WHEAT SURGES WHILE CORN & BEANS DISAPPOINT

Overview

Grains close mixed following an up and down day full of volatility. As new crop corn and beans close well off their highs, and old crop takes a hit.

The wheat market sees a big rally led by KC and Minneapolis near 50 cent rallies. The strength in wheat was due to a few different global headlines which we will touch on later in today's write up.

Monday we had crop conditions out after close, so today was the first market reaction we got from the numbers. Not quiet the reaction bean bulls had hoped today for with the decrease.

All of the numbers are below but to sum it up, corn conditions improved by 1%. Which was expected, so nothing major there but it does show that the corn crop may be improving. Beans and wheat stole the show however. Beans came in 1% lower than last week, and 2% below what the trade was expecting. The trade was expecting improvements, but instead we saw another decline. Spring wheat came in 2% lower than last week, and 4% below what the trade has been guessing. As they were expecting a 2% increase, when in reality we deteriorated by 2%. Winter wheat harvest is also running behind.

***

In case you missed it, read Sunday's Weekly Newsletter

What's Next For Corn & Beans? - Read Here

Crop Conditions

Corn 🌽

Rated G/E: 51%

Trade: 51%

Last Week: 50%

Last Year: 64%

Beans 🌱

Rated G/E: 50%

Trade: 52%

Last Week: 51%

Last Year: 63%

Spring Wheat 🌾

Rated G/E: 48%

Trade: 52%

Last Week: 50%

Last Year: 66%

Winter Wheat 🌾

Harvested: 37%

Trade: 40%

Last Week: 24%

Average: 46%

Today's Main Takeaways

Corn

Corn opened strong but ultimately fell a dime off it's highs ending the day unchanged. As corn just can’t make up it's mind on which direction it wants to go.

As expected, corn conditions did see some slight improvements. As overall ratings jumped by 1% to 51% rated good to excellent. Which is still well below last year's 64%.

Here is a state by state breakdown. Some very clear improvements in the corn belt. The most notable changes being in the 3 I-states.

Illinois: +10% (Rated 36% G/E)

Iowa: +5% (Rated 61% G/E)

Indiana: +5% (Rated 52% G/E)

Despite the improvements, I still wanted to look at how this June shapes up compared to other years when we look at total precipitation.

Yes we got meaningful rain, but the corn belt still had one of it’s driest years on record. With parts of Illinois being the driest in over 120 of 131 years.

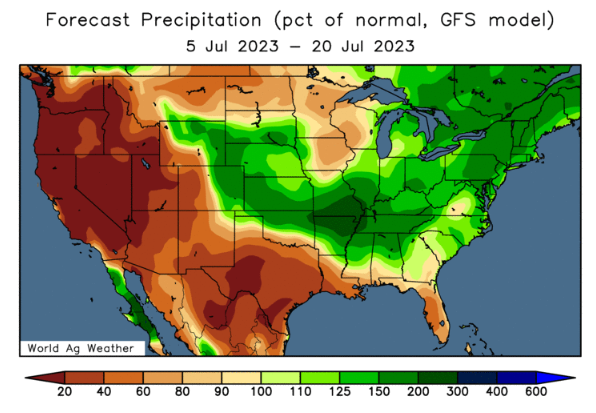

Here is the current weather outlook. A lot of this is likely priced in. But is definitely something to keep your eyes on. These forecasts could lead to some additional pressure to the downside short term.

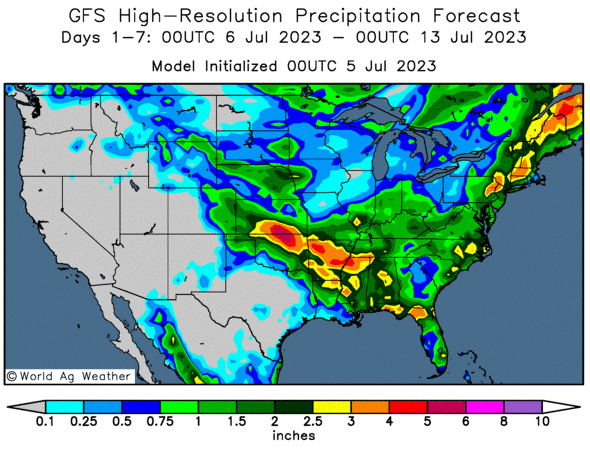

Now here is something else we are watching. The GFS models show a potential dry pocket in Iowa, which could spread into Illinois.

After a 7 day $1.40 sell off I don’t think anyone wants to sell cash grain here. I am not saying we can’t go lower, because of course we can. No one has any idea how the weather will shake out. I actually wouldn’t be surprised to see one more leg down, and close below Monday's lows.

In this morning's audio we talked about a 50% retracement bringing us into that $5.55 to $5.60 range. Which is also right around our 100-day moving average. This is a range we could look to make additional sales. In this morning's audio we also go over possibly owning calls. You can listen to that here.

If we take a look at the charts, yes I think we have the potential to make a quick new low. But we also could have just created a double bottom. Nonetheless, we are very very oversold here on the charts, and I expect us to get a nice rebound in the next few days. My first upside target is $5.25 followed by the $5.50 range.

Corn Dec-23

Soybeans

Beans also opened up very strong following the holiday. At one point we broke 40 cents off our highs, but managed to claw back 17 cents or so. Ultimately ending the day still higher by a penny but 23 cents off our early highs.

Friday we had a very bullish report. Monday we had bullish crop conditions. Yet soybeans struggled to hold on to the momentum, suggesting that a lot of this is already priced in. The lack of momentum was also simply due to some profit taking following the massive rally we just had.

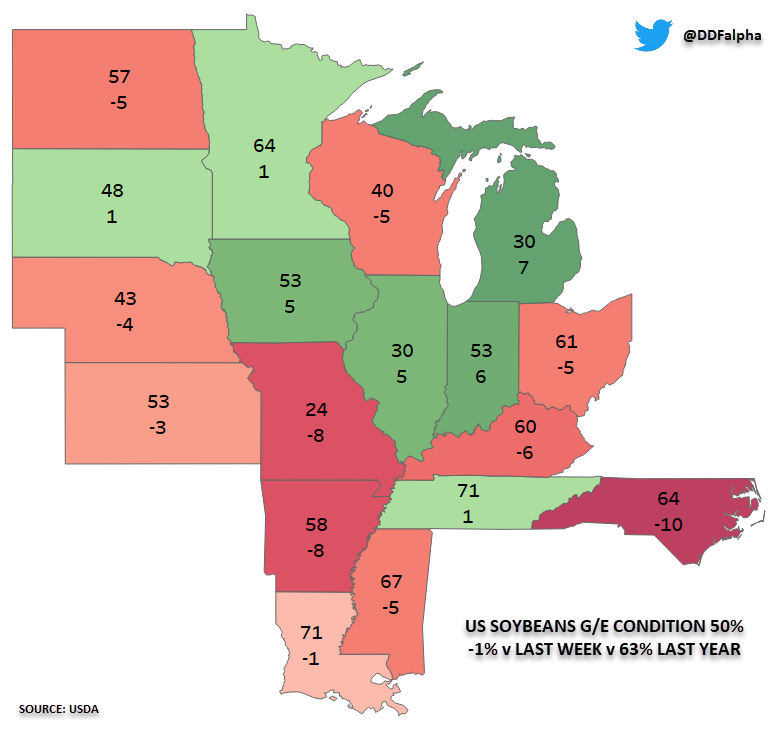

Unlike corn, soybeans conditions fell again. Falling 1% to 50% rated good to excellent. This was a bullish surprise, as the trade was expecting ratings to actually improve by 1% to 52% rated good to excellent. Just like corn, much of the I-states saw some good improvement. Part of the reason we didn’t see a ton of reaction to the decrease in ratings was, firstly a lot of this was already priced in, and secondly, the top 4 producing states all saw improvements.

Some notable changes:

Illinois: +5% (30% rated G/E)

Indiana: +6% (53% rated G/E)

Iowa: +5% (53% rated G/E)

Missouri: -8% (24% rated G/E)

Michigan: -5% (40% rated G/E)

There is nothing wrong with rewarding this recent rally. I don’t mind taking some risk off the table here with prices within 35 cents off their 2023 highs. Is there the potential for more upside? Yes. If the cards get dealt right, there is a ton of potential for beans to make new highs for the year. I think beans even have the potential to see near $15. But you still need to take into consideration what makes the best sense for your operation and remain comfortable no matter what scenario plays out. So if you need to make some sales, make a few. This is also not a terrible area to start looking to grab some puts soon in the coming weeks.

If you want help deciding what to do, or want to learn more about other risk management strategies give Jeremey a call at (605) 295-3100 as every single operation is different with different risk to reward profiles.

I also include an incredible write up from Wright on the Markets that can help you decide what to do and give you some guidance at the end of today's write up. I highly recommend giving it a read as he is one of our most respected other advisor services who always puts the producer first.

Going forward, I think soybeans should be well supported on any breaks. Now we didn’t get the traction bulls had hoped for today. With the extremely bullish report Friday, and the bullish surprise from the crop conditions. Which means a lot of this bullish news is already priced in. So I wouldn’t be too surprised to see some additional profit taking short term and perhaps test that upward support trendline before the next big move higher.

One thing to keep in mind that is included in Wright on the Markets write up is that the seasonal price trend for soybeans is upward until July 15th. So we could be looking to makes sales here soon, within the next 2 weeks or so. Again, I highly recommend reading his full breakdown at the end of today's update.

If we can get a break above Monday's highs, that opens the charts wide open to see more upside. A break above and we look to the $14 level and possible new 2023 highs……

The rest of this post is subscriber-only content. Please subscribe to continue reading.

4TH OF JULY SALE

Get every single one of our daily exclusive updates sent via text & email for a massive discount. (Scroll to see past updates you would’ve received).

OFFER: $350/yr or $35/mo

USUALLY: $800/$80

Not sure? Try Free Trial HERE

Become a Price Maker. Not a Price Taker

INCLUDED IN TODAYS UPDATE

Wheat recommendation

Why was wheat so strong today?

Factors in the wheat market

How to decide when to price grain

Should you be making sales?

Fertilizer update

Check Out Past Updates

7/5/23 - Audio

THE HEAVY VOLATILITY CONTINUES

7/3/23 - Audio

ARE THE MARKETS GOING TO BLOW UP OR FIZZLE

7/2/23 - Weekly Grain Newsletter

WEATHERING THE STORM: WHAT’S NEXT FOR CORN & BEANS?

6/30/23 - Audio & Report Recap

WHAT THE USDA REPORT MEANS

6/29/23 - Market Update

MORE DROUGHT & USDA REPORT TOMORROW

6/29/23 - Audio

WHAT’S NEXT FOR THE GRAINS?

6/28/23 - Audio

FREE FALL CONTINUES. HOW WILL THIS PLAY OUT?

6/27/23 - Audio

GRAINS SMACKED DESPITE AWFUL CROP CONDITIONS

6/27/23 - Audio