WHY BRAZIL COULD PUSH THE GRAINS HIGHER

Overview

Grains end of the week mixed following yesterday's bearish USDA report.

On today’s action, both corn and wheat were lower as corn finally broke below that $4.68 key support and old harvest low. Posting a new low today closing at $4.64.

Despite the bearishness, beans actually managed to trade higher today and were only down 4 cents on the week after falling over 20 cents yesterday after the report.

If you missed yesterday's USDA report audio recap, you can listen to it HERE

Here were the weekly price changes. Corn hit the hardest due to the report, beans barely lower due to the report, and wheat market was mixed.

Weekly Price Changes:

There are 2 main factors that have the ability to push both corn and beans higher. With corn's 2 billion carry out, it will likely need help from one or both of these factors if it wants to hold a sustainable rally.

The first factor is more Chinese demand. Which I think is reasonable. We just saw a great week of sales for both corn and beans. Why wouldn’t you they want to buy corn with our prices so cheap currently?

The second is Brazil. This factor alone has the power to overtake the bearishness from yesterday's report. It also has the potential to push us to $14 to $15 or perhaps higher beans if the cards all fall right. Again "potential".

We will be going over the report more later in today’s update. But first let's take a look at how Brazil's weather is shaping up.

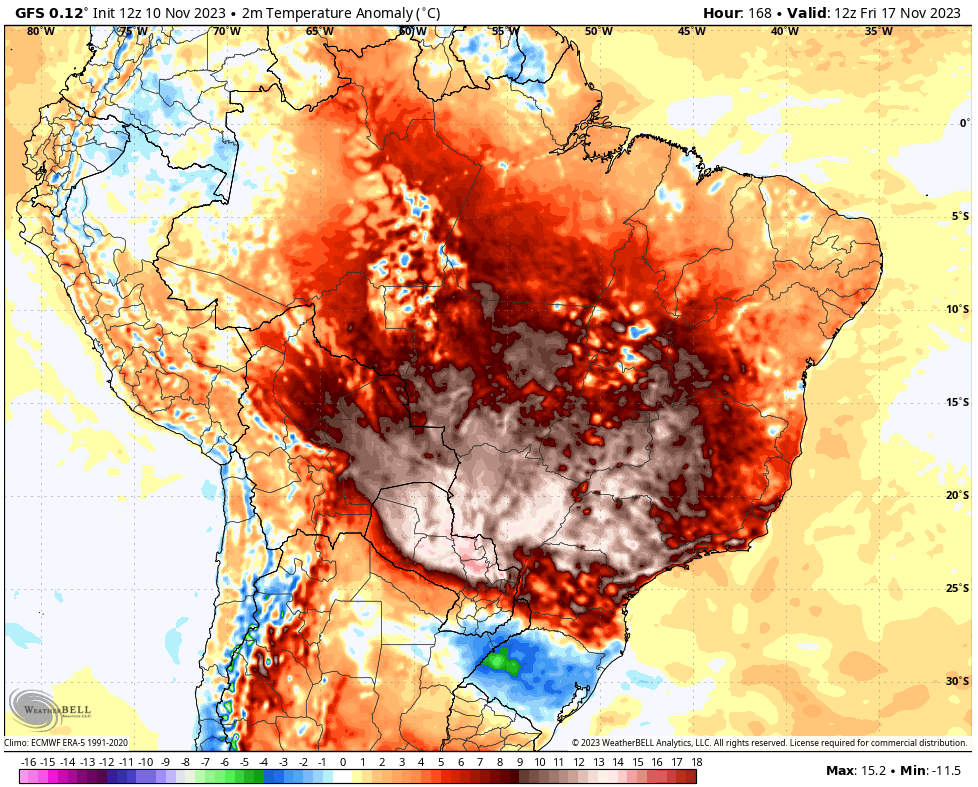

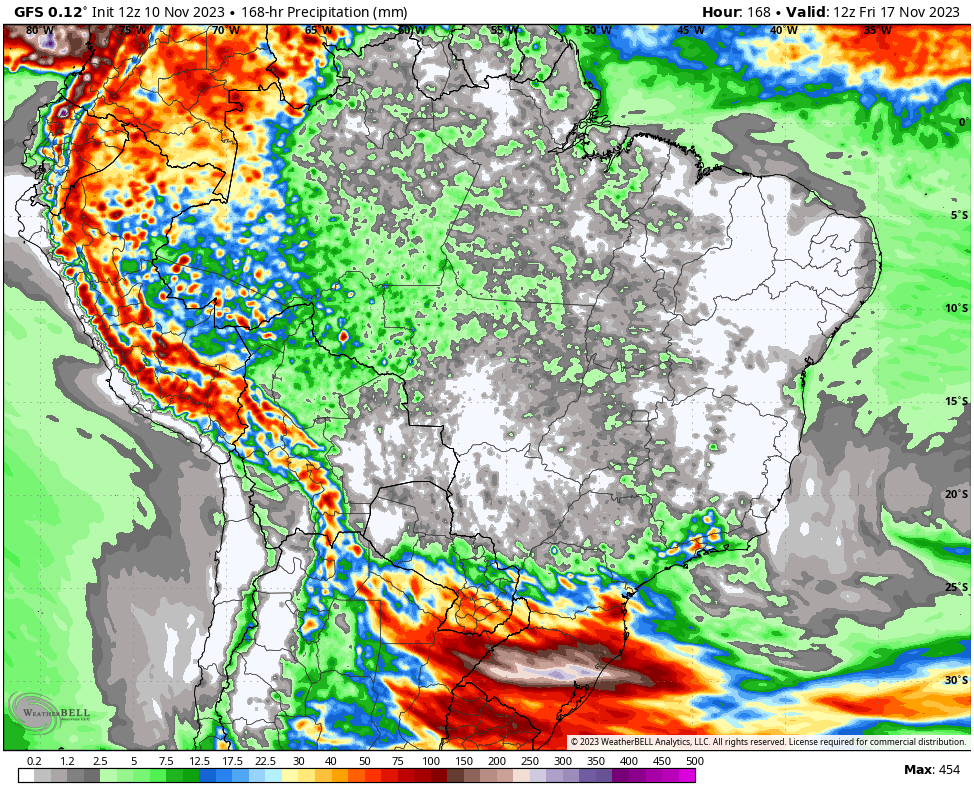

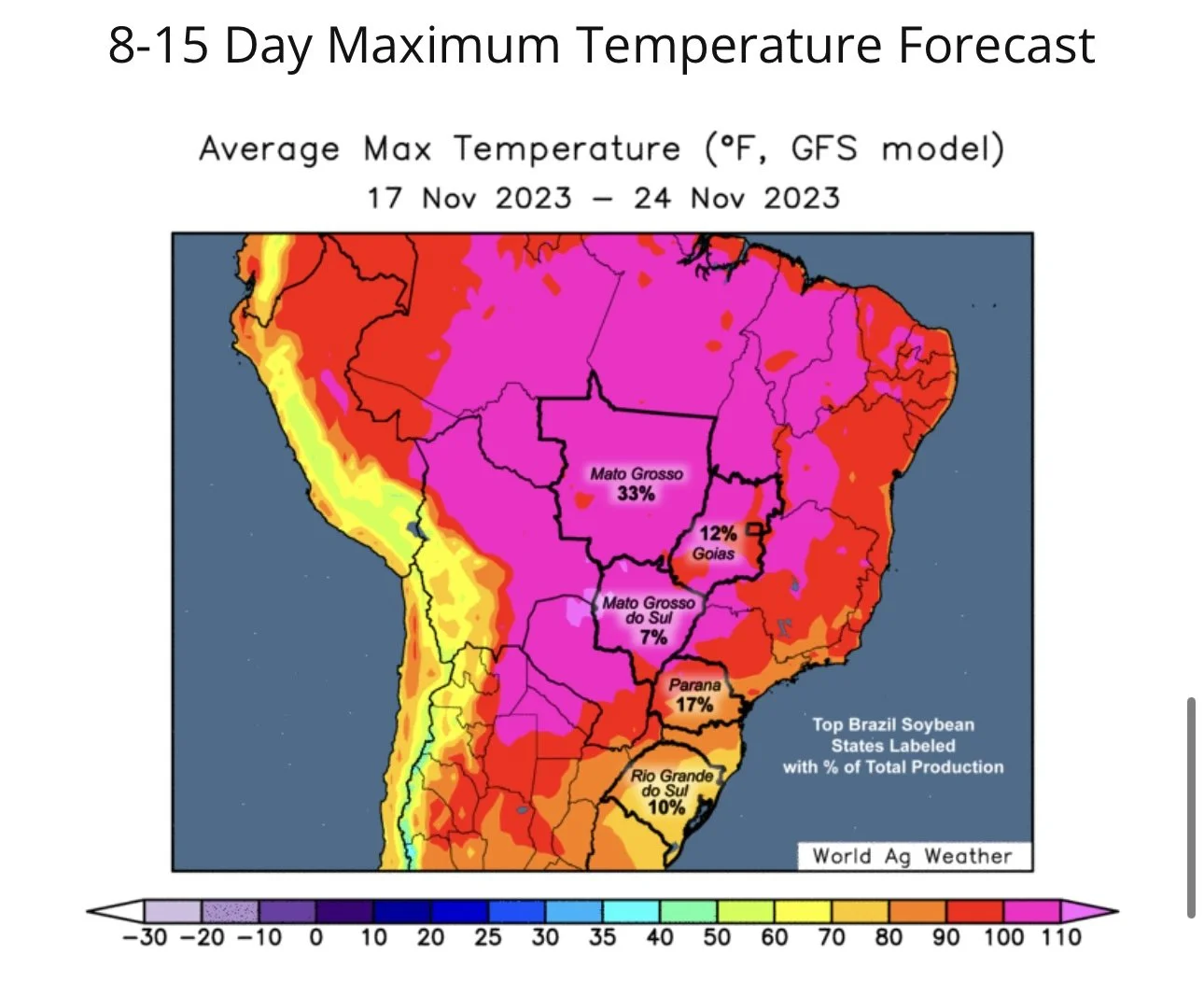

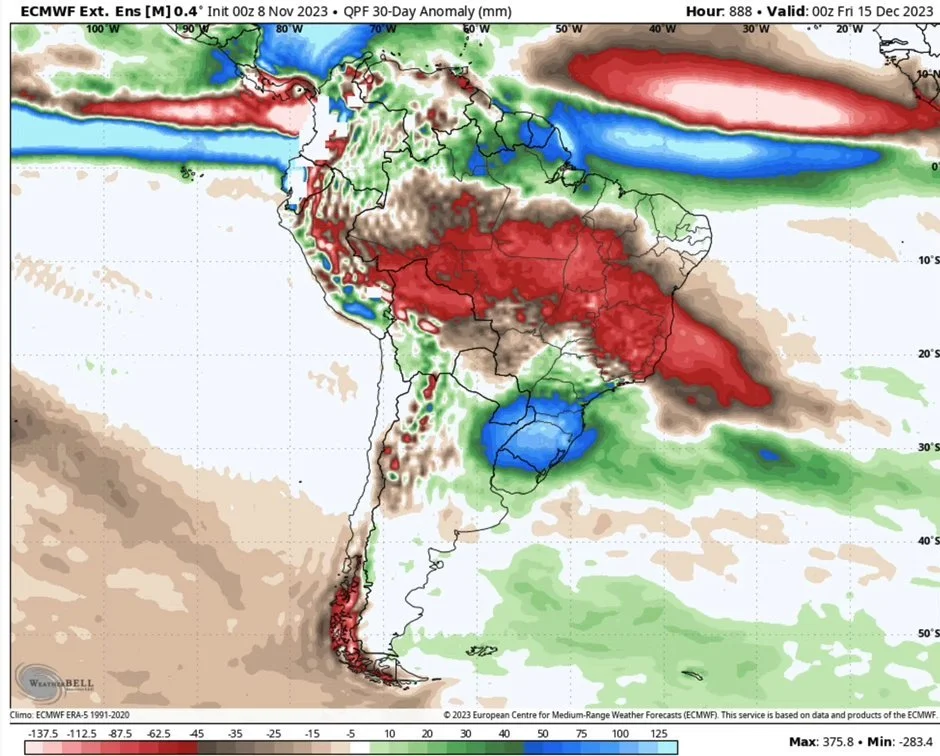

Currently, this still remains a bullish factor. It is far too wet down south, and brutally dry and hot to north. Not only is the north lacking rain, but they are also now facing record heat up there with temps of over 100 degrees.

Take a look at these forecasts and I’ll let you decide if you think this is favorable growing conditions.

Now weather can always change, but if this persists into December, Brazil could have a problem on their hands.

From Kory Melby, Brazil Ag Consultant:

"Massive replant needed the next 20 days. Doubt if enough seed and for sure wrong maturity for the cycle we are in now. Yield hit is a given."

From Wright on the Market:

"While the chatter about South American weather is much greater this week, the market is not yet investing money on it. That will happen soon, but maybe not until the first half of December, then again maybe next week. Rest assured, it will happen. Brazil is going to have little corn to export in 2024. Argentina will not have any until at least May and we know for sure Ukraine will have less corn to export for the 3rd consecutive year. Figure out a way to stay long corn & beans."

Today's Main Takeaways

Corn

Corn is 11 cents lower the past two days due to the USDA report. As mentioned, we took out that key support of $4.68 we have been talking about for weeks now. We did mention two weeks ago that there was a good possibility we looked to test or even break those lows. Now we have. So what now?

First let's look at the report. Overall, bearish.

Yield was increased nearly a large 2 bushels an acre. We have a large carryout, which we have said will make it difficult for corn to rally. But what they did do in the report was also increase our demand across the board. So that was somewhat of a silver lining, offsetting some of the production with demand. But overall, we still have a ton of corn which isn’t going to help corn rally.

What the market did not reflect in the price action the past two days is……

The rest of this is subscriber-only. Please subscribe to continue reading and receive access to all of our exclusive updates.

In today’s update we will be going over why Brazil could push the grains much higher. What the market hasn’t reflected yet from the report. Short term & long term outlook for the grains and some takeaways from the report.

TRY 30 DAYS FREE

Get every exclusive update sent vis text & email. Become a Price Maker.

Check Out Past Updates

11/9/23

USDA REPORT RECAP

Read More

11/8/23

GRAINS FIRM AHEAD OF USDA REPORT

11/7/23

GRAINS LOWER AS TRADE PREPARES FOR USDA

11/6/23

BEANS CONTINUE BULL RUN AS HARVEST WRAPS UP

11/3/23

BEANS RALLY & CORN HOLDS OFF NEW LOWS

11/2/23

EVENING THE PLAYING FIELD

Read More

11/1/23

CORN CONTINUES LOWER & BRAZIL CONCERNS

10/30/23

HOW TO BEAT BIG AG AT THEIR OWN GAME

10/27/23