FIRST HIGHER WEEK IN MONTHS

WEEKLY WRAP

Prefer to Listen? Audio Version

Futures Prices Close

Overview

Grains mixed as soybeans rally. Corn fails to take out last weeks high of $4.34 to complete it's weekly reversal. The wheat market gets hammered looking to test those recent lows as wheat posted a new low close.

After 16 brutal weeks, this was soybeans first week higher since October. Soybeans were up +9 1/2 cents on the week.

This was also corns first week higher since early December. Corn was up +11 1/4 cents on the week.

With the fall out today, Chicago wheat was down -11 1/4 cents on the week while KC wheat was only down -1 cent.

The pressure in wheat today came from matif wheat in France falling to their lowest levels since 2020. This was due to ample supply in Russia along with no issues getting grain out of Ukraine. This dragged down our wheat market and some of this weakness spread into the corn market as well.

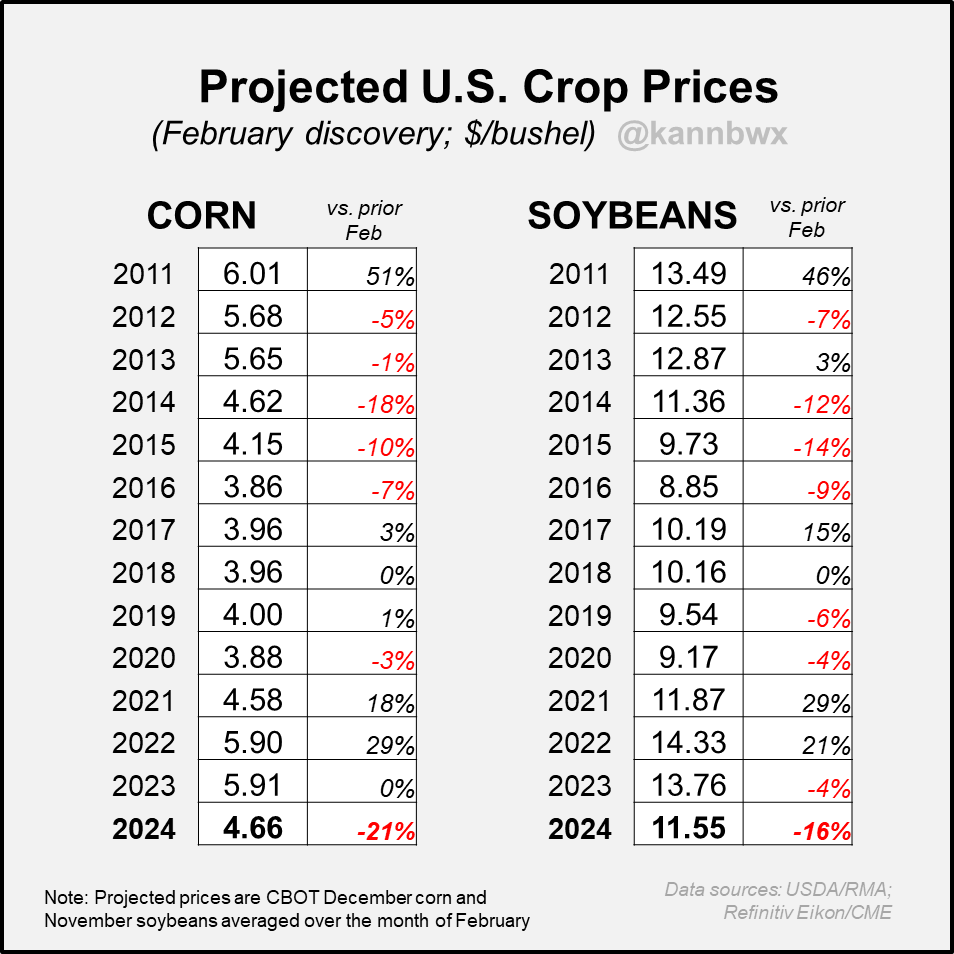

Insurances prices got set today. Here is the results:

Corn: $4.66

Beans: $11.55

Chart Credit: Karen Braun

It felt like there was a lot of pricing heading into first notice day. The market drove us lower to force farmers to sell ahead of that. Then after they sold, we bounced. There was a lot of people racing to sell basis contracts.

Everybody knew the farmer had a lot of basis contracts that needed to be priced or rolled going into first notice day.

I wonder if it was big ag selling ahead of time, pressing the market down because they knew you would be forced to sell or roll. Would anyone put that past your buyer to do?

There are several people that mention it was a race to drive the market to new lows before first notice day. Sometimes it feels like it is the farmers vs everyone. Big ag, the funds, the USDA, etc. The greatest trick the devil ever played was convincing people he wasn't real.

Ways to NOT Manage Risk

The first thing I wanted to talk about today is ways you should NOT be managing your risk this time of year in my opinion.

With prices depressed and implied volatility low, right now is not the time to be using strategies that use short implied volatility because seasonally as we get into March, our markets can get more volatile with the ending of bean harvest in South America and as we roll into the second corn crop growing season portion where we determine what they are going to raise.

This time frame for their second corn is the equivalent to our July. Then we have the March 31st USDA acre report.

Then when we really get into our growing season, this will all add to volatility. So you will want to stay away from the crap some of these buyers try to sell you such as accumulators.

The time to do accumulators and to sell calls is when implied volatility gets higher. Typically it starts to raise from now until we get into June and July. The best time to use accumulators will typically be in June and July, which is typically the weather scare season.

So this is one way not to get taken advantage of by Big Ag. Do not use accumulators or sell calls when implied volatility is low. Implied volatility means the market is not expecting big moves which lowers the price of options.

If you have questions, before you do an accumulator with a buyer that may have motivation to buy your grain cheap. Give us a call because we will give you an unbiased opinion. (605)295-3100

South America

Which brings me to my next topic. South America.

This has been partly a reason why corn and soybeans have struggled to find momentum. As there isn’t a major threat right now and soybean harvest is moving along well. But could that change?

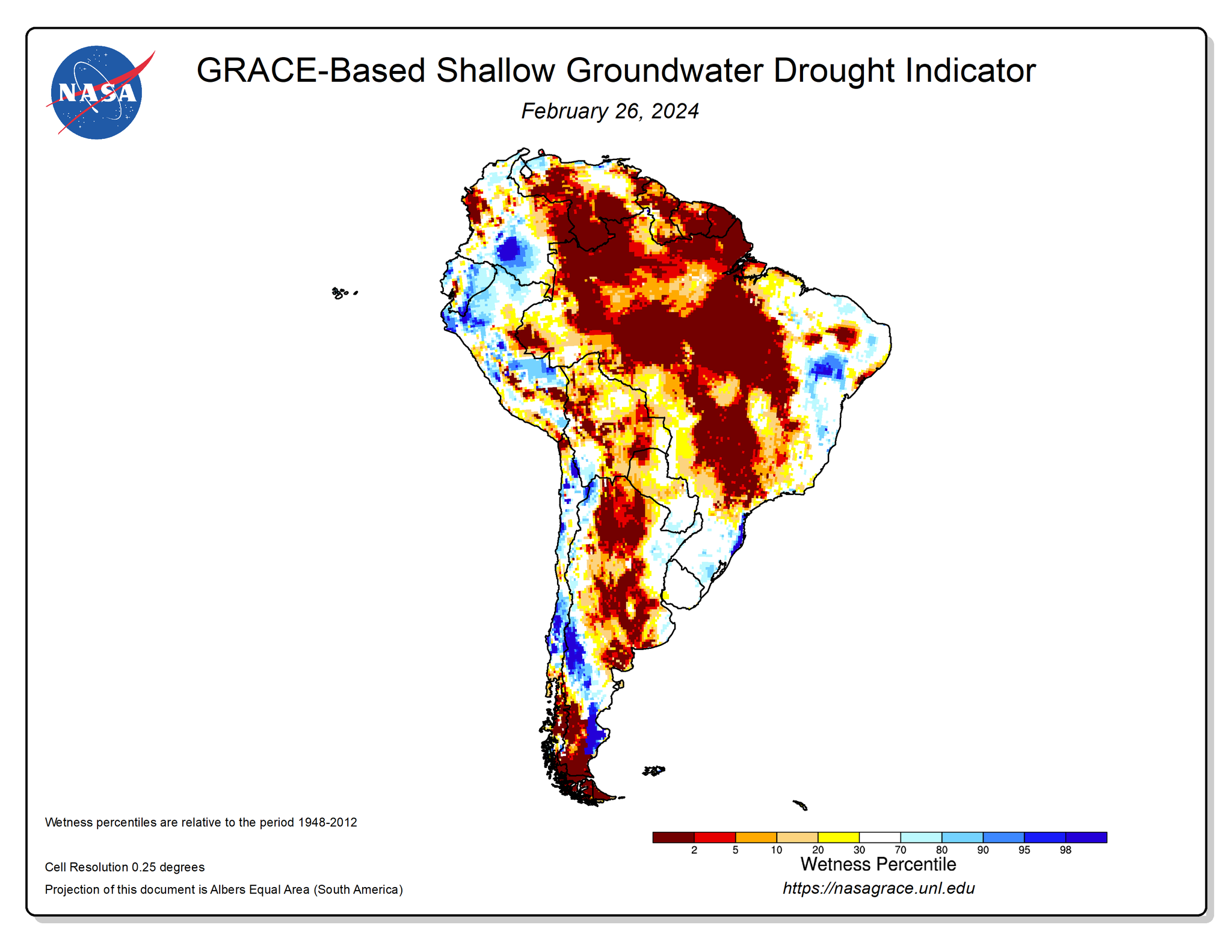

South America as a whole, should produce an okay soybean crop. However, the recent yield reports from Brazil are showing yields a little worse than expected. This is giving soybeans some support around this $11.30 level.

Keep in mind, fast harvest is not always a good thing. What does a fast harvest usually mean? It means it is dry.

Now the biggest concern with this is their second crop corn. Remember, this corn got planted late. Which pushes the crop into a less favorable growing window and puts the crop at risk.

The forecasts remain dry looking longer term and they already lack soil moisture. If it does not rain, that corn crop could take a big toll.

April is the month where this second corn crop pollinates and their seasonal drought begins. They have missed a ton of rain, and have the lowest subsoil moisture situation on record.

There are several advisors that believe this could be the catalyst corn needs.

The market may not realize it now, but they will if it stays hot and dry. If this happens, will likely take place in late April or May. Similar to that of 2016.

US Weather

Next let's look at the US weather.

As I have been talking about for a week now, warmest winter on record. Lack of precipitation.

But what does this mean?………..

The rest of this is subscriber-only content. Subscribe to keep reading and get every exclusive update. Comes with 1 on 1 marketing planning tailored to you.

IN THE REST OF TODAYS UPDATE

What does this Feb weather mean for spring & summer?

Is there any merit to a 2012 or last year comparison?

Our soil moisture is lacking

What path prices could follow spring and summer

How should you be managing your risk?

TRY OUR UPDATES FOR FREE

Let’s turn these challenging price levels into opportunities.

Try 30 days completely free.

Want to Talk?

Our phones are open 24/7 for you guys if you ever need anything or want to discuss your operation.

Hedge Account

Interested in a hedge account? Use the link below to set up an account or shoot Jeremey a call at (605)295-3100 or Wade at (605)870-0091

Check Out Past Updates

2/29/24

HOW TO USE TARGETS VS TRIGGERS

2/28/24

BIGGEST 3 DAYS IN CORN SINCE AUGUST

2/27/24

DID CHINA BUY CORN YESTERDAY?

2/26/24

EARLY PLANTING, DROUGHT, & FINDING YOUR GRAIN MARKETING STRATEGY

2/23/24

MORE DOOM & GLOOM AS CORN BREAKS BELOW $4.00

2/22/24

HAVING A PLAN & DEFINING RISK

2/21/24

LOWER LOWS & DROUGHT TALK

2/20/24

HOPE ISN’T A MARKETING PLAN BUT HISTORY REPEATS ITSELF

2/16/24

HAVE ENOUGH OF YOUR NEIGHBORS THROWN IN THE TOWEL SO WE CAN BOTTOM?

2/15/24

BASIS CONTRACTS & USDA OUTLOOK

Read More

2/14/24

SELL OFF AHEAD OF USDA OUTLOOK: STRATEGIES TO CONSIDER

2/13/24

LA NINA, FUNDS, & USDA OUTLOOK FORUM

2/12/24

WHAT TYPE OF GARBAGE USDA OUTLOOK REPORT IS ALREADY PRICED IN?

2/9/24

RECORD SHORT FUNDS, SOUTH AMERICA, & MANAGING RISK

2/8/24

CONAB VERY FRIENDLY. USDA NOT. FULL BREAKDOWN

2/7/24

NEW LOWS IN CORN & USDA PREVIEW

2/6/24

WHAT IS EXPECTED FROM USDA & WAYS TO GET COMFORTABLE

2/5/24

STILL NO CLEAR DIRECTIONS IN THE MARKETS

2/2/24

NEW BEAN LOWS.. HOW LOW CAN CORN GO?

2/1/24

NO CONFIRMATION OF HIGHER OR LOWER PRICES IN GRAINS

1/31/24

HOW SHOULD YOU BE SETTING YOUR TARGETS?

1/30/24

OUTSIDE UP DAY IN ALL THE GRAINS

1/29/24