SOYBEANS SELL OFF & WHEAT REBOUNDS

MARKET UPDATE & AUDIO COMMENTARY

Listen to Today's Audio Commentary Here

Audio Commentary Highlights

Bean Meal & Bean Oil

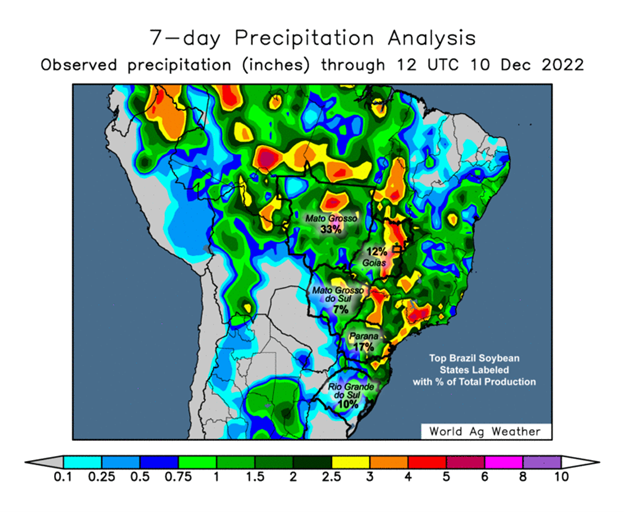

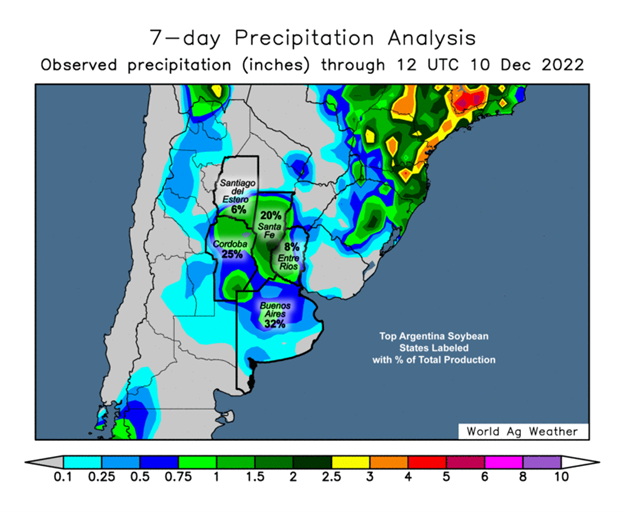

South America

Price Projections

Overview

As everyone knows by this point, Friday's USDA Report was a snoozer. With wheat getting hit after the report and corn being the only grain to close in the green despite the somewhat poor numbers.

To start the week off, the wheat market got that bounce bulls were looking for, as Russia launches more strikes, further increasing uncertainties. While soybeans are sharply lower as Argentina gets rain and China sees more covid cases. Soymeal also sees a big correction which was expected given the massive rally we just saw. The corn market also following wheat higher today.

If you missed yesterday's Weekly Grain Newsletter you can read the full version Here

Today's Main Takeaways

Corn

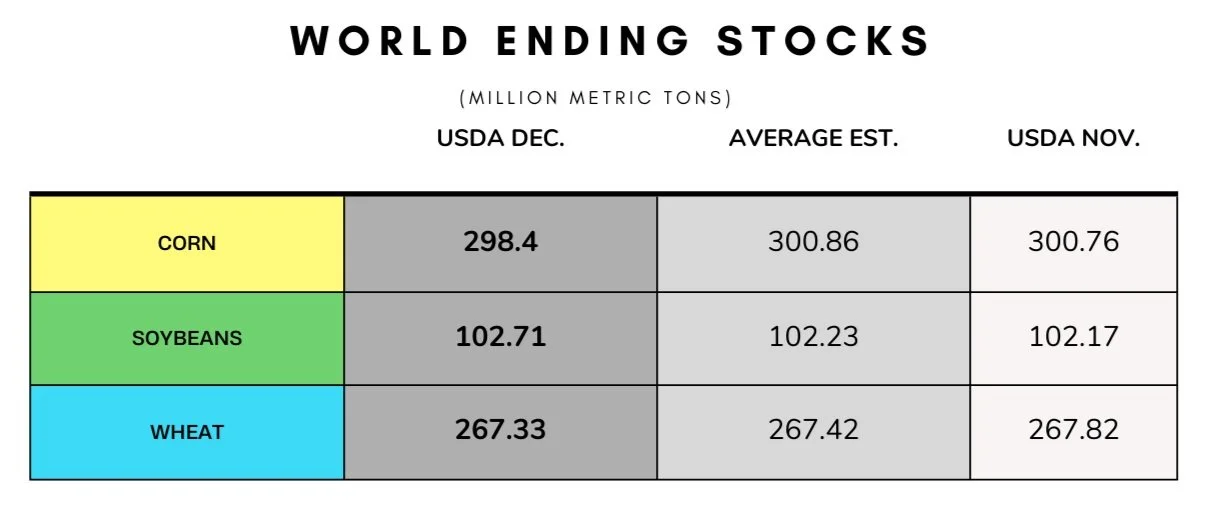

The USDA report was overall very neutral for the grains, but out of all the grains, corn probably saw the worst numbers. While both wheat and bean carry out was left unchanged, we saw corn carry out increased by 75 million bushels due to a reduction in exports.

Despite the report, corn was fairly strong to end the week and continues that strength today. Closing up +10 cents to $6.54 following wheat higher.

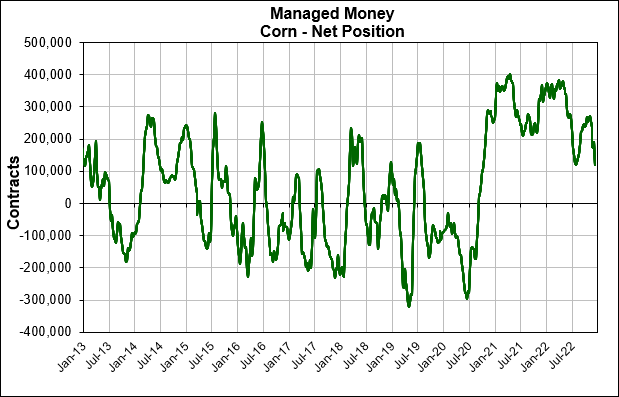

Last week we saw corn drop to a low that was driven by fund selling, looks like they may have stopped selling as we saw a bottom on Wednesday and have slowly climbed higher since. Spec funds current net long position in corn is the smallest it’s been since October of 2020.

U.S. demand remains one of the bigger uncertainties in the corn market. As we did see that cut in U.S. export estimates. But it looks like some think we may see another cut in the future. China's appetite for U.S. exports also remains in question, especially given their whole covid fiasco as they are seeing a new surge of cases. China's corn imports are already far behind that of the USDA forecasts.

Additionally some adding support, we saw some global production cuts in Russia, Ukraine, and the EU. Overall International global production was lowered by 5.9 million metric tons. Production estimates for Brazil and Argentina were left unchanged.

For the time being I'm currently on the sidelines waiting for more headlines to give us a better direction. As from now until the Christmas holidays, we might see lower volume thus leading to higher volatility here in the markets. And there just isn’t a ton of headlines to swing things either way. But some of the larger factors will continue to be Chinese demand, South America weather, and war headlines.

March-22 (6 Month)

Funds Positions via Roach Ag

Soybeans

Soybeans futures see a ton of pressure today following their 45-cent gain last week. Pressure coming from rains over in Argentina over the weekend. Soybeans closed down -23 cents.

We also have soymeal getting hit very hard, down over -4% today. This sell-off was somewhat expected given the recent rally and lack of other factors to keep prices floating that high.

From Yesterday's Update - "Soybeans have created a pretty solid uptrend, but with the USDA numbers not providing much and with not a ton of bullish headlines right now, we could possibly see prices see a small correction this week as it’s not too unlikely we see soy meal impressive rally see some correction here as well. Soy oil on the other hand is looking to find support with its recent sell off."

Soymeal broke lower today for the first time in eight trading days. While soy oil is higher looking for that support following its recent sell off from the poor EPA guidance. Soyoil is trading over +3% higher today.

Despite a hot and dry forecast in Argentina, they saw some rain over the weekend, easing some of the drought concerns. This has added some pressure to the bean market today. While the current Brazil forecast remains favorable for their crops so no new changes there.

Going forward, I've said this multiple times but my biggest concern with soybean futures is the expected record crop out of Brazil. As CONAB recently left their record production estimates unchanged at 153.5 million metric tons. While the USDA kept theirs at 152 million. Unless we see a weather scare to shift these estimates we could see soybeans continued to be pressured in the future. But then again, every other year we hear talks about record production.

We also have China getting hit by a wave of covid cases which has also added some pressure. If more outbreaks occur this will have a large effect on their economy. As there is talks about China going into a recession. If this happens this won't be good for demand. So overall, the two biggest factors going forward will be South American weather and China demand/headlines.

Soymeal & Soyoil

Soymeal down -20 to 448.4 (-4.3%)

Soyoil up +1.93 to 61.47

Soybeans Jan-23 (6 Month)

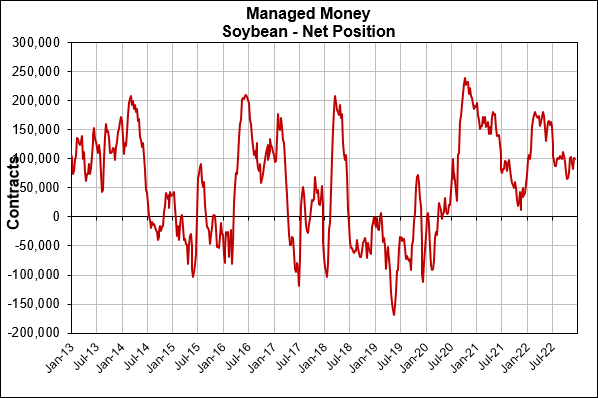

Fund Positions via Roach Ag

Wheat

Wheat futures see that bounce bulls have been looking for. We will have to see if this rally is sustainable and can push even higher. As following our recent most rally, we did see some more bleeding the following days.

Wheat prices are down around -15% the last three months and have given up all our gains made through out the entire year.

We have some support coming from Russia & Ukraine escalations. As Russia launched another strike. This time hitting Odessa (Ukraine's largest port). They took out Odessa's two energy facilities yesterday, and is being reported that it may take months to restore the damage and power. Over 1.5 million people as well as their grain loading facilities are without power currently. This is pretty bullish news and as expected is giving some support to both the wheat and corn market.

We mentioned this in the last two updates, but in the USDA report we saw some global reductions in both Canada and Argentina but this was somewhat offset by a boost in Australia. As Australia saw their production estimates raised to a record 36.6 million metric tons. We also have to keeping mind that even with the recent cuts, Canada is on track for their thrid largest crop on record. Other than that it was a very quiet report for wheat as the balance sheet was left unchanged for the U.S.

We all know the problems Argentina has faced with their crop. In a recent Reuters article, Argentina stated that there might be more trimming on the way. Argentinas crop forecast is already at 11.8 million metric tons, which is far below that of the original 19 million. They also stated that moisture levels are worse than that of the 2008/09 season, where their production was just 8.3 million metric tons.

Here is the article from Reuters, which shows how bad Argentina's drought has been. As it shows dead cows amongst other problems. Read Here

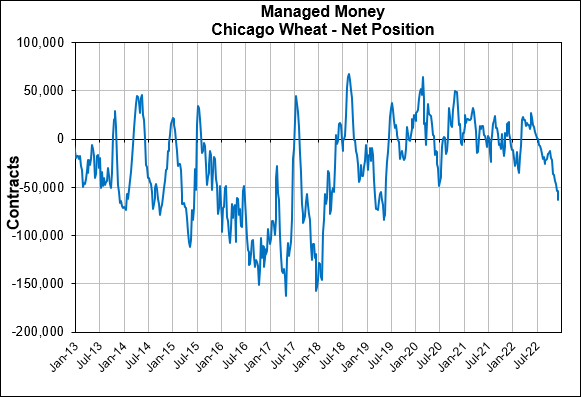

Funds continue to add to their short position. As they currently hold their largest net short position in Chicago wheat since May of 2019.

Overall, bulls would like to see this rally sustained and hope this was the bottom we have been looking for the past few weeks. We have global production being lower, with the possibility to see even more trimming in countries such as Argentina who have faced some serious concerns. We also have the crop here in the U.S. still being in question. So I’m not wildly bullish here short term, although I think prices could continue to gain traction off these recent lows. But looking further in the future and going into next year I think wheat has some good potential as most of these headlines will continue to be mostly bullish stories for the future.

Chicago March-22 (6 month)

KC March-22 (6 month)

MPLS March-22 (6 month)

Fund Positions via Roach Ag

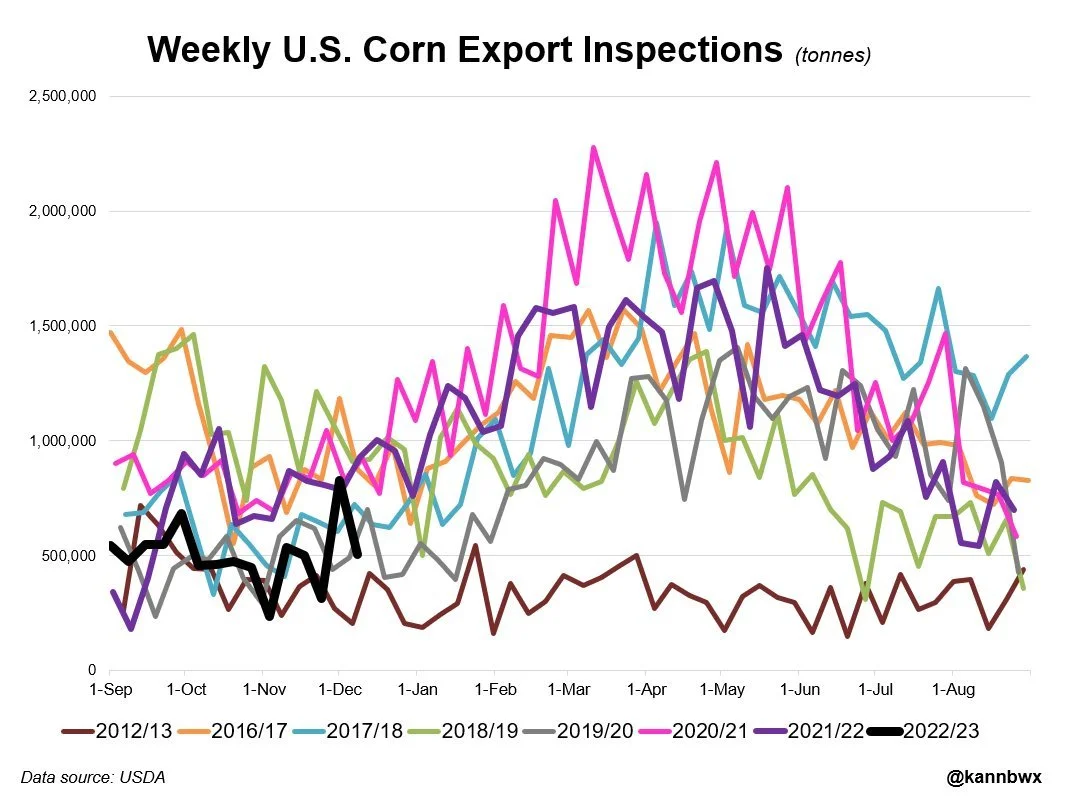

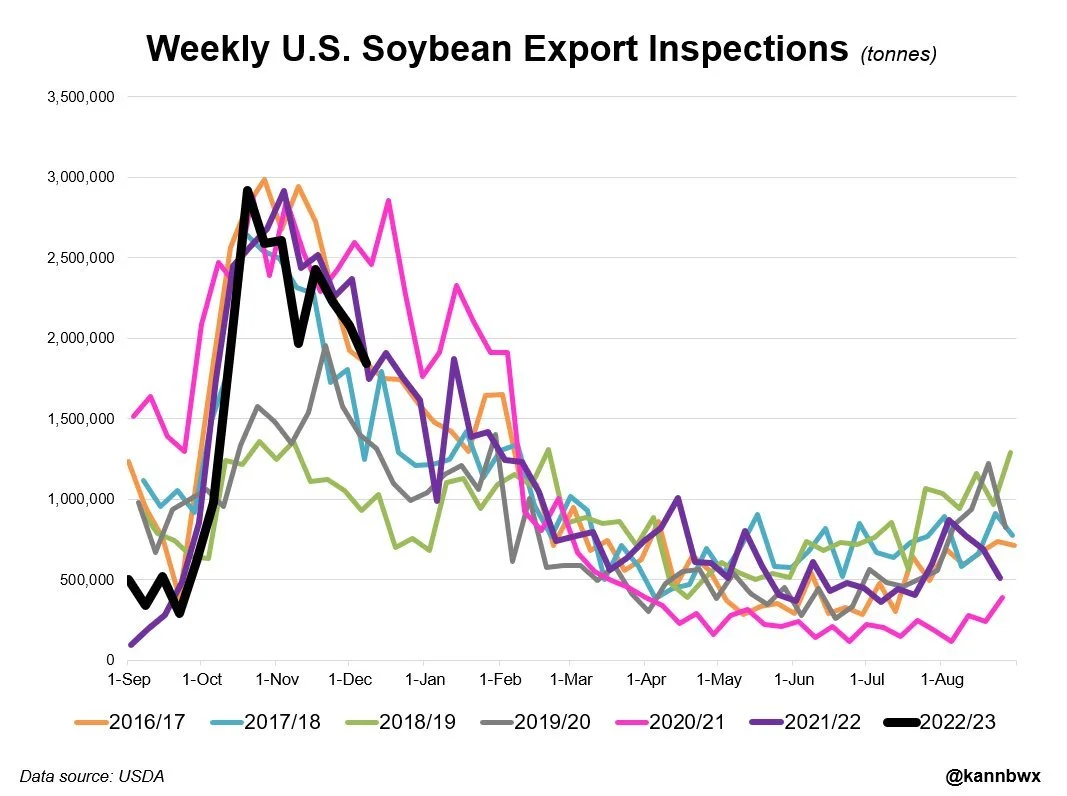

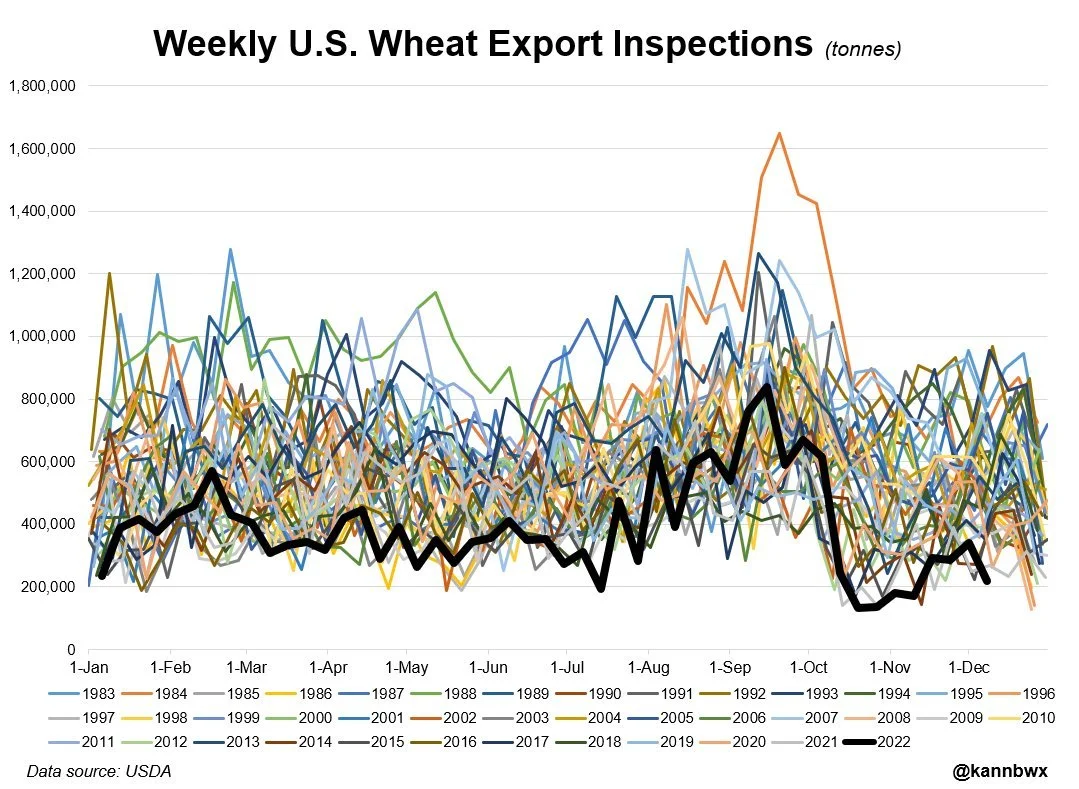

Export Inspections

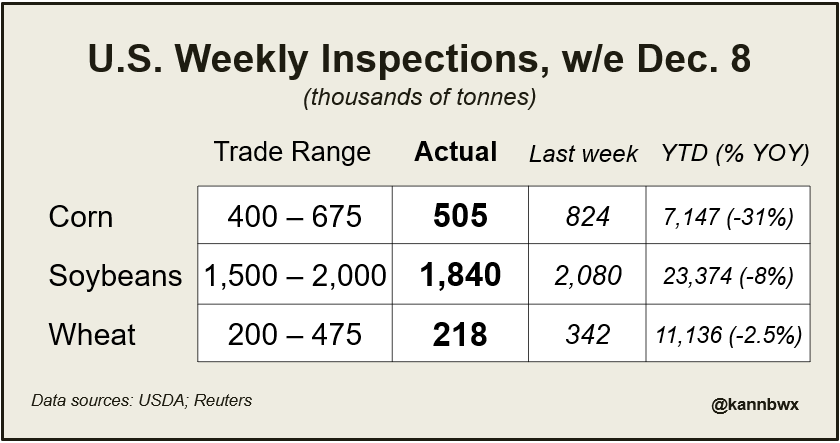

U.S. export inspections nothing special. With all numbers within trade estimates. But we did see pretty big upward adjustments in corn and soybeans. If wheats number holds, this will be the lowest ever for a week.

YTD soybeans down 8% vs 11% week prior

YTD corn is down 31% vs 33% week prior

All Chart Credit to Karen Braun @kannbwx on Twitter

Other Markets

Crude oil sees nice small rally from its recent lows, closing up +2.11 to 73.11

Dow Jones up +300

Dollar Index up +0.376 to 105.175

Cotton down -1.56 to 79.39

News

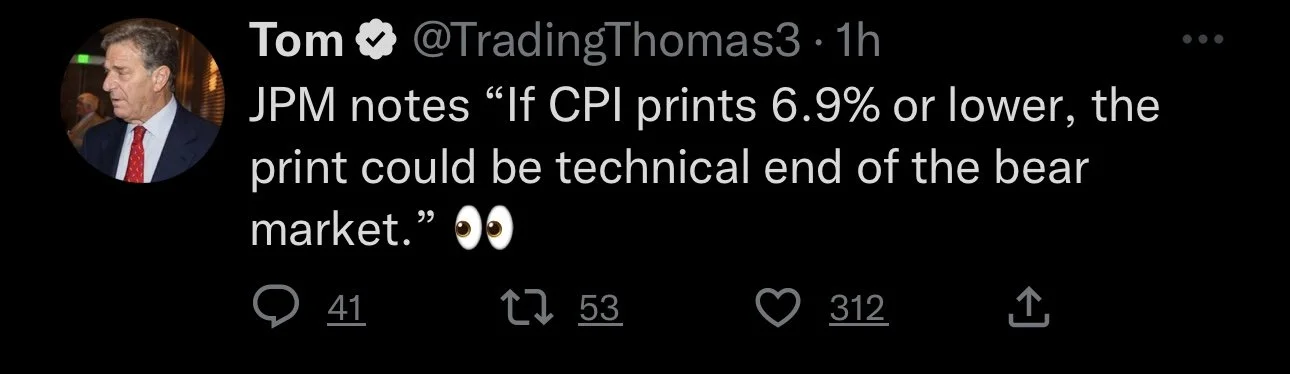

Tomorrow we will see the CPI inflation meeting, this will have a large effect on the stock market more so than the grains. We will be watching to see what the Feds do here and if it comes in hotter than expected.

Odessa port is not operating after its recent attack.

China cuts cotton demand outlook amid their slow economic growth.

Due to the hurricane we saw a while back in Florida, we may see juice shortage worsen

USDA Numbers

Livestock

Live Cattle up +0.550 to 156.100

Feeder Cattle down -0.275 to 183.650

Live Cattle (6 Month)

Feeder Cattle (6 month)

In Case You Missed It..

Yesterday's Weekly Newsletter - Full Version

South America Weather

Social Media

All credit to respectful owners

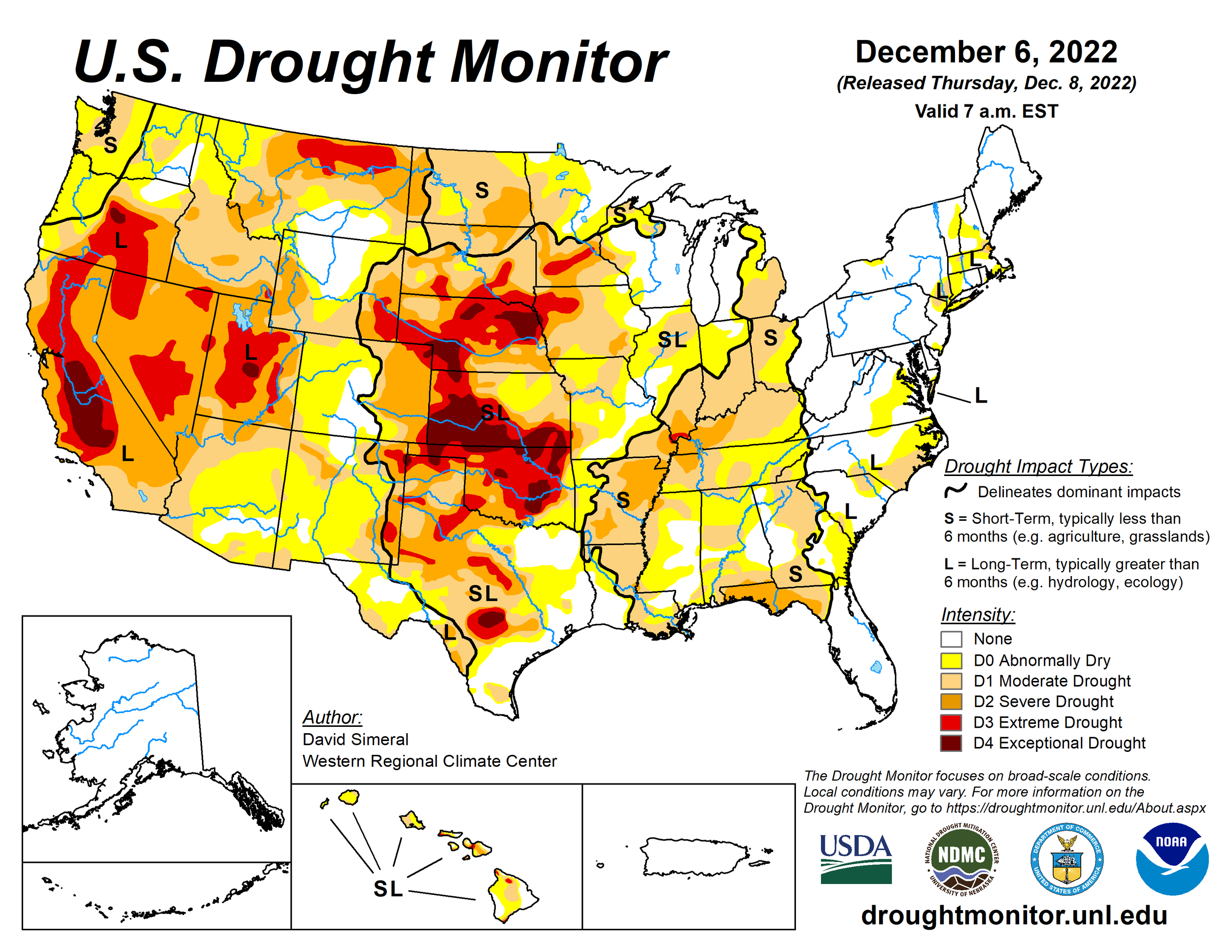

U.S. Weather

Source: National Weather Service