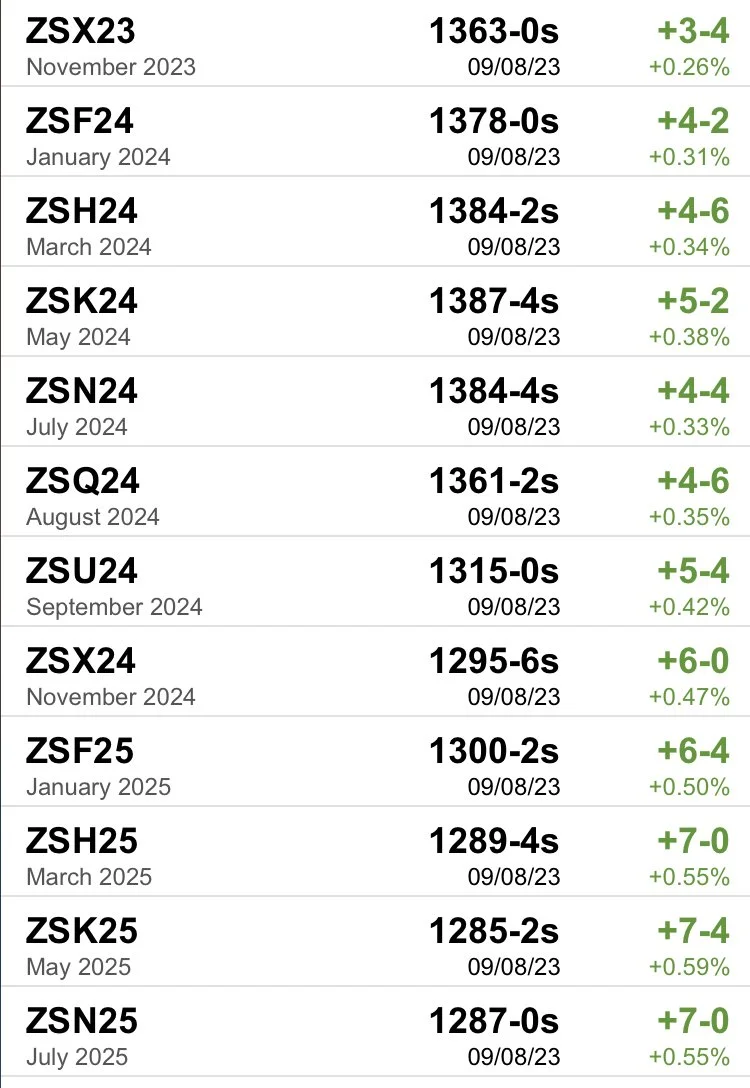

First is beans which has a decent carry but when comparing the base price of the product the carry is light versus corn as example.

Corn now has a carry from 2023 new crop to 2024 new crop.

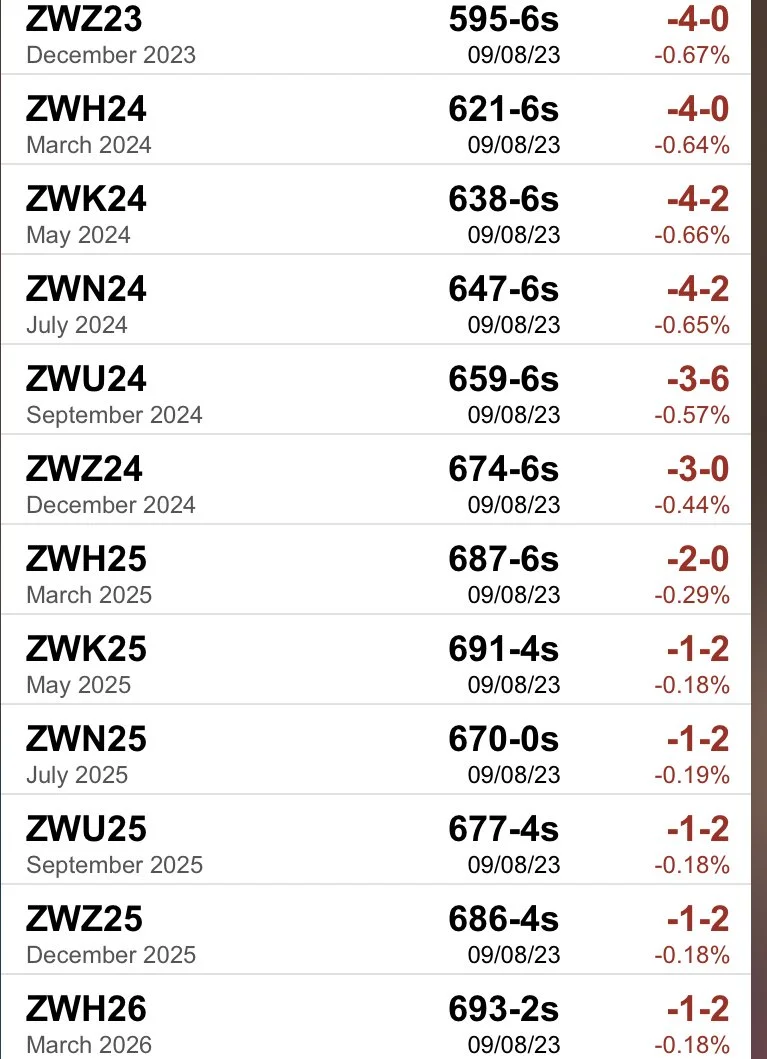

CBOT wheat carry is screaming sell the carry with nearly 80 cent premium from the Dec 23 to the Dec 24 contract.

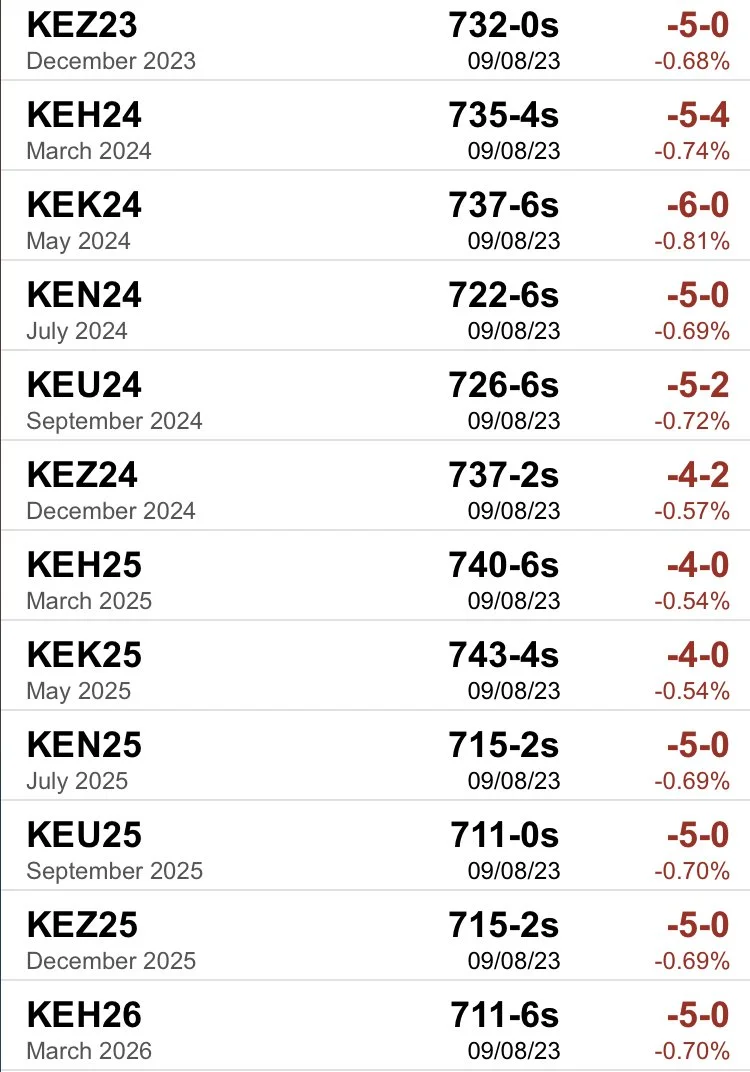

KC wheat shows a market despite the lack of nearby demand that is willing to pay more for 23 wheat then new crop 24 wheat.

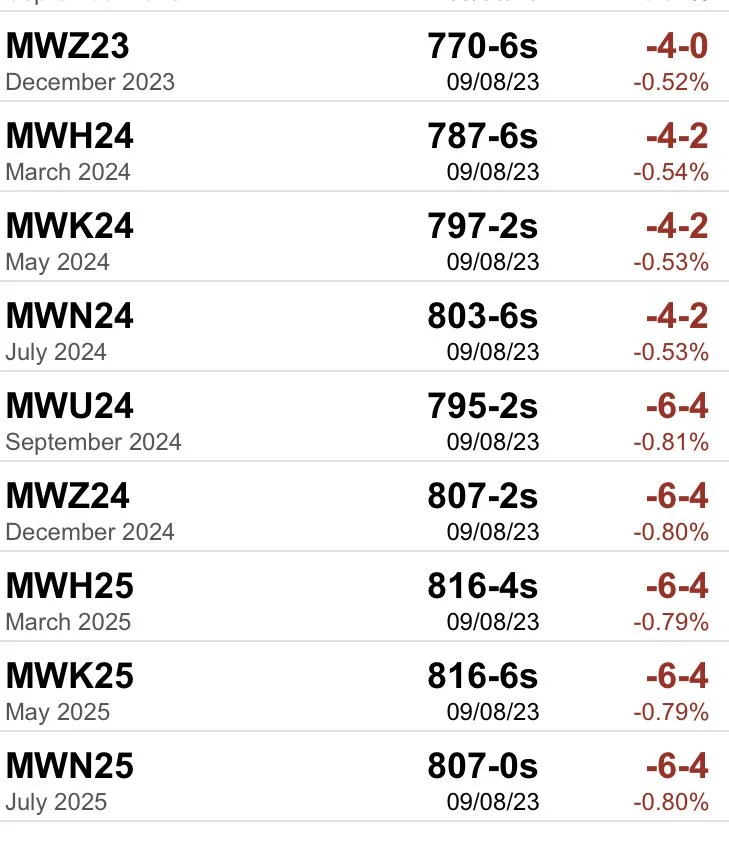

While MPLS wheat has a nice carry as well out to next spring.

The carry in the markets typically indicate what the end users view as “true” supply and demand tightness.

So looking at the above you get left with this big mixed bag. Where the structures of the market are most bullish for soybeans, followed by KC wheat. But those same structures that are bullish in nature nearly force one to sell soybeans versus holding soybeans and selling corn or CBOT wheat.

Let’s take the example of a producer who has corn and soybeans. Let’s assume that he will end up holding whatever grain he doesn’t sell off the combine and he will employ his bins in about a year right before next years harvest. He doesn’t have room for both and is borrowing some money on his line of credit. The market is saying if he holds his beans he will take nearly 80 cents less. While if he holds his corn he will get nearly 25 cents more.

Plus the fact that he will get nearly 9 dollars a bushel more for his soybeans make it a no-brainer from a cash flow perspective to sell beans and store corn.

But fundamentally beans have so much more upside so why would one sell the soybeans? It is just how the market does its job in forcing farmers to supply product when they really don’t want to and maybe shouldn’t. It is also why many times it might make sense to the cash beans and re-own with call options.

Look at the wheat market in CBOT, are many or any of you selling the big carry? From who I have talked to it appears that very few put their operations in a situation where they can sell the big carry.

Hence why we see the pressure day after day on the charts, why we see basis weakness and why we have this huge carry. Because no one needs nor wants the wheat today. Cheap prices along with a wide carry will cure this, but when?…….

The rest of this post is subscriber content only. Please subscribe to keep reading and receive every exclusive update via text & email.

LAST CHANCE FOR OUR BIGGEST SALE EVER

Get all of our exclusive updates for a fraction of the cost. Scroll to check out past updates you would have received.

Become a Price Maker. Not a Price Taker.

SALE: $299/yr

WILL BE: $800/yr

Not Sure? Try 30 Days Free HERE

INCLUDED IN TODAY’S EDITION

Recommendations

Technicals

Have we made our lows?

Check Out Past Updates

9/8/23 - Audio Commentary

WILL USDA REPORT BOOM OR BUST?

Read More

9/7/23 - Market Update

BEANS GIVE BACK GAINS, TRADE PREPARES FOR USDA

9/6/23 - Audio Commentary

BE PATIENT MAKING SALES AT HARVEST TIME

9/5/23 - Market Update

WEATHER IMPROVING, BUT DAMAGE WAS DONE

9/1/23 - Audio Commentary

HOW MUCH DAMAGE WAS DONE & WHAT IS MARKET EXPECTING

Read More

8/31/23 - Audio Commentary

THIS CROP HAS MORE DAMAGE THAN MOST REALIZE. DON’T PANIC SELL

8/30/23 - Audio Commentary

THIS VOLATILITY ISN’T GOING ANYWHERE

8/28/23 - Market Update

WEATHER REMAINS BULLISH BUT CROP CONDITIONS DISAPPOINT

Read More

8/27/23 - Weekly Grain Newsletter

ECON 101 APPLIED TO GRAIN SALES

Read More

8/25/23 - Market Update

BEANS CONTINUE BULL RUN

Read More

8/24/23 - Audio

BEAN DEMAND STORY CONTINUES TO GROW AS CROPS GETTING SMALLER

8/23/23 - Market Update

CROP TOURS, BRUTAL HEAT, & NO RAIN

8/22/23 - Audio