USDA REPORT

SHORT RECAP - FLAT REPORT AS EXPECTED

The USDA report this morning was for the most part a snoozer. No huge changes were made, and this was expected as the larger changes are usually made in January. With the lack of changes, focus shifted towards the pretty non eventful news day in the markets.

Before the report, corn futures were about a nickle higher, soybeans a penny or two lower, and wheat futures were around 2-5 cents lower as well.

After the report, not a whole lot changed outside of some more weakness in wheat. Corn trading slightly higher even after seeing somewhat negative numbers, and soybeans trading a nickle or so lower here with no real news to further support the rally.

Read Full USDA Report Here

Corn

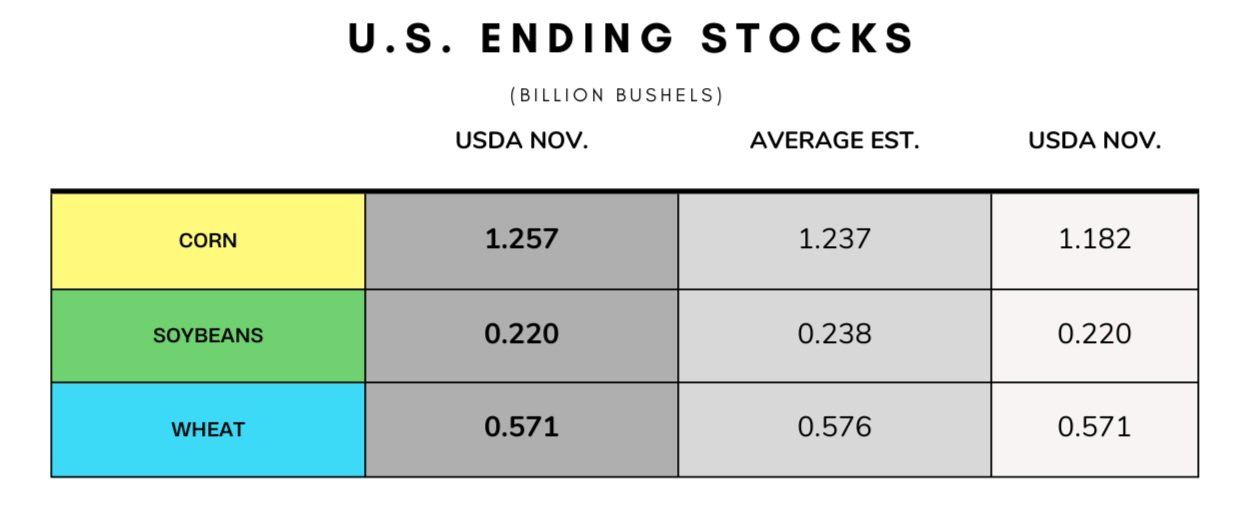

It was a slightly negative report for corn. As we saw exports lowered and U.S. ending stocks came in higher. With the USDA lowering its export forecast by -75 million. Overall, no huge changes and this report didn’t change much of the landscape for corn. We saw production estimates in South America left unchanged, but many think we will continue to see Argentina's lowered in the future with all the problems they face. We also have lower productions globally in many countries such as Russia, Ukraine, and EU. Despite the slightly negative report, corn is still pretty strong today which should be a good sign, as corn is trying to rebound following its filled gap lower we saw not too long ago.

Soybeans

Soybean numbers came in neutral as well to maybe slightly bullish. With no changes to the U.S. balance sheet. With U.S. ending stocks being left unchanged coming in below estimates and world stocks coming in slightly over. South American production was unchanged. As expected it looks like the USDA is going to wait before making any substantial changes. The recent $1.20 rally has been supported by strong bean meal and Chinese purchases. With not much for these numbers to show and no real other bullish headlines it’s not a surprise to see beans slightly lower here today.

Wheat

We saw slight production cuts in global wheat. With Australia seeing a 2 MMT boost which somewhat offset the other cuts we saw. As Argentina came in 3 MMT lighter, and Canadian crop came in reduced by 1 MMT. Wheat exports were upped by 2.2 MMT. Overall it wasn’t a bad report for wheat, but wheat continues to trade lower here following the report. Wheat is looking to find that seasonal bottom.

South America

Despite all of the problems we have seen Argentina face, the USDA decided to leave their corn and bean numbers unchanged. I think we may see them start to walk back some of these numbers in the future, as they don't want to jump the gun early.

This Weekend's Weekly Grain Newsletter

The USDA report today didn't change a whole for the landscape of the grains. But in Sunday's Newsletter will go into more detail on the numbers, and take a deep dive into everything going on in the grains.

The Numbers

This weekend will go into far more detail on the USDA report as well as the grains as a whole. If you want to receive this weekend's in depth Weekly Grain Newsletter make sure you subscribe, as it will be subscriber only.

Last Week's Weekly Grain Newsletter

Why You Shouldn’t Be Fear Selling

Here was last week's full version in case you missed it.