USDA PRICED IN? FAIR VALUE OF CORN? BEAN BREAKOUT?

MARKET UPDATE

Todays Video Version is Subscriber Only

For Full Access: CLICK HERE

You can scroll to read part of today’s update.

Want to talk? (605)295-3100

Futures Prices Close

Overview

Soybeans and wheat both higher following yesterdays USDA report.

Corn on the other hand actually closes lower, topping out right at that 200-day MA target we had been mentioning.

Why was corn lower today?

Usually a report this bullish would’ve led to a big rally. But it did not.

It looks like the trade was already pricing in this bump in demand. Hence the recent rally.

If corn carryout would’ve remained unchanged, we likely would have taken it on the chin.

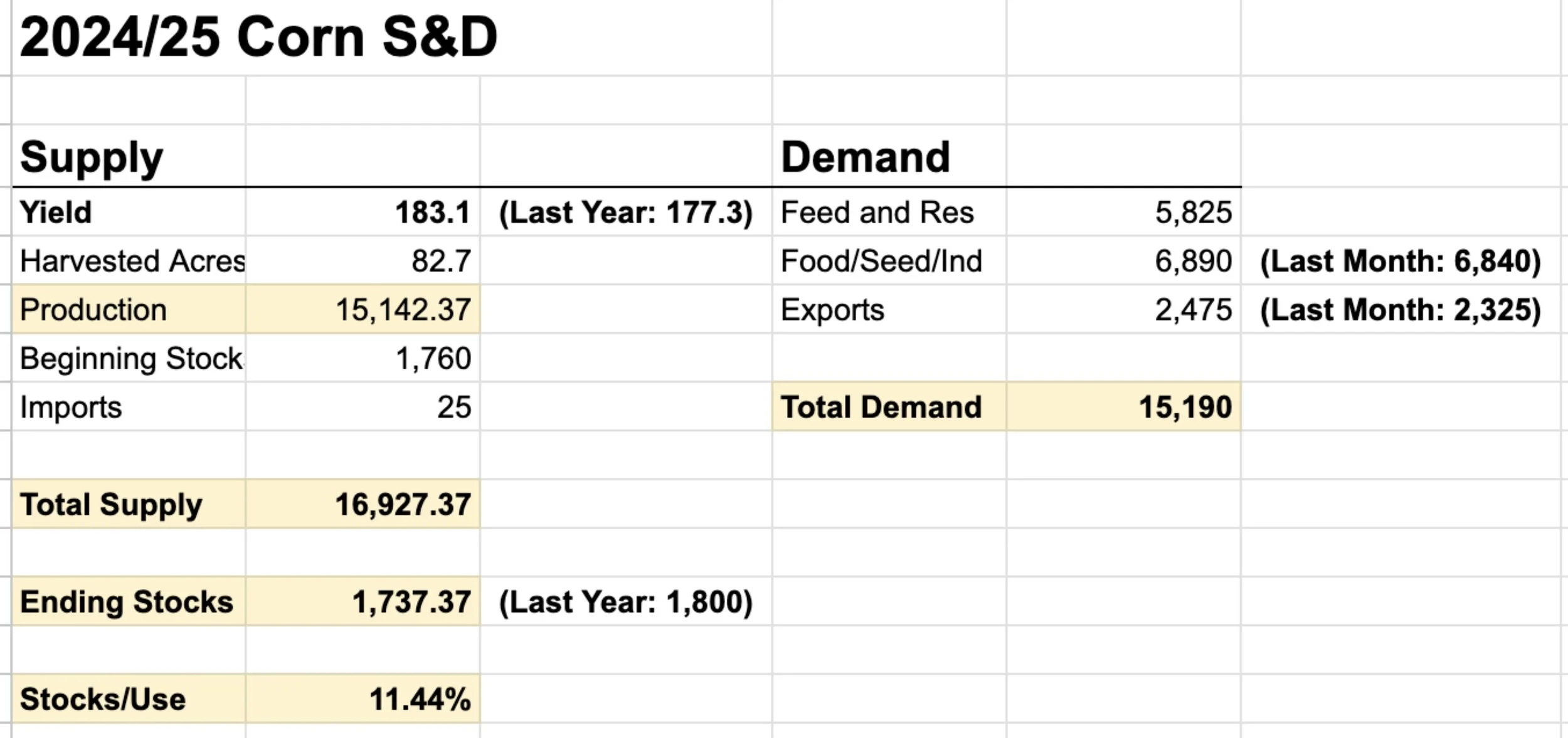

USDA Report

The USDA report was in my opinion friendly for corn and neutral to both wheat and soybeans.

The biggest surprise was of course corn demand. We thought the USDA should acknowledge demand but weren’t sure if they'd kick the can down the road.

Corn carryout fell from 1.938 to 1.738 billion. A huge -200 million bushel decrease from last month.

The demand increase came from:

+50 million bushels of ethanol

+150 million bushels of exports

Many weren’t sure if they'd pull the trigger on exports, with some questioning if demand was front ran before Trump. So the USDA must think these sales are here to stay.

Consensus was ethanol needed to be bumped and we got it. So great report for corn as the USDA acknowledged demand.

A 1.74 billion bushel carryout isn’t wildly bullish. But remember, not too long ago there was chatter about the potential for a 2.5 billion one.

As for soybeans & wheat, we didn’t see major changes.

We saw a slight bump to exports in wheat which led to US carryout dropping slightly.

The USDA also dropped China corn imports by -2 MMT to 14 MMT, so the USDA isn’t too confident China will be buying corn.

What's Fair Value for Corn?

A while ago I mentioned in my update that historically a 1 billion bushel carryout in corn roughly equates to $8.00 futures to ration demand.

Where as a 2 billion bushel carryout roughly equates to $4.00 futures.

So 1 billion = $8 and 2 billion = $4

This means that every 100 million bushels of carryout in-between equates to around 40 cents of value.

Before yesterday we had a carryout of 1.9 billion which meant corn's "fair value" was about $4.40

Today corn carryout is at 1.74 billion. Which means we have 250 million bushels less than 2 billion.

That equates to about +$1.00 higher than $4.00 (2 billion bushels) if every 100 million truly equals $0.40 cents of value.

The numbers broke down:

-100 million = $0.40 cents

-100 million = $0.40 cents

-50 million = $0.20 cents

Total: -250 million or $1.00 of value vs a 2 billion bushel carryout and $4.00 futures.

Based on this, one could suggest corn has a true value of about $5.00 as of today.

Black Oil Sunflowers Offers:

We are looking for black oil sunflower offers.

Shoot Jeremey a call or text at (605)295-3100 with any new crop black oil sunflowers you have for sale.

With harvest over now, this is the time where you need to be proactive and have a marketing plan.

So if you'd like to talk through your operation, please feel free to reach out to us. It doesn’t cost you anything.

(605)295-3100

Today's Main Takeaways

Corn

Like I have been saying for a long time, I still think demand will lead corn higher longer term. Which is exactly what we are seeing thus far.

Corn yield is +6 bpa higher than last year, but carryout is now actually lower than last year, (Current: 1.738 / Last Year: 1.80 billion). This is possible due to demand.

Demand driven markets last. Supply driven ones do not.

Short term, I could see us take a breather. From a technical standpoint we are overbought and due for a small correction.

Looking long term, one tailwind we might face next year is……………..

The rest of this is subscriber-only. Please subscribe to keep reading & get every daily update.

In today’s update we go over why corn might be due for a short term correction, the possible breakout in beans, why wheat could be undervalued & more.

TRY 30 DAYS FREEE

Comes with our daily updates. Signals & 1 on 1 market plans tailored to your specific operation.

Past Sell or Protection Signals

We recently incorporated these. Here are our past signals.

Oct 2nd: 🌾

Wheat sell signal at $6.12 target

Sep 30th: 🌽

Corn protection signal at $4.23-26

Sep 27th: 🌱

Soybean sell & protection signal at $10.65

Sep 13th: 🌾

Wheat sell signal at $5.98

May 22nd: 🌾

Wheat sell signal when wheat traded +$7.00

Want to Talk?

Our phones are open 24/7 for you guys if you ever need anything or want to discuss your operation.

Hedge Account

Interested in a hedge account? Use the link below to set up an account or shoot Jeremey a call at (605)295-3100.

Check Out Past Updates

12/10/24

USDA BREAKDOWN

12/9/24

USDA TOMORROW

12/6/24

CORN TRYING TO BREAKOUT. MAKING MARKETING DECISIONS

12/5/24

OPTIMISTIC BOUNCE IN GRAINS

12/4/24

WHEAT UNDERVALUED? MOST RISK IN BEANS. HAVE A GAME PLAN

12/3/24

BEANS HOLDING DESPITE LACK OF BULLISH STORY

12/2/24

TRUMP & BRAZIL HURDLES

11/27/24

CORN SPREADS, CRUCIAL SPOT FOR BEANS, SEASONALITY SAYS BUY

11/26/24

TARIFF TALK PRESSURE

11/25/24

HOLIDAY TRADE, SEASONALS, TARGETS & DOWNSIDE RISKS

11/22/24

CORN TARGETS & CHINA CONCERNS

11/21/24

BEANS NEAR LOWS. CORN NEAR HIGHS. 2025 SALE THOUGHTS

11/19/24

WHAT’S NEXT FOR GRAINS

11/18/24

WHEAT LEADS THE GRAINS REBOUND

11/15/24

BIG BOUNCE, FUNDS LONG CORN, DOLLAR & DEMAND

11/14/24

3RD DAY OF GRAINS FALL OUT

11/13/24

GRAINS CONTINUE WEAKNESS & DOLLAR CONTINUES RALLY

11/12/24

ANOTHER POOR PERFORMANCE IN GRAINS

11/11/24

POOR ACTION IN GRAINS POST FRIENDLY USDA

11/8/24

USDA FRIENDLY BUT GRAINS WELL OFF HIGHS

11/6/24

GRAINS STORM BACK POST TRADE WAR FEAR

11/5/24

ALL ABOUT THE ELECTION & VIDEO CHART UDPATE

11/4/24

ELECTION TOMORROW

11/1/24

GRAINS WAITING ON NEWS

10/31/24

ELECTION & USDA NEXT WEEK

10/30/24

SEASONALS, CORN DEMAND, BRAZIL REAL & MORE

10/29/24

WHAT’S NEXT AFTER HARVEST?

10/25/24

POOR PRICE ACTION & SPREADS WEAKEN

10/24/24

BIG BUYERS WANT CORN?

10/23/24

6TH STRAIGHT DAY OF CORN SALES

10/22/24

STRONG DEMAND & TECHNICAL BUYING FOR GRAINS

10/21/24

SPREADS, BASIS CONTRACTS, STRONG CORN, BIG SALES

10/18/24

BEANS & WHEAT HAMMERED

10/17/24

OPTIMISTIC PRICE ACTION IN GRAINS

10/16/24

BEANS CONTINUE DOWNFALL. CORN & WHEAT FIND SUPPORT

10/15/24

MORE PAIN FOR GRAINS

10/14/24

GRAINS SMACKED. BEANS BREAK $10.00

10/10/24

USDA TOMORROW

10/9/24

MARKETING STYLES, USDA RISK, & FEED NEEDS

10/8/24

BEANS FALL APART

10/7/24

FLOORS, RISKS, & POTENTIAL UPSIDE

10/4/24

HEDGE PRESSURE

10/3/24

GRAINS TAKE A STEP BACK

10/2/24

CORN & WHEAT CONTINUE RUN

10/1/24

CORN & WHEAT POST MULTI-MONTH HIGHS

9/30/24