WHY WERE GRAINS LOWER DESPITE DOLLAR DECLINE?

MARKET UPDATE & AUDIO COMMENTARY

Listen to today’s audio below

Futures Prices Close

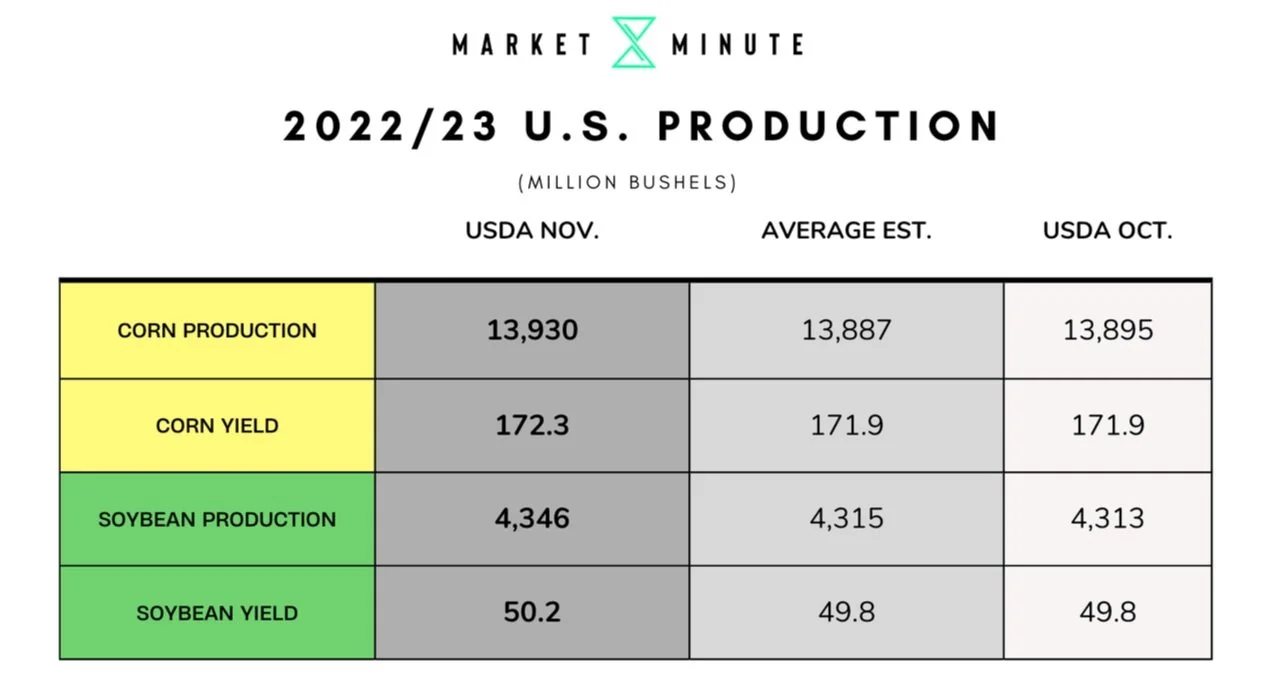

Yesterday’s USDA Numbers

Overview

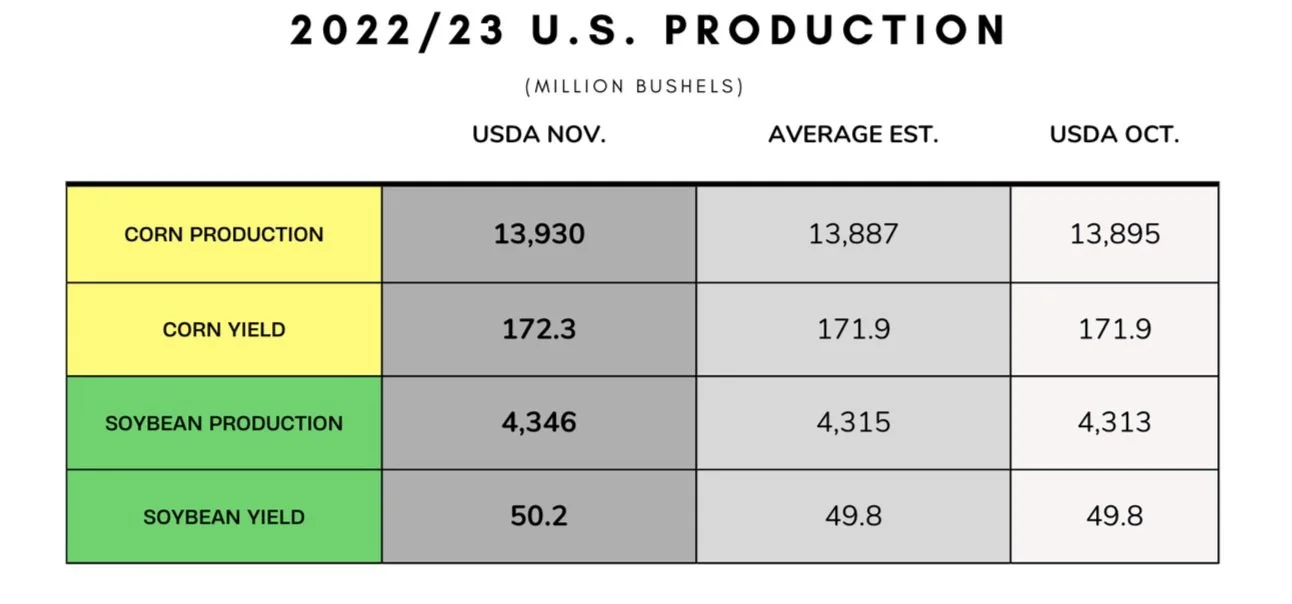

Grains sharply lower following yesterday’s USDA report. The big news today was the CPI number came in at 7.7% rather than the expected 7.9%, which led to stocks and equities seeing a big rally today. However, the cooling of inflation concerns didn’t help the grains today. Following the CPI announcement we saw Dow Jones rally nearly 1,000 points off its low. The dollar also sharply lower with the news.

Export sales this morning were on the light side for all the grains, not helping support the weakness today from yesterday's neutral report. Yesterday’s report itself wasn’t a huge mover but it definitely wasn't friendly. The USDA didn’t change export numbers which was somewhat of a surprise. Most think we are going to see the USDA have to cut soybean and corn exports.

Today's Main Takeaways

Corn

Corn is around -11 cents lower on the day, trading near the very bottom of its range. We are now almost -50 cents off our highs we saw not too long ago where trade was trading around $7. Now at the lowest levels we have seen since August.

Corn lower following yesterday’s USDA report where we saw the USDA slightly raise their U.S. production and carryout estimates. As well as raise their yield by 0.4 bpa to 172.3 bpa. However, it was surprising to see the USDA leave the export numbers unchanged for both corn and soybeans. While also leaving ethanol unchanged. Dec-22 corn is now testing the lower end of the trade range that its been trading at for around two months now.

With corn being at its current levels, I have a slight bullish tilt here, and I wouldn’t be too surprised to see buyers step back in here if we hold support. The report of course wasn’t good, but it was in line with expectations and could have been far worse. But also we definitely have to be cautious, as a close below the $6.50 level could potentially cause some more selling.

Export sales for corn once again came in very light, the lowest for the week since 2012 again. Hopefully we can see exports pick up here from the low levels sometime in the near future.

Dec-22 (6 Month)

Soybeans

Soybeans got hit the hardest following the day of the USDA report. As beans closed nearly -30 lower on the day, at the very bottom of its trade range. A couple days ago I mentioned that we definitely had to possibility to see soybeans trade a lot lower off its recent highs. But comparatively we are still at high price levels, as not too long ago we were struggling to break up past $14.

In yesterday's report we saw the USDA raise soybean yield estimates by 0.4 bpa up to 50.2 bpa which was in the middle of the trade estimate range. We also saw the USDA raise ending stocks by +20 million bushels, and production raised by +33 million. As the same for corn, we saw exports left unchanged for soybeans.

Export sales came in on the lower end of trade range, and were no better than the the average for the week.

If weather continues to be decent Brazil is looking for a very massive crop. Rains have also helped Argentina's situation. But we have to keep in mind that Argentina's weather is one of the worst we they have seen in history. So there is chance that Argentina steals some of the focus from Brazil. But we of course can’t ignore the large crop in Brazil. South American weather will continue to be the largest factor going forward.

There is the chance we see weather problems arise in South America, but if we don't and people realize how large Brazil's crop is we could see a lot of people start to sell at these high prices. Soybeans prices are still relatively high, and from a marketing standpoint, it wouldn’t be unlogical to protect yourself here with all the other factors the soybean market is facing in the future. But overall, we will just have to wait and see what South America has in store. The other factor to keep an eye out for would be China and if they continue to stand by their zero covid policy.

Soymeal & Soyoil

Soymeal down -13.5 to 404.1

Soyoil up +0.55 to 76.09

Soybeans Nov-22 (6 Month)

Wheat

Wheat following the rest of the grains lower today. As expected, the USDA didn’t make any massive changes to the wheat numbers. Wheat slipped lower yesterday and today without any major changes made or fresh news to chew on.

We did the USDA lower U.S. ending stocks to the lowest we have seen since 2007/2008. With Argentina production being reduced quiet a bit. But then on the other hand, we saw Australia production higher than expected.

The drought in Argentina has severely damaged their wheat crop from what it sounds like. as estimates have been cut 1.9 million metric tons to 11.8 million metric tons yesterday for the 2022/23 wheat production, this cut was made by Rosario grains exchange. They also are giving warning that we may continue to see the crop worsen.

With wheat being at such low levels here its tempting not to be somewhat bullish. Demand just isn't there currently. But looking forward, I think wheat has the potential to break out from these low prices. We have the weak dollar that showed a little bit of support. We also can’t forget about the Russia and Ukraine headlines, as those could of course make the market move significantly.

Chicago Dec-22 (6 month)

KC Dec-22 (6 month)

MPLS Dec-22 (6 month)

Is The Recession Over?

CPI (Consumer Price Index) came in this morning at 7.7% (YOY) which was below expectations of the anticipated 7.9%. Which is the smallest raise we have seen since January. This led to a massive rally in the stock and equity markets, as well as the dollar hitting its lowest levels in over a month. With inflation cooling this much, some are asking the question; Has inflation peaked?.

Today, Dow Jones is up nearly +3% today, with the U.S. dollar down almost -2%. The NASDAQ is up an astonishing 6% nearly.

Back in March of 2009 the stock market hit a rock bottom. Just one year later the market bounced 70%. And within 2 years, the market had rallied nearly 100%. Now 12 years later, the S&P 500 is up over +600% since. This fact is just food for thought. None of us really know whether this is the end of the recent recession or not. Keep in mind, the Feds are on their most aggressive rate hike campaign since the 1980s.

Goldman Sachs stated that they believe there is a 35% chance the U.S. still sees a recession 12 months from now. We also have to remember that the Feds have said they will continue to raise interest rates, and do whatever it takes to combat the ongoing battle with inflation. Yes inflation this month came in below expectations, but it was still far higher than normal levels. The 7.7% is actually still at historic levels. The Feds have also not changed their narrative comments thus far surrounding inflation.

Jason Furman, an economist at Harvard University who was also a top economic advisor for former president Barack Obama stated "This was good news, but I wouldn’t change my view on the world based on one data point." As well as "One should feel better about inflation than yesterday, but not much better." So from what the vast majority of people are thinking is, this was a good step in the right direction, but the battle against the recession and inflation is far from over.

Price Increases Over The Last Year

Gasoline: +17.5%

Food at Home: +12.4%

Fuel Oil: +68.5%

New Cars: +8.4%

Used Cars: +2%

Overall CPI: +7.7%

Couldn’t find the exact number, but fertilizer costs are still through the roof as well.

Other Markets

Crude oil up +0.54 to 86.36

Dow Jones up over +1,000 points

Dollar Index down -2.36 to 108.1

Cotton down -0.17 to 84.56

News

Russia has ordered a withdrawal from the Ukrainian city of Kherson.

Amazon is set to lose $1 trillion in market value after its cap sank to $879 billion. Down from its all time high of $1.9 trillion in July 2021.

Threat of Rail Strike eases as Union extends deadline

Russia and Ukraine will further discuss the grain deal tomorrow

Argentine soybeans farmers sell 72% of their current crop

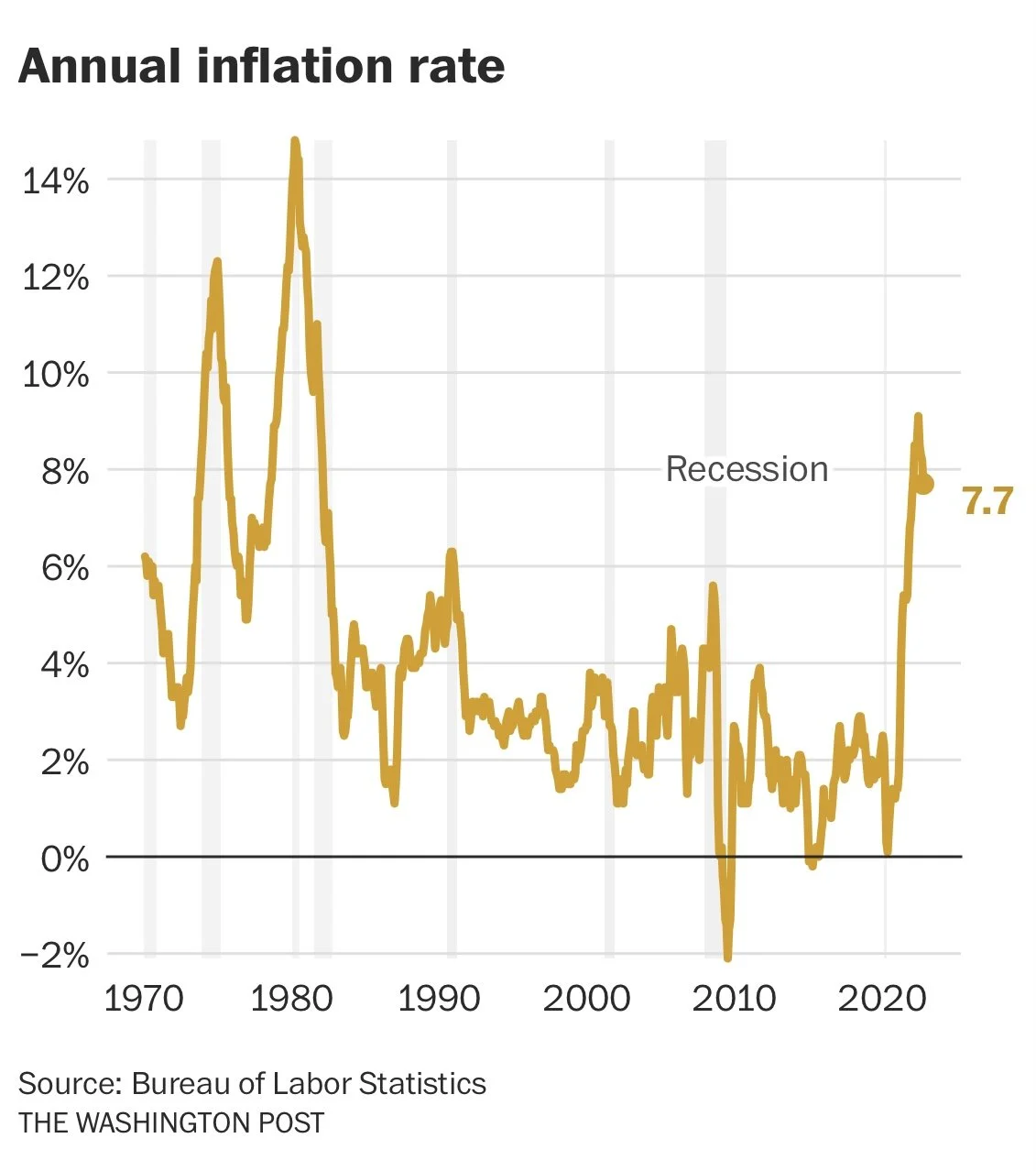

Livestock

Live Cattle +1.500 to 153.075

Feeder Cattle +2.050 to 181.700

Live Cattle (6 Month)

Feeder Cattle (6 month)

Social Media

All credit to respectful owners

Precipitation Forecast 2-Day

Weather

Source: National Weather Service