WEEKLY NEWSLETTER

Will any grains 5x like they did 21 years ago??

By Jeremey Frost

Today marks 21 years since 9/11

I remember exactly where I was when the news hit. I was at work at CHS Midwest Cooperatives. A few months before I had become the Grain Merchandiser after having started as a grain settlement clerk about a year before that.

Interestingly enough when I started as the grain merchandiser millet went from 4.00 or so per cwt to 20.00 per cwt. A couple of major stories I have from back then.

First, a producer contracted millet and then the drought hit millet-producing areas and the producer was short on the contract. Talk about a way to break a producer. Make a sale, then not produce it and have the grain go 5 times what it started. Luckily enough my general manager at the time got in front of the run-up and helped the producer out before it broke them.

The next story was the speed at which the market moved. It was simply crazy how fast the market moved as buyers got into a fear mode in a hurry. The prices moved dollars per cwt almost per trade. But a few months later the price was about ½ of what it was.

The last story is when three producers who each had 5 million pounds of millet, all wanted 20.00 for it so they could get a million dollars for it.

One of them sold the millet, and two others because of the shipment time period passed on it. One of them sold it within the next year for around 7.00 per cwt. About $650,000 less than he could have had. The other producer carried the millet until about 2011-2012 and sold it for 44.00 per cwt to me.

A few points; first off we are in a similar market for millet as we were 21 years ago. It has doubled in about a month. Will we continue to go higher or will it stall out like last year. Could we do a 5x like twenty-one years ago? To me, I think this is a fear-driven market that moves fast; in both directions. When it’s over don’t be long a bunch because without demand prices could come down fast.

Next point; are you working with someone that is going to work with you if you oversell? Are you at risk of being oversold? To me, I think the risk of being oversold is a tremendous risk in some markets. It can break a farmer. Never get oversold in a market that might not have any other sellers.

The last point is simple risk management and staying power. You have to know your staying power. If you don’t have super strong staying power then you need tighter risk management. If you have staying power like some Sully and Potter County Farmers that I work with you can afford to be a grain hoarder.

Sticking with YouTube and moving to some of my wife’s conspiracy theories. In the Conspiracy Corner

Here is a video showing how bad the drought in China is

Here is Mr. Musk talking about depopulation. (The Chinese and big Money controlling us puppets is one reason I am long-term bullish grain prices.)

In remembrance of 9/11 here is one of my favorite songs “I believe 9/11 Memorial Tribute”

A tribute by Blessid Union of Souls.

What’s going on in the field??

Here are a couple of tidbits of advice from Mr. Bryan Lutter.

This first one is for both farmers and maybe more importantly sunflower buyers. As there is a serious issue in South Dakota with weevils in sunflowers. I have talked to several farmers that didn’t get much of a kill and didn’t realize what they were using didn’t work.

Others sprayed 2 and sometimes as many as 4 times. The cost isn’t going to add sunflower acres. So please contact the National Sunflower Association and ask them to help (see below).

This next tidbit basically tells me that some guys are trying to plant wheat in the dust and maybe making decisions in an attempt to get paid from insurance.

The bottom line is to make sure you are checking with your agronomist and make sure you work with someone like Bryan that has your best interest and isn't just trying to make some sort of a sale

Not so fearless predictions

We see new all-time highs in the following markets by 12-31-2023

Corn

Soybeans

CBOT Wheat

The US stock market rallies in September-December and starts 2023 off strong.

White Proso Millet trades to $30 by the end of the month and $40 by the end of the year only to trade down to sub $20 pre-harvest 2023.

Russia Ukraine war is still going on until January 1st, 2023 and escalates in the spring of 2023

Soybean demand in the US sets record domestic usage in 2024-2028 each year

Sunflower prices are bid as cheap as 24 per cwt at harvest in 2022, but prices increase to over $48 in 2023

The volatility leaves a sunflower plant on the wrong side of the market and we experience another Anderson Seed type of meltdown.

Farmers with bin room and holding power continue to gain ground against farmers without proper storage.

Be comfortable being uncomfortable

USDA report out tomorrow on 9-12; my suggestion for reports and in grain marketing, in general, is to find a way to be uncomfortable with the unknowns. It’s how you react to what life throws at you.

Some of the possibilities for the report include. Nonevent whereas USDA gives us numbers in line with the estimates. A bearish report whereas USDA doesn’t lower corn yield. A bullish but as expected report whereas USDA lowers corn yield but not much more than estimates and it leads to a buy the rumor sell the fact type of price action. Or a shocker whereas USDA prints yield at PRO FARMER type or lower numbers. Which leads to another leg up in the grains and helps prediction of new all-time highs.

Most feel it’s unlikely that the USDA adjusts as much as PRO FARMER type of numbers in one report. It would probably take until the January crop report to see some of those numbers realized.

One can put a probability on any of those and perhaps other scenarios. But the bottom line is you and your operation have to feel comfortable knowing the possibilities. If you have plenty of cash and plenty of storage then one probably isn’t supposed to do anything. But if you don’t have storage or will be forced to sell you might want to have protection in place via purchases some puts or some sort of risk management.

If you need help in trying to determine what is right for you and your operation give me a call at (605) 295-3100 or give Wade a call at 605-870-0091.

The one piece of advice I strongly recommend is to find a grain marketing style that works for you and your operation. Don’t chase what works from year to year. Find one; grow with it; learn and improve but don’t get caught switching styles year to year unless you are ok with hitting only grand slams or striking out.

50% off deal ending soon

For some of you that have not yet subscribed, this will be your last free trial before our introductory sale ends. If you would like to subscribe please use code "GRAIN" for half off

Commodities Overview by Sebastian Frost

Overview

Tomorrow is the big day, as everyone has eyes on tomorrow’s USDA report. The big question remains, where will we see yield come in at?

Today's Main Takeaways

Corn

Tomorrow we will get a look at the USDA's updated estimates. Most are thinking we see yield lowered from 175.4 bushels per acre down to 171.5 - 172.5 bushels per acre. With production expected to drop anywhere from 250-350 million bushels.

It's really tough to say where the USDA will actually come in at here. There is obvious damage across a large portion of growing states. With the ProFarmer tours finding problems in a few key growing areas as well.

It's unlikely we see the USDA make a cut as low as ProFarmers estimates, but it's a slim possibility. The USDA is likely going to be fairly hesitant. Realistically, we will likely see yield come in around where everyone is assuming it will. The big question still remains, how much can the USDA continue to hide, and for how long? Only time will tell when the USDA gives us the full picture.

We also have to keep in mind, that the USDA might not even lower it as much as bulls want. Which could ultimately wind up in a disappointing fashion tomorrow.

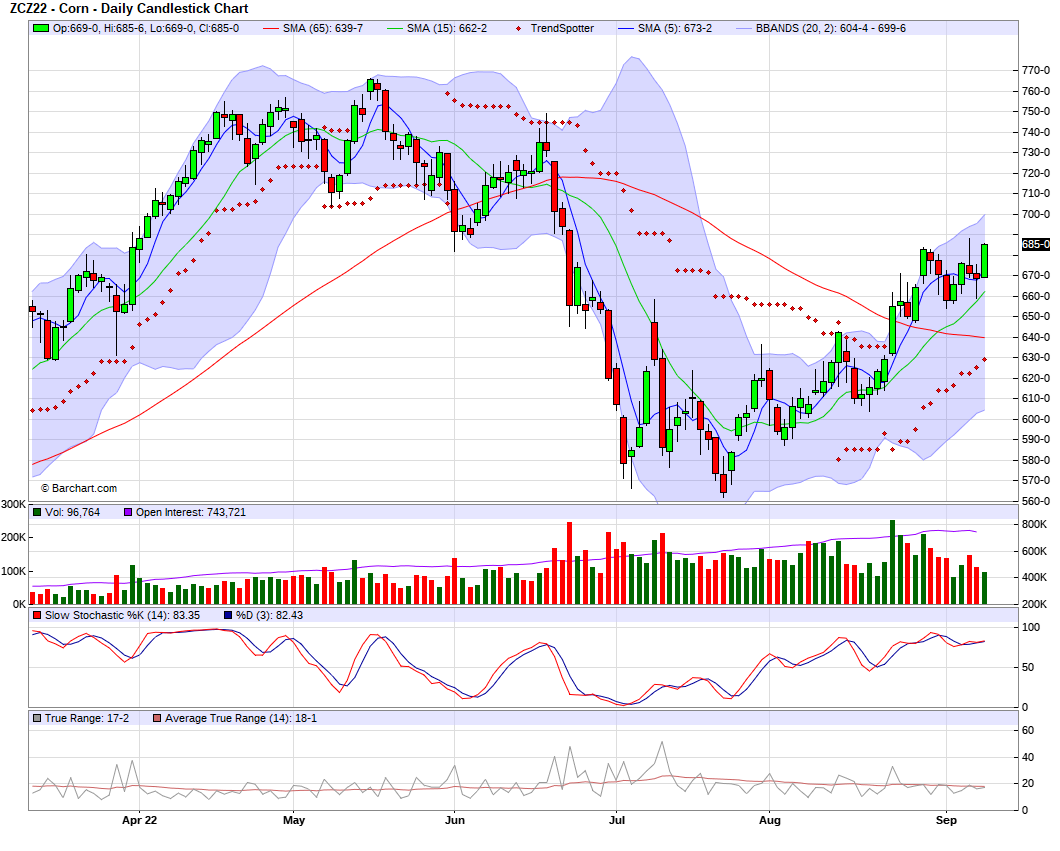

Either way, the yields have to favor the price looking long term. Whether we see a curveball tomorrow or not. Overall, the charts look very friendly for corn, and I think we will continue to see corn climb.

USDA Estimates Corn

2022/23 U.S. production

Average estimate 14,088 million bushels

August USDA 14,359 million bushels

Corn yield

Average estimate 172.5 bpa

August USDA 175.4 bpa

Corn harvest acres

Average estimate 81.686 million bushels

August USDA 81.840 million bushels

2021/22 U.S. ending stocks

Average estimate 1,547 million bushels

August USDA 1,530 million bushels

2022/23 U.S. ending stocks

Average estimate 1,217 million bushels

August USDA 1,388 million bushels

2022/23 World ending stocks

Average estimate 302.29 MMT

August USDA 306.68 MMT

Here is a snippet and technical analysis from 'Wright on the Market's Tech Guy'

"The Dec Corn chart is in a steady uptrend, consistently marking higher highs and lows - momentum is up, so it would take a bigger force to stop the up movement. Support comes in at 659. Resistance is the gap at 733 then 749 above that."

"We have no control over what the USDA prints on Monday morning. All we can do is stick to what the charts are saying and keep in mind what the previous findings and observations have been - the crop progress reports - less than ideal growing conditions, and what other outfits have said about what they think yields are, etc. It is very difficult to quantify fundamentals."

He provides a great amount of knowledge and insights. I highly recommend reading a few of his articles

Read his full write-up and analysis here

Tech Guy's Corn Chart Analysis

Dec-22 Corn (6 Month)

Soybeans

Similar to corn, tomorrow we will see an update from the USDA. Most are thinking we see yield lowered from 51.9 down to 51.5 bushels per acre. However, some analysts are thinking we might see an even larger cut. We also have the updated planted and harvested acres for both corn and soybeans tomorrow. So there is a possibility we see a curveball for total production.

Soybeans continue to be mostly dominated by demand and other headlines. We continue to see problems arise with China's covid lockdowns putting a damper on Chinese demand. Chinas imports lowered -25% during August compared to last year.

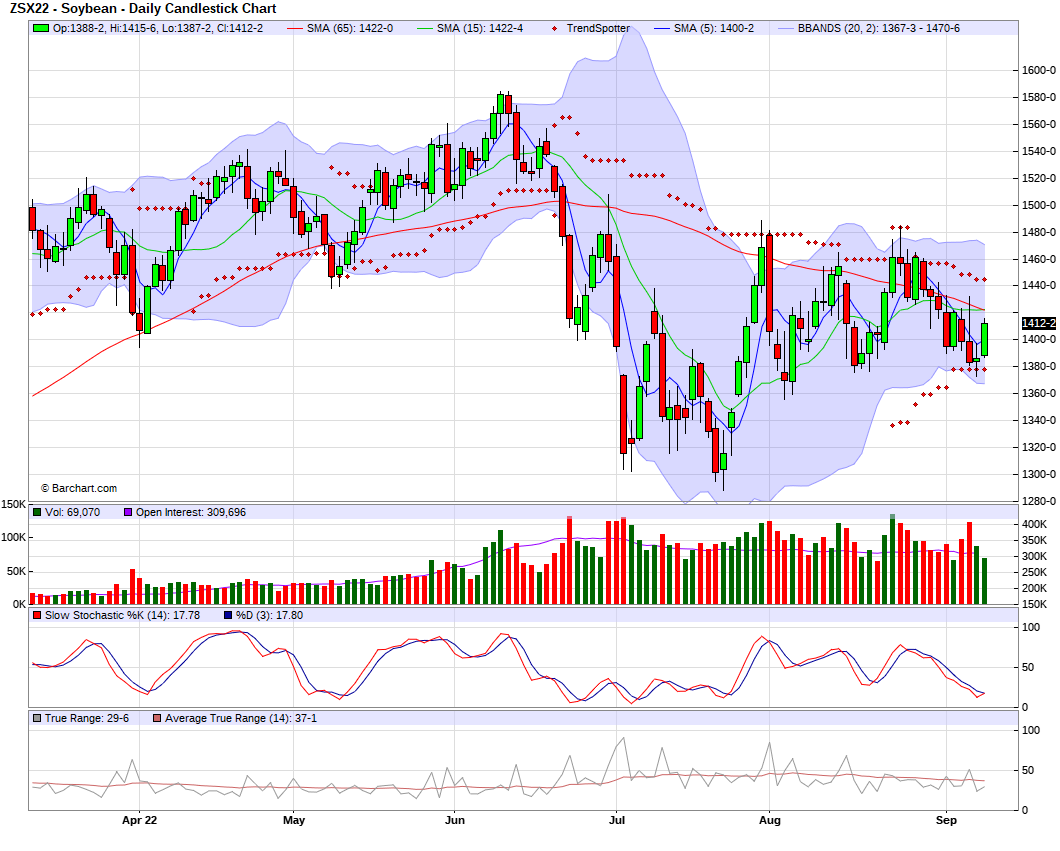

Out of the three commodities, I'm currently the most hesitant to be bullish on soybeans. While the corn and wheat charts both look great, it's a very different story for soybeans. With all the different factors affecting the soybean market. As we don't know how large of an effect these China lockdowns will have, how many cities will have a lockdown, and how long they will last. As well as the China and U.S. relationship currently still somewhat skeptical.

It's difficult to be extremely bullish here on soybeans at least looking short-term for the next few weeks. However, there is that chance we see some surprise in tomorrow’s report that sparks some interest. Or perhaps we see demand increase sooner rather than later.

USDA Estimates Soybeans

2022/23 U.S. production

Average estimate 4,496 million bushels

August USDA 4,531 million bushels

Soybean yield

Average estimate 51.5 bpa

August USDA 51.9 bpa

Soybean harvest acres

Average estimate 87.288 million bushels

August USDA 87.211 million bushels

2021/22 U.S. ending stocks

Average estimate 236 million bushels

August USDA 225 million bushels

2022/23 U.S. ending stocks

Average estimate 247 million bushels

August USDA 245 million bushels

2022/23 World ending stocks

Average estimate 101.19 MMT

August USDA 101.41 MMT

Again here is a snipet from 'Wright on the Market's Tech Guy'

"The Nov Bean chart is more neutral. The gap below (1348) is still slightly at risk of being filled (bearish surprise) - and would serve as support on a selloff. However, it was somewhat bullish that the market rallied from the Aug 18th low (1376.50) on Thursday and Friday."

"Resistance is at 1457 and then 1536.50 with the latter being an overhead gap to the left side of the chart. The one fact we know for sure is that Nov Beans have been accumulating energy since the July 22nd low - moving up and down 6 times until now - this is a good amount of energy."

Highly recommend you read his full breakdown of the markets here

Tech Guy's Bean Chart

Nov-22 Soybeans (6 Month)

Wheat

Unlike corn and soybeans, we won't be getting a ton of new information from tomorrow’s report. As we won't be getting an update to the USDA's U.S. wheat production. Everyone keeps discussing all the headlines surrounding Russia and Ukraine, and how much grain is actually being exported, and if Putin will actually cut ties on his recent export deal. We also have the dry conditions around the world.

The big news last week came from Putin's remarks regarding the grain export deal. Where is he visibly irritated that the grain isn't going where he initially says he thought it would be. It's not likely we see this deal terminated. But there is the possible that the deal isn't renewed after its 6-month term.

Overall, I think wheat has some bullish potential. We recently broke out from our down trends and charts look good. On the other hand, we do have some other small factors and the strength of the U.S. dollar adding some pressure to the markets. But I currently have a slightly bullish tilt for now.

USDA Estimates

Wheat 2022/23 U.S. ending stocks

Average estimate 618 million bushels

August USDA 610 million bushels

Wheat 2022/23 World ending stocks

Average estimate 268.10 MMT

August USDA 267.34 MMT

News

The EU announced they would put a price cap on Russian crude oil. Scheduled to take effect in December

CONAB cuts Brazil corn production, but still +30% above last year

India imposes a rice export tax

Demand remains difficult with our prices being higher than other world exporters

Still no weekly export data from the USDA

You can see in the chart below that crude oil had a very nice recovery Friday to end the week. With a bounce just where it needed it.

Crude Oil WTI (6 Month)

Here is a few of our recent newsletters/audio in case you missed them..

Audio Sep. 9 - What to expect after the USDA report

Audio - Sep. 8

Last weeks weekly newsletter - Sep. 5

Precipitation Forecasts

Sep. 12

Sep. 13

Weather

Source: National Weather Service