STOCKS & EQUITIES PLUNGE - WHAT DOES THIS MEAN FOR THE GRAINS?

Grains were mixed as it was a fairly quiet day overall for the grains. Now the stock market and equity markets on the other hand had an eventful day. With both the stock and equity markets getting slapped hard, closing sharply lower with the CPI coming in hotter than expected. The CPI was expected to fall 0.1% to 8.1%, but instead, it rose an additional 0.1% bringing it to 8.3%. Many economists are now thinking we may see Feds raise interest rates a full 1.0% near the end of September.

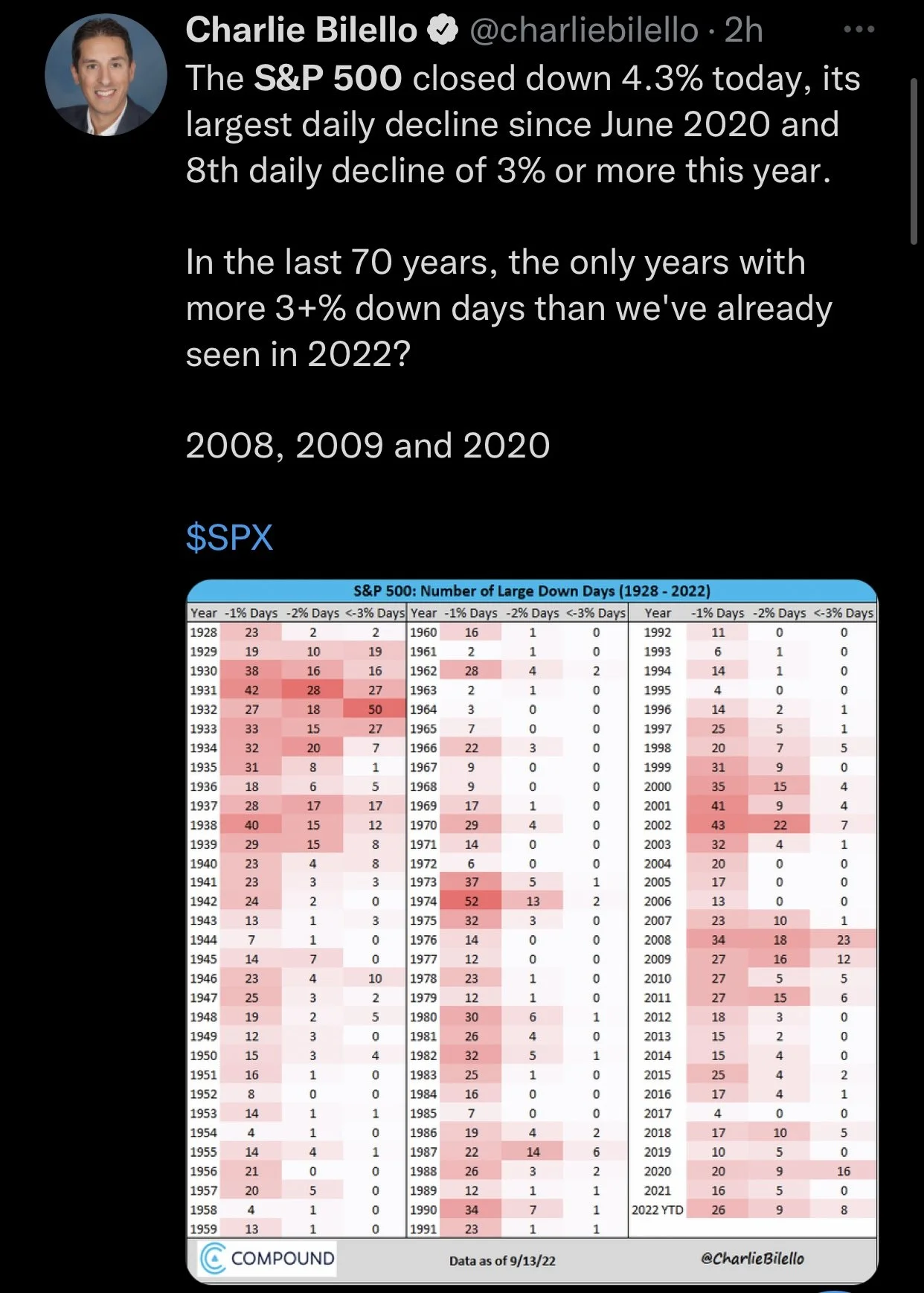

We saw the worst day of the year for; S&P 500, NASDAQ, and Dow Jones. It was actually the worst day since the COVID pandemic started.

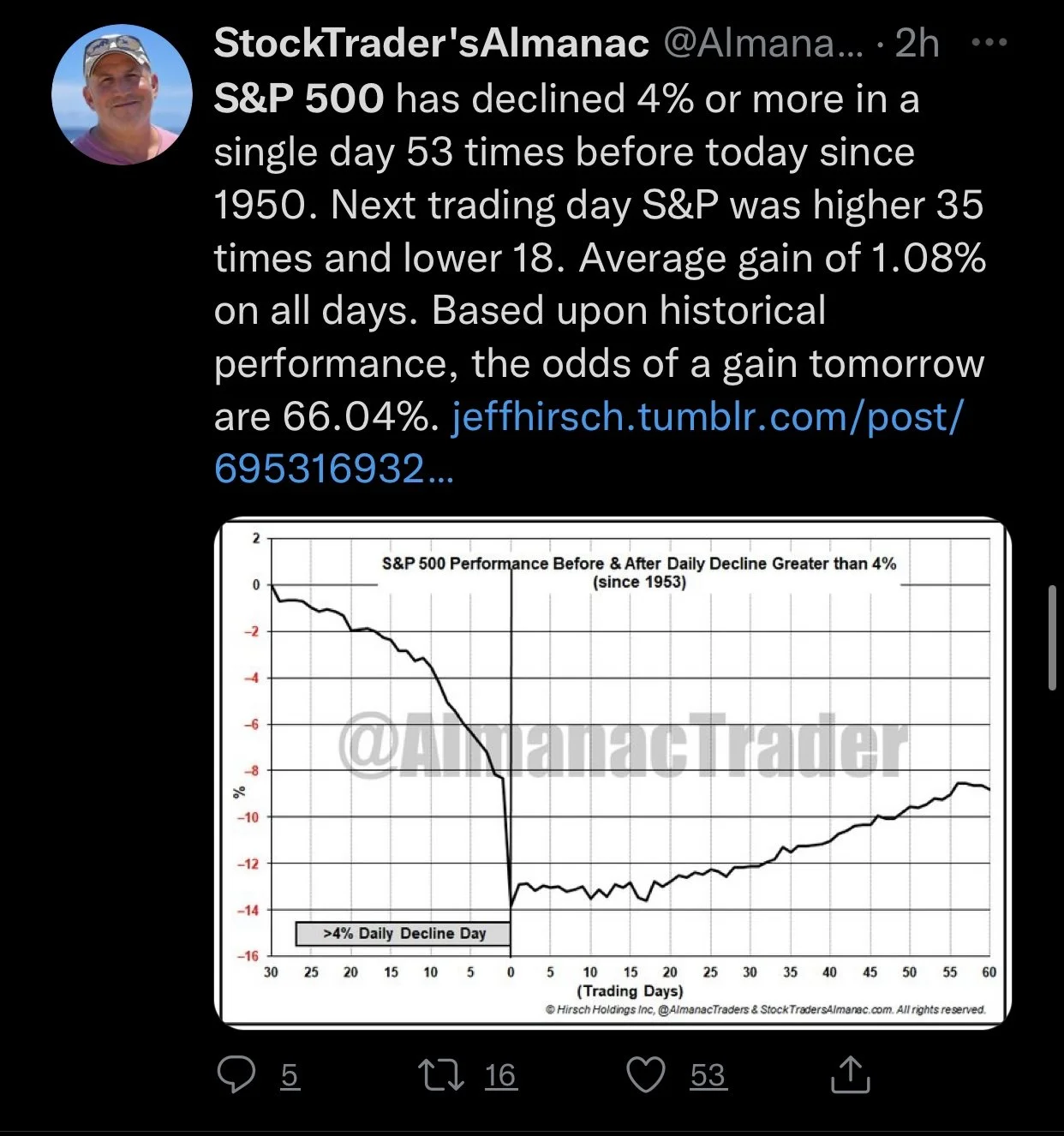

The S&P 500 closed down 4.3% today. Making today the largest daily decline we've since June 2020, and the 8th daily decline of 3% or more this year. In the past 70 years, the only 3 years that have seen more days with 3% or more daily losses were.. 2008, 2009, and 2020.

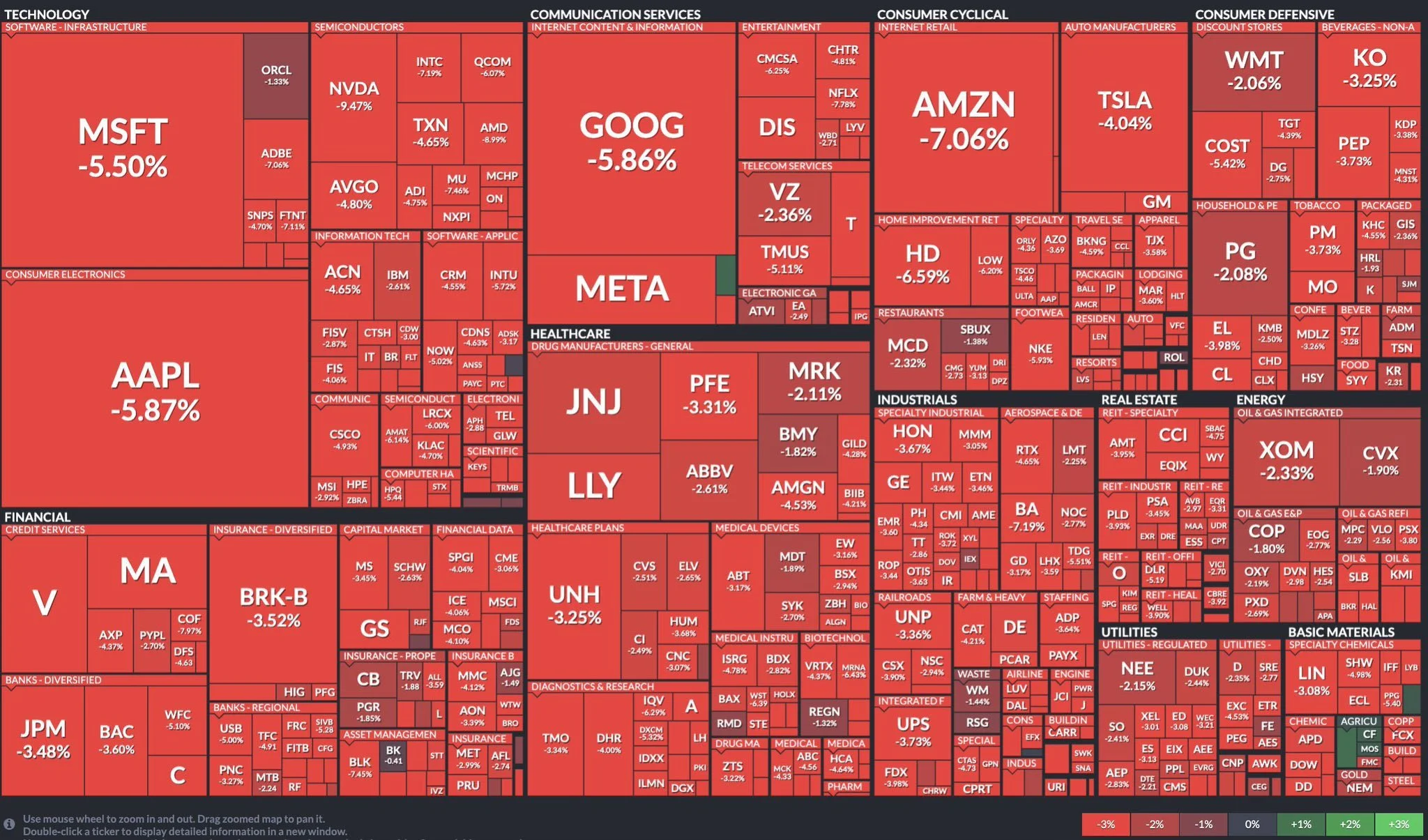

There were only 5 stocks in the S&P 500 that were green today. Not a single one of them closed up more than 1%.

Many of the biggest names in the stock market closed over -5% lower

S&P -4.35%

Facebook -9.37%

Apple -5.87%

Microsoft -5.50%

QQQ -5.48%

Tesla -4.04%

The Dow Jones fell nearly 1,300 points (3.94%), also its worst day since June 2020.

The NASDAQ plunged 5.16%

Year To Date:

NASDAQ -25.64%

S&P 500 -17.49%

Dow Jones -14.4%

The dollar index was nearly 1.500 points higher. Making its largest daily gain since early July.

CNBC also reported - The Bank of America says "the S&P 500 bottom for the next 12 months is not in yet"

Stock Market Heat Map

Now what does this mean for the grain markets?

Obviously the recession fears have recently had some impact on the grains, and today this likely definitely added some pressure to lower grains. Will we continue to see panic and recession fears? If so, how will these headlines affect the grains? Will we continue to see inflation and recession add pressure and can they with stand these headlines.

Todays Takeaways

A large portion of slightly lower prices in corn and soybeans following yesterday's gains had to do with the Feds raising the rates. As investors rushed to lock in some profits following a massive rally yesterday. Despite the headlines and sell-off across the markets, the grain markets held up really well comparatively speaking. We did see a lot of the talk from yesterday’s report get drowned out by the stock market news, but I think tom9that the grains will shift their focus back to the task at hand.

Corn was trading near $7 last night before eventually giving back its gains. However, we are still sitting great as we didn't see corn give much up despite all the headlines. We are still above last week's high which was $6.88. We only lost -3 cents this afternoon despite the outside markets crumbling, which could be looked at as a good sign. Yesterday we had our highest close since June 21. The outlook on corn is still fairly bullish as the majority believes we will continue to see lower yields.

Overnight we also saw soybeans go above yesterday's highs. However, similar to corn, we saw selling this morning. Giving back overnight gains. Closing near its session lows (-9 cents). We will have to see if the trade switches back its focus to the yield report. Even with the CPI headlines and outside markets, a pullback today was inevitable. A large reason the cash side remains weak is the mass amount of Argentina beans flowing, with their recent deal. I still have concerns with soybean demand as it's tough to be superly bullish on Chinese demand carrying the bean market, as well as the lockdown issues but we will have to wait and see what the trade looks like tomorrow. We also will get to see a month's worth of export data for soybeans Thursday, so that could be interesting to see as we haven’t got a look at the export numbers in quite some time.

Now wheat, on the other hand, was the outlier in the grains market. All three classes closing higher after being the only market to not have much of a reaction after yesterday's report. Aside from wheat closing higher there wasn't much news to shake up anything. A lot of the support came from the continued skepticism surrounding Ukraine's exports. As Putin is still looking to do something with the agreement, and many believe the exports are being overestimated as well. Wheat is still looking firm good with the charts looking pretty friendly, especially for KC and Chicago. KC had its highest close since July 7. We could still potentially see some bullish wild cards with the ongoing global weather concerns, as well as the war headlines.

Previous Newsletters

Here are our last 2 newsletters. Would love any feedback or things you would like to see.

Post USDA Market Update - Read Here

Weekly Newsletter - Read Here

Social Media

Credit: All credit to users of posts