WEEKLY WRAP

Overview

Grains mixed as beans get a great bounce while the wheat market gives back yesterday’s gains.

Beans were strong to end the week as China canceled Brazillian soybeans. The thought process is that this business will move to the US.

Wheat under some pressure as grain in moving in the Black Sea again after a 3-day pause from Ukraine. Ukraine appears to not be too concerned with the potential drone attacks or mines, as they now deny that they ever stopped shipping out of their ports.

We have rains across the midwest and it is going to be getting cold this weekend. This has some wondering if we see any damage to beans.

The war in Isreal is getting more dicey, slowly gaining more tension.

Mark Gold said: "I still think the war is a powder keg and frankly wouldn't want to be short anything over the weekend."

Not only did the China cancellation support beans, bean meal was strong again, up another +12.9 (+3%) today as its rally continues, making new contract highs. Trading at its highest level since July 27th. Now up +76.0 since the October 9th lows.

Both corn and beans have been mainly pressured by US harvest which is wrapping up soon as well as some "favorable" forecasts in Brazil.

However, I wouldn’t look at the South American forecasts as necessarily favorable. Rain continues to disappear and not fall despite what the forecasts have been calling for.

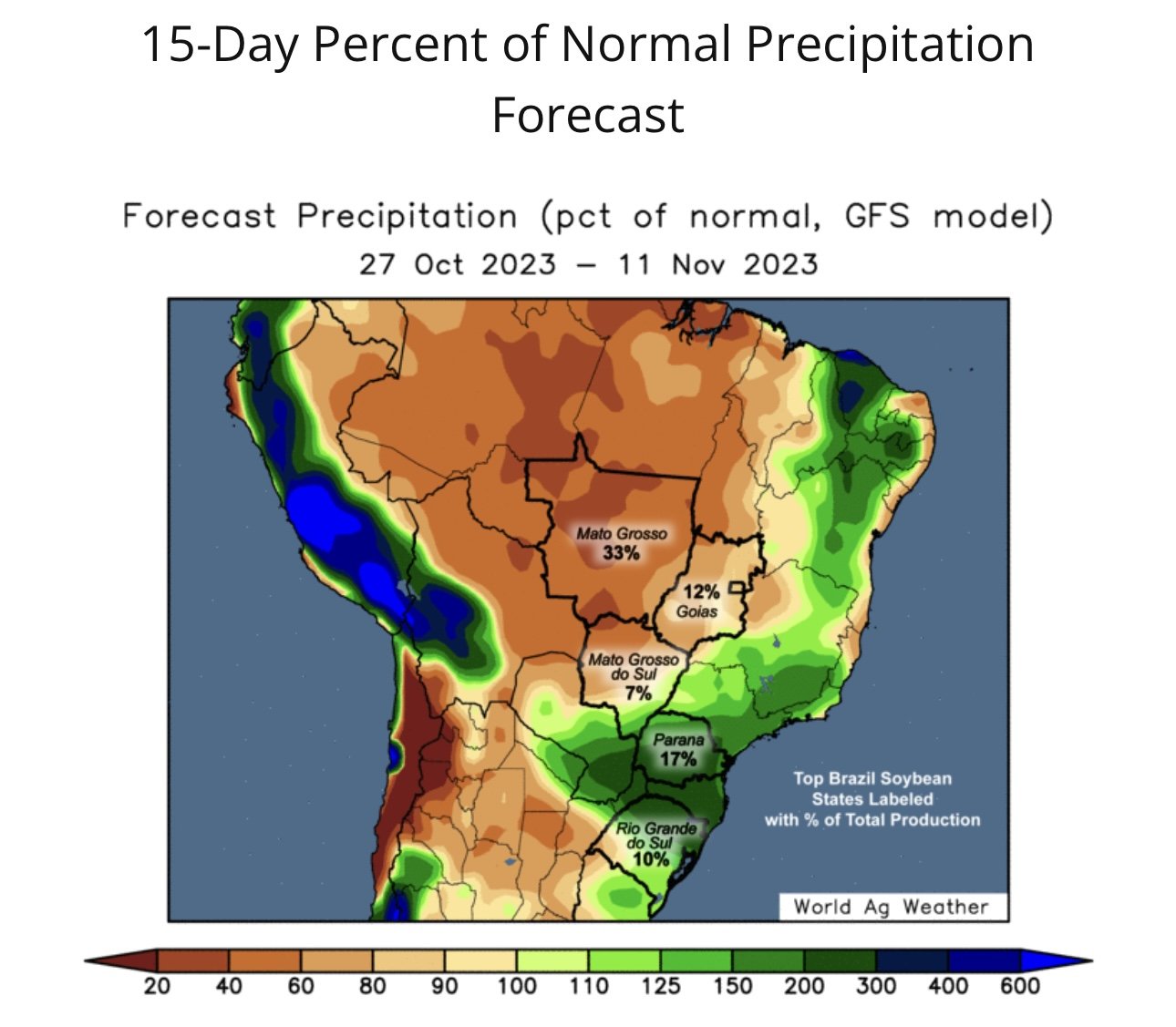

Here are the forecasts:

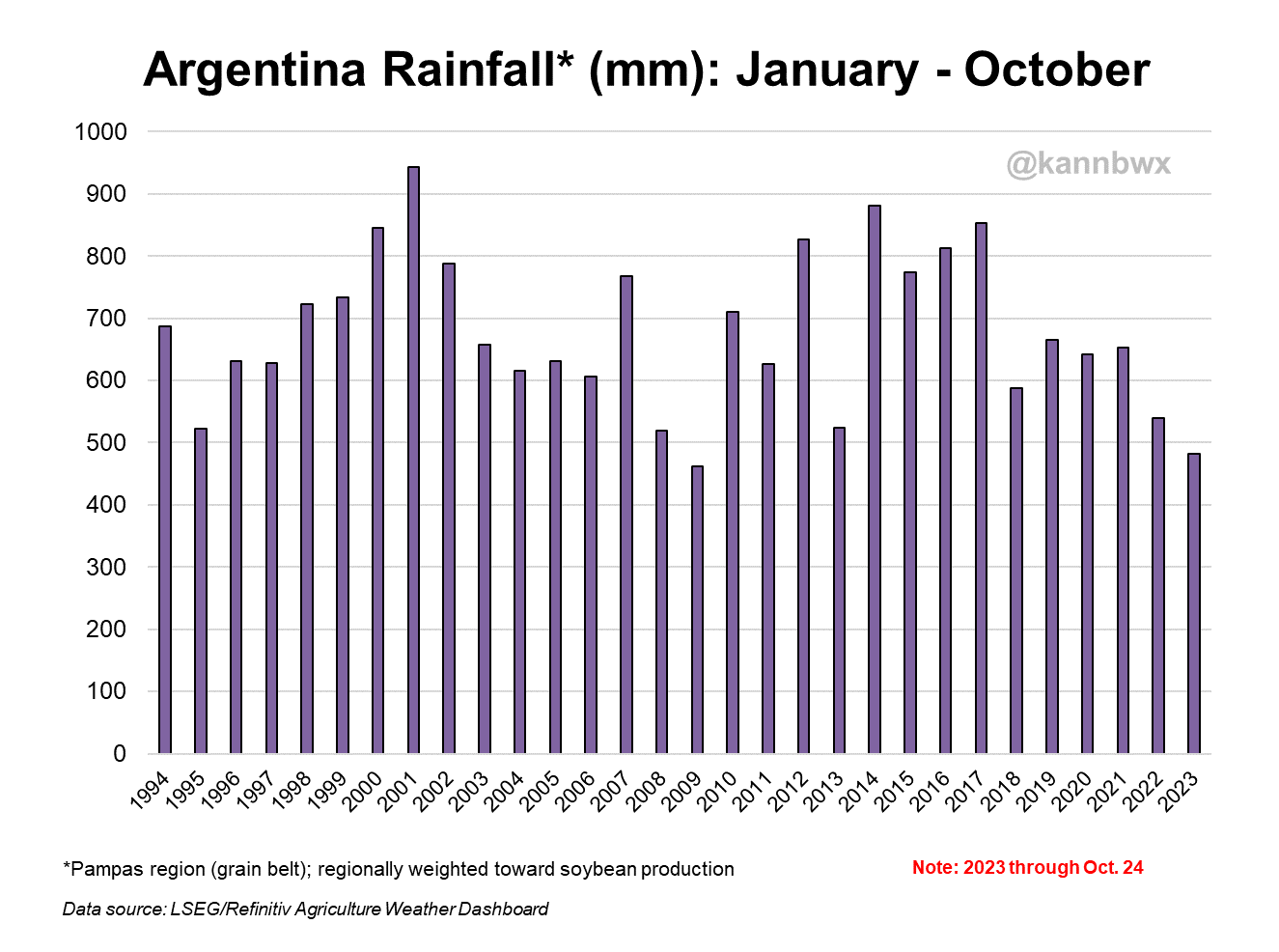

How dry has South America been thus far?

If we look at this chart, 2023 for Argentina has been the 2nd driest year in the past 30 years, only behind 2009 which featured horrible crop outcomes. Their year-to-date rainfall is 30% below average.

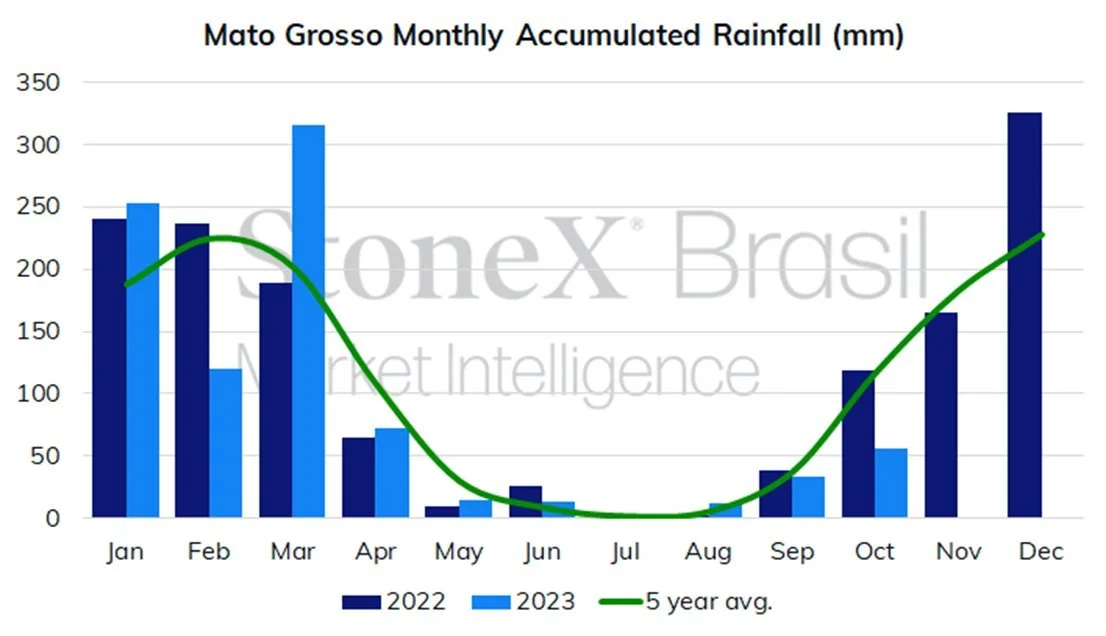

Now let's take a look at Brazil. Where their production comes in at will be more impactful than Argentina's. If we take a look at Mato Grosso (their largest producing area) you will see they have received far less rain than last year as well as the 5 year average.

Taking a look at October, this year is not even half of what it was last year.

So far, this looks like a pretty bullish factor. But of course, November and December will be what it all comes down to.

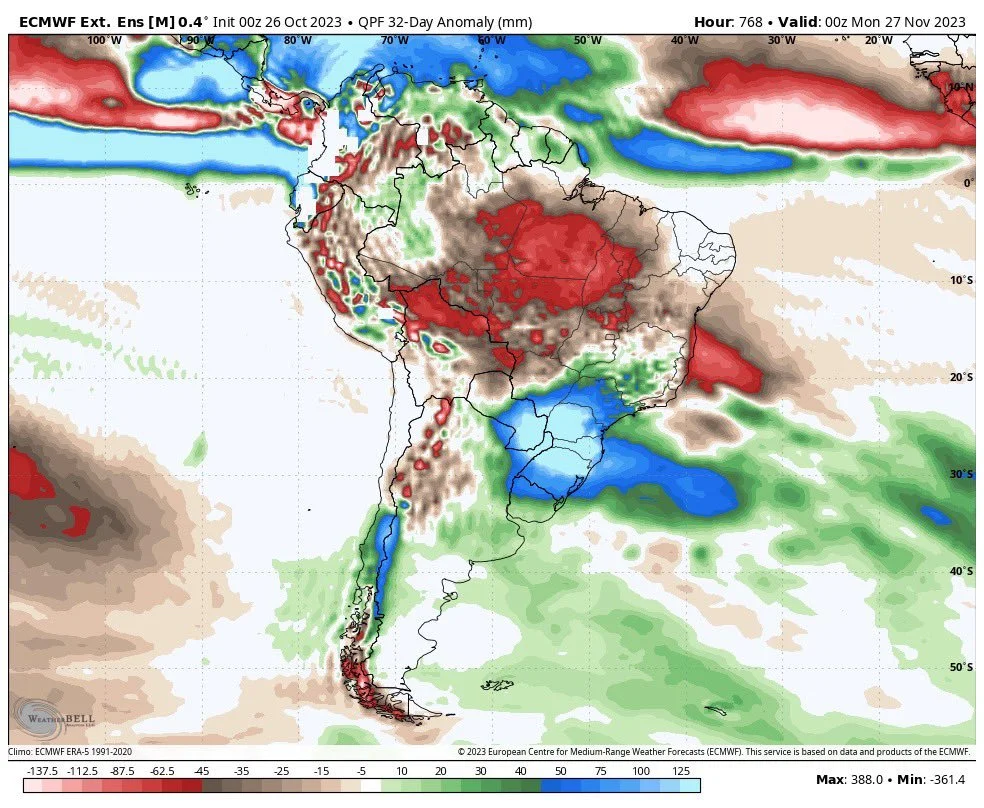

From Darren Frye of Water Street Consulting:

"The next 32 days do not offer much improvement. If this verifies the trade will start talking about 145 instead of 165 for Brazil. Safrinha will be much smaller also."

Weekly Price Changes:

Today's Main Takeaways

Corn

Corn has given back 28 cents from last Friday's highs of $5.09, ending the week at $4.81 1/2. As corn has mainly been stuck between $4.75 and $5.00 for the vast majority of the past 3 months now.

There has just been a risk off mentality this week from the funds who remain heavily short. As we have mentioned time and time again, a major rally will not be easy with a 2 billion bushel carryout.

One thing that could surprise bulls later on is…..

The rest of this is subscriber-only content.

Please subscribe to keep reading and receive every exclusive update via text & email.

Scroll to check out past updates you would have received.

Become a Price Maker.

Try 30 Days Free

INCLUDED IN TODAY’S UPDATE

Things that could push corn higher

Levels in corn

Managing risk in beans

Nov. bean basis contract recommendation

Wheat market break down

Check Out Past Updates

10/26/23

SEPARATING THE FUTURES & BASIS COMPONENT TO BECOME A PRICE MAKER

10/25/23

LONG TERM UPSIDE & BEING PATIENT

10/24/23

TECHNICAL SELLING, SA WEATHER, & MANAGING RISK

10/23/23

IS THIS CORRECTION A HEAD FAKE?

Read More

10/20/23

BIG WEEKEND CORRECTION

10/19/23

CORN BREAKS $5. IS WHEAT NEXT? - SOYBEAN RECCOMENDATION

10/18/23

BEANS BREAK $13. IS CORN NEXT?

10/17/23

DID BEANS CONFIRM REVERSAL?

10/16/23

CHOPPY BORING TRADE

10/13/23

POST USDA REPORT CORRECTION

10/12/23

BULLISH REACTION TO USDA REPORT

10/11/23

CAN THE USDA GIVE US A BULLISH SURPRISE?