RUSSIA EXTENDS GRAIN EXPORT DEAL

MARKET UPDATE

Futures Prices 10:45am CT

Overview

Markets were under pressure yesterday from the increasing possibility that Russia would extend the grain export deal with Ukraine. Early this morning it was announced that Russia has confirmed they would be extending the deal. As expected with this announcement, grains are under pressure and trading lower again this morning.

*As mentioned yesterday. If you are subscribed to our text alerts and haven’t received one the past few days, we want to apologize as we are experiencing technical difficulties sending out text updates. But everything should be fixed soon.

Today's Main Takeaways

Corn

Corn trading lower here along with the rest of the grains with the news Russia would be extending the grain export deal by 120 days. Earlier this week, corn tried to push higher off its recent lows but ultimately saw resistance. Overnight we saw corn prices fall back down to their recent lows. Similar story to yesterday, corn is holding up the best of the grains today, only down a nickel despite the news.

Yesterday we saw the USDA announced a purchase from Mexico of 1.87 million metric tons of corn. Which has added a little bit of support here, as recently corn exports and demand have been pretty lackluster to say the least. This sale was actually one of the top 5 largest single daily sales we have ever seen announced.

This morning we saw weekly export sale numbers for last week. Corn numbers came in at 1.17 MMT. Which was actually pretty good. Coming in near the higher of the trade estimate of 0.7 - 1.4 MMT.

Last week we saw ethanol production decrease. This was after 6 straight weeks of seeing increases to production. However, production still remained over 1 million barrels per day.

From a technical standpoint, we are close to some major support at the $6.50 which has held thus far. Dec-22 corn's low this morning was $6.54 3/4. Hopefully can can continue to see support here. Dec-22 contracts expire next week, Nov. 25th.

We have a ton of different factors. As always we have the war situation and where we go from here now that the export deal was renewd. Chinese demand, and whether they cater to the U.S. or to Brazil. As well as South American weather. We also have potential headlines with the rail road strike and low river levels still at play. Overall I'm staying patient here with a small bullish tilt. As I think prices have a lot of room for growth here going into the end of the year.

Dec-22 (6 Month)

Soybeans

Soybeans sharply lower again here this morning, as soybeans have continued to trickle lower the past few days. We are now over 50 cents off our highs we saw just two days ago.

Soybean exports for the week ending November 10th came in stronger than expected. Coming in at 3.03 million metric tons. Which was nearly double the trade estimates of 0.9 - 1.7 MMT. This was a nice surprise following a few weeks of average volume. Main destination was China. We will have to see if we can continue to see strong export demand.

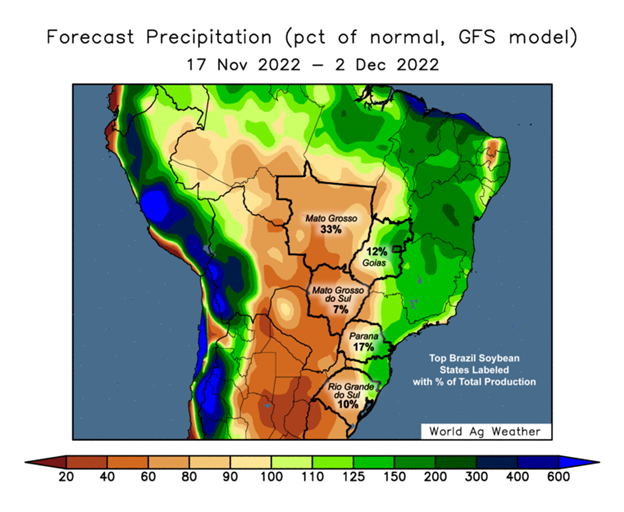

Brazilian weather is looking cooperative for the most part here. But this is always subject to change. They are starting to see a little more rain up north and a little less down south. Going forward, my only concern with soybeans is that Brazil is still expecting a rather large crop. Which could hurt U.S. demand in the future. But of course, we do have that possibility for weather scares to combat the large crop.

Overall, soybeans have had an impressive run and I wouldn’t be too totally surprised for prices to correct lower here. Since our initial rally, I have said in the last few write ups that we could expect soybeans to come down lower off their highs with all the headwinds they are facing, and they have. Now 50 cents off their highs. From a technical standpoint, soybeans are now below their 200-day moving average. As I'm writing this soybeans also just broke their 100-day moving average at the $14.13 range. If we don’t find support here we could definitely see beans back below $14 or lower. Nonetheless I'm not staying patient here as there are plenty of factors that can swing things.

Soymeal & Soyoil

Soymeal down -2.9 to 401

Soyoil down -2.35 to 69.75

Soybeans Jan-23 (6 Month)

Wheat

Wheat lower again this this morning, with the news of the grain deal extension which was expected. Overnight we saw Chicago wheat fall to a new recent low and grains have continued to trade lower. Wheat trading near the bottom of its trade range.

We all knew we would probably see prices lower if Russia did agree to extend the grain export deal, which they did. Now, outside of the agreement, most other factors affecting the wheat market are actually fairly bullish. So with the prices being lower after this announcement, most and myself agree that this is a good buying opportunity for wheat.

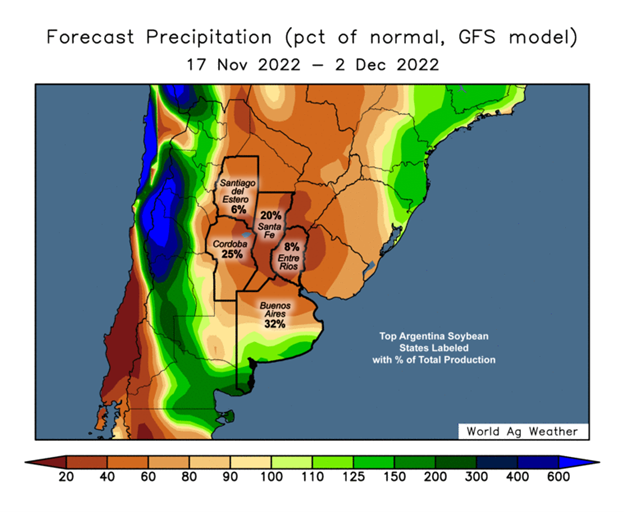

For starters we have global issues surrounding the wheat crop. We all know the problems Argentina has been facing with drought. Their wheat crop is roughly half of what it typically is. With their crop continuing to lose a ton of production every week. We also have Australia, who was expected to have a record crop. But that crop has quickly been diminished. Losing around 1/3 of their crop due to their heavy rain and flooding they have experienced. As we have seen storage facilities underwater, fields flooded, and sprout damage.

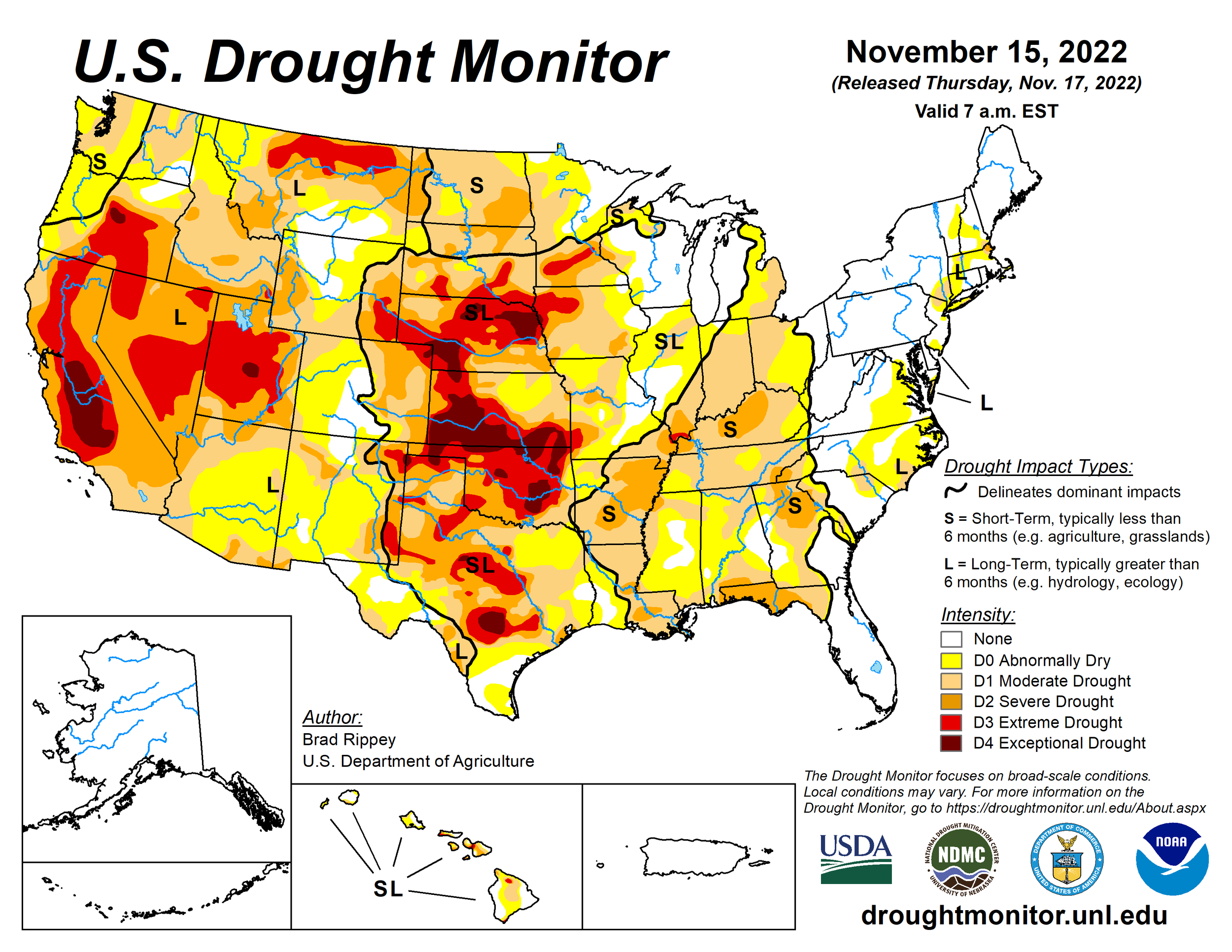

Even in the U.S. we have seen some problems with the winter wheat crop. With this crop being in one of the worst conditions in recent history. The USDA currently has WW conditions at 32% rated good/excellent vs 46% at this time last year, so you can put into perspective what condition this crop is in. We also have 74% of winter wheat and 79% of spring wheat in the U.S. still suffering from drought. So overall, I think there are many factors that can continue to support the wheat market from here.

Chicago Dec-22 (6 month)

KC Dec-22 (6 month)

MPLS Dec-22 (6 month)

Other Markets

Crude oil down -3.50 to 81.50

Dow Jones down -180

Dollar Index up +0.843 to 106.995

Cotton down down -1.95 to 84.81

News

Russia agrees to extend the grain export deal by 120 days

Donald Trumo has confirmed he will be running in the next election

Republicans announce an investigation into Joe Biden

Average 401k balances decreased 23% YOY according to Fidelity

Livestock

Live Cattle up +0.550 to 154.800

Feeder Cattle up +2.200 to 179.675

Live Cattle (6 Month)

Feeder Cattle (6 month)

In Case You Missed It..

Click here to listen to Tuesday’s Audio - Russia Adds Volatility to the Markets

Click here to read Sunday's Weekly Grain Newsletter

Social Media

All credit to respectful owners

South America Weather

Chart Source: Roach Ag

Precipitation Forecast 2-Day

U.S. Weather

Source: National Weather Service