ARE GRAIN SPREADS TELLING US SOMETHING?

Apologies for getting this out late as we are traveling*

Overview

After 7 brutal days corn and beans finally rally. Both posting one of their best days all year year long.

Corn had a phenomenal close at the highs. Engulfing the past 4 closes.

On the other hand, despite continued worries about the Russian wheat crop, harvest pressure led to lower wheat today. Harvest is going well and so far the crops are looking good. However, these crops looking good was expected. We have better ratings than the last two years and the crop tours already confirmed this a while back.

Today's rally in corn and beans was a lot of technical and fund buying. This sell off was overdone and the funds realize that. Like I mentioned earlier this week, there wasn’t a major reason for prices to continue to fall out of bed.

Not only did we have technical and fund buying, there is rumors that China is looking to buy. As we made sales to Spain and unknown (likely China).

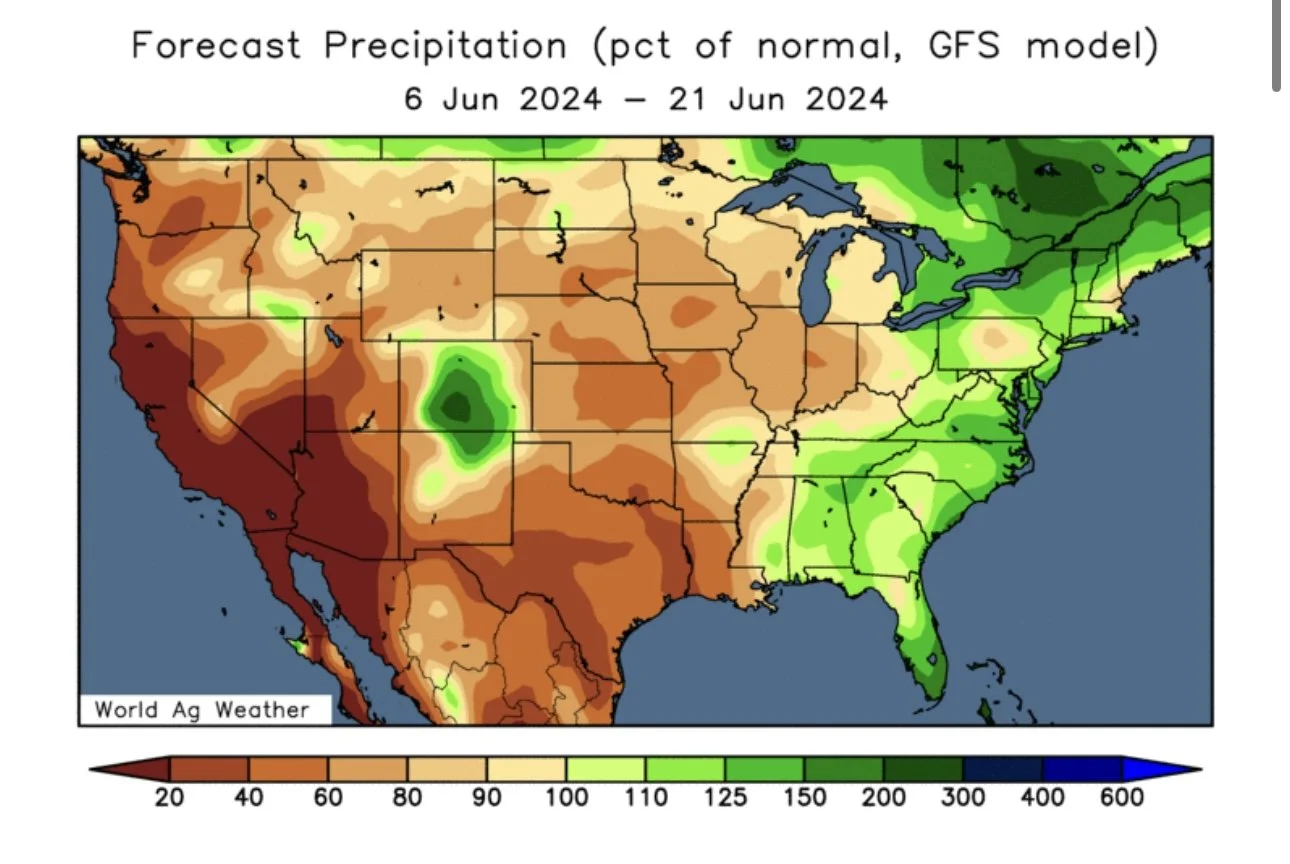

Weather looks dry and cool for most of corn belt next 10 days. But come June 14th, things are looking to heat up FAST. Normally, this 10 day dry forecast would be seen as a concern the past few years, but our subsoil moisture is great so it is not a concern at all here.

Our subsoil moisture is amazing, but hot temps and little rain in the forecasts is going to catch the attention of traders as we get back into a weather market. Too wet early and too hot late are usually not the best recipe either.

One day of higher prices doesn’t change a trend and we 1,000% need another day of follow through strength to confirm more upside.

But the biggest thing today that perhaps signals that we might be going higher is the spreads.

Both corn and bean bull spreads made new highs for the move today, as the nearby has been gaining on the deferred.

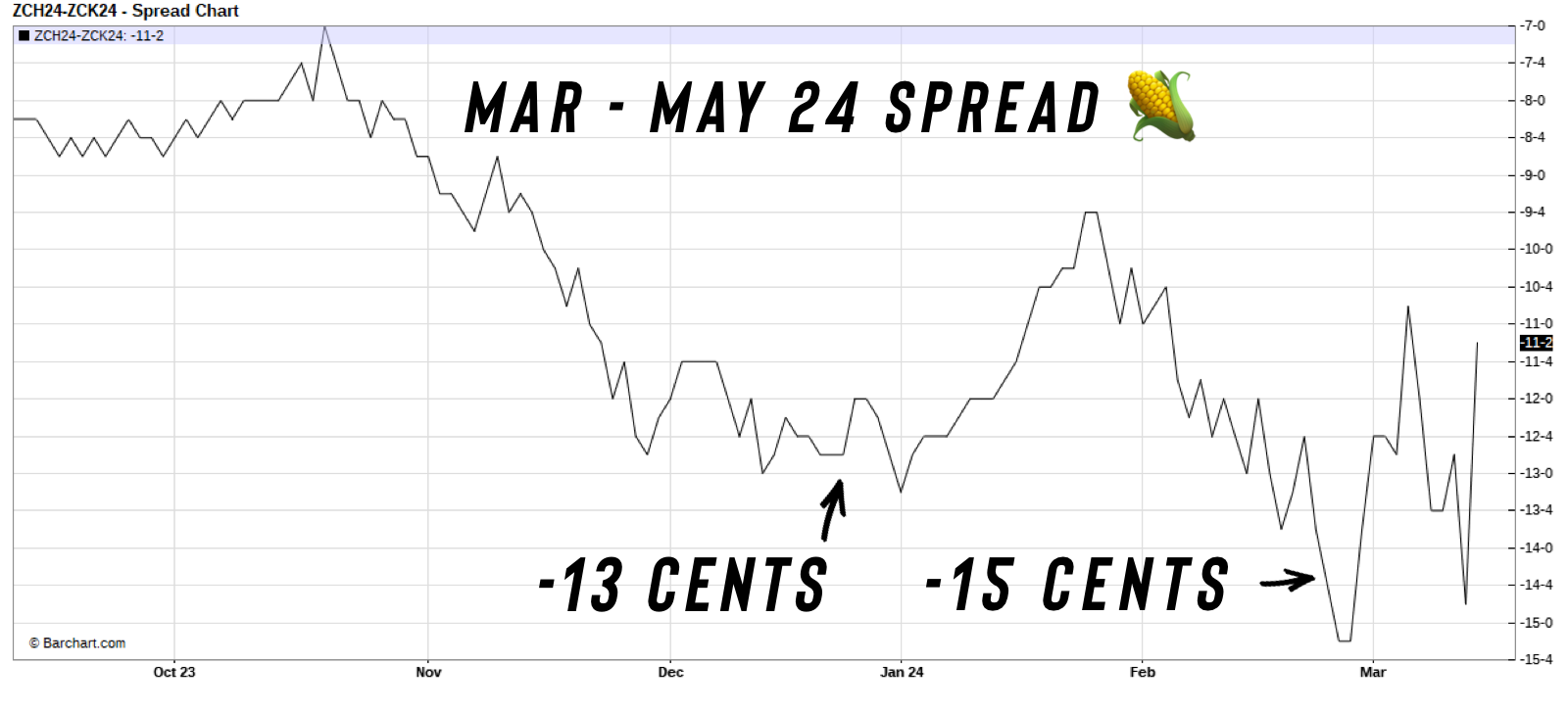

First take a look at corn. The July-Sep spread went from -11 cents to -5 cents. And is now at less of a carry than where we were at our highs.

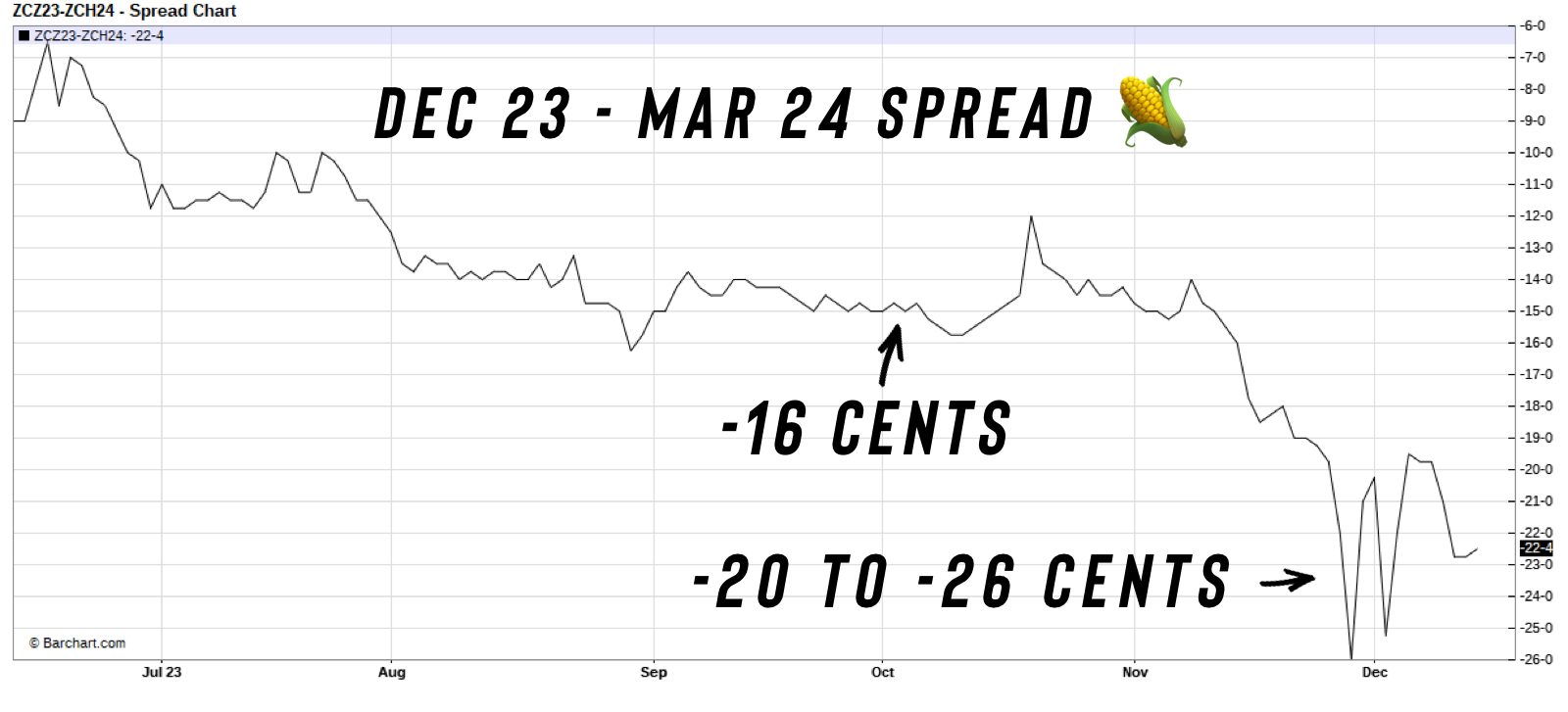

Look at how massive the carrys were.

In the March to May spread we had a -15 cent carry.

In Dec 23 to March 24 spread we had up to a -26 cent carry.

Today we have less than a -6 cent carry. The spread was massive, and now it is shrinking. It is not doing what previous months did.

When spreads firm, it indicates higher prices. It shows the market has more demand or needs more supply vs than it did back then. If prices were as bearish as they were in a few months ago, that spread would be 10-15 cents instead of 6. So it shows we are finding demand at these levels.

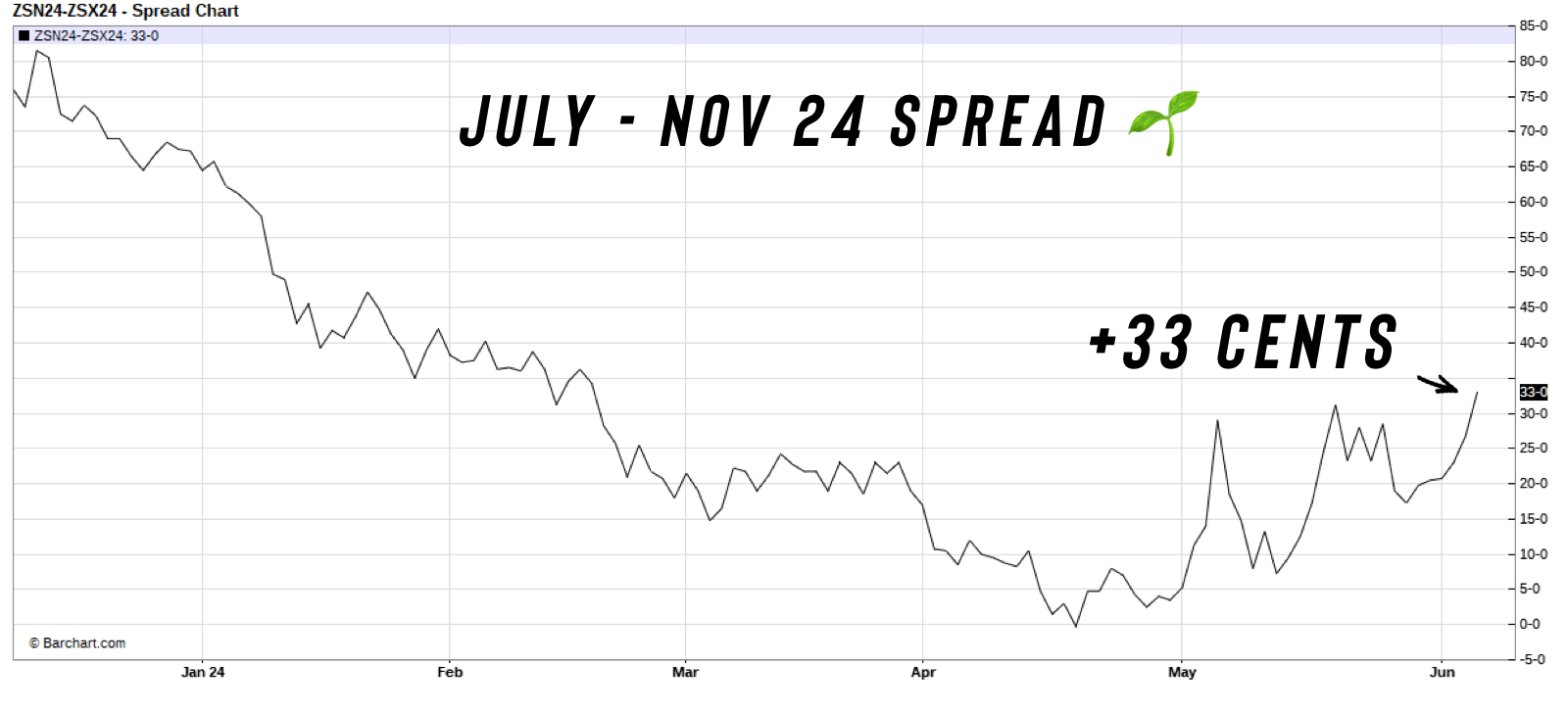

Beans old crop futures were already inverted even though futures had been down 7 days in a row. Now that is a bullish indicator.

We are now at a +33 cent inverse, a larger inverse than when we made our highs.

Usually spreads firm when a market goes up. When they firm up while futures are falling, that is usually a sign that we are done going down.

Spreads are firming. Basis is also firming. This isn’t something you usually see if we are going to get a lot lower prices.

Today's Main Takeaways

Corn

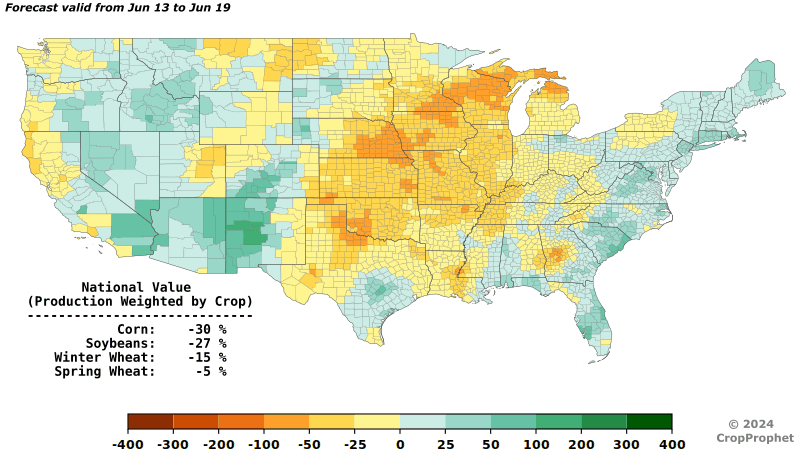

The funds has been selling on the idea that there isn't any risk here to the crop. That the crops right now look fantastic, the ratings were good, and our subsoil moisture is the best in years.

No. There is no immediate weather concern. But as I have been mentioning for months, the outlook for this summer is still very hot. Not the type of heat where you say "It gets hot every year"…………..

The rest of this is subscriber-only. Subscribe to keep reading & get every update along with 1 on 1 market plans.

IN TODAYS UPDATE

Why I see corn higher

Managing risk here

Big day on corn chart

Implied volatility is cheap

Brazil taxing their farmers, big deal?

Wheat overview

TRY OUR UPDATES FREE

Try completely free for 30 days. Get 1 on 1 plans. Be comfortable & prepared.

Want to Talk?

Our phones are open 24/7 for you guys if you ever need anything or want to discuss your operation.

Hedge Account

Interested in a hedge account? Use the link below to set up an account or shoot Jeremey a call at (605)295-3100 or Wade at (605)870-0091

Check Out Past Updates

6/5/24

GRAINS NEARING BOTTOM? 7 DAYS OF RED

Read More

6/4/24

HIGH CORN RATINGS, SCORCHING SUMMER, & RUSSIA CONCERNS

Read More

6/3/24

5TH DAY OF THE SELL OFF. ARE YOU COMFORTABLE?

5/31/24

4 STRAIGHT DAYS OF LOSSES IN GRAINS

5/30/24

I DON’T THINK SEASONAL RALLY IS OVER. WHAT IS THE PLAN IF I’M WRONG?

5/29/24

PLANTING DELAY STORY VANISHES. BUT IS REAL STORY OVER?

5/28/24

GETTING COMFORTABLE WITH GRAIN MARKET VOLATILITY

5/24/24

WET SPRINGS DON’T CREATE RECORD YIELDS, DO THEY?

5/23/24

MANAGE RISK DESPITE STUPID PRICE POTENTIAL IN GRAINS

5/22/24

BEANS NEAR NEW HIGHS. WHAT TO DO WITH WHEAT?

5/21/24

BIG MONEY KEEPS DRIVING WHEAT HIGHER

Read More

5/20/24

ALGOS & BIG MONEY CONTINUE TO MOVE GRAIN PRICES

5/17/24

WEATHER MARKET VOLATILITY CONTINUES TO HEAT UP

5/16/24

SITUATIONAL GRAIN MARKETING

5/15/24

HEDGING VS GUESSING

5/14/24

CORRECTIONS ARE HEALTHY

5/13/24

FUNDS DON’T WANT TO BE SHORT GRAINS

5/10/24

PRICE ACTION TELLS DIFFERENT STORY FROM USDA REPORT

Read More

5/9/24

MARKET PRICING IN NEGATIVE REPORT. WHAT TO EXPECT FROM USDA

5/8/24

USDA IN 2 DAYS

5/7/24

WHO SHOULD WAIT FOR TRIGGERS NOT TARGETS

Read More

5/6/24

GRAINS HIGHEST IN 4 MONTHS

Read More

5/3/24

SEASONAL RALLY JUST BEGINNING OR BULL TRAP?

5/2/24

ARE THE TIDES STARTING TO TURN?

5/1/24

BE PATIENT & READY FOR THESE OPPORTUNITIES

4/30/24

FIRST NOTICE DAY SELL OFF

4/29/24

WHEAT TAKES A BREATHER

Read More

4/26/24

SHOULD YOU REWARD WHEAT RALLY?

4/25/24