WEATHER IMPROVING, BUT DAMAGE WAS DONE

MARKET UPDATE

Futures Prices Close

Overview

Grains mixed as corn and wheat see a slight bounce as they look for a bottom while soybeans continue to slip off of their recent highs. However, beans did manage to close nearly a dime off their lows.

This morning we saw yet another sale of beans, with 251k tonnes to unknown. We now have a crop that is getting smaller everyday and China continues to take more soybeans. Not exactly a bearish scenario.

The crude oil market continues it's recent rally. Trading at it's highest levels since last November. WTI crude is now up nearly 30% in the past 2 months.

The dollar also continues it's recent rally, trading at it's highest levels since March. This definitely isn’t helping our exports.

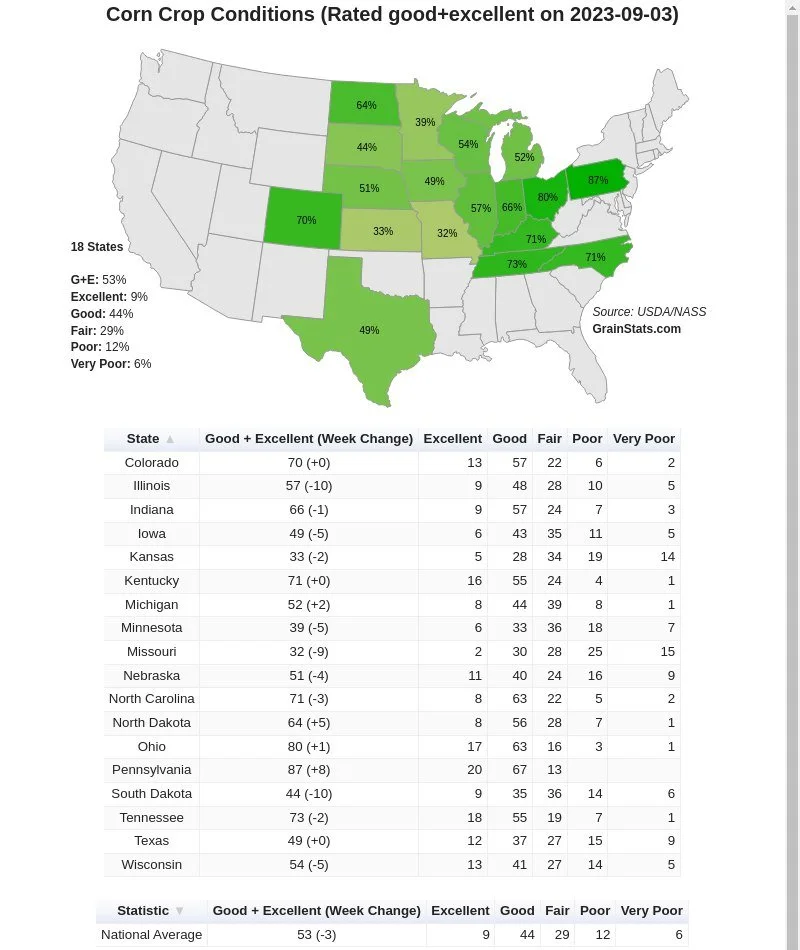

Now crop conditions, I've been patiently waiting since last Monday to see these. I mentioned all week last week that I fully excepted these to drop much more significantly than we had seen them drop last Monday.

Bulls get a nice little surprise especially in the beans. As bean ratings dropped by 5% from 58% to 53% rated good to excellent.

Corn also dropped by 3% from last week, to add on to last week's 2% drop.

Much more bullish numbers than last week's disappointing numbers, where soybeans only dropped 1% last week..

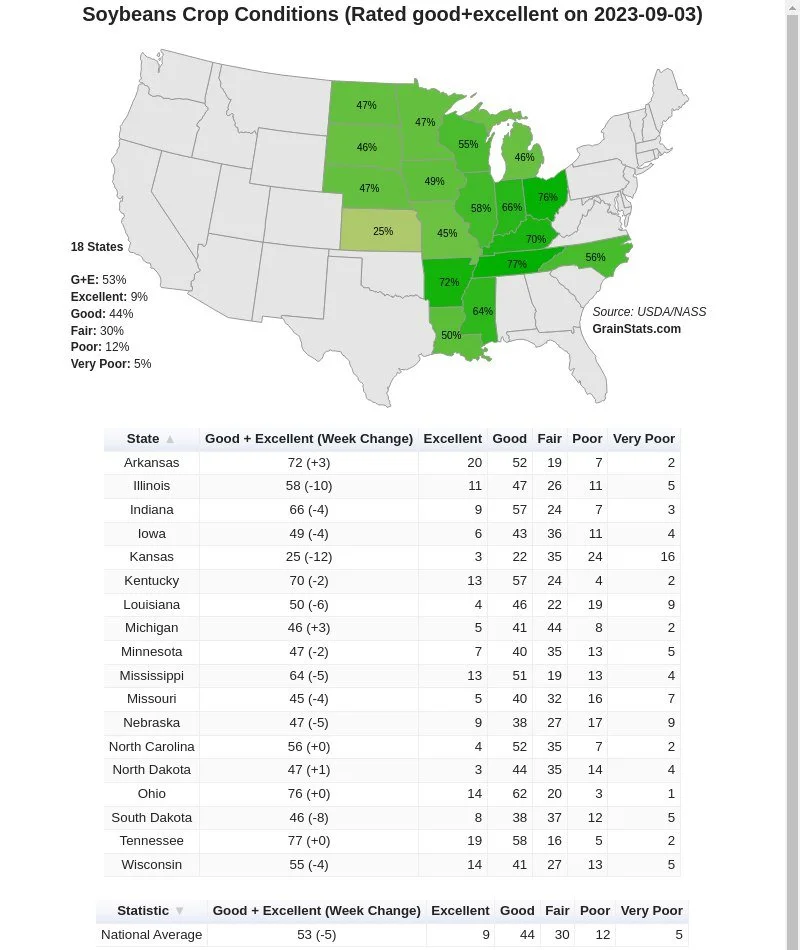

Here are the top 5 producing soybean states vs their ratings from last year:

Illinois: -9%

Iowa: -17%

Minnesota: -23%

Indiana: +10%

Ohio: +19%

Very good chance that the USDA printed it's high for bean yields.

Here is the state by state breakdown and changes from GrainStats.

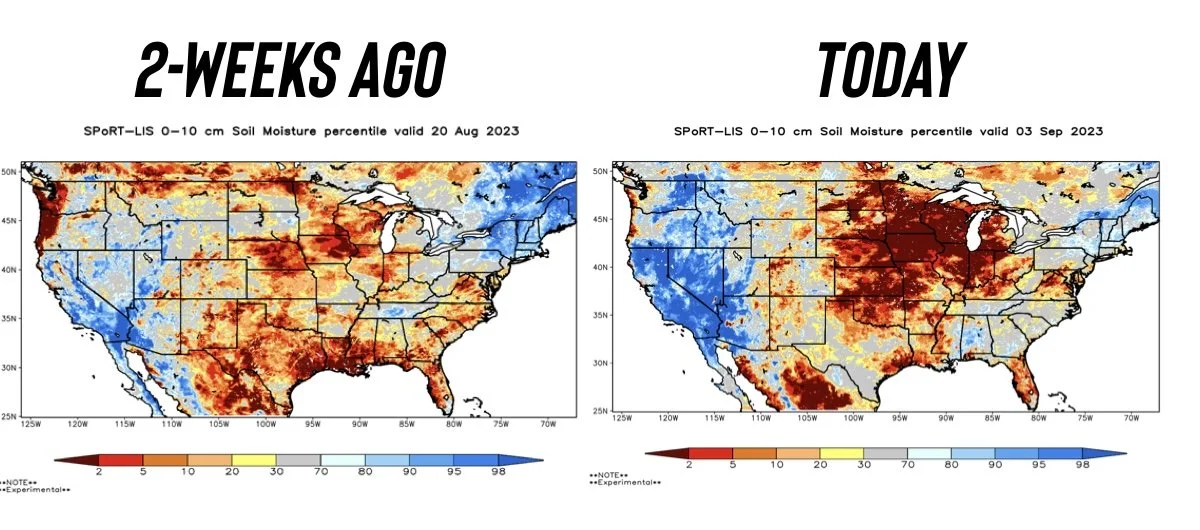

Let's take a look at the soil moisture situation.

Not much of a difference between the top 4 inches and the top 40 inches.

Here is the soil moisture change over the past 2-weeks.

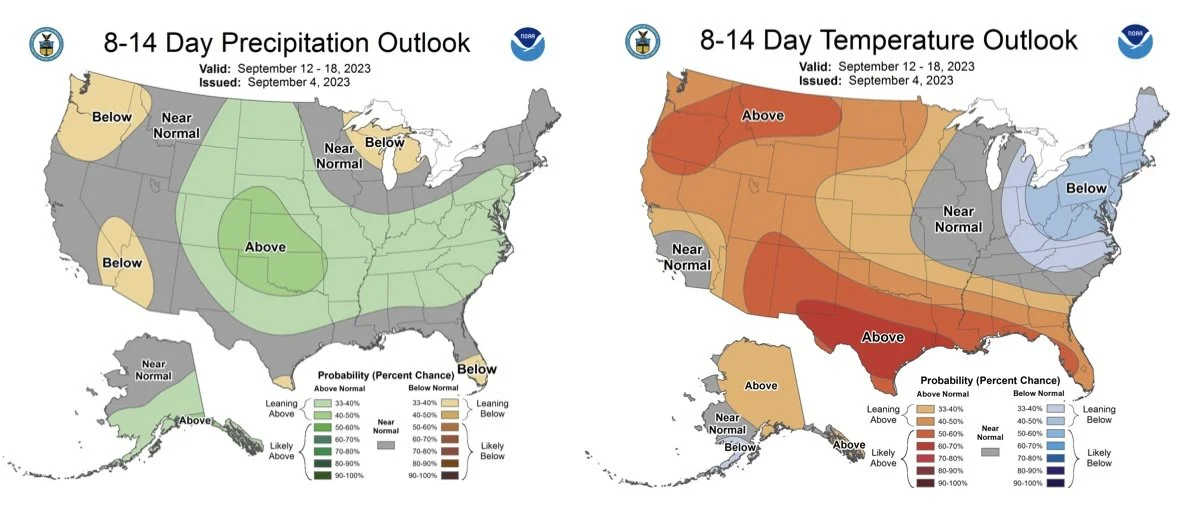

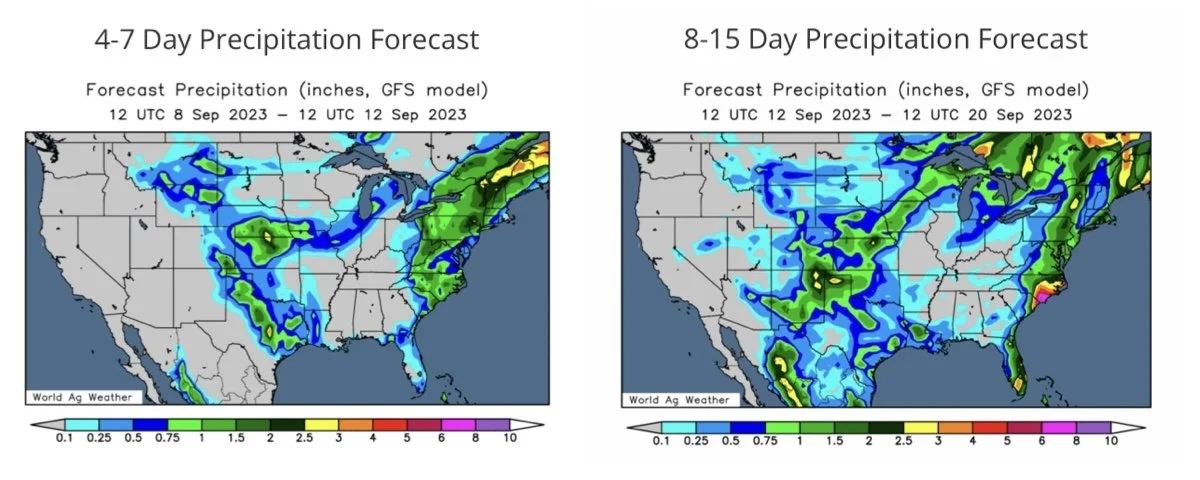

The forecasts have started shifting more bearish, especially considering the recent heat and dryness. As a good portion of the corn belt is now expected to see some rain with cooler temps.

Although rain is expected, the next two weeks still look fairly dry compared to normal for a good portion of the corn belt aside from the west side of the Dakotas, Nebraska, and Kansas.

Overall, we had a brutal last two weeks. It was extremely hot and dry over the weekend, causing more damage to these crops, and I think the extent of this damage is being underestimated by the market and I think we still have some issues not only in the US but globally in countries such as Australia, India, Argentina. Long term a bullish picture for the grains, but we may have to get through the harvest first before we are looking at a major rally in corn and wheat.

However, I do expect this crop conditions report to support us nicely heading into tomorrow on the corn and beans.

One week from today, all eyes will be on the USDA's crop production and Supply & Demand reports. More importantly, everyone will be watching where yields come in at for corn and beans as well as demand for new crop.

Today's Main Takeaways

Corn

Corn nearly a nickel higher here today, as bulls look to find a bottom.

This next image is from Ben Heath, a producer in Nebraska. These 2 ears of corn have the same number of kernels. The importance of how a crop finishes is this simple.

The market is going to be in for a surprise when they realize the extent of damage we've seen and that yes. It matters how a crop finishes.

The market is nowhere close to pricing in a 167 crop, but it is definitely a real possibility. Now it may take a very long time until the USDA comes to the realization, but eventually they will.

The past 10 years. Corn has made it's harvest low in August 6 of those years. This year could still be one of those years that follows history, as our current low of $4.72 was made back on August 16th.

What about years where we didn’t make our lows in August? 3 of those 10 years, we made our lows in September. The latest we have made a low in the past decade was all the way back in 2014, where we made our low on October 1st.

Our average rally from these harvest lows the past decade is $0.64 cents. However, the past 3 years, this average jumps to $1.05. I expect this rally from our harvest low to be in the same realm, as things are so much more volatile over the past few years. Take this past July for example. We rallied $0.90 cents from July 13th to July 25th. 12 days is all that took. What about our May to June rally? That was a $1.40 rally.

Harvest is not the time to be selling……

The rest of this post is subscriber content only. Please subscribe to keep reading and receive every exclusive update via text & email.

In the rest of today’s update we go over corn could be going higher from here and where our lows could be made. Why the bull run in beans isn’t quiet over yet and more.

LABOR DAY SALE ENDS SOON

Get all of our exclusive updates for a fraction of the cost. Scroll to check out past updates you would have received.

NOT SURE? TRY 30 DAYS FREE

Check Out Past Updates

9/1/23 - Audio Commentary

HOW MUCH DAMAGE WAS DONE & WHAT IS MARKET EXPECTING

Read More

8/31/23 - Audio Commentary

THIS CROP HAS MORE DAMAGE THAN MOST REALIZE. DON’T PANIC SELL

8/30/23 - Audio Commentary

THIS VOLATILITY ISN’T GOING ANYWHERE

8/28/23 - Market Update

WEATHER REMAINS BULLISH BUT CROP CONDITIONS DISAPPOINT

Read More

8/27/23 - Weekly Grain Newsletter

ECON 101 APPLIED TO GRAIN SALES

Read More

8/25/23 - Market Update

BEANS CONTINUE BULL RUN

Read More

8/24/23 - Audio

BEAN DEMAND STORY CONTINUES TO GROW AS CROPS GETTING SMALLER

8/23/23 - Market Update

CROP TOURS, BRUTAL HEAT, & NO RAIN

8/22/23 - Audio