LA NINA, FUNDS, & USDA OUTLOOK FORUM

MARKET UPDATE

Futures Prices Close

Overview

Grains mixed while soybeans gave back yesterdays gains ahead of Thursday and Friday’s USDA Outlook Forum.

Not a ton of fresh news for the markets to digest with both China and Brazil celebrating holidays. Soybeans were pressured from Argentina getting decent rains with little problems expected moving forward. The next big debate will soon be the US acerage.

We had the CPI (Consumer Price Index) data come in this morning. It came in higher than expected, signaling that the Feds might not cut rates until closer to summer now. This added a small amount of pressure to the grains and led to the dollar rallying to 4 month highs which doesn’t help the grains.

The biggest thing this week is the upcoming USDA Outlook Forum.

Most are expecting pretty bearish numbers because this report tends to be bearish.

The general talk is lower farm income. Which means bigger production numbers and larger stocks.

Analysts are expecting corn acres to come in a little smaller than last year, while expecting soybeans to come in a little higher. However, if you plug in the yield on corn to go along with demand, will very likely still be at a massive carryout.

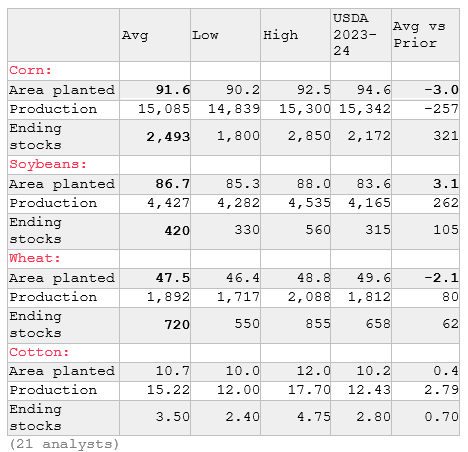

Here is a poll from 21 analysts at Bloomberg. These numbers are the analysts own numbers, not what they think the USDA will say.

If the USDA agrees with these analysts, they have soybean ending stocks up an aggressive +33% from last year.

They also see corn carryout to be a whopping 2.49 billion bushels.

If these numbers are even close, the US is going to need a lot more demand. Because overall, these numbers do not look good at all.

Dave Brock of Brock Report said:

"We did just our 24 balance sheets and are pretty close to these averages. Main takeaway was corn needs a miracle."

Mark Gold from Top Third said:

"I would expect lower wheat acres around the world to be a trend with the cheap wheat prices around the world. I would expect US acres to be down as well."

The funds still hold some of their shortest positions on record in both corn and beans.

They are short around -140k contracts of soybeans. The shortest ever only behind 2019's -169k contracts.

They are short around -300k contracts of corn. The shortest all time for this time of year, and very very close to approaching their shortest all time from 2019.

The funds have zero reason to cover before this report. If the markets take a hit from this upcoming report, most think we will see them at the very least look to cover a small amount of their shorts following this report simply because everyone was already expecting this report to be bearish and a lot of bearish factors are already priced in.

The funds are going to be key if we want any sort of rally.

From Arlan Suderman of StoneX:

"Big shorts already pushed this market hard. Farmer still has lots to sell on both sides of the equator. Won’t say it can’t go lower, but downside momentum is slowing."

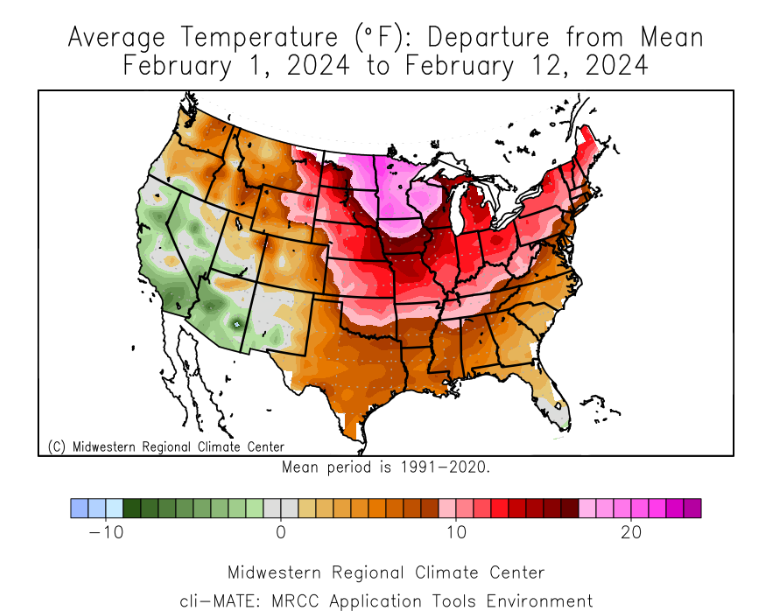

Next let's take a look at weather here in the US.

Many of primary growing areas are having their warmest February on record. With temperature anomalies around +20 degrees F in the upper midwest.

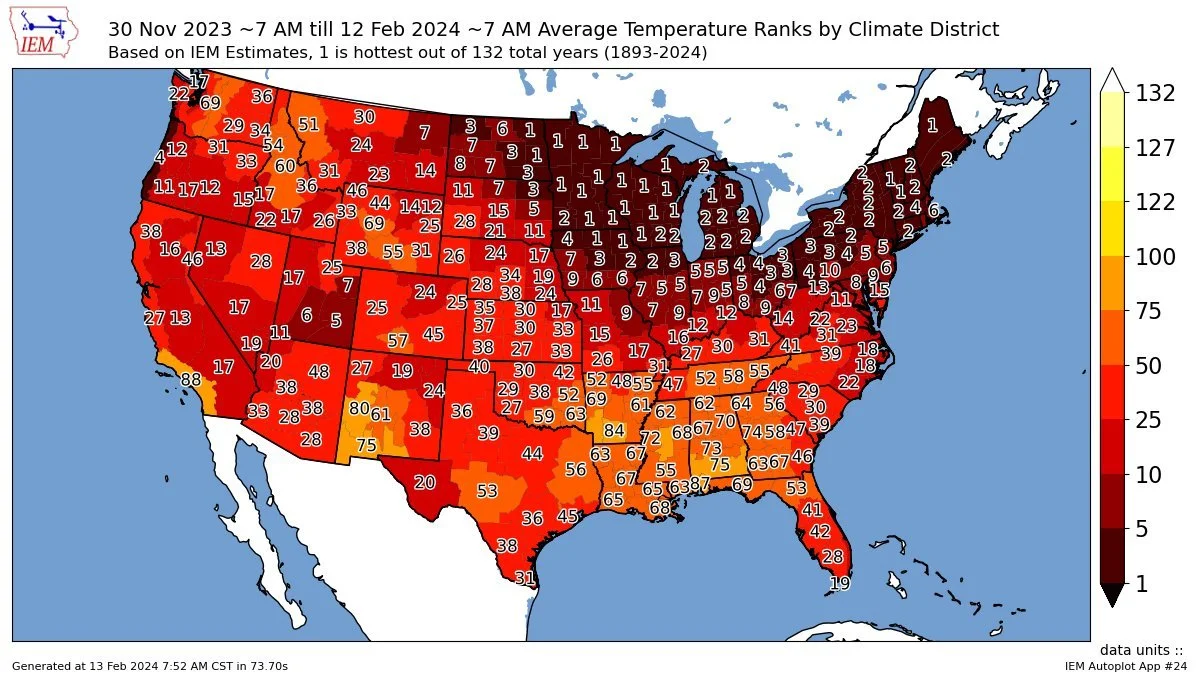

Now let's take a look at how temperatures since November until now shape up.

Again, a good portion are the warmest on record.

Why does this matter? Well what if this same pattern occurs this summer?

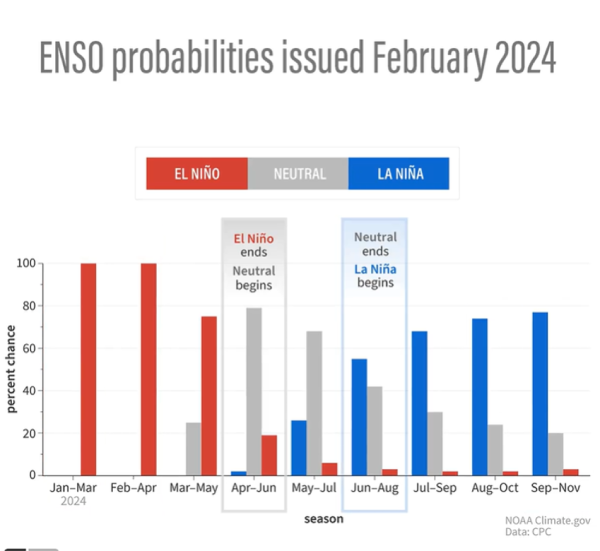

The official ENSO probabilities for La Nina are actually expecting La Nina to be in full effect come May and June. Which would bring hotter and drier weather if holds true. Still too early to make bold predictions, but could certainly be a big potential wild card looking long term.

From Farms.com Risk Management:

"Funds remain too short with La Nina (hot and dry weather pattern potentially returning as early as May of 2024. After 11 straight weeks of selling the commodities remain out of favor with big hedge funds and now almost as record short as they were in 2019."

"The fundamental impetus for a massive short covering rally could start from when we get a 'real' final read on South American soybean crop size and taken over by the North America 2024 growing season. (See chart below)"

Also from Farms.com Risk Management:

"The bullish key catalyst in a bear market is the potential for a massive short covering rally in the grain markets as the big hedge speculator funds are record short. The funds have overdone it to the downside.

But we need to give the funds a reason and our best guess is when the Brazilian soybean harvest is complete at the end of February, and we get closer to the 2024 growing season in North America is when we could finally see a recovery in grain prices."

"We never had a strong El Nino so a return of La Nina could happen sooner than expected but its still early and the funds are always late to the party just like the USDA and will not panic until they have to. Remember 2012 it was not until July 1 that the funds hit the panic button that took corn futures from $6.00 to $8.49 to an all time record high."

Now let's jump into the rest of today's update..

Today's Main Takeaways

Corn

Corn continues to struggle

Later this week we have the USDA Outlook Forum. What is expected and what is priced in?…….

The rest of this is subscriber-only. Subscribe to keep reading and get every update. Comes with 1 on 1 tailored marketing plans and recommendations.

WHAT WE GO OVER TODAY:

The USDA outlook forum and what to expect

Brazil debates. What happened the last time they had drought?

What could make the funds cover?

Why the wheat spreads are friendly. Carry vs inverse markets

Cattle hedge recommendation

TRY OUR UPDATES & RECOMMENDATIONS FREE

Become a price maker and get 1 on 1 marketing planning. Try free for 30 days.

Want to Talk?

Our phones are open 24/7 for you guys if you ever need anything or want to discuss your operation.

Hedge Account

Interested in a hedge account? Use the link below to set up an account or shoot Jeremey a call at (605)295-3100 or Wade at (605)870-0091

Check Out Past Updates

2/12/24

WHAT TYPE OF GARBAGE USDA OUTLOOK REPORT IS ALREADY PRICED IN?

2/9/24

RECORD SHORT FUNDS, SOUTH AMERICA, & MANAGING RISK

2/8/24

CONAB VERY FRIENDLY. USDA NOT. FULL BREAKDOWN

2/7/24

NEW LOWS IN CORN & USDA PREVIEW

2/6/24

WHAT IS EXPECTED FROM USDA & WAYS TO GET COMFORTABLE

2/5/24

STILL NO CLEAR DIRECTIONS IN THE MARKETS

2/2/24

NEW BEAN LOWS.. HOW LOW CAN CORN GO?

2/1/24

NO CONFIRMATION OF HIGHER OR LOWER PRICES IN GRAINS

1/31/24

HOW SHOULD YOU BE SETTING YOUR TARGETS?

1/30/24

OUTSIDE UP DAY IN ALL THE GRAINS

1/29/24

GEO POLITICS, CHINESE, BRAZIL, ALGOS, & BIG MONEY

1/26/24

SOLD RALLIES & HISTORICAL HIGHS

1/25/24

DEVELOPING A GRAIN MARKETING PLAN WITH TECHNICALS

1/24/24

5TH GREEN DAY IN A ROW: WAYS TO OUTPERFORM THE MARKET

1/23/24

GRAINS CONTINUE TO BOUNCE

1/22/24

HAVE MARKETS FOUND A BOTTOM?

1/19/24

FAILED REVERSALS & ELECTION YEAR RALLIES?

1/18/24