SOYBEANS BREAK $15 & GRAINS EXTEND 3-DAY RALLY

Overview

Markets continued their strength from Friday into the last week of the year. As grains were higher yesterday, with corn up nearly a dime and soybeans broke $15 early in the day but eventually came down and closed roughly 30 cents off its highs. Grains all higher here again today for the third day in a row now.

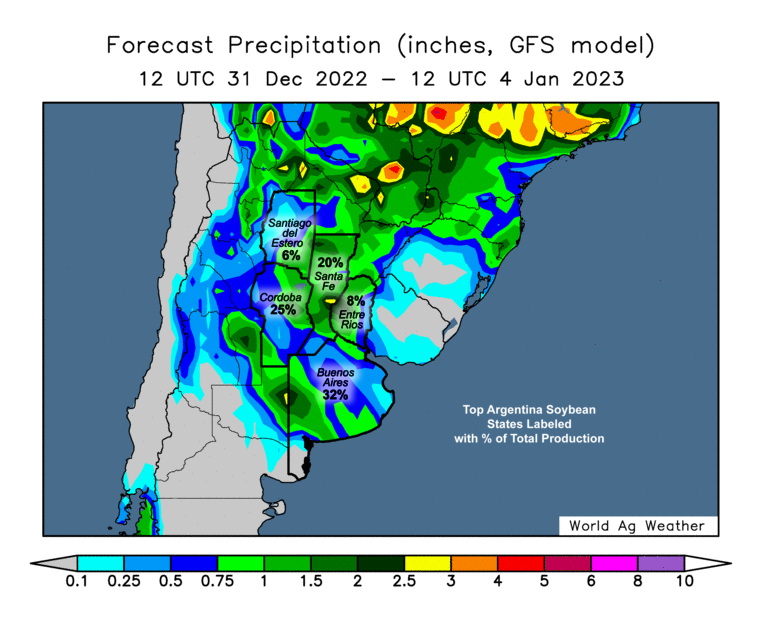

Strength in the grains coming from dry and hot weather in Argentina as well as the announcement that China will officially start loosening some of its covid restrictions and drop nearly all travel restrictions starting January 8th. So this definitely gave some optimism and helped boost the grains higher.

There is still conflict with the Russia & Ukraine war. As over the weekend we saw some more attacks on Ukraine's Kyiv. There has been talks about possible peace treaties but its not looking like either side is going to come to an agreement anytime soon.

With the markets being in holiday mode and not a ton of traders, we can expect prices to remain fairly volatile the rest of the week.

Below is yesterday's audio commentary in case you missed it

Is It Time To Sell Soybeans? - Listen Here

For those of you still on a trial, our 50% off holiday sale ends Saturday, December 31st.

Today's Main Takeaways

Corn

Corn started off the last week of the year firmly higher following the long holiday weekend. Closing up +8 1/2 cents yesterday, and seeing some follow through strength here again today, up +8 cents. Corn has formed a nice nearby uptrend. Bulls would love to see $7, we closed at $6.82 3/4 today.

Majority of the strength came from the continuation of hot and dry weather over in Argentina. Prices are now over +50 cents off our lows earlier in the month and over $1 off our late July lows. Corn has seen some pretty strong closes and has held up the best amongst soybeans and wheat as of recent when the market sees weakness.

We also saw a lot of strength come from a new marketing year high for U.S. export inspections of 856,606 metric tons which is 33.7 million bushels. Corn inspection volume has been trending higher the last month but volume is still well below the USDA forecast.

Overall we have had record low U.S. corn exports, but despite this basis remains strong. So looks like there definitely might be some demand, as demand is still one of the larger concerns regarding the corn market. Will have to see what the USDA has to say in their January report.

Argentina actually did receive rain over the weekend as expected, but it doesn’t look to have been much of anything crazy and didn’t have a very large effect on the crops and moisture levels. Production estimates again being lowered for Argentina, with most estimates cutting another 1 million metric tons, bringing total production estimates to 46 MMT.

Looking short term, all eyes are going to be on Argentina and whether or not they get plentiful rain.

From a technical standpoint, we broke through a nearby target of the $6.70 and the $6.80 resistance. I wouldn’t be too surprised to see prices take a breather here and correct to the $6.70 range or so which is about where the current trendline lays. But corn has been so strong as of late, and ultimately I don't think $7 corn is too unrealistic as that is the number most bulls have their eyes set on. If we get some headlines and weather forecasts to work in our favor I think there is a good chance we do see corn try to retest $7 sometime in the near future.

March-23 (6 Month)

Soybeans

The big story yesterday was in the soybean market. As they started hot and surged well past that $15 resistance and hitting a high of $15.22 3/4 which is the bottom of the gap from late June (meaning this was also the highest we have seen March beans since June). But ultimately beans fell off and closed over 33 cents off their highs. Soybeans seeing more strength today trying to capture back some of the early gains from yesterday, up +25 cents today closing over well over that $15 resistance but still below our highs we made yesterday.

Strength to start the week is some of the same stories as it was for corn. With dry Argentina forecasts providing a boost. Another large beneficial factor for the soybean market was the announcements China made. As China announced they would officially be loosening up a lot of their covid restrictions. This news obviously benefits the soybean market greatly and gives optimism that we continue to see Chinese demand. We also saw a sharp rally in palm oil prices which added support. The rally in soymeal has also definitely helped push prices higher here.

There are 2 countries that export roughly 90% of the worlds palm oil. One of those two is Indonesia. Indonesia's president said he will announce a commodity export ban today. The ban could be bauxite or palm oil, or possibly both. Palm oil holds the largest market share of the veg oil market. Soybean oil comes in second to only palm oil. If they do ban these exports, we could see some more strength in the soy oil market.

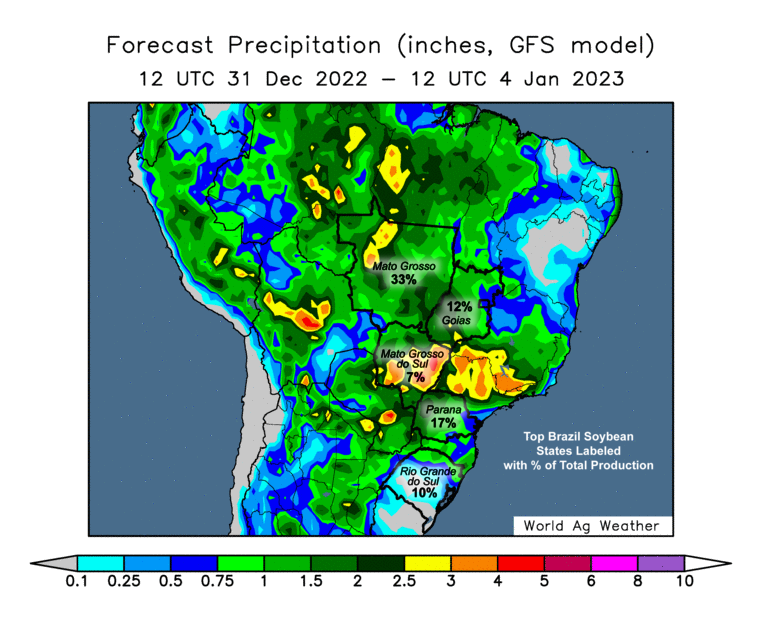

Going into the long weekend, the main headline was the potential rain in Argentina. And it appears that yes they did get some rain, but it wasn’t anything extremely meaningful. Now the overall outlook for Argentina weather still remains hot and dry which will look to continue to add support to the markets. Despite the rains, Dr. Cordonnier again made some production cuts to both his corn and soybean production estimates. As he cut his Argentina soybean estimate by 2 million tons. So far its looking pretty safe to say the USDA will also need to adjust their estimates lower.

The big news last week in South America was that their soybean harvest had officially gotten underway. Dry weather in Rio Grande do Sul (Brazil's southernmost state) has led to some negative impact in their planting. As they should already be done planting but currently sit around 80% complete. We also have roughly 40% of Argentina soybeans yet to be planted, which is definitely some cause for concern. Argentina soybean conditions were rated just 12% good/excellent. With 25% rated poor.

In Friday's update we talked about how every single time soybeans approach the $15 level we see some pretty firm resistance and prices correct lower. This again happened yesterday. The price action yesterday wasn’t amazing, closing over 30 cents off our highs. The way the markets acted yesterday made me slightly nervous on whether soybeans can truly see a break out to the upside or not. We will have to wait and see if prices will try to retest yesterday's highs or trickle lower.

The main factor that is going to decide what direction we go is ultimately South American weather. If Argentina gets some meaningful rain we would probably see prices lower. On the other hand, if we don't get any rain and the forecasts remain dry and we can manage to close above $15 come Friday I think we could ultimately see prices higher from here, perhaps we see prices gain another 30 cents or so if weather works in our favor and we don’t get any bearish news from China in the meantime.

But of course with prices still historically high, it's never a terrible idea to lock in some sales and reduce risk as there are plenty of uncertainties going forward that none of us can control such as the weather. As we have to keep in mind that Brazil is still expecting a record crop. If you are nervous, another option would be to grab some puts to get you through the January report and put a floor in at these levels. In yesterday's audio we went into a little more depth on what to do in the soybean market, you can listen to that here.

If you have any questions regarding your grain marketing, don’t hesitate to give us a call at (605)295-3100 as we would love to help you out with anything you need.

Soymeal up +13.5 (+3.25%)

Soy oil down -1.42 (-2.5%)

Soybeans March-23 (6 Month)

Wheat

Wheat firmly higher here following a mixed trading session to start the week yesterday. Wheat higher again here today with the rest of the markets, with Chicago up +11 cents and KC and Minneapolis following behind.

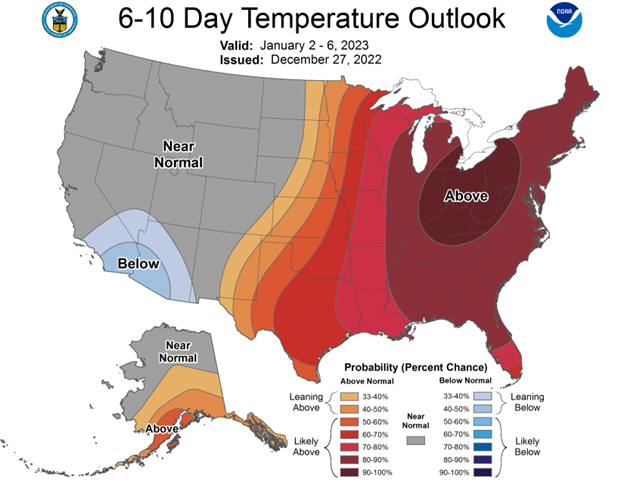

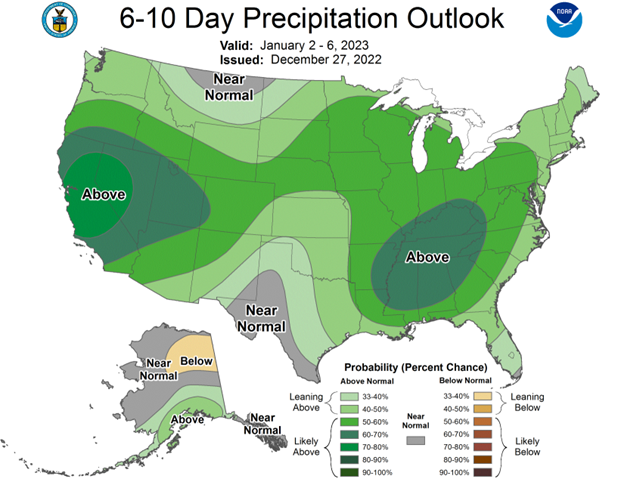

Taking a look at weather here in the U.S., we just saw some pretty massive snow storms. But it looks like temps are starting to warm up for the next week or so. Which will melt a lot of that snow and create plenty of moisture for the crops which might put some pressure prices. But with this snow melting, it leaves the wheat crop vulnerable to winter kill as the protective snow would be melted. Next week when we get crop ratings we will see how mich winter kill we have already seen.

Outside of the U.S. weather there hasn’t been a ton of headlines surrounding the wheat market as one of the largest factors traders are watching is Argentina. But, we certainly can’t forget about the war. As there has been some continuation of escalation. As Russia recently launched some more attacks on Ukraine's Kyiv. This is still a factor that will look to continue to support the markets as there is no signs of peace in the rearview mirror anytime soon.

From a technical standpoint, wheat has now formed a solid nearby uptrend. As we broke through some key resistance. The next target from a technical standpoint would be the $8 mark which I don't think is too unreasonable.

Wheat prices have just got started moving off their recent lows. Some advisors have placed sell signals across the wheat market. But personally I think there is far more upside than there is downside in the wheat market. We have to keep in mind that Chicago wheat is nearly $5 off its post war highs. We just saw a yearly low at the beginning of the month, and prices have moved up nicely, sitting 50 cents off our lows. But fundamentals are pretty bullish. The seasonal trend is up. There are just plenty of factors that could lead to higher prices. So in conclusion I still think we have tremendous potential on the upside looking into next year and early spring despite the recent gains we have already made.

Below is a wheat technical analysis from GrainStats

Thhis is what they had to say in their analysis;

"Wheat has broken through our 7.69 target we published last week opening the door to 8.00. We will have to see if wheat can break out of the major down trend line of 2022 this week or next week. Be mindful if the near term, trendline up is broken and we are truly in a bear market in wheat."

🟢 Current upside target is 8.00

🔴 Current downside target is 7.41 and 7.23

You can visit GrainStats website here

Chicago March-23 (6 month)

KC March-23 (6 month)

MPLS March-23 (6 month)

Wheat & Managed Money

This is a great write up from Wright on the Markets where he talks about the funds and wheat production and consumption. Not many people are talking about the fact that wheat consumption will now outweigh wheat production for the 4th year in a row.

Here is what he said;

"Let’s say the fastest you ever drove a car was 115 MPH, probably when you were young and dumb, like all of us were. What event would it take to get you to drive a car now faster than 115 MPH? Something truly extraordinary, like your grandchild got bit by rattlesnake and the nearest hospital is 85 miles away.

And so it is with managed trading funds. The soft red winter wheat chart shows the managed funds have a net short position larger than any of the past four years for this time of year. What event has to happen to make them want to sell more contracts to add to that short position?

Think of all the crazy wheat market stuff that has happened the past four years and, yet, managed money is risking more money now than any time the past four years thinking the soft red winter wheat price will continue to decline.

Does the war in the largest wheat producing area on earth make them want to sell more wheat?

Does the fact that 2023 will be the fourth consecutive year that the world produces less wheat than it consumes motivate a money manager to sell more wheat?

Argentina, a major wheat exporter, will harvest half of a normal wheat crop next month. Will that make managed money managers want to sell more wheat?

Will Australia’s record large (by a small margin) wheat crop being heavily damaged by excessive rain during harvest motivate a person to sell more wheat?

A reasonable person would conclude there is nothing likely to happen to make managed funds add to their large short CBOT wheat position. In fact, quite the contrary, there are plenty of reasons why fund managers are likely to decide to reduce their net short soft red wheat position and that means they will be buyers and that will rally prices.

CBOT soft red winter wheat is up about 50 cents this month. If you look closely at the line inside the green circle on the chart below, you can see the funds have, in fact, already reduced their monster short position in CBOT wheat this month. It is not a coincidence that the price of wheat has rallied 50 cents as the funds liquidated some of their short (sold) positions. Will they continue to be buyers? We will have to wait and see, but we can conclude anyone shorting (selling before buying) CBOT wheat right now will provide that trader with a high probability of a major league losing position."

I highly recommend visiting Wright on the Markets as they provide a ton of value every single day. Visit their website here

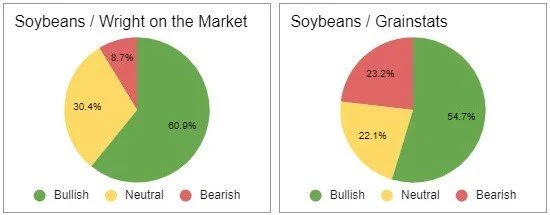

South America Update

Conditions, Planting, Estimates Highlights

Brazil

Brazil's 22/23 corn production estimate has been lowered by 0.5 MMT to 125 MMT, most seem to think we we will see steady to lower numbers in the future.

Brazil’s 22/23 soybean production estimates were left unchanged at 151 MMT.

Dry weather is affecting Rio Grande Sul (southernmost state). They should already be done planting but sit at 80% complete.

Argentina

40% of their beans have yet to be planted.

Argentina's 22/23 soybean production estimate has been lowered by 2 million to 43 million tons.

Argentina's 22/23 corn production estimate has been lowered by 1 million tons to 46 million.

Argentina corn is 52% planted vs 68% average

Some areas in southern Argentina is 90% planted, while some are 45%, and some northern regions are 0% planted.

Argentina corn crop conditions

26% rated poor/very poor

59% rated fair

15% rated good/excellent

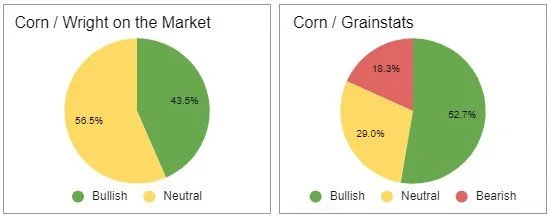

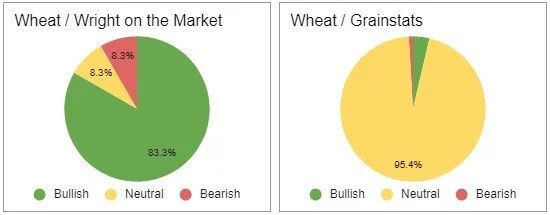

Bullish & Bearish Consensus

The following charts were voted on by Wright on the Market & GrainStats audience. Here are 3 charts showcasing the results

Corn 🌽

Soybeans 🌱

Wheat 🌾

Other Markets

Crude oil down -0.70 to 78.80

Dow Jones down -235

Dollar Index up +0.237 to 104.13

Cotton down -0.98 to 83.26

News

Markets will be closed next Monday, January 2nd.

4 states have now banned gas powered cars that is supposed to be effective in 2035. Thos 4 states are California, New York, Washington, and Oregon.

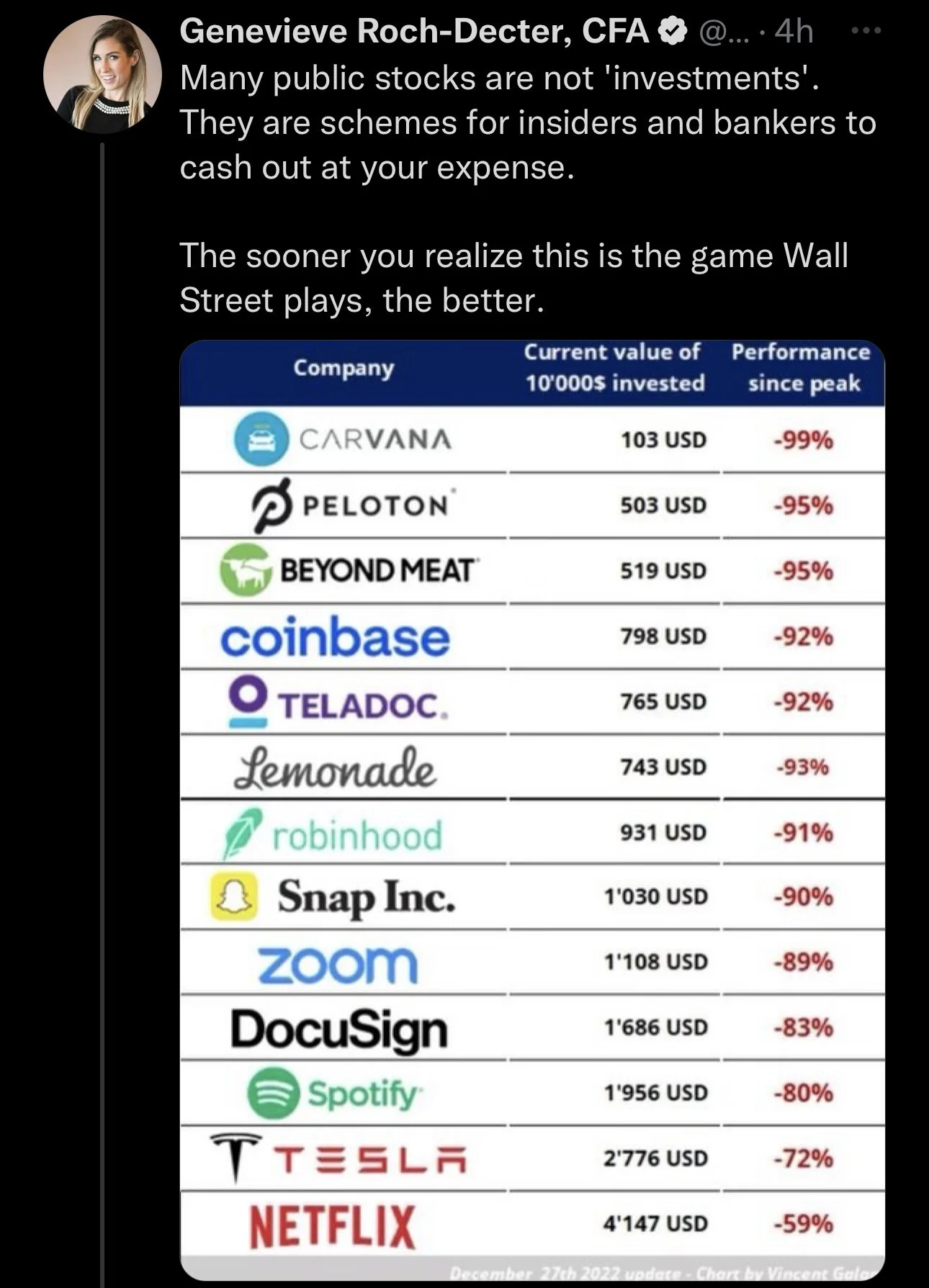

S&P 500 is currently down -22% on the year

Putin signed a decree yesterday that prohibits the sale of Russian oil to a country supporting a price cap on Russian oil.

3 Japanese insurance companies will stop insuring ships in Russian waters due to the war.

Brazil harvested their largest wheat crop ever, but demand surpassed production.

Livestock

Live Cattle down -0.075 to 157.800

Feeder Cattle up +0.800 to 186.200

Central stockyards is suspending fed cattle exchange auctions until January 3rd for the holidays. OKC feeder cattle auctions also postponed through January 9th.

USDA has no cattle sales reported for Tuesday.

Live Cattle (6 Month)

Feeder Cattle (6 month)

South America Weather

Social Media

All credit to respectful owners

U.S. Weather

Source: National Weather Service