SOYBEAN RALLY & CHINA PROTESTS

MARKET UPDATE

Prefer to listen instead? Click here for an audio version

Futures Prices 12:15pm CT

Overview

Markets opened lower for the most part, some of this was due to protests in China. But soybeans have picked up some strength seeing an impressive rally, while wheat on the other hand has continued to trickle lower hitting new lows.

The protests were anit-goverment protests with the zero covid policy and were taking place in many large cities. Looks like China wants to keep covid under control at any costs. This is having a negative effect on their economy and causing problems here in the U.S. as well. We also have the possibility for a rail strike if union labor agreements can't be made before the deadline on December 9th.

Today's Main Takeaways

Corn

Friday we saw corn trade higher but it wasn’t able to see a break through of resistance of $6.74, trading almost a nickle lower here today. We haven’t been able to see corn prices move too much in the past few weeks trading in a pretty tight range. As we have seen the March-23 contract seem somewhat comfortable trading in the $6.55-75 range. From a technical standpoint, we have some nearby resistance around $6.80 and some more difficult resistance as we head up towards the $7 range.

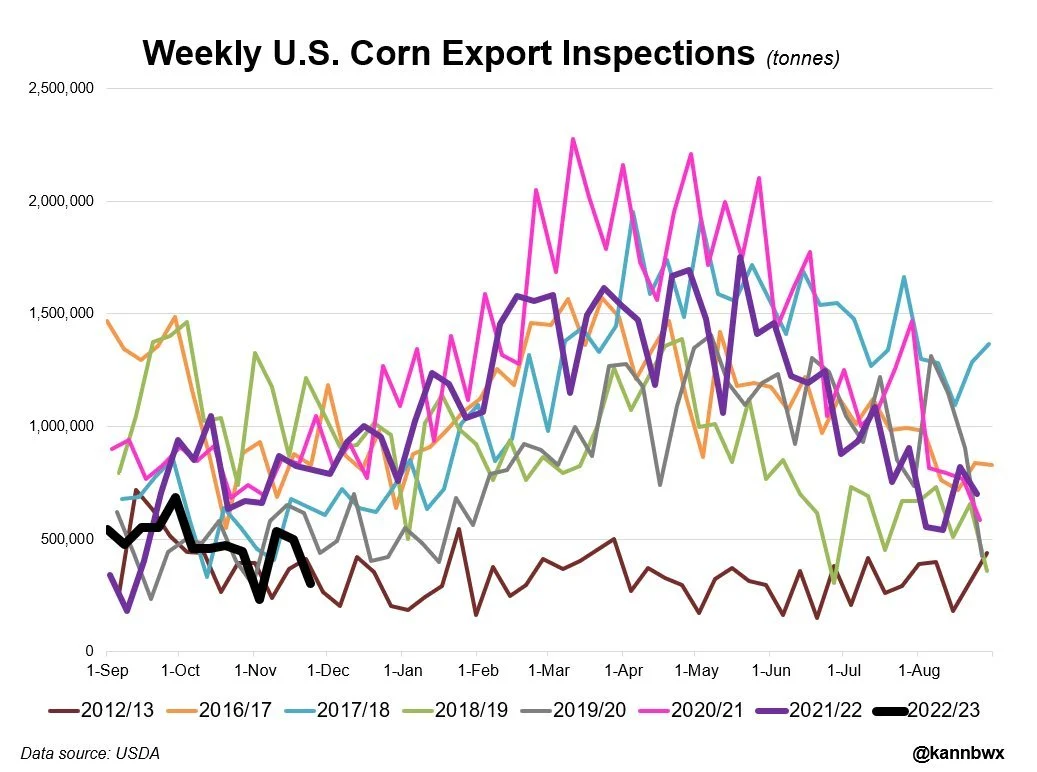

Last week we saw corn export sales hit a year high but are still severely behind the USDA pace, currently 250 million bushels or 12% behind pace.

Export inspections for corn came in somewhat poor at 302 thousand tons below estimates of 400 to 850.

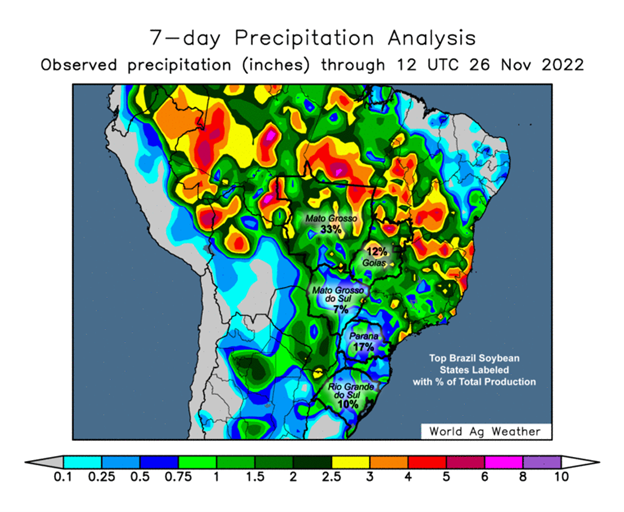

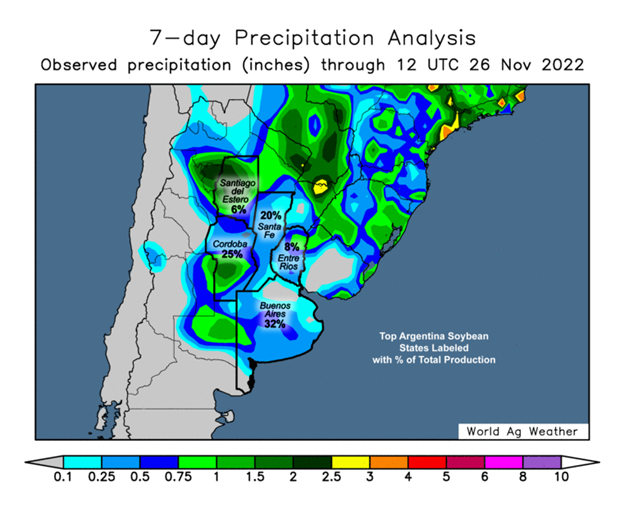

Taking a look at weather, there isn't much to chew on. The U.S. is basically done with harvest and Brazil weather looks decent for now. But on the flip side, there is talks we will need to see Argentina estimates lowered which is a good possibility given all the problems they have faced. The USDA currently has them at 55 MMT but nobody would be too shocked to see that number closer to 50.

Additionally, Buenos Aires Grain Exchange has Argentina's at 12% rated good/excellent which is a massive difference from last years 81% at this time. Argentina is also running far behind pace for planting. So the situation in Argentina should add some support to the corn market.

We are also seeing estimates cut in the EU due to drought. As their estimates would be at 15 year lows. They reduced their usable corn production to 53.3 million metric tons, down from 54.9 million last month. This would be the lowest number since 2007.

However, one could make the argument that demand has been pretty weak, and with these China protests its tough to imagine we see a huge spark in demand here. We also have to keep an eye out for the potential railroad strike that could happen as early as next week if it does.

March-22 (6 Month)

Chart Credit: Karen Braun @kannbwx on Twitter

Soybeans

Soybeans firmly today, being the only one of the three major commodities to be trading in the green. Soybeans have been trading in a pretty tight range for the past few months. Some strength coming from the protests, as it is giving optimism that perhaps China will cool down some of its lockdowns and open things back up, thus creating some more potential for demand. Soymeal and soyoil also very strong today, helping support bean prices on this rally.

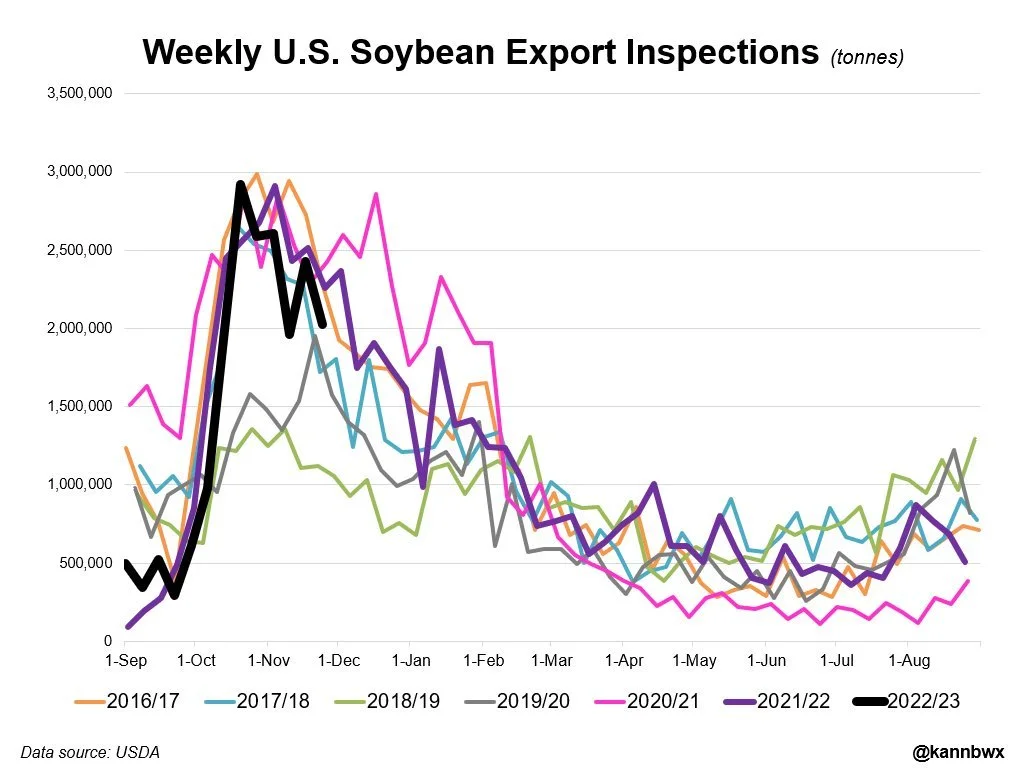

This morning U.S. weekly export inspections came in okay for soybeans, near the higher end of trade estimates. Coming in at 2.02 million tons, with estimates ranging between 1.8 and 2.25 million. 74% of the beans were to China.

Argentina brought back their peso change rate deal through out the end of the year. Giving producers 230 pesos vs the exchange rate of 165 pesos. With this new China said they are going to purchase 1 to 1.5 MMT of Argentina soybeans. So we may not see Brazil and the U.S. make too many sales the next few weeks, and we will likely start to see Argentina farmers sell a lot of their beans.

Weather in South America looks pretty good for the most part. Although Argentina did see some pretty scorching temps of 104 degrees F over the weekend. Buenos Aires Grain Exchange has Argentina soybean crop at 19% planted vs the 40% average. So their soybean crop has been severely delayed, mostly due to drought. This along side Chinese demand will continue to be one of the bigger factors going forward.

One one hand we have South America and Brazil expecting record crops, on the other there is a lot of uncertainty going forward and there are a few dry areas being monitored in both Brazil and Argentina. So my largest concern going forward is that we don't get that weather scare we need for prices to climb higher as if we don't, this large crop could very negatively effect prices. But then again, nobody knows and we very well could get a weather scare. For the time being I'm sitting on the sidelines waiting until we get a better outlook. The China lockdowns and protests have also added a ton of uncertainty to these markets.

Last week we saw soybean export sales hit nearly a marketing year low following its recent year high a few weeks ago. Despite the poor sales last week, soybeans are still ahead of the USDA pace by roughly 4%.

Soymeal & Soyoil

Soymeal is up +6.7 to 413

Soyoil is up +1.54 to 73.25

Soybeans Jan-23 (6 Month)

Chart Credit: Karen Braun @kannbwx on Twitter

Wheat

Wheat prices continue to trade lower hitting new lows, as March-23 Chicago wheat closed below $8 on Friday, for the first time in three months, and Dec-22 Chicago almost 50 cents from where it opened on Friday following Thanksgiving on Thursday, and down almost $1.50 off our $9 highs made not even a month ago on November 1st. So the question remains when will wheat find support?

As the U.S. prices remain higher than global competitors, this had led to competition here in the U.S. against these global competitors. Egypt bought Russian and Ukrainian wheat last week. Iraq made some purchases from the U.S. but had larger purchases from Canada and Australia. So overall global competition remains very high.

Weather in the U.S. looks pretty good for the most part with expected rains across the midwest which has added some pressure.

One would think wheat would see some buyers step back in here. As wheat supplies are pretty tight everywhere aside from Russia. To add on to this, the USDA currently has the U.S. winter wheat crop at 32% rated good/excellent, which is the lowest assessment we have seen in 40 years. Additionally, the USDA is estimating U.S. ending wheat stocks ar 571 million bushels for 2022-23. Which would be the lowest in 15 years. There is also rumors that Ukraines final harvest could very well be half of what it was last year. So overall, there are plenty of factors that could benefit wheat prices in the long run.

Here is a very good article are why it could be dangerous to be short wheat going from here. The article is by DTN Analyst Todd Hultman. Read Here

Chicago March-22 (6 month)

KC March-22 (6 month)

MPLS March-22 (6 month)

Other Markets

Crude oi is up +1.05 to 77.30

Dow Jones down -350 points

Dollar Index up +0.373 to 106.290. If downside continues the 100 area would be the next downside target.

Cotton down -0.55 to 79.63

News

California farms are facing $3 billion in losses due to historical drought

Argentina instates the peso deal through the end of the year

November job reports comes out Friday, expectations are we see a second straight month of decline in unemployment.

USDA confirmed the sale of 110,000 tons of U.S. soybeans for delivery to unknown destinations in 2022/23.

Millions of people in Ukraine are without heat, water, and electricity after recent air strikes.

Livestock

Live Cattle down -0.755 to 154.350

Feeder Cattle down -1.400 to 176.900

It was a solid week for live cash cattle last week but we didn't see the futures follow the same path. As cash cattle was up nearly $3 on the week while futures were essentially unchanged.

Live Cattle (6 Month)

Feeder Cattle (6 month)

South America Weather

Chart Source: Roach Ag

Watch Last Weeks’s Market to Market Podcast - Featuring Jeremey Frost

Helping farmers become price makers, not price takers

Social Media

All credit to respectful owners

Precipitation Forecast 2-Day

U.S. Weather

Source: National Weather Service