FIRST WEEK OF NEW YEAR FLOPS

Overview

An eventful week to start off the new year.

Soybeans continue their sharp downfall despite estimates from nearly everyone continuing to drop. As we break below our June $12.61 lows and hit fresh 7-month lows.

Corn makes yet another new low on today's action, taking out the previous two days of slight gains.

The wheat market continues higher following yesterday’s solid rally and reversal.

So why are soybeans falling off a cliff like this Brazil crop is made while everyone is lowering their estimates?

First of all, export sales were awful across the board. Beans saw a big reduction from unknown, which was likely China. This was not a good look, and to go along with that, there is still rain in the forecasts for Brazil to go along with the fact that yes they received some decent rains.

Let's take a look at some of the estimates we have now as we sit a week away from the January USDA report, and 5 days from the CONAB on Wednesday.

The USDA has their Brazil bean crop at 161. Now I’m sure this will drop, but by how much remains the question.

Today we saw Safras drop their bean number from 158.23 to 151.36. I found this one interesting because last year they were right on the money. They had their crop for Brazil at 157.8 and the final number came in at 158.

AgResource has the crop at 150.72

Pine is at 149.94

Dr. Cordonnier is at 151

Agricomp is at 149.53

Even StoneX Brazil is at 152.8

So why are soybeans down over $1.50 the past month and a half despite just having the worst 3-month drought period in history?

This crop has definitely gotten smaller since November, but the market just hasn’t seen that on paper.

Some think this crop can be somewhat "saved", others disagree. But it doesn’t matter what we all think. All that matters is what the market and big money think. Right now they think these upcoming rains are going to go a long ways.

At the end of the day, Brazil production will come down to how much of Mato Grosso's damage is beyond repair and what the funds want to do here ahead and following the report.

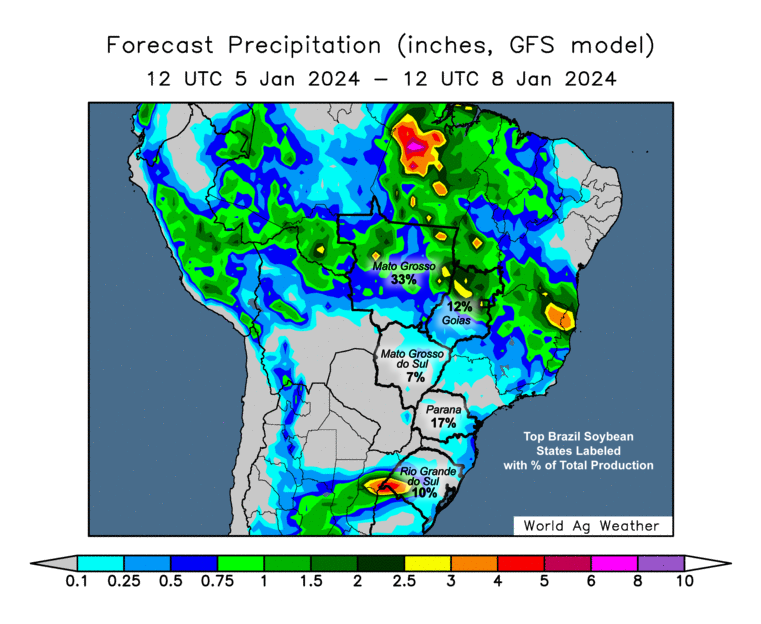

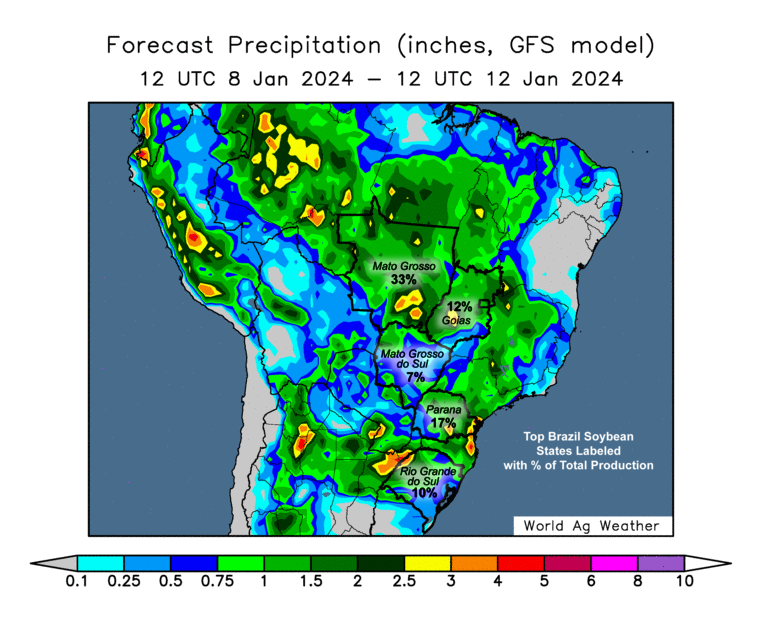

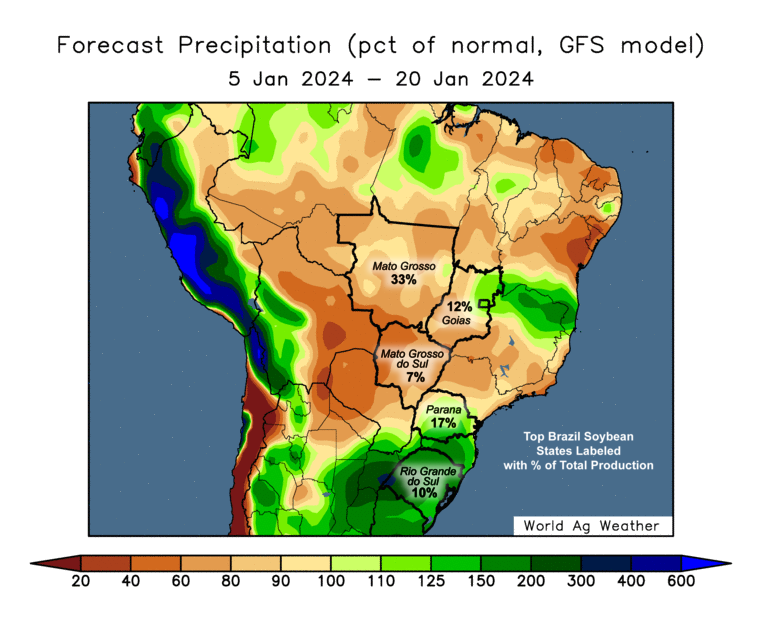

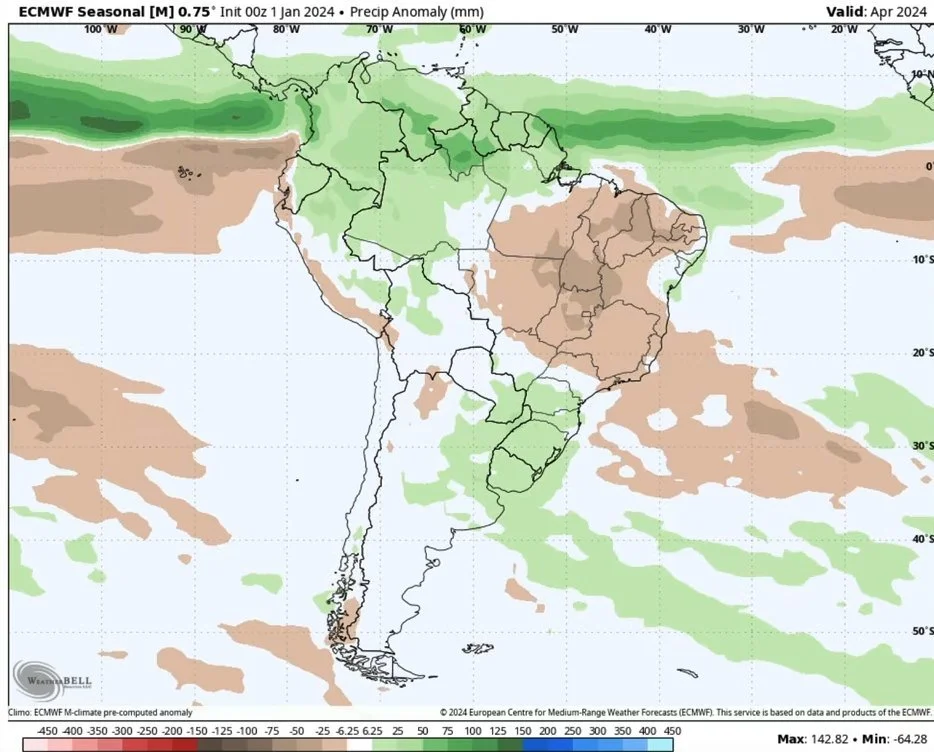

Here is the forecasts for Brazil:

1-3 Day Forecast

4-7 Day Forecast

15-Day % of Normal Forecast

7 Day Forecast Anomaly

January Forecast Anomaly

Yes the forecasts show rain for the next 10 days, then they are expected to back off and become hotter and drier once again.

Some are saying these upcoming rains could actually be "too much" and delay harvest and second crop corn plantings.

From BAM Weather:

"Now the million dollar questions in my opinion are: how long with this next dry and hot pattern linger before the next opportunity of rain?"

Friday's report is going to be a big one. Not only do we get their take on Brazil, but we also get final yields for US production and acreage as well as demand numbers.

Fund Rebalancing

Index fund rebalancing should be happening next week. Below is an estimate of what they should be doing. At least someone will be buying some grain.

Now let's dive into today's update..

Today's Main Takeaways

Corn

Corn finished the week lower due to the awful export data and a continuation of weakness from soybeans. As corn finished down 10 cents for the first week of the new year.

Corn has mainly been pressured by the funds here. They remain heavily short and they just don’t have a major reason to stop selling.

We have the Brazil situation, but this……

The rest of this is subscriber only. Please subscribe to keep reading and get every exclusive update. Scroll to check out past updates you would’ve received.

In today’s update we go over the Brazil corn situation, short & long term outlooks, risks, potential bullish factors, takes from others in the industry, managing risk & more.

LAST CHANCE HOLIDAY SALE

Don’t miss the opportunity. Biggest offer of the year.

With a subscription you get access to call us 24/7 with questions and tailored recommendations.

Make this the year you beat Big Ag at their own game.

OFFER: $399 vs $800 a year

NOT SURE? TRY 30 DAYS FREE

Try a month free.

Want to Talk?

Our phones are open 24/7 for you guys if you ever need anything or want to discuss your operation.

Hedge Account

Interested in a hedge account? Use the link below to set up an account or shoot Jeremey a call at (605)295-3100 or Wade at (605)870-0091

Check Out Past Updates

1/4/24

REALIZING POTENTIAL UPSIDE BUT BEING AWARE OF RISKS

1/3/24

RAINS & BRAZIL ESTIMATES

1/2/24

UGLY DAY: BRAZIL, RISKS, & MARKETING STRATEGIES

Read More

12/29/23

SHORT TERM RISK & LONG TERM UPSIDE

12/28/23

BRAZIL RAINS?

12/27/23

EFFECTS OF US DOLLAR COLLAPSE ON GRAINS & STRATEGIES TO CONSIDER

12/26/23

GETTING COMFORTABLE WITH ALL POSSIBILITIES

12/22/23

BEAN BASIS RECOMMENDATION TO TAKE BACK CONTROL FROM BIG AG

12/21/23

COMMODITIES ARE DIRT CHEAP VS STOCKS

12/20/23

ARE YOU COMFORTABLE WITH $3 CORN OR $6 CORN?

12/19/23

CORN FIGHTING NEW LOWS & BRAZIL RAINS

12/18/23