WHAT COULD CAUSE THE FUNDS TO COVER?

BLACK FRIDAY SALE ENDS THIS WEEKEND

Overview

Mostly higher prices in the grains following the sell off the past few days. As all fo the grains aside from corn who continues to trade slightly lower, making new contract lows.

Yesterday both corn and wheat made new lows.

Today, the wheat market managed to hold yesterday's lows, while soybeans led the way higher today. Taking back a good chunk of the the 2 day -45 cent sell off.

Beans mainly higher with Brazil forecasts looking dry. As well as news that the estimates for Brazil's bean crop come in at 155 million metric tons. This is a -5% drop from what the USDA currently has forecasted.

Why did we make new lows in corn and wheat?

There was no fresh news to support the lower price action. Matter of fact it was simply a "lack" of bullish news to feed the bulls.

Once corn and wheat came face to face with those lows yesterday and we were not able to hold, this triggered additional technical selling and selling from the funds.

The funds main goal is to make money, as is anyone else’s in the market. Here are the rough numbers of their current positions.

Corn: Short 185k

Chicago: Short 108k

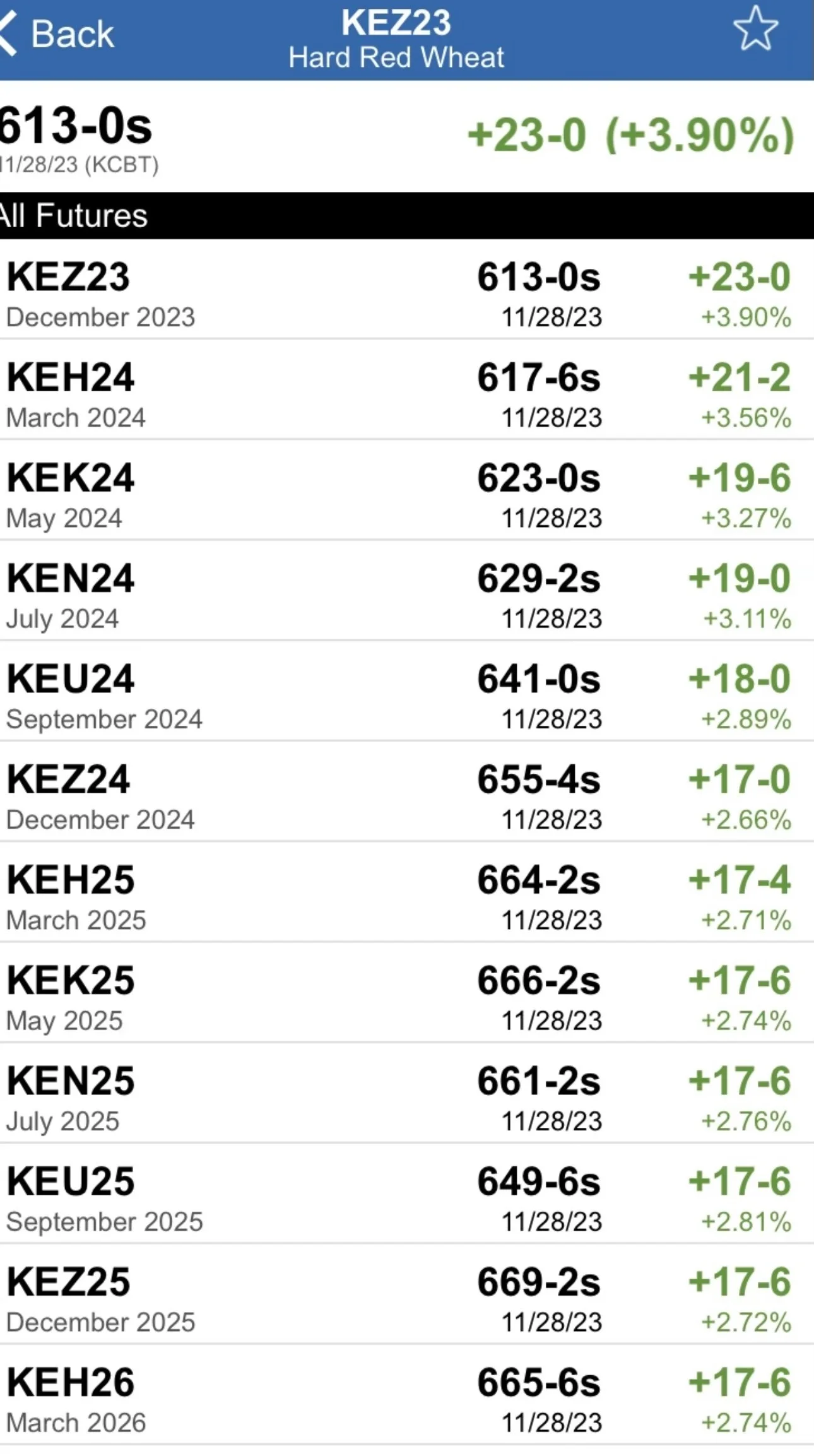

KC: Short 48k

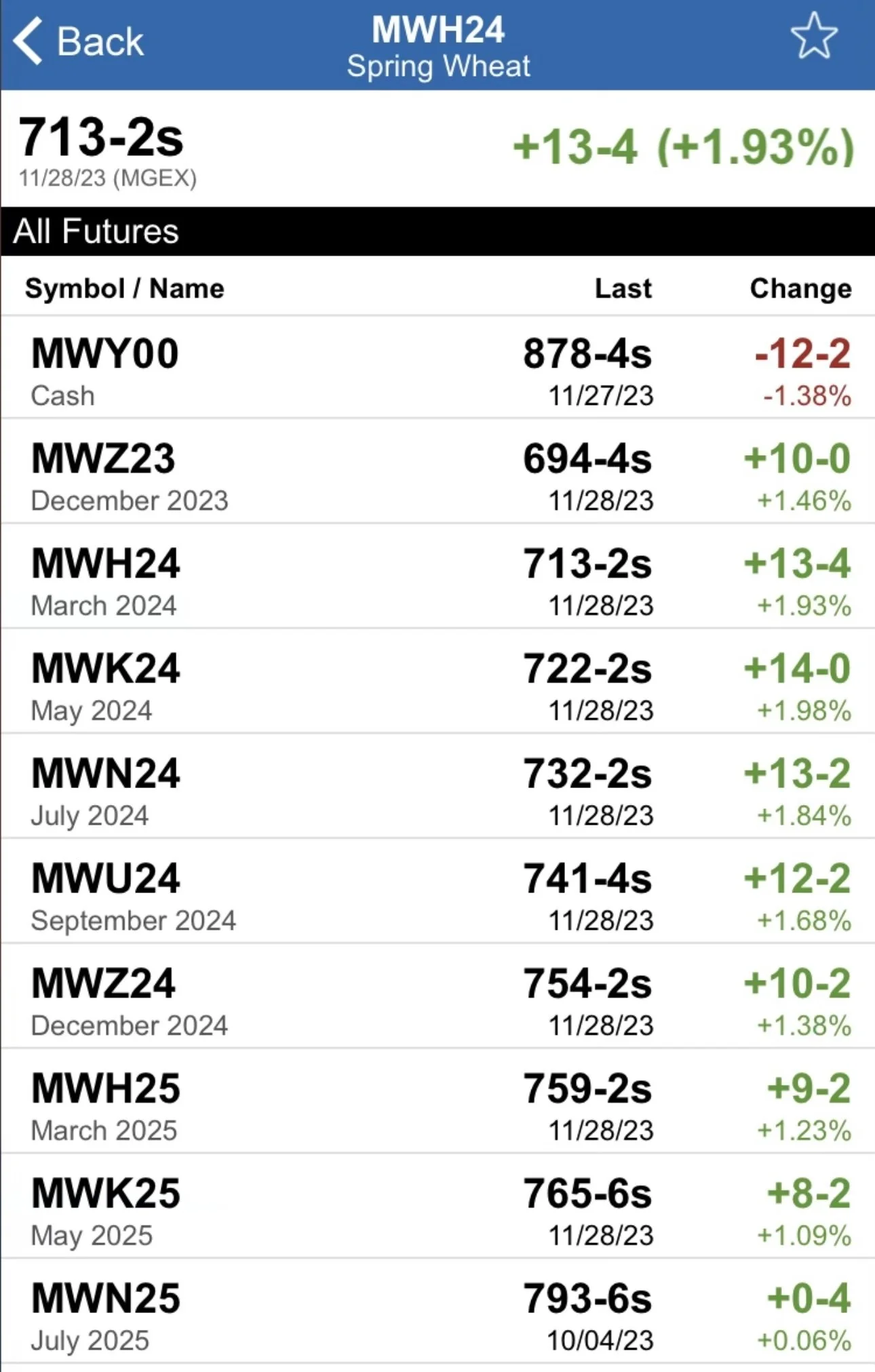

MPLS: Short 28k

Beans: Long 82k

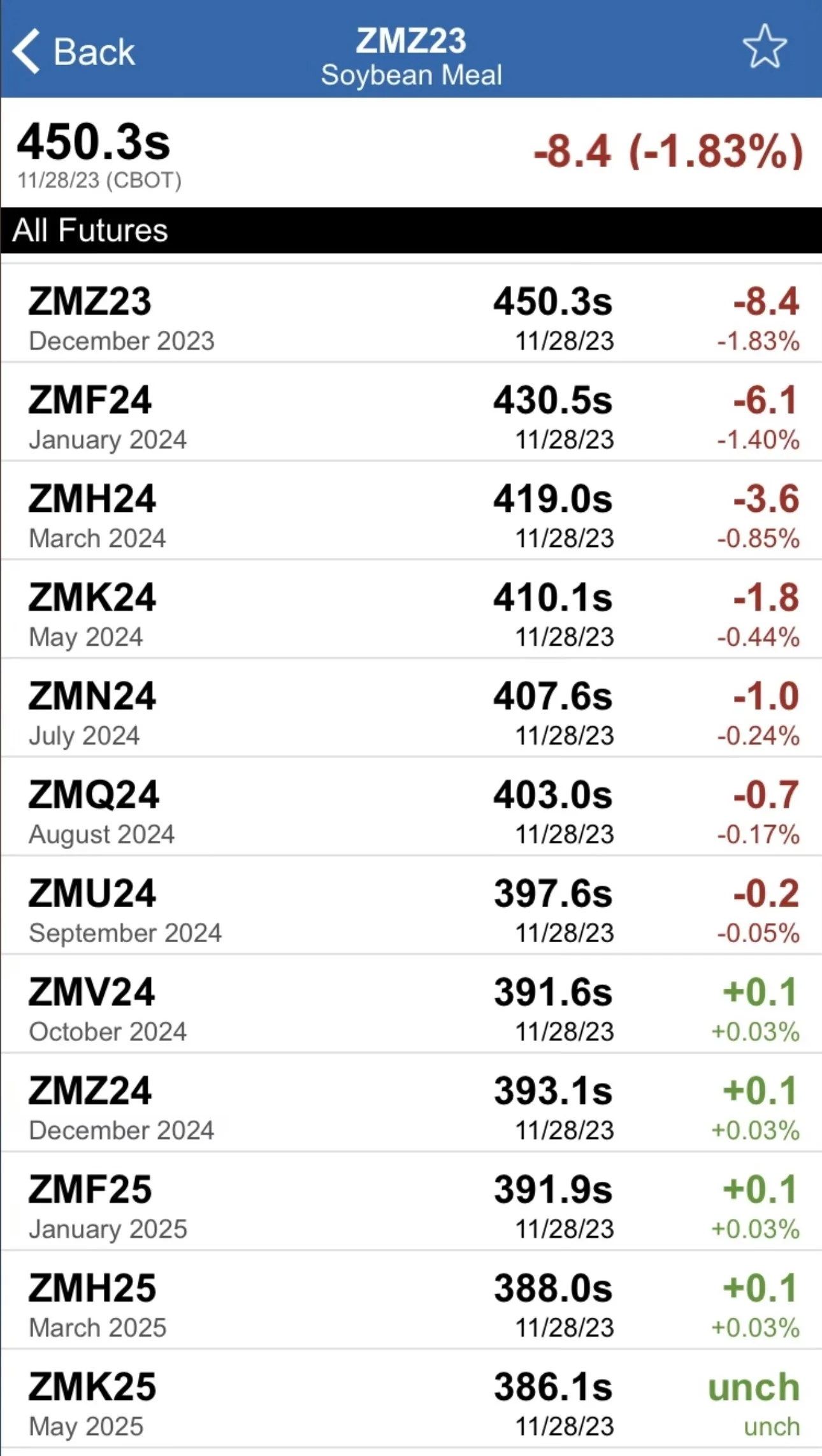

Bean Meal: Long 138k

The funds believe this is their best way to make money currently. Short corn and wheat, while being long the bean complex.

One thing to keep in mind here.. the funds do NOT ride a losing position. If things start to go sideways and the tables shift, they will jump shift and liquidate that entire position.

So what are some things that could cause this to happen?

For corn and beans, they are both largely going to be determined by this South American crop as forecasts.

Mark Gold from Top Third said:

"I think the USDA and Brazil will have to start ratcheting down these expectations of crop sizes out there. We are heading into December & January which are the key growing months for beans. They are very short moisture in the northern part of the country, they are too wet to the south. I don’t think that will make for a crop that's a bin buster."

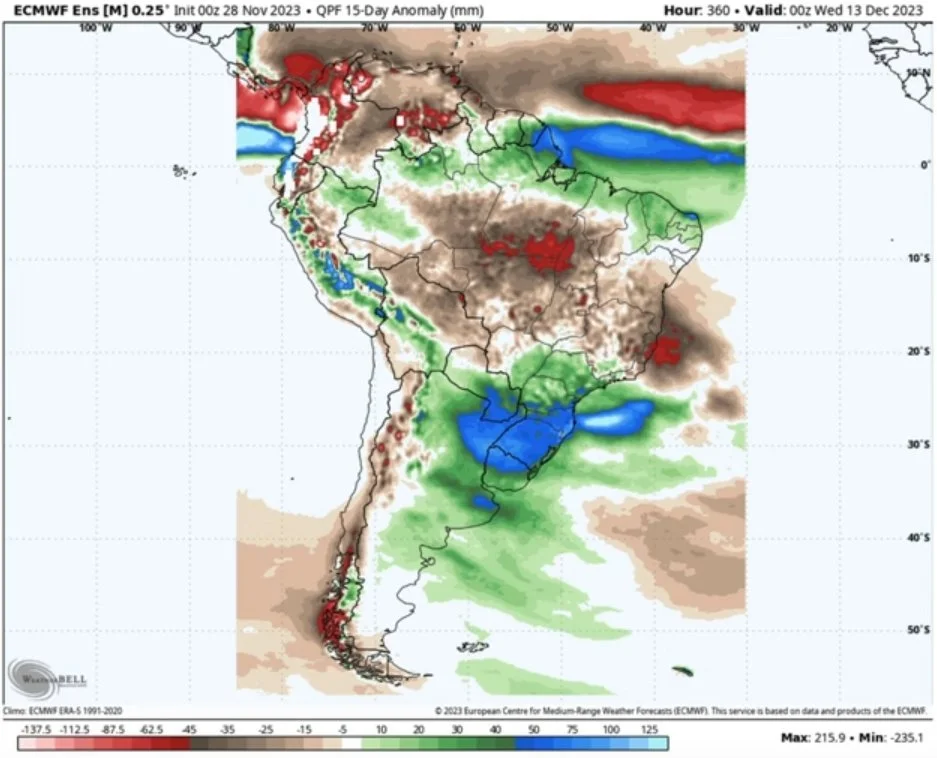

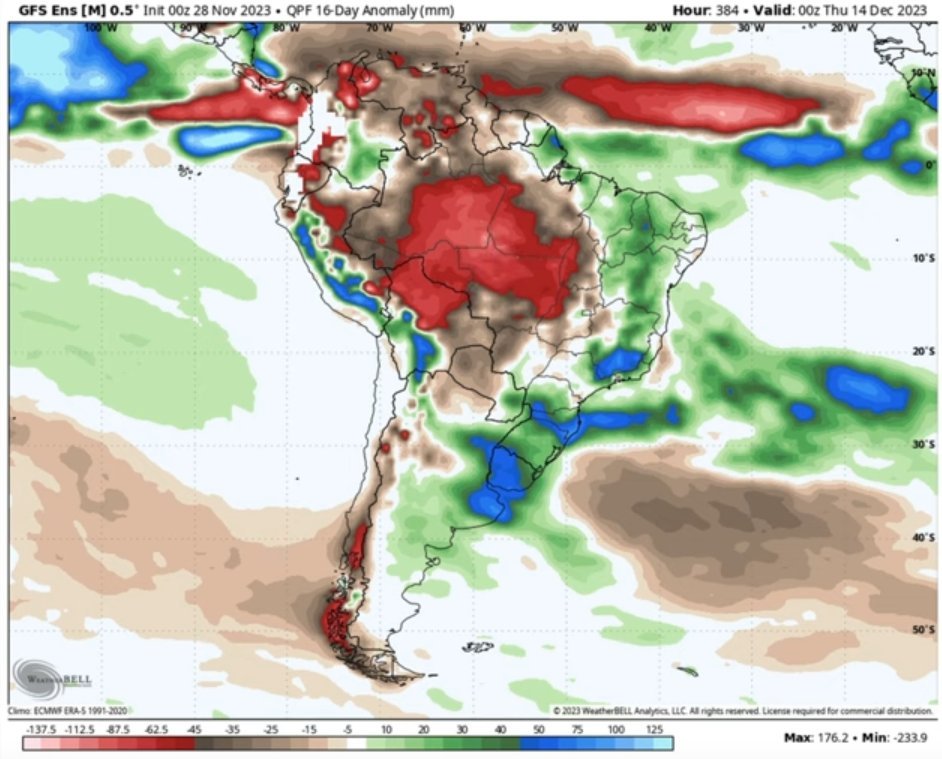

The US models suggest Brazil will be hot and dry once again.

Here is the current outlook for Brazil:

Now yes, this whole Brazil situation will have a far more direct correlation to beans rather than corn. Even though yes, I believe Brazil could have a big safrinha corn problem down the line. But it may take the markets a few months to come to that realization.

So what could give the funds a reason to cover corn?

Well we have a massive carry out. So a major rally will not be an easy task here short term, but it's possible.

Corn will need a change in the demand story and they will need China to step in with a large appetite.

What about wheat? There are a few "potential" factors that could cause some short covering. Those being, an unknown black swan event, the war, Australia crop size, and Chinese demand. We also have the fact that at the end of the year, the funds often look to "rebalance" and take profit.

We will touch on these more later in today's update.

Before we get into the update. Here was a question from Jared from Illinois that he asked us.

He asked:

"How can I capture the carry on my corn basis contract?"

Our response was:

"Some guys don't know this, but when you do a basis contract you sold your corn. Once it's delivered you no longer own it. If the company goes bankrupt, your corn is not protected by the USDA like it would be if it was on open storage.

Once you deliver on a basis contract, you are long FUTURES in the buyers account. If you roll and don’t price, you will be deducting the carry and possibly fees from your basis or net price received."

His response:

"How do I capture the carry on the corn then? I have corn in my bin how can I capture the carry?"

Our response:

"You can capture the carry by making deferred delivery cash sale or locking in the futures portion via either an HTA or selling futures in your hedge account.

If you already have an HTA or futures sold, you roll to the appropriate month.

Just putting the corn in the bin by itself DOES NOT lock in any carry, It exposes you to flat price. The definition of a carry in our view is getting paid more to deliver the grain later than nearby and locking it.

When deciding if you should do a cash sale for later delivery or to use futures, you should consider your basis outlook, time of year when you want to deliver along with local supply outlook for that time. Typically in a carry market, one should wait for basis and use futures versus a cash sale."

He then asked:

"Can I lock in carry without setting the price?"

We said:

"Yes you can but it is very tricky and it only locks it in if you actually get priced at some point. You can do this by buying the nearby contract and selling the deferred."

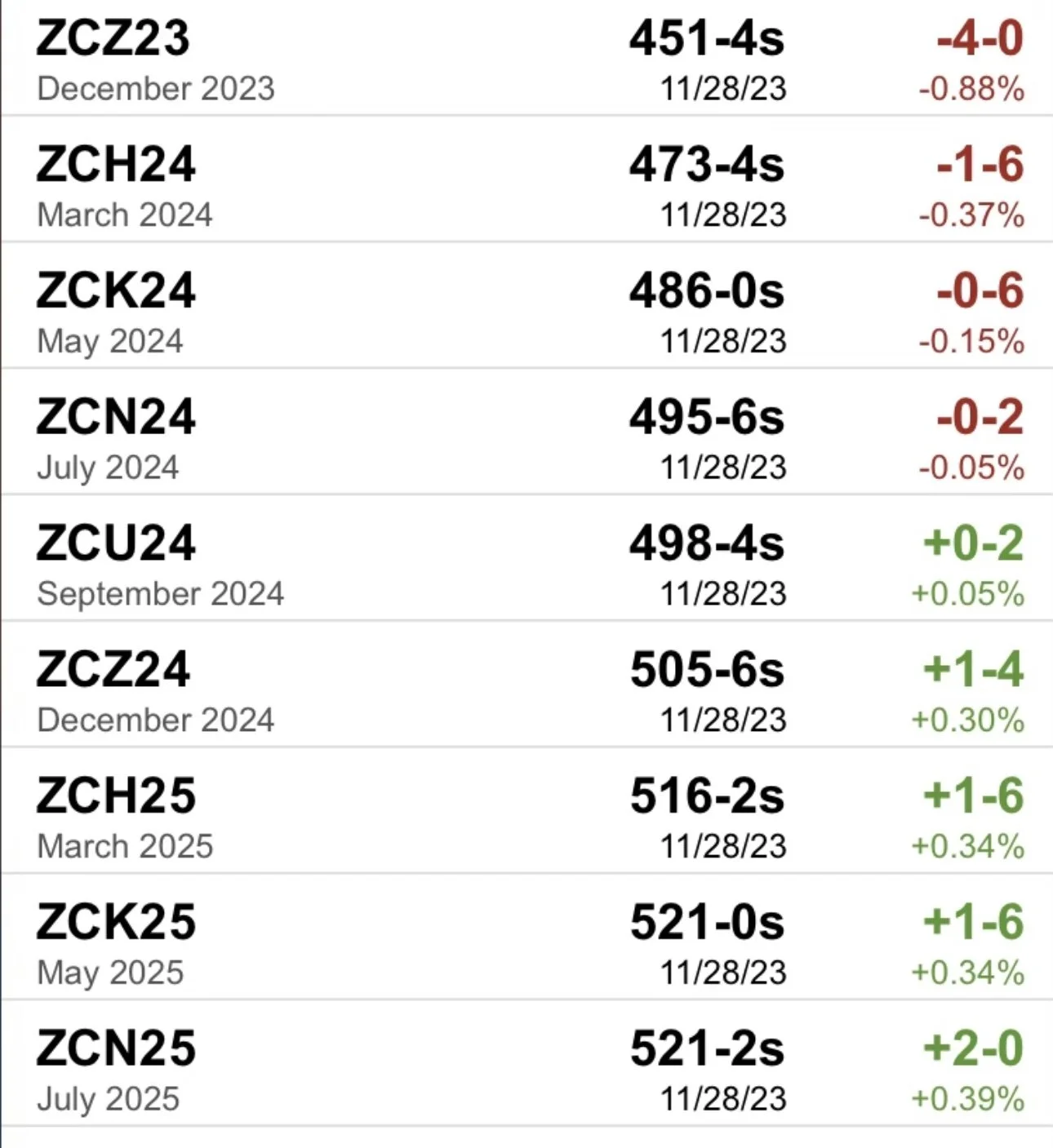

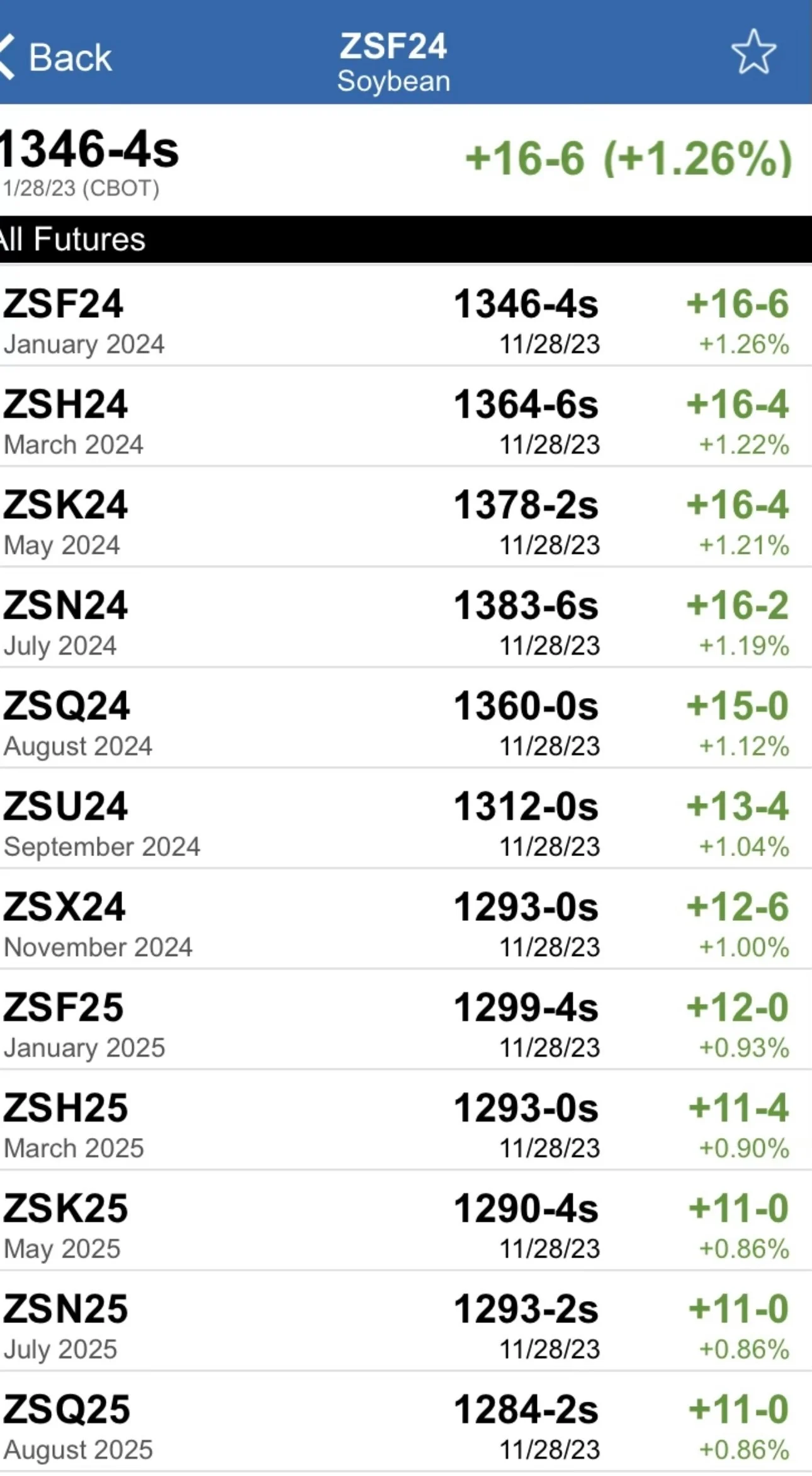

For those of you that are familiar with DTN, one of their biggest approaches is about what the futures spreads are telling us. A carry market means that the end users will pay you to store the product because they don’t need it right away.

An inverted market means that they need the supply sooner than later. An inverted market is bullish, while a carry market is bearish. Notice that soybeans have a carry to July, but then inverted to new crop of 24.

Corn and wheat have big carries... if one is selling these sell the carry.

One bullish sign out there is the bean oil and meal... both are inverted.

Take a look at the following market structures:

Today's Main Takeaways

Corn

Corn slightly lower again after posting new lows yesterday.

Why did corn drag lower while the rest of the grains rebounded today?

For starters, the weather in Brazil is more impactful for soybeans. The sarfihna corn crop worries are coming, but not quiet there yet.

We also have……

The rest of this is subscriber only content. Subscribe to keep reading & receive every exclusive update. Scroll to check out updates you would have received.

OUR BIGGEST SALE OF THE YEAR ENDS THIS WEEKEND

Don’t miss out. Become a price maker.

NOT SURE? TRY 30 DAYS FREE

Get every update sent via text & email

CHECK OUT OUR PRICE MAKER PROGRAM

Completely take your marketing to the next level. Limited spots.

WANT TO TALK?

Our phones are open 24/7 for you guys if you ever need anything or want to discuss your operation.

PAST UPDATES

11/24/23

POST THANKSGIVING MELT DOWN

11/22/23

WHAT’S THE BRAZIL STORY?

11/21/23

WHAT TO DO WITH YOUR CORN BASIS CONTRACTS

11/20/23

ARE YOU UTILIZING THE RIGHT STRATEGIES OR GETTING TAKEN ADVANTAGE OF?

11/17/23

DO THESE BRAZIL RAINS MATTER?

11/16/23

WAYS TO OUTPERFORM THE MARKET

11/15/23

FINDING THE RIGHT GAME PLAN

11/14/23