USDA IN 2 DAYS

Overview

Blood bath as grains see heavy pressure for the first time in weeks as everyone is expecting Friday's USDA report to be a bearish one filled with huge stocks and high starting yields in the US.

Today we saw a lot of farmer selling, technical selling, and fund selling. As today there was just no reason to go straight higher especially with expectations of a bearish report. The big money are positioning themselves ahead of that report.

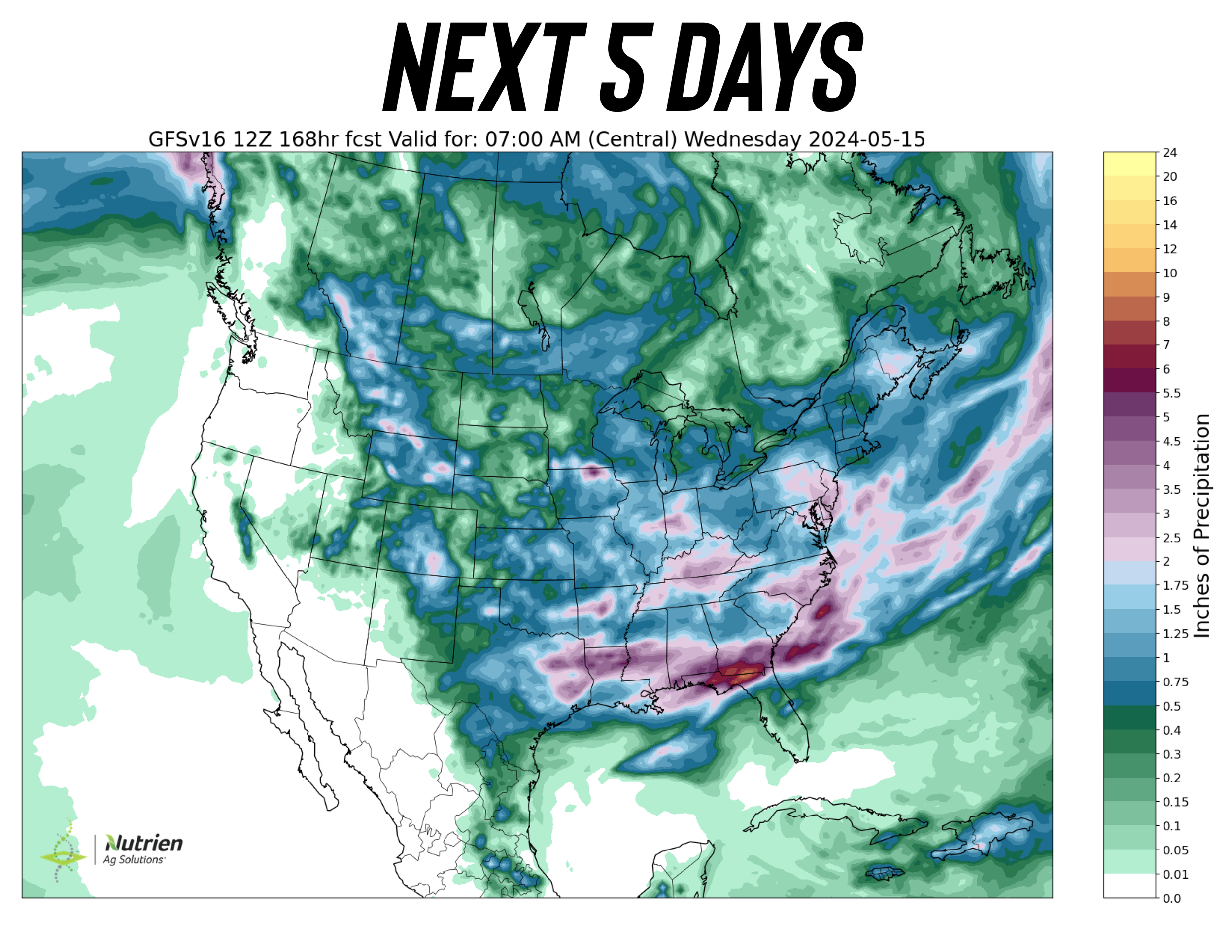

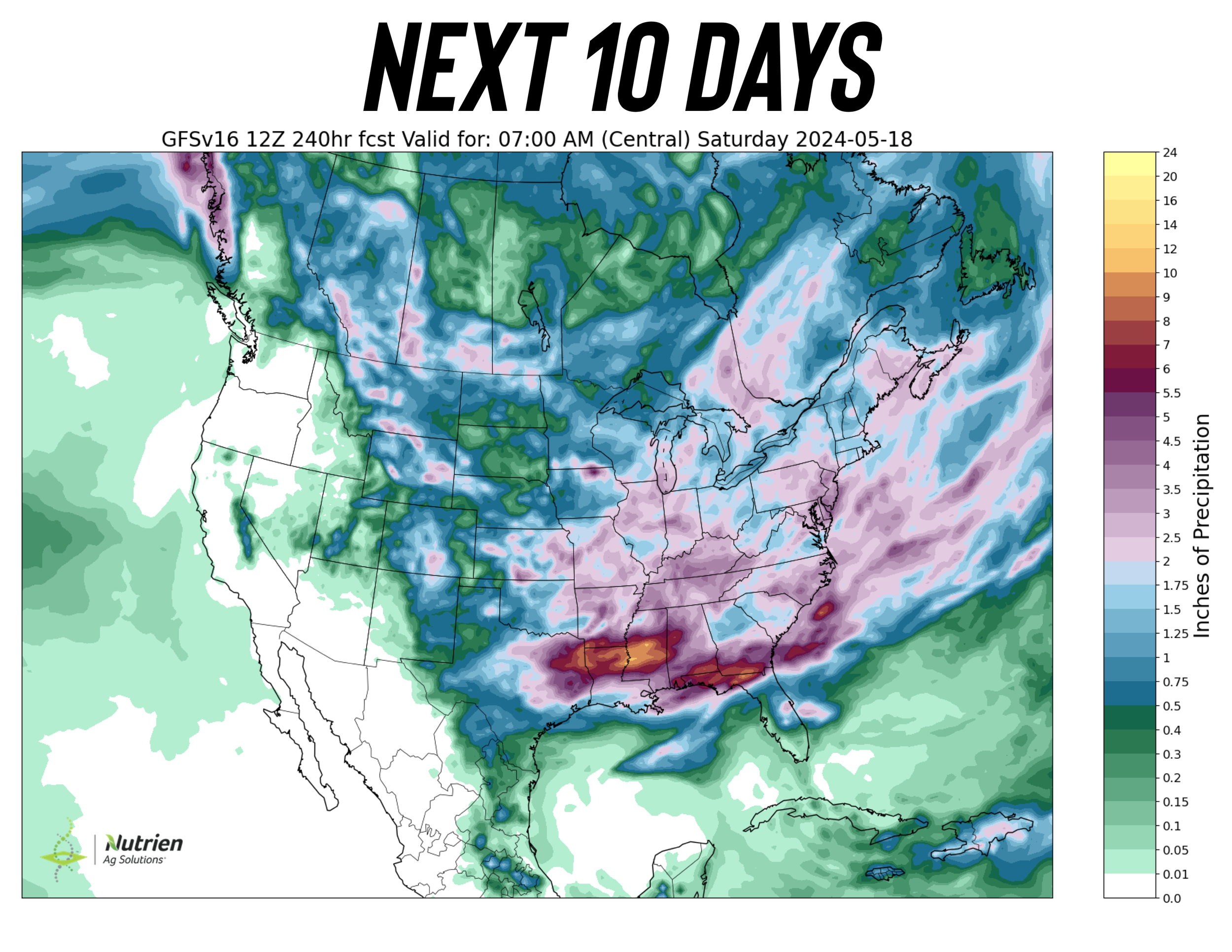

A better planting outlook window a week from now also added some pressure. As right now we are slightly behind, but we all know just how quickly we can catch back up if it dries out.

These next few weeks will be huge. If it dries out, the market could take it on the chin for a while. If the forecasts stay wet, then we could see more premium added.

Any acres planted after the 15th of May are at a greater risk to yield loss. Some historical data says that every week we are behind on planting equates to roughly a 4 bpa loss on corn. Which would already give us a 177 yield vs the USDA's 181.

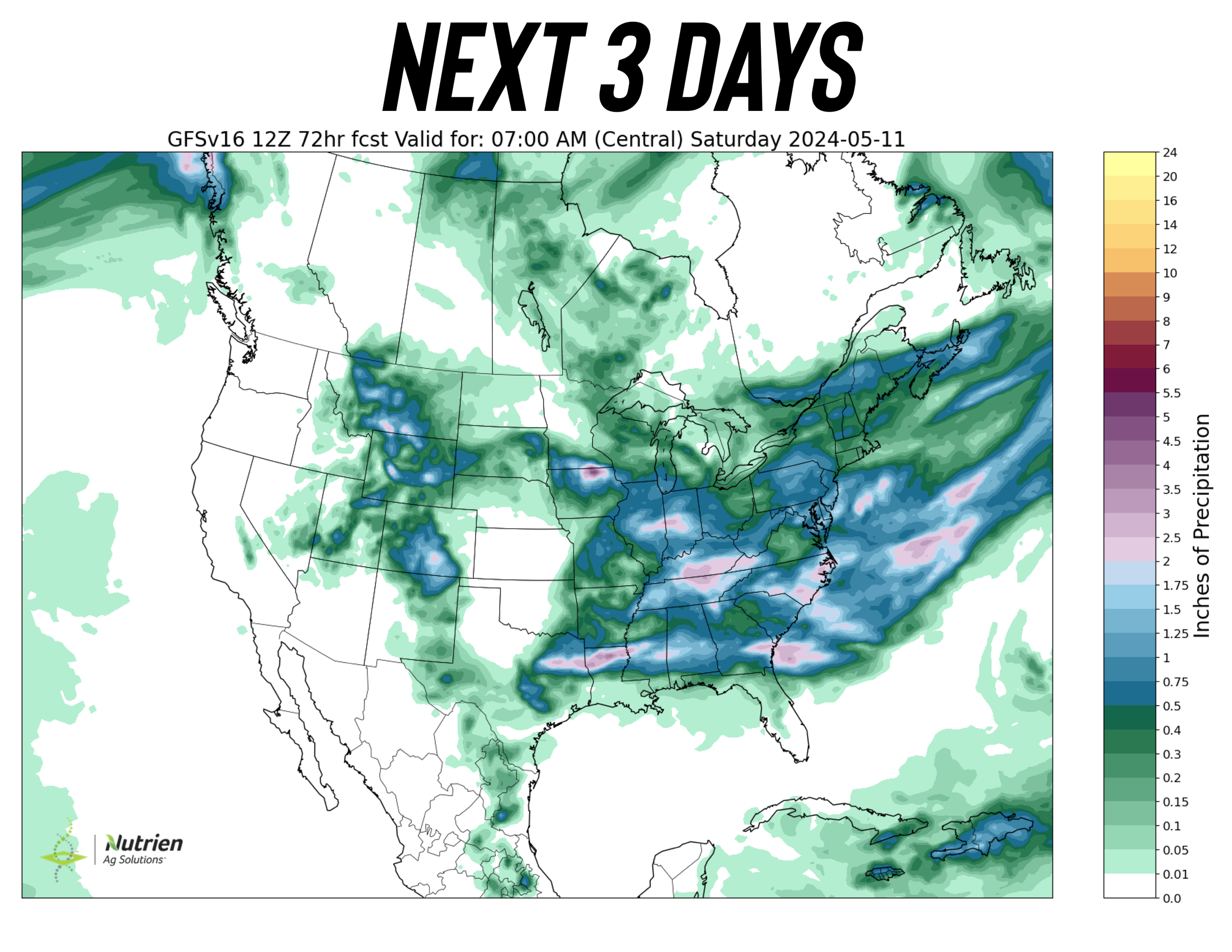

Here is the current forecasts. Still pretty wet over those leading I-states that are seeing some issues right now.

USDA Preview

This report will very likely not be bullish on the US side of things.

We will probably see a 181 yield.

Why?

There have only been 2 times the past decade where May yield came in lower than the February yield.

Those two years were 2013 and 2022.

May 1st Planting Progress:

2013: 8% (Yield Down in May)

2019: 18% (Worst Delayed Planting)

2022: 14% (Yield Down in May)

2024: 27% (This Year)

As you can see, planting progress is far ahead of those years. Altough we are seeing slight delays, there is still not a major concern. And we all know the USDA does not jump the gun.

Soybeans will likely come in at 52 as well.

However, I do not think the market is going to care about these yield numbers. These are already baked in from the February Outlook.

Looking at ending stocks, 2024/25 stocks are expected to be up a lot higher than last year. But down from the February USDA Outlook.

The estimate range however is massive for ending stocks. On corn the estimates range from 2.5 to 2 billion. A 500 million gap. On soybeans its a 240 million gap between 550 million to 310 million. Wheat has a near 200 million one as well between 880 million and 700 million.

Extreme wide ranges. So these numbers could come in anywhere.

Lastly South America numbers. These continue to shrink.

They are expecting sizeable cuts to both Brazil corn and soybeans. While Argentina corn is expected to take over a -5% trim due to disease.

CONAB is out next Tuesday, their estimates are far smaller. With Brazil beans at 146.5 and corn at 111. A massive difference, will be interesting to see if the market respects their numbers.

What should you expect from this report?

Overall we should……….

The rest of this is subscriber only. Subscribe to keep reading & get every update along with 1 on 1 market plans.

IN REST OF TODAYS UPDATE

What to expect from this USDA report

Where could corn makes it’s highs?

Is 2014 similar to 2024?

Managing risk

Price targets

TRY 30 DAYS FREE

Try our daily updates completely free. Be ready for these opportunities.

READY TO COMMIT? PLANTING SALE

Take advantage of our planting sale and get 1 on 1 tailored market plans. Be prepared for this growing season and the upcoming opportunities.

Offer: $399 vs $1,250 a year

Want to Talk?

Our phones are open 24/7 for you guys if you ever need anything or want to discuss your operation.

Hedge Account

Interested in a hedge account? Use the link below to set up an account or shoot Jeremey a call at (605)295-3100 or Wade at (605)870-0091

Check Out Past Updates

5/7/24

WHO SHOULD WAIT FOR TRIGGERS NOT TARGETS

Read More

5/6/24

GRAINS HIGHEST IN 4 MONTHS

Read More

5/3/24

SEASONAL RALLY JUST BEGINNING OR BULL TRAP?

5/2/24

ARE THE TIDES STARTING TO TURN?

5/1/24

BE PATIENT & READY FOR THESE OPPORTUNITIES

4/30/24

FIRST NOTICE DAY SELL OFF

4/29/24

WHEAT TAKES A BREATHER

Read More

4/26/24

SHOULD YOU REWARD WHEAT RALLY?

4/25/24

WILL FUNDS BE FORCED TO COVER?

4/24/24

WHEAT CONTINUES BULL RUN & CORN FAILS BREAK OUT

4/23/24

FUNDS CONTINUE TO COVER & RALLY GRAINS

4/22/24

GRAINS CONTINUE 2-DAY RALLY

Read More

4/19/24

ONE DAY WONDER? EXTREME VOLATILITY & RALLY

4/18/24

GRAINS WAITING FOR WEATHER MARKET

4/17/24

NOT IN THE WEATHER MARKET QUITE YET

Read More

4/16/24

CHOPPY TRADE IN GRAINS CONTINUES

4/15/24

PLANTING PROGRESS & BRUTAL CHOP

4/12/24

MARKET DOESN’T BELIEVE THE USDA

Read More

4/11/24