TECHNICAL SELLING, SA WEATHER, & MANAGING RISK

Overview

Grains mixed with soybeans leading the way to the upside while corn and wheat take it on the chin. Soybeans higher after their 25 cent correction the past two sessions. Corn trades lower for the 3rd session in a row, down 20 cents since Thursday.

Short story short, corn and wheat see technical selling pressure with some macroeconomic concerns while soybeans trade higher with the rally in bean meal and drier South America forecasts.

Meal closed at it's highest levels since March, and the market is up 18.5% the past 3 weeks now.

Harvest progress came in yesterday, moving along slightly faster than average. Corn is 59% complete while beans are 76% harvested.

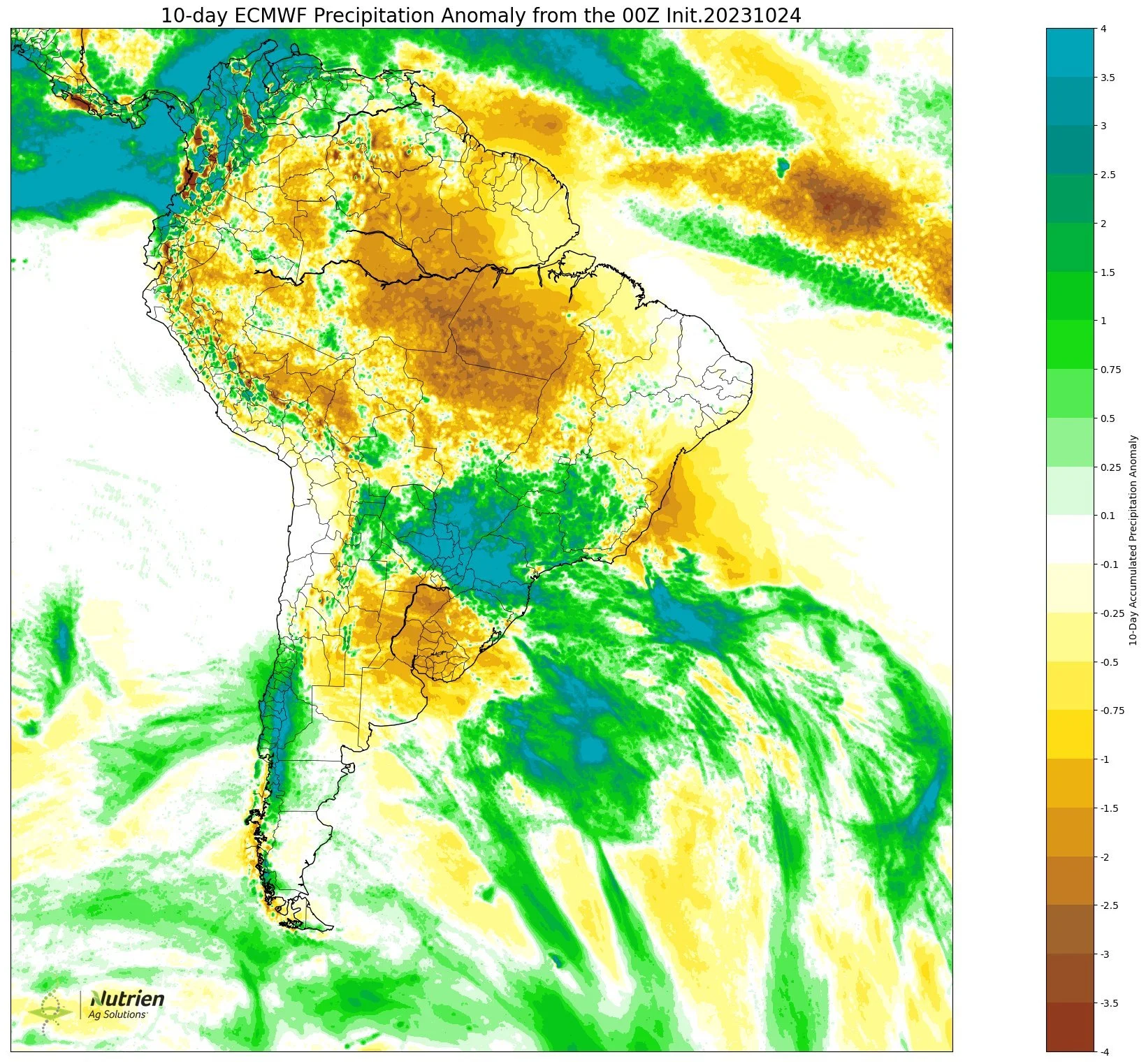

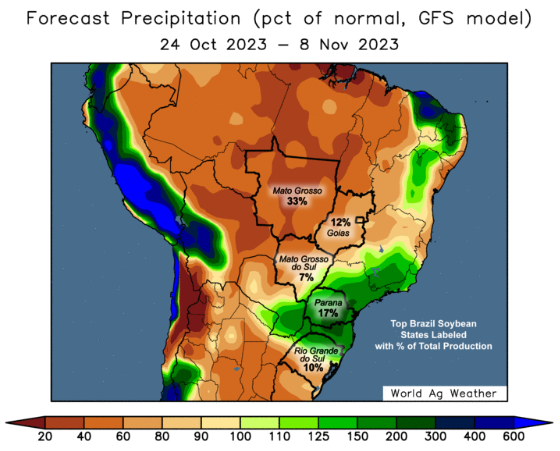

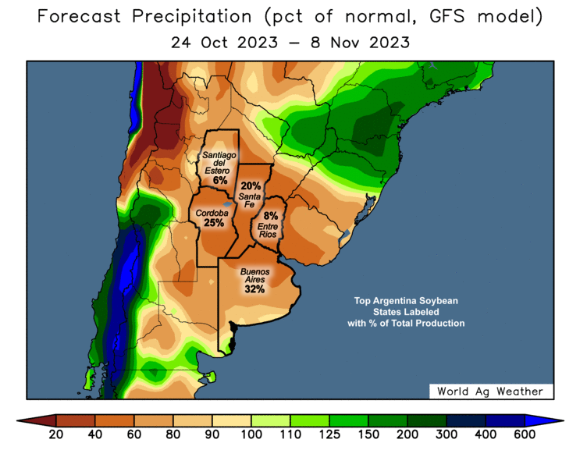

Argentina had some good rains recently which has added some pressure, but if we take a look at the forecasts, they have turned considerably drier for both Argentina and Brazil.

ADM CEO says he expects Argentina to run out of soybeans to crush in November.

Here's the outlook for South America.

Today's Main Takeaways

Corn

Corn lower here for the 3rd session in a row, now 25 cents off their highs from Friday of $5.09 as corn makes it's lowest close since September 29th.

Just some food for thought, corn hasn’t had 4 consecutive red days since our July sell off where we traded lower 8 straight sessions from July 25th to August 8th. Since then, we have seen 6 different times where we have traded red for 3 straight days, trading green on the 4th day each time. Will tomorrow be the 7th? Guess we will have to see.

In yesterday's audio we said the $4.90 level was key, and if we couldn’t hold we could likely make another leg lower due to technical selling, which have now done.

Why the correction? For starters, Argentina received some pretty rains. However, the future outlook still looks dry, this added pressure. We have the recent correction in crude oil, down $6 a barrel the past 3 sessions. Then we have harvest pressure, but with harvest reaching 59%, harvest pressure will mostly be in the rear view mirror.

But more than anything, it's really just a risk off mentality from the funds and algos. We failed to hold $5, then we failed $4.90, and the funds just haven’t had a major reason to cover their shorts.

I agree that it is hard to see a bullish enough story right now to cause a major short covering rally. We have mentioned several times that the path higher will not be an easy one for corn with our 2 billion carryout.

What could cause a bullish enough story for the funds to decide to reduce their exposure? One that will be closely monitored is South America weather. If they see any problems in the weeks ahead it will push both corn and beans higher. Still too early, but it's looking dry.

Another potential factor is China. Will they start to have a bigger appetite for US corn? It's possible but still an unknown.

Overall, I still see higher prices from here. Could we look to retest those harvest lows? It's possible. But I'm leaning towards the thought that we will slowly move higher from here. Remember, corn likely won’t take off and rally to $5.30 right away out of nowhere. It's going to be a marathon.

How should you be managing your risk? If you have to decide whether to sell or store corn vs beans. It might make sense to sell beans and hold corn. Beans have so much more upside, but they also have far more downside. Another main reason would be cash flow and interest expenses.

If you made sales, consider some calls. If you will be having to make sales, consider putting in a floor with puts.

Taking a look at the charts, bulls need a bounce very soon. The downside risk is $4.77. We need a close back above the 20-day moving average of $4.90.

Corn Dec-23

Basis Outlook Tools

Before deciding what tool is best for you to use, make sure you consider your local basis outlook.

If you know your local basis outlook, and don't know what the right tool is give us a call and we will walk you through the benefits of using the correct tool based on your basis outlook.

Soybeans

Soybeans find some life following their 30 cent correction from Friday's highs. Now right back up near that key $13 level once again.

From Duane Lowry, Producer Marketing Consultant:

"Soybean prices are back to "too cheap" levels. South American weather themes/patterns are not bearish and the current 10-day moisture outlook doesn't change that situation. Whether focusing on big SA production expectations or just complacent "non bullish" sentiment, the trade is way too bearish when it considers what the future might hold."………

The rest of this is subscriber-only content. Please subscribe to continue reading and get access to exclusive updates. Sent via text & email.

Scroll to check out past updates you would have received.

TRY 30 DAYS FREE

Try our daily updates completely free.

Become a Price Maker.

Check Out Past Updates

10/23/23

IS THIS CORRECTION A HEAD FAKE?

Read More

10/20/23

BIG WEEKEND CORRECTION

10/19/23

CORN BREAKS $5. IS WHEAT NEXT? - SOYBEAN RECCOMENDATION

10/18/23

BEANS BREAK $13. IS CORN NEXT?

10/17/23

DID BEANS CONFIRM REVERSAL?

10/16/23

CHOPPY BORING TRADE

10/13/23

POST USDA REPORT CORRECTION

10/12/23

BULLISH REACTION TO USDA REPORT

10/11/23

CAN THE USDA GIVE US A BULLISH SURPRISE?

10/10/23

BEANS BREAK THEN BOUNCE - USDA PREVIEW

10/9/23

WILL YOU BE FORCED TO SELL ANYTHING AT HARVEST?

10/6/23

CORN & WHEAT HOLD LAST WEEK’S LOWS

10/5/23

UPSIDE BREAKOUT IN CORN

10/4/23

ARE YOU A PRICE MAKER OR PRICE TAKER THIS HARVEST?