WHY YOU SHOULDN’T BE MAKING 2023 SALES

MARKET UPDATE & AUDIO COMMENTARY

Listen to today’s audio below

Audio Commentary Highlights

Why you shouldn’t be making 2023 sales

Risk management

Basis

Spreads

Futures Prices Close

Click here for an audio version of our market update

Overview

Grains mixed with wheat trading higher, with soybeans and corn both trading lower.

Export sales were strong for corn and wheat but fairly modest for beans.

A wetter Argentina forecast is the main reason for the pressure across both corn and soybeans, negatively affecting soybeans the most.

Keep your eyes out for this weekends Weekly Grain Newsletter. If you missed this weeks edition, Read Here

Today's Main Takeaways

Corn

Despite the great export sales numbers, corn following soybeans lower here today, trading just slightly lower down -1 cent.

One thing on the bearish side of things is the exports coming out of Brazil and Ukraine remain competitive compared to the US.

Ethanol production is back up over +1 million barrels a day, which is supportive. But we are still running behind last years numbers.

Overall, there isn’t a ton of new fresh bullish news surrounding the corn market. Pair that with the Argentina rain and it makes me slightly nervous here looking short term. As there isn't much of a demand story right now.

Factors that could push corn higher are demand headlines, South America problems, and war escalation headlines.

Bulls still have their eyes set on $7 as a target. If we could just get a few bullish catalysts, I don't think that's too unreasonable of a target.

Highlights

Despite Argy rains, corn estimates continue to be lowered.

Buenos Aires recently cut their Argy estimate from 50 to 44.5 million metric tons, which is a sizeable cut. They also noted that this number could drop even further, perhaps 6 to 7 million more.

USDA remains far above this estimate at 52 million.

Dr. Cordonnier has the lowest estimate at 44 million.

Weekly export sales were well above expectations at 44.6 million bushels, with a range of 10 to 31 million.

Yesterday there were rumors of an Egypt corn purchase from Ukraine at 336 per metric tons, which is slightly below US offers of 338-345.

Weekly ethanol production numbers were at 1,008 thousand barrels. Up 943 from last week.

Ethanol stocks dropped 0.4 million barrels and was the lowest stocks number over the last 6 weeks.

Main Factors

Argentina weather

Funds

Demand

War

Seasonal tendencies

After flirting with a break out, corn retraced back down below its trend line. We will have to see if we go back and test the bottom of the triangle or retest a break out.

Corn March-23

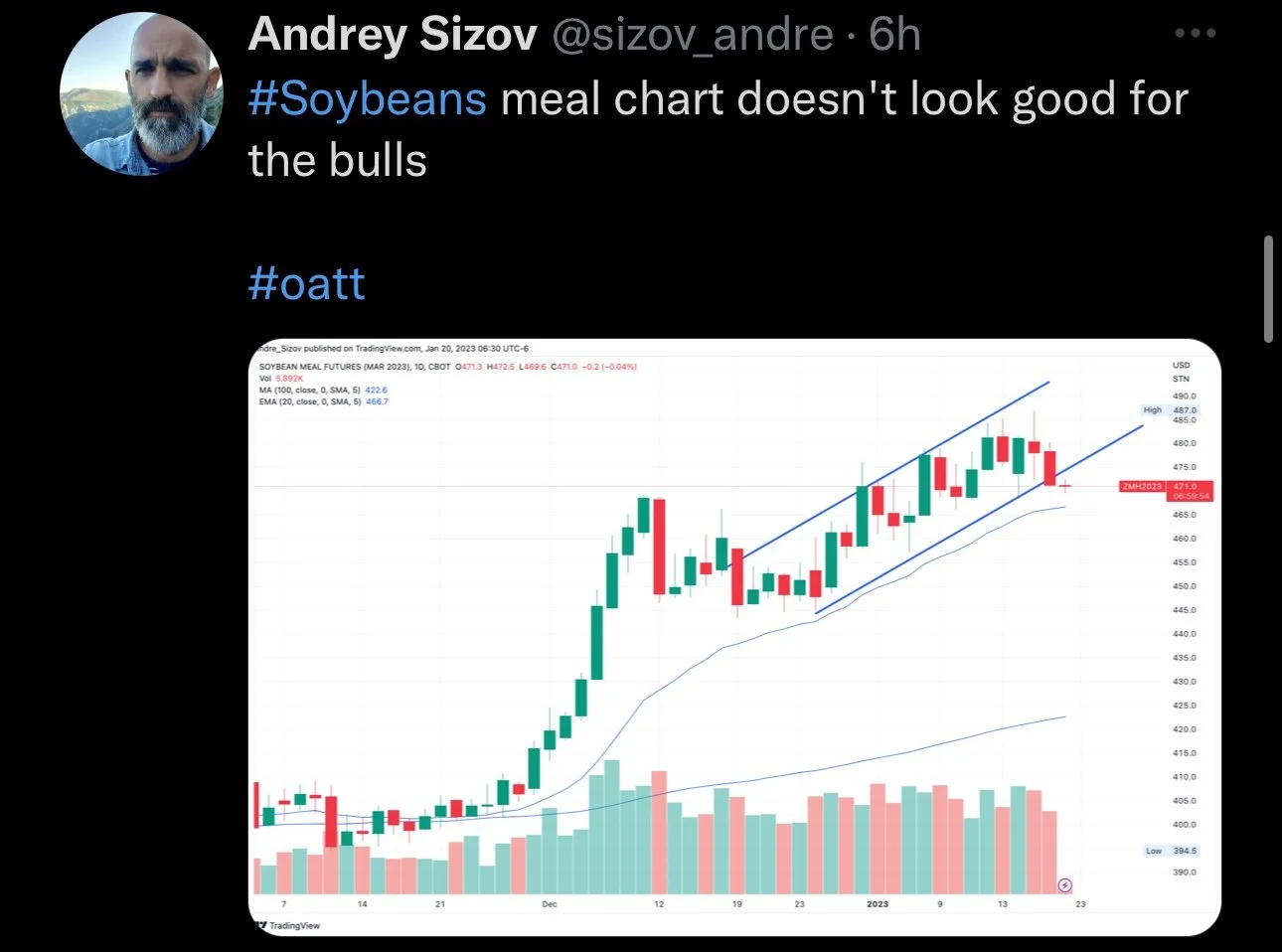

Soybeans

Soybeans continue to trade lower off their recent highs. Closing down -8 cents, nearing the $15 range again, currently at $15.06. Mainly being pressured from timely rain in Argentina.

One thing bulls are keeping their eyes on is Brazil. As their harvest is being delayed, currently looks like they are over a week behind. If this continues, this would be great for bean futures as globally, people would have to look to get supplies from the US if Brazil's isn't available. But this isn’t a huge concern right now. We also have to keep in mind that Brazil is still expecting a record large crop.

Soybeans are down around 30 cents following the rally Tuesday where they closed at their highest level since June 2022. In Wednesday's update, I said it was tough to hop on the bull train here unless we see more Argentina problems. But now that they are expected to get some rain, fundamentally soybeans don’t have a whole lot more going for them short term. Perhaps there is some hope there if China's situation approves and we see some harvest problems over in Brazil. But without any of these bullish catalysts, it's tough to see us sustaining these recent rallies when we push into the higher end of our recent trade range.

Despite the Argentina rain, we have to ask ourselves is this rain just simply late? As there is some talks that none of this rain will even matter, as most of the damage is already done. If this is the case, this could be beneficial in helping support prices looking long term.

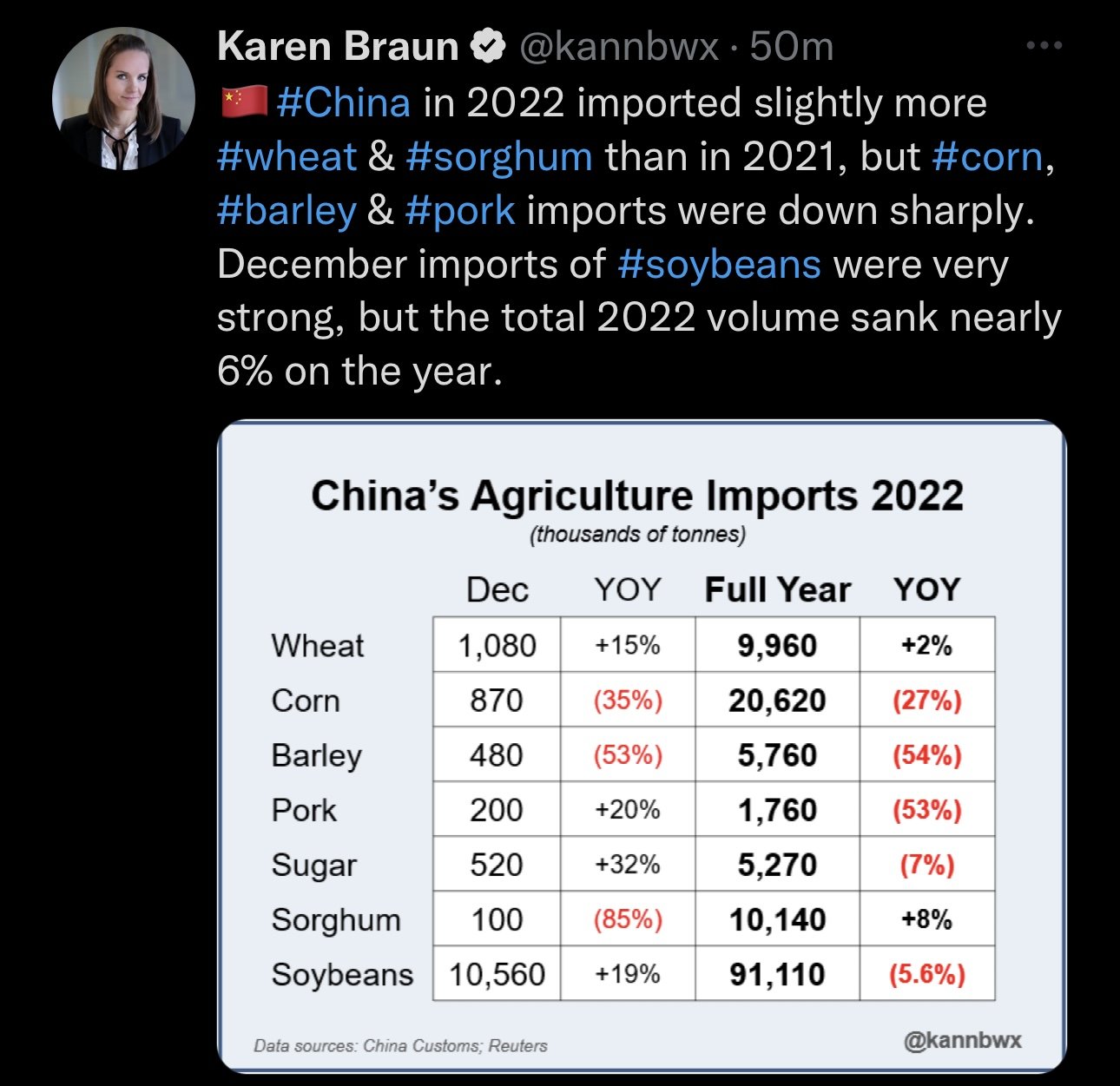

The other main thing effecting the soybean market is Chinese headlines. As there is still some uncertainties regarding their demand and economy as a whole. China remains mostly a wild card.

Highlights

Early yield reports in Brazil point to above average yields.

Pretty good export sales, coming in at 36.2 million bushels, at the high end of the estimate range.

China covid uncertainty has put some pressure om ocean freight values and demand expectations.

Weather forecasts showing decent chance of rain in Argentina the next couple weeks.

Main Factors

Argentina rain and drought

China covid & economy

Funds

Seasonal tendancies

Soybeans continue to bounce around. Falling lower after testing resistance early in the week, looks like they might go back and test the trend line around $15.

Soybeans March-23

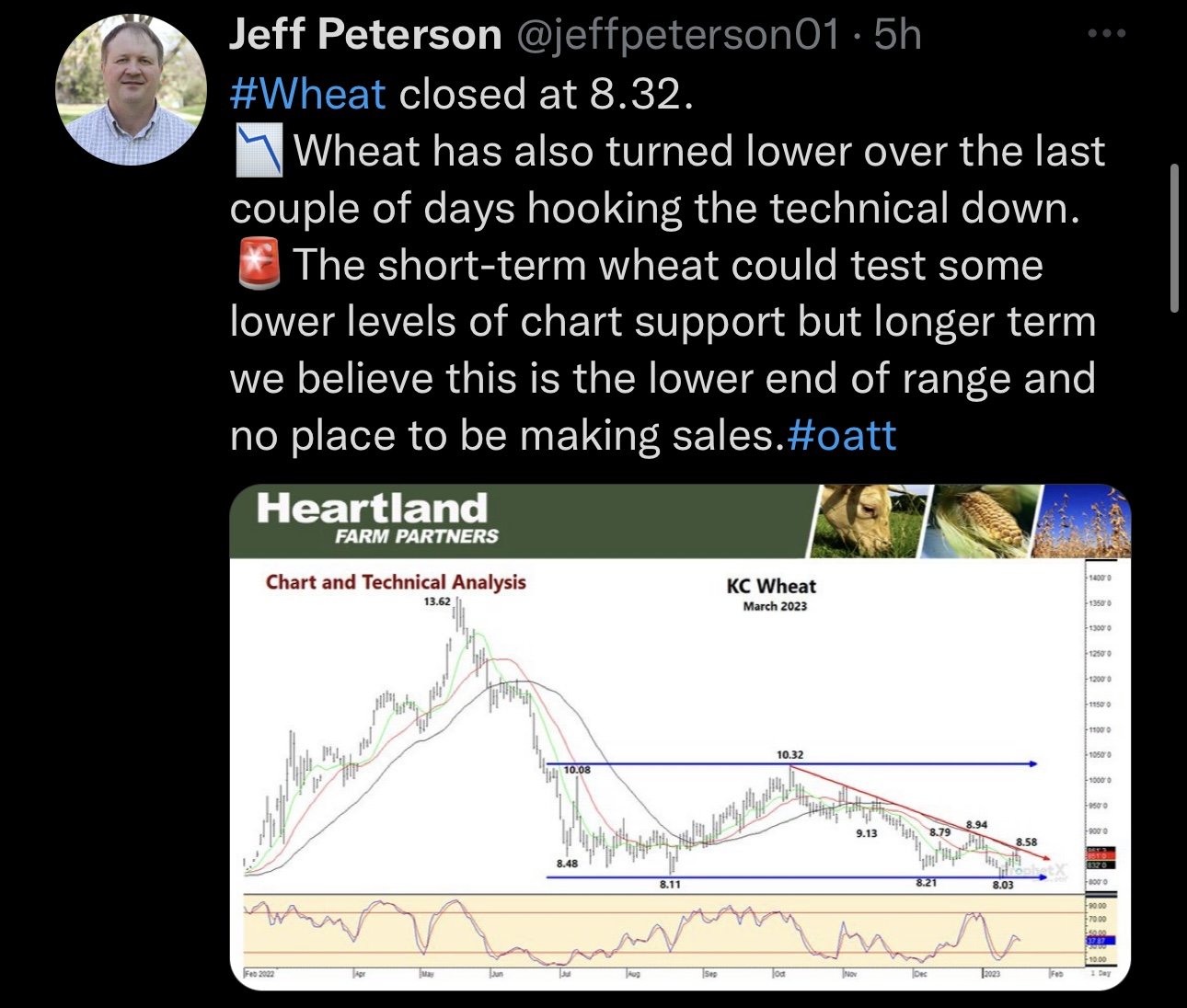

Wheat

Wheat was the outlier today, trading higher while both corn and beans closed lower. Chicago and Minneapolis closed up +7-8 cents while KC wheat saw a nice rally of over +16 cents.

Overall, not a ton has changed this week for the wheat market. The main problem is the simple fact that the U.S. still remains overpriced compared to other countries.

We also have the supposedly record crop out of Russia, which on the surface is bearish, but there is some talk that it might not quite be as large as most are expecting.

You can’t mention wheat without war. War is still a large factor at play. But hasn’t quiet moved the markets as much as bulls would like when we get news of escalation. To go along with Putin's recent comments about restricting exports. There is still definitely a chance to see this cause some buying in wheat. Keep in mind, this war is between our world leading exporters in wheat.

Funds are the other big thing. They still hold a massive short position. I think they could definitely be caught off guard if we get some bullish headlines, leading to them exiting these. Ultimately, I just think there is far more upside than there is downside in the wheat market and continue to hold a bullish tilt for the coming months.

Highlights

Strong export sales from wheat as well. Coming in at 17.4 million bushels.

Russia's Ag Minister reported that they plan on exporting 55-60 metric tons of grain for 2022/23.

The recent rains have reduced the drought here in the US.

Russia's wheat exports in January are roughly 1.2 million less than they were in December.

There is a large backup of ships off the coast of Turkey that are having problems getting Ukraine exports loaded and inspected.

Main Factors

Global competition

US Weather. Moisture in the southern plains.

Funds (still short)

War

Seasonal tendencies

Chicago wheat found support right around our recent lows. Still sitting in a downtrend. I think we see the funds step in here if we can break out of this down trend.

Chicago March-23

KC March-23

MPLS March-23

Other Markets

Crude oil up +1.15 to 81.76

Dow Jones up almost +300

Dollar Index up down slightly -0.09 to 101.74

Cotton up strong, +3.31 to 86.70

Livestock

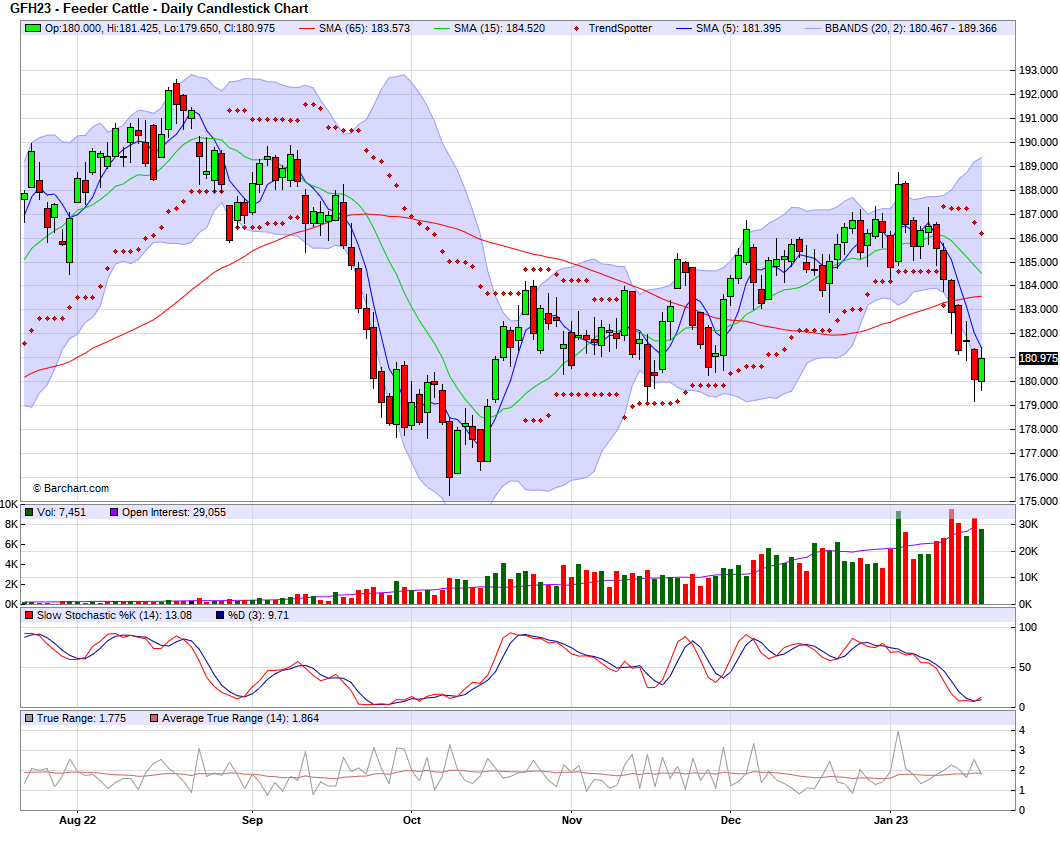

Feeder Cattle up +0.800 to 159.925

Live Cattle up +0.975 to 180.975

Live Cattle

Feeder Cattle

South America Weather

Argentina 8-15 Precipitation

Argentina 8-15 Max Temp

Brazil 8-15 Precipitation

Social Media

All credit to respectful owners

U.S. Weather

Source: National Weather Service