TRADE PREPARES FOR USDA REPORT

Overview

Grains mostly lower here today following some early strength where all the grains were trading higher. At one point soybeans were up 17 cents, closing up just 2 1/2 cents. The wheat market sees the most pressure, with Chicago down 21 cents followed by Minneapolis down 10 3/4 cents. Corn closes back below $5 after starting out the day a few cents higher, ultimately closing down 4 1/2 cents at $4.94 1/4.

Soybeans opened up strong with more business to China, but ultimately came well off their highs as it is hard for beans to keep a rally with more rain and cooler temps on the radar. However, the forecasts have started adding more heat in both the 6 to 10 and 8 to 14 day maps.

On yesterday’s lows we did bounce and hold right off of that 50% retracement at $12.83 and the 100-day moving average which bulls liked.

Corn and wheat have been pressured from slow demand and pre positioning for the USDA report on Friday. Another reason for the pressure in wheat was these rains, as we continue to get rains in parts that needed it. It might not have made a big difference for winter wheat but definitely helped out the soil moisture situation for the new crop.

Adding to the weakness in wheat, we saw Egypt purchase wheat from Russia. As the US remains uncompetitive in the world market. However, Egypt did pay a pretty penny so perhaps we will start to see a better balance in this wheat market.

Crude oil continues it's bull run, as it hit a new high for the year.

The USDA announced they may revise acres for oats, spring wheat, and winter wheat on the August report, with corn and beans on the September report.

Taking a look at the upcoming report Friday. Traders are expecting yield cuts to both corn and beans. Production is also expected to see a decrease from last month. (full estimates below).

Only 2 of the 20 analysts polled by Reuters voted for corn yield to come at or above last month's 177.5 bpa. While only 2 of those 20 saw bean yield staying at 52 bpa. However, no one predicted it coming in higher.

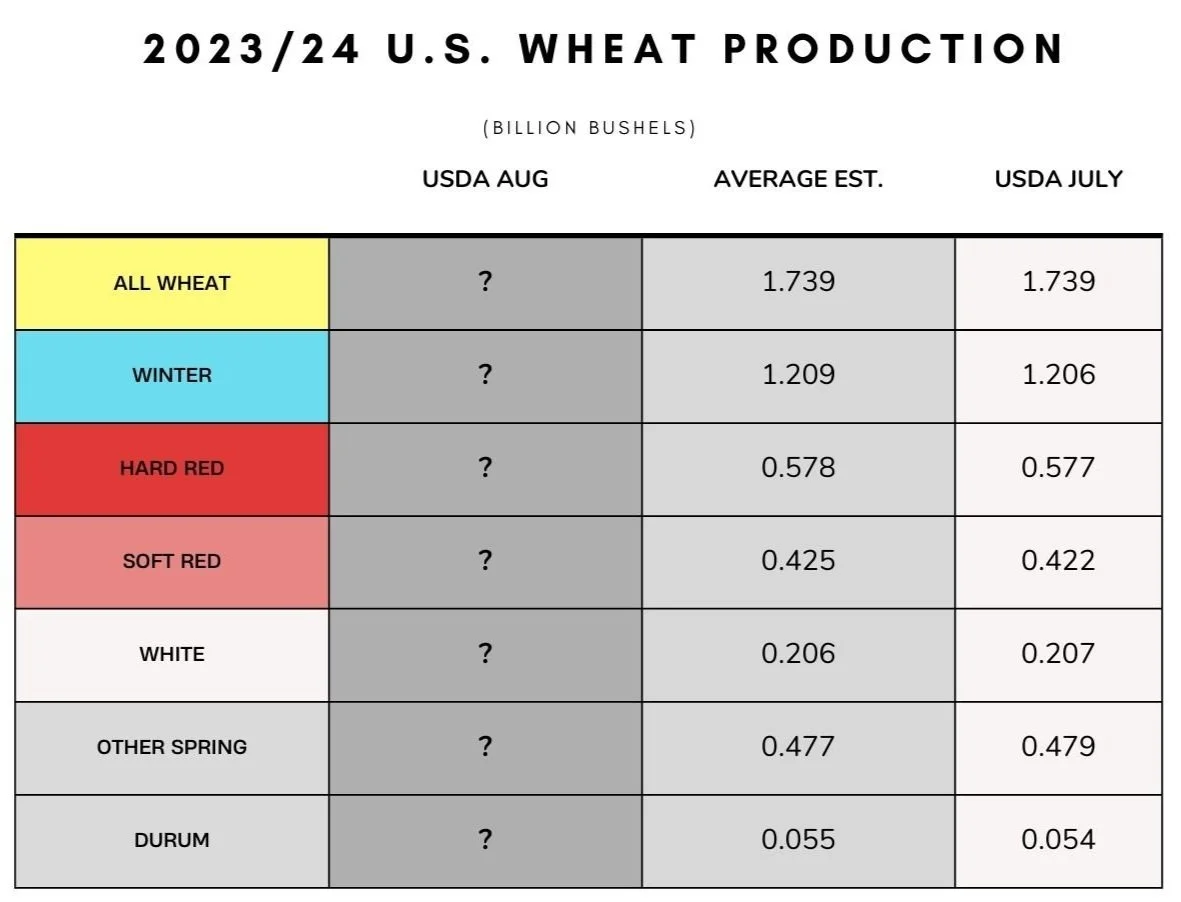

Wheat production is expected to come in nearly identical to that of last month's USDA estimates. With very little changes being made there.

Overall, the numbers look pretty friendly for corn and beans, especially on such a heavy break to the downside like this. We will have to see if we actually get them.

The funds are still heavily short wheat, while long beans, meal, and oil. We will probably see the funds defend their positions as we head into the report tomorrow.

Makre sure you read to the very end of today’s update where we include a great small write up from Wright on the Market where he goes over making money on the meal market as well as another write up from Scott Irwin where he goes over how the “Golden Number” is working out for the corn belt this year.

USDA Report Estimates

Today's Main Takeaways

Corn

Corn again gets caught in between the strength in beans and weakness in wheat. Corn traded a few cents higher, but ultimately closed down nearly a nickel.

Lack of demand has been the biggest thing bears continue to point at. As well as the big crop out of Brazil.

All eyes are on the USDA report Friday. The estimates have yield at 175.5 bpa which is a 2 bushel decrease from last month's report. The trade range is 172.4 to 178.

It is highly doubtful we see yield left unchanged or higher with the dryness and heat we saw in July which we all know is where the corn crop is made. But who knows, perhaps we do see them once again decide to "kick the can down the road" and make very little change. Does anyone still think we are far better than year like the USDA does?

However, an argument I am seeing heading into the report is that even if bulls get their wish and yield drops to say the 172 range. The USDA might just offset that on the demand side. So there is talk that the bears are going to win no matter what yield they print come Friday. Guess we will have to see what kind of changes are made.

If we take a look, anything above a yield of 173.8 still gives us a +15 billion in new crop production. The record is 15.14 billion in 2016. The current estimate is at a record 15.32 billion with the 177.5 yield. So this is the thing bears are watching. They are also making the argument that we will ultimately need to see the USDA trim its corn used for export and ethanol.

Overall, demand is the number one thing holding corn back. Going into the report I expect a cut to yield, just how big of one is the question. With us heavily oversold here, I think we might get a nice bullish surprise from the report, leading to a nice bounce. That's just my thoughts. The bigger question there however is can we hold the bounce or will the rally be sold like it has been? I don’t think a bounce into the $5.38 range would be all that unreasonable.

Upside targets are still $5.16, a gap fill to $5.30, then $5.38. While the downside support bulls need to hold is $4.81. If we were to break that support we could be in for another leg lower into perhaps the $4.50 range which I don’t want to see happen, but could.

We still like the idea of reowning with cheap calls here depending on your situation. If you made sales north of $6 and north of $5.55 to $5.72 on the recent rally, perhaps take a look at cheap calls.

If the USDA does give us a bullish surprise, we want to catch the move before it happens. We want to be hedging, not chasing a move after it's made.

This idea isn’t necessarily for everyone. If you want specific advise or help with your operation shoot us a call free of charge and we will gladly help you with anything you need. (605)295-3100

Corn Dec-23

Soybeans

Beans continue to find a little bit of support as traders prepare for the USDA report. The funds are still long beans, so we will see if they want to defend their position tomorrow.

The next two days are all going to be about the report…….

The rest of this is subscriber-only. Please subscribe to continue reading where we go over our full breakdowns for the bean and wheat market. Where does the USDA see beans at and what are some possible scenarios? Reasons why they could opt to leave yield unchanged or cut it. Will the balance sheet get tighter? Making money in the meal market and the is the “Golden Number” for the corn belt actually working?

Find out. Get every single one of our exclusive daily updates sent via text & email. Scroll to check out past updates you would’ve received.

OUR USDA SALE ENDS IN 3 DAYS

Lock in this huge discount. Unsure? Try 30 Days Free HERE

Check Out Past Updates

8/8/23 - Audio

MARKETS PUT BANDAID ON THE BLEEDING

8/7/23 - Market Update

BEANS SELL OFF WHILE WHEAT RALLIES

8/7/23 - Audio

NAVIGATING WEATHER & WAR YOYO

8/6/23 - Weekly Grain Newsletter

ARE YOU READY FOR THE NEXT BIG MOVE?

8/4/23 - Audio

CAN OUR MARKETS BOUNCE ONE MORE TIME?

8/3/23 - Market Update

YIELD, DROUGHT UPDATE, TIME FOR CALLS?

8/3/23 - Audio

BUYING RECOMMENDATIONS

8/2/23 - Audio

WEATHER & WAR VOLATILITY CONTINUES

8/1/23 - Weekly Grain Newsletter