WEEKLY GRAIN NEWSLETTER

BASIS CONTINUES TO FIRM

By Jeremey Frost

This is Jeremey Frost with some not so fearless grain marketing commentary for www.dailymarketminute.com

First off I need to thank the Veterans that have given me the opportunity to live in the best country in the world. The Veterans have made America Great, thank you!

This picture collage pretty much sums up life. Thank you farmers and thank you Veterans.

The above should remind farmers just how important they are as well as how much control they can have on the journey to becoming price makers.

Welcome to the team!

“Howdy! I am Barry Morris, friends call me Bud. I am a graduate of Texas A&M University with a degree in Agricultural Development. I worked as a grain merchandiser in Texas, Kansas and Arkansas for the last 12 years. Now as a grain and feed broker with Morris Agriculture, I am excited to be joining the team at Daily Market Minute.

I reside in McKinney, Texas with my wife, two children and an old, crotchety blue heeler. My wife believes I can fix, build or smoke anything, but my favorite skill is beekeeping. I manage several apiaries across North Central Texas.”

For those of you in Texas, Oklahoma, Kansas, and Missouri make sure you give Barry a call if you need help moving some grain as he will do his best to give you the best information to help your decision making. Barry’s number is 214-250-3888.

Where do the grain markets go from here?

Let’s just say this, as winter hits where do bears go? Hibernation. And that’s if they don’t get caught in a bear trap that the bulls have been setting. With harvest over, look for the bears to start leaving our markets. Too much uncertainty with Russia and Ukraine, along with tight balance sheets and upcoming weather scares over the next several months will likely leave the bulls in charge. I look for grains to bounce as we close the year out. We have much tighter balance sheets, with less days supply for all three of the major grains than a year ago.

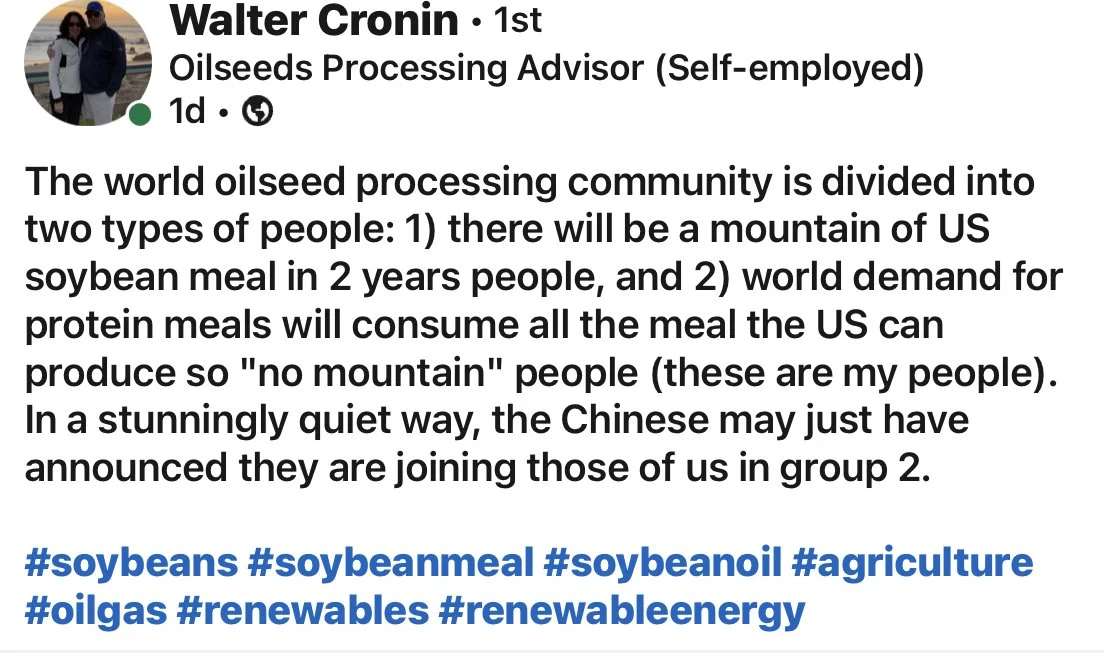

Below is from Walter Cronin from LinkedIn. I think he is on to something very major and that is “world demand for protein meals will consume all the US can produce…….the Chinese may have just announced they are joining” that they will consume all that the US can produce. This is major and is just one more reason why I think we will see new all-time highs for most of the grain markets in 2023.

Take a look for yourself.

The above looks extremely bullish to me. As we are basically about ready to tell China we don’t have enough beans for you. But we will get you some soybean meal. How bullish is it that the US is about to tell its biggest customer that we don’t have enough soybeans to supply you, but you can have our leftover soybean meal.

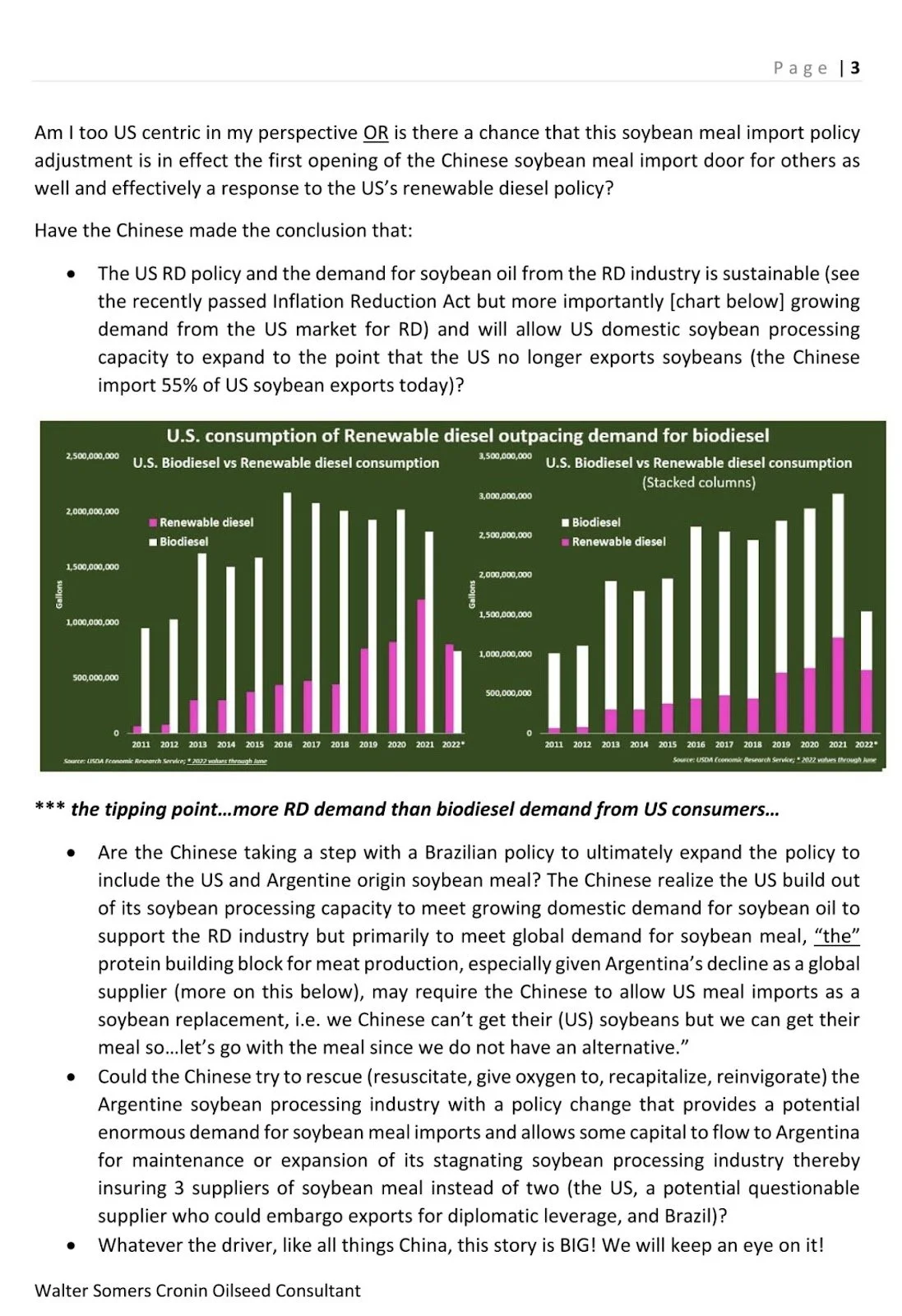

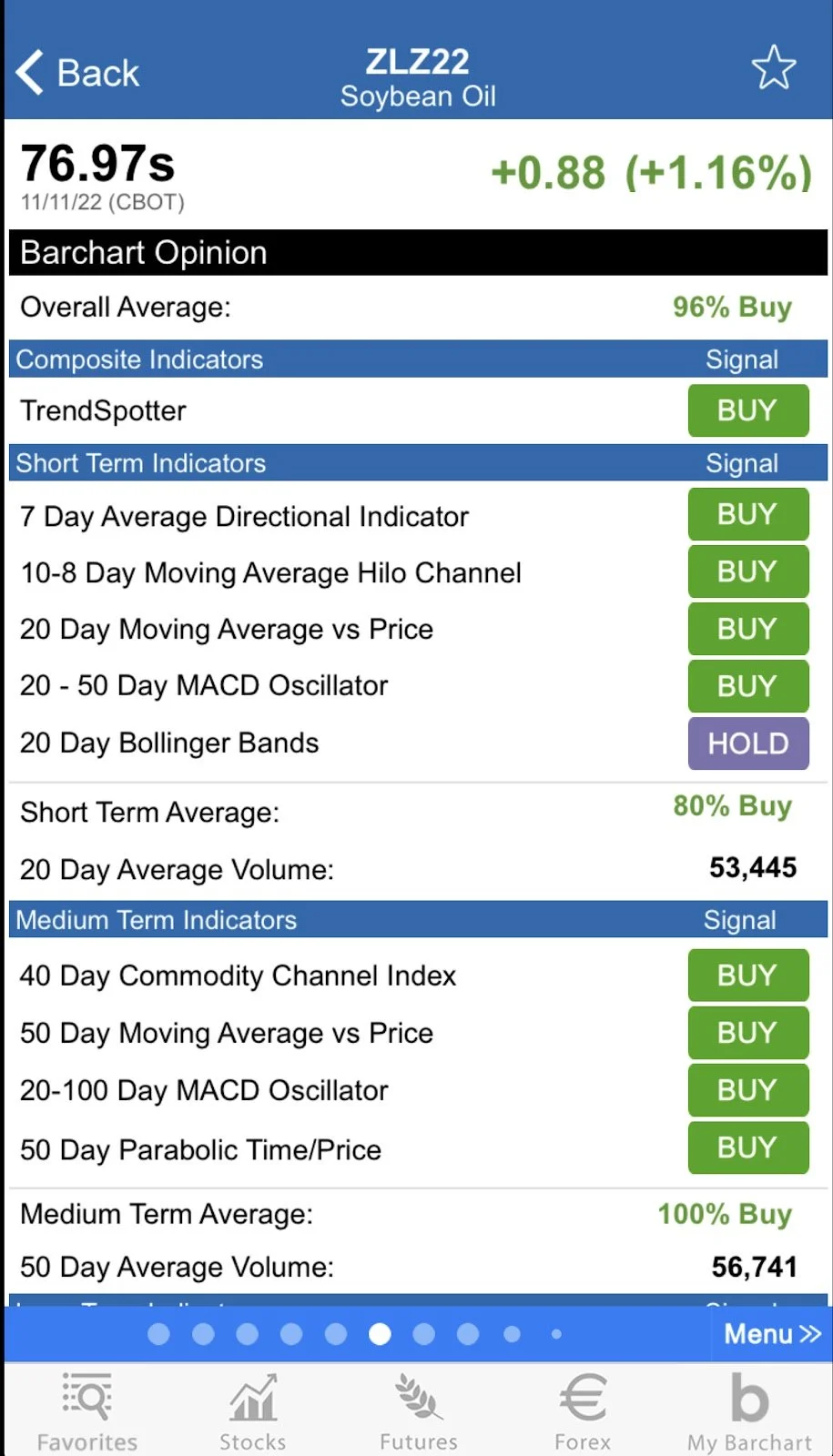

We have all heard the term “Acre War”, but now we are about ready to have a demand war for the different outputs that soybeans leave, bean meal and bean oil. Bean oil is doing its parts making another new multi month high on Veterans day, breaking out to the upside on the charts.

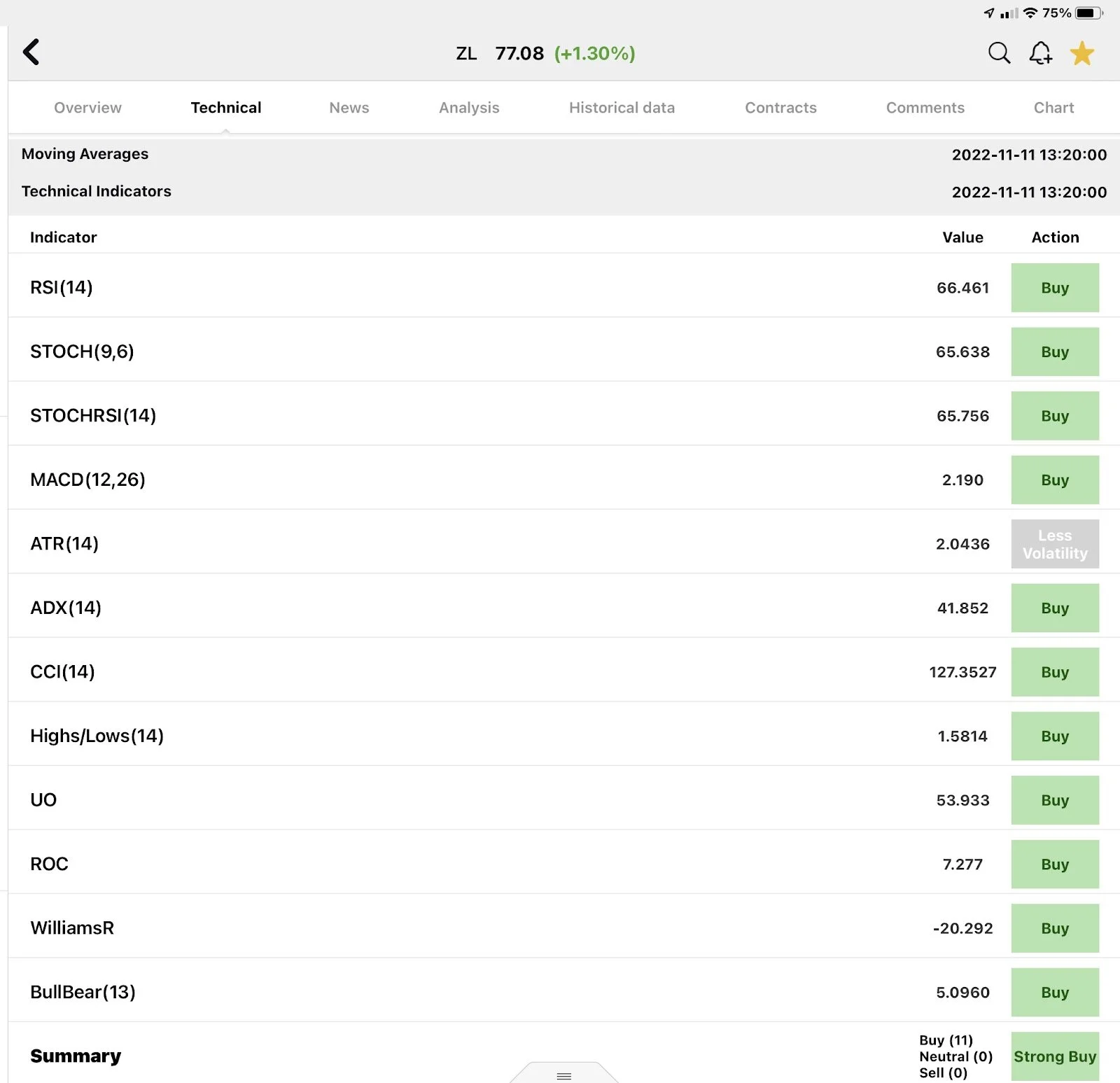

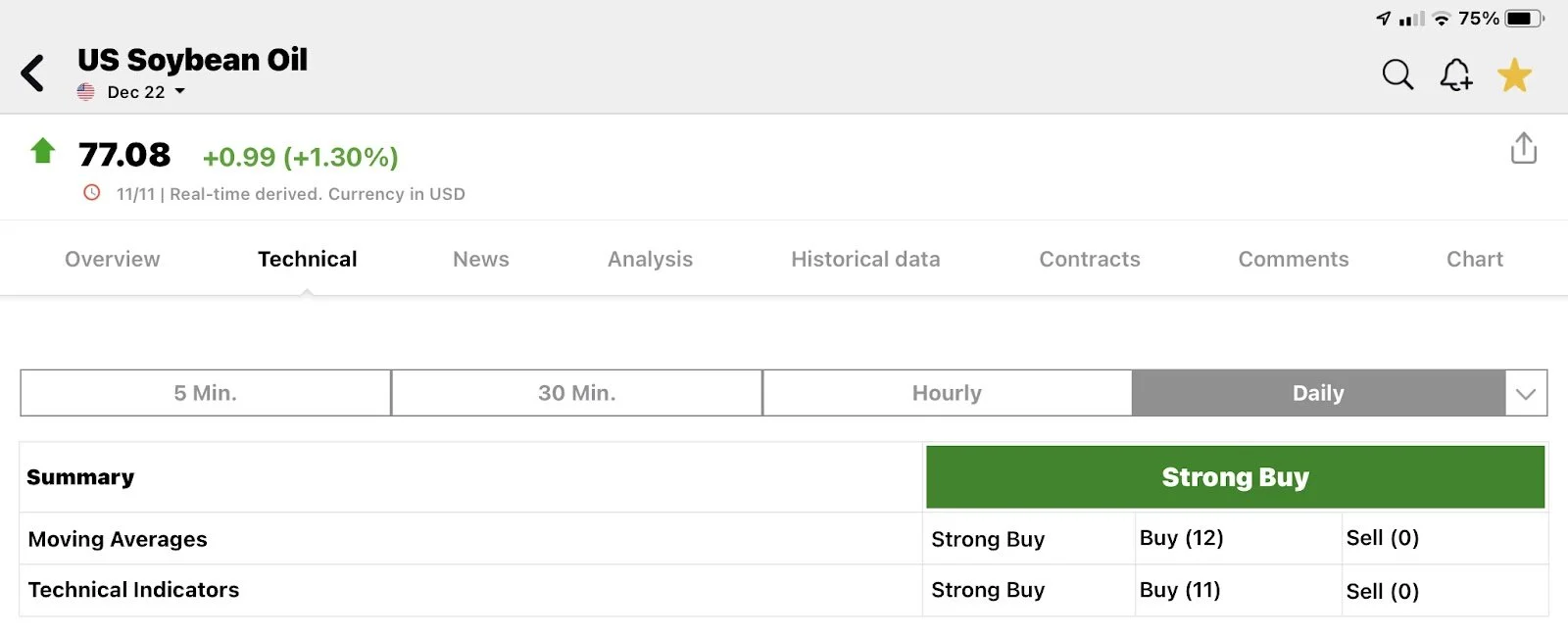

I am going to include a couple charts in this section of the newsletter, these charts are coming from investing.com. For those of you that have never been to that website, it offers plenty for free. Including live quotes. There are plenty of services out there that offer delayed quotes for the grains but the investing.com app offers free live quotes along with buy and sell signals.

So I am going to show you a couple charts as well as technical buy/sell signals from investing.com and Barchart.com

This first chart is a daily soybean oil chart. You can see we had an upside breakout day on Friday, making a new high for the move. This is off of the barchart.com app.

This next chart is a monthly soybean oil chart. This shows how much stronger bean oil is from a historical perspective. Well above 2008 and 2012 levels and within reach of the all-time highs we had just a few months ago.

This next screen show is a technical opinion from the Barchart app. Notice they have soybean at 96% buy.

This new one is still soybean oil, but it is from the investing.com app. It has 11 buy indicators.

The next screen shot is also for soybean oil, and it shows 12 moving averages as buy, and 11 technical indicators as buy signals.

Add the above charts to the fundamental info above and one can see why I am very bullish on the soybean oil market.

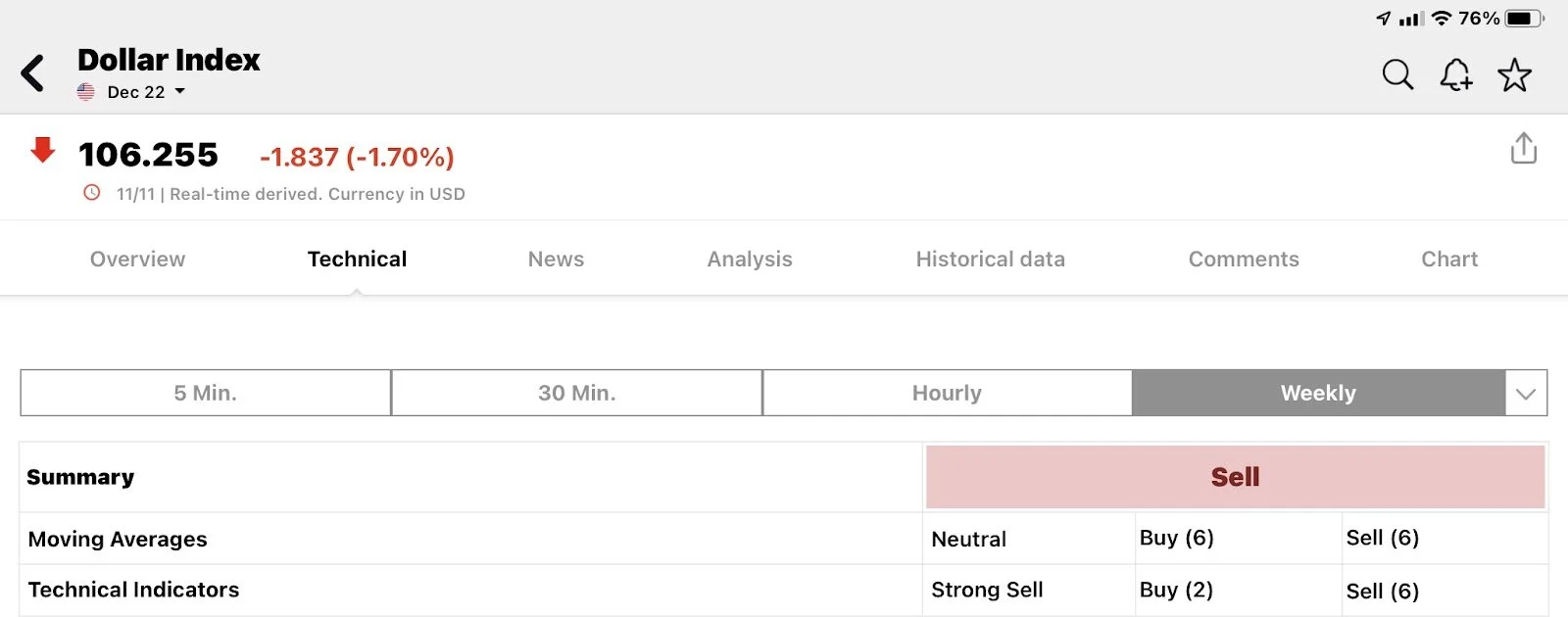

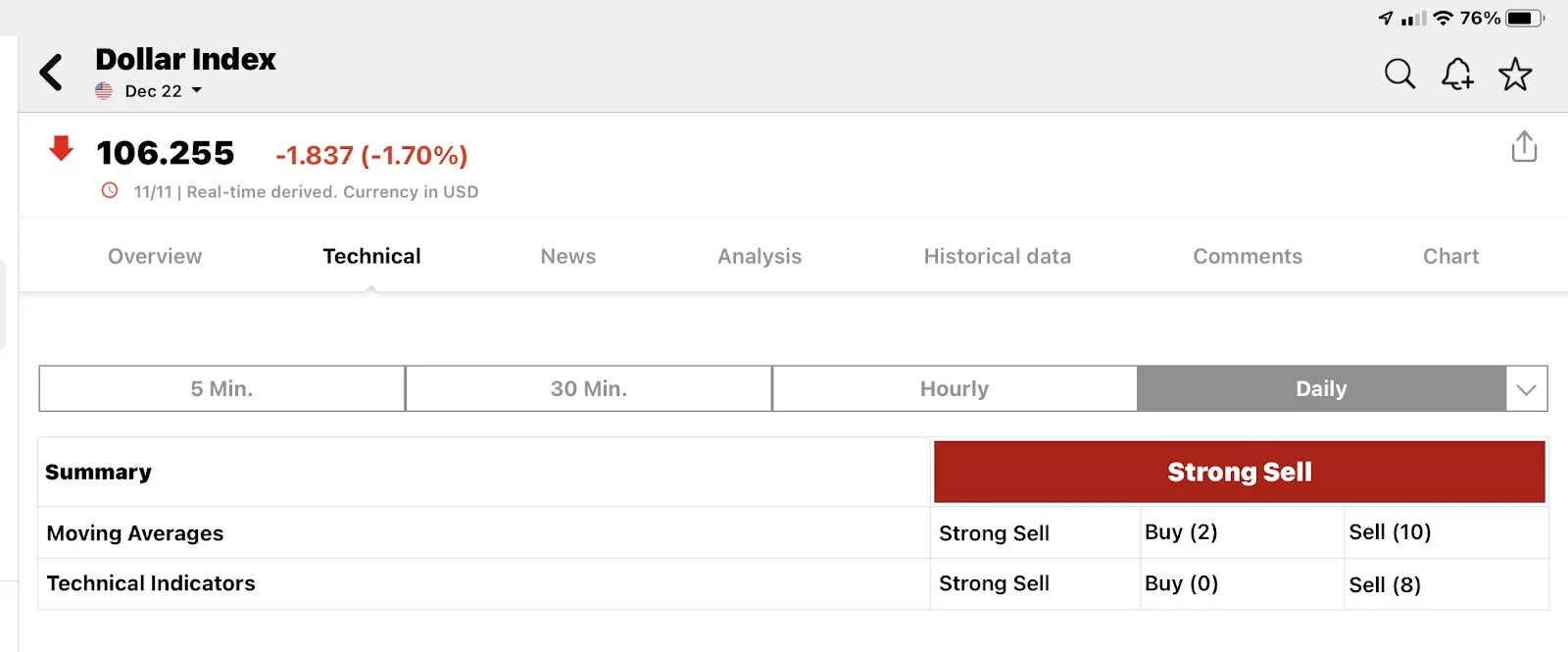

Next is the US Dollar daily chart from investing.com, and this leads to another reason why I am bullish corn, soybeans, and wheat.

You can see we have a multi-month low now.

Here are technical indicators on a weekly basis that have a sell bias.

Next is a daily indicators, moving averages and these have a very strong sell signal.

Ever heard the saying “trend is your friend”, well that’s what all of these technical indicators as well as moving averages are telling us. First off, soybean oil is poised to continue to go higher and next that the US dollar looks like it is going to continue to go lower.

Both of those are very good for US farmers, a word of caution for technical trading is it can be a lagger. The candlestick that the bean oil chart left on Friday would give one a little caution.

Buy recommendation

I watched market to market over the weekend, plus I already subscribe to Roach Ag, and I watch charts for RSI and STOCH, which measure how fast a market moves. If a market has moved too much one direction or the other. All of these indicate buy signals on corn and most wheat contracts. I also noticed Pro Farmer issuing buy signals for livestock feed needs last week. The charts to me look like bulls have set bear traps and I expect wheat and corn to be much higher by Thanksgiving.

So if you have sold corn or wheat, now might not be the worst time in the world to re-own some of it. You have the worst wheat conditions to start off a wheat crop ever. We still have a Russia-Ukraine war that still is happening, granted they have been trying to move as much as possible, but that should be expected. As the choice is to move the grain now or maybe not have an opportunity to ship it later.

Basis tidbits

If you didn’t subscribe last week then you probably missed a bunch of info on basis as well as other info. Here is a link to last week’s complete newsletter. If you want to see the rest of this week’s make sure you go and subscribe at our website here.

Read last week's Weekly Grain Newsletter Here

This newsletter is subscriber only content. To view the rest of this newsletter as well as every other update sent directly to you via text message and email please upgrade to our subscription