YIELD, DROUGHT UPDATE, TIME FOR CALLS?

Overview

Grains end mixed with soybeans getting a slight bounce following their recent sell-off while corn and beans continue to struggle to gain any moment. As wheat led us to the downside, down 12 in Chicago and 19 1/2 in KC.

Corn and beans had a relatively quiet day compared to as of late with the massive volatility we've seen. With a small 10 cent range in corn, and a 19 cent range in beans.

We another sale of beans to China this morning. Export sales this morning were huge for soybeans, 2.74 million metric tons. Was a little surprising to see beans not pick as much momentum as some would have thought, but the weather is still pressuring the beans.

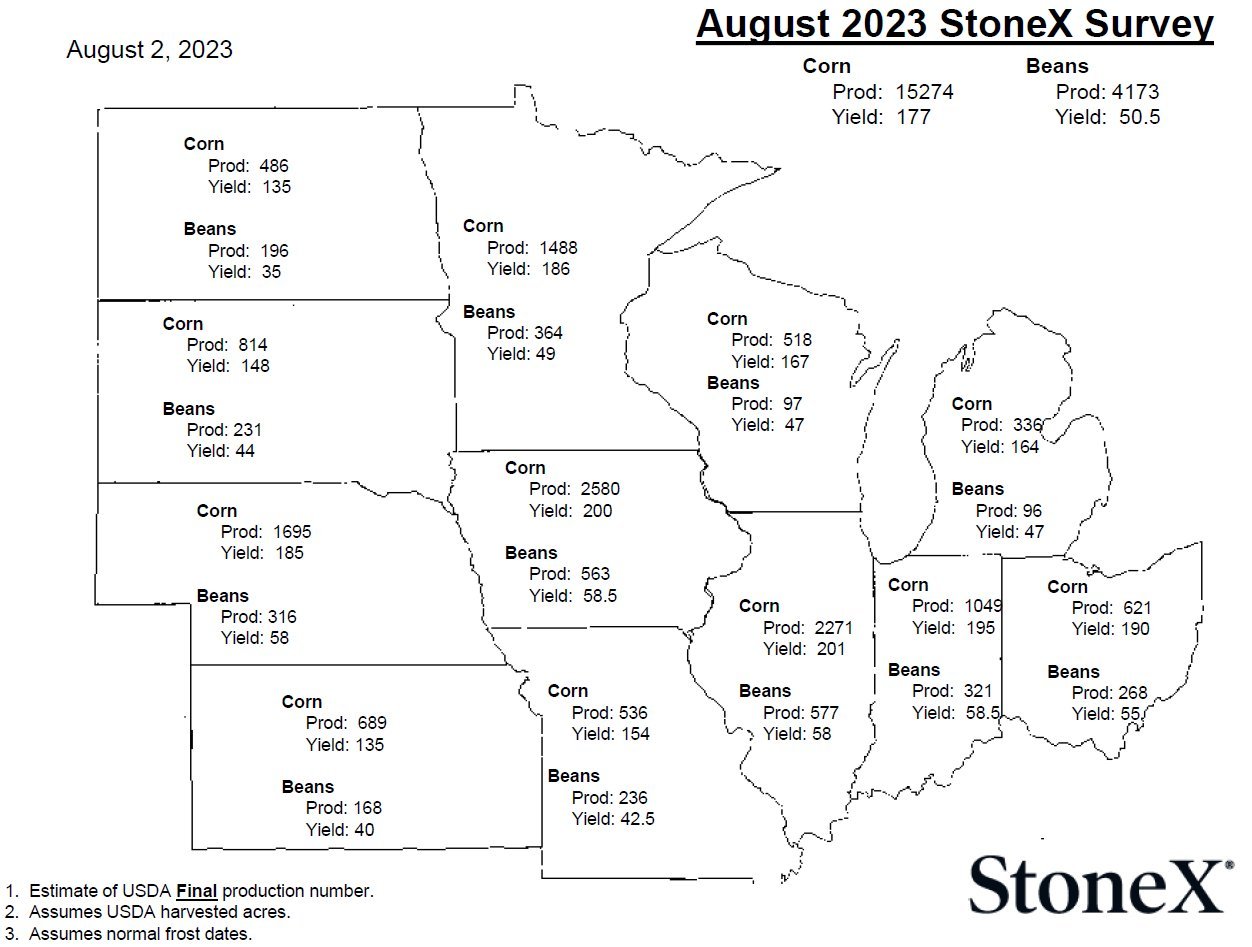

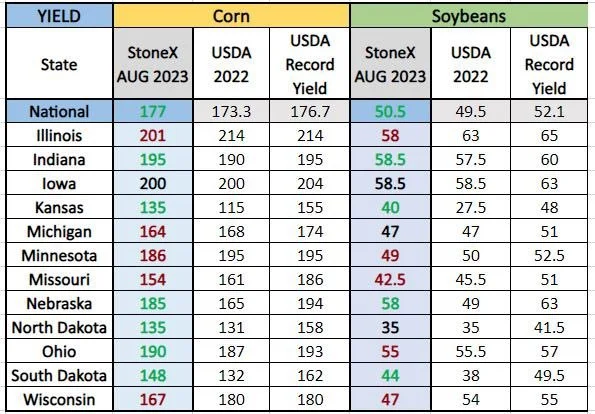

StoneX came out with some yield estimates from a survey. For corn they had 177 bpa compared to the USDA's 177.5 bpa. On the beans they had 50.5 bpa for beans vs the USDA 52 bpa.

The rain and cooler weather are certainly going to help the crop. But I still think the trade is underestimating the amount of damage we have done thus far. To have our bean crop rated at just 52% good to excellent this late in the season is a pretty good indication that we likely won’t even be close to what the USDA seems to think.

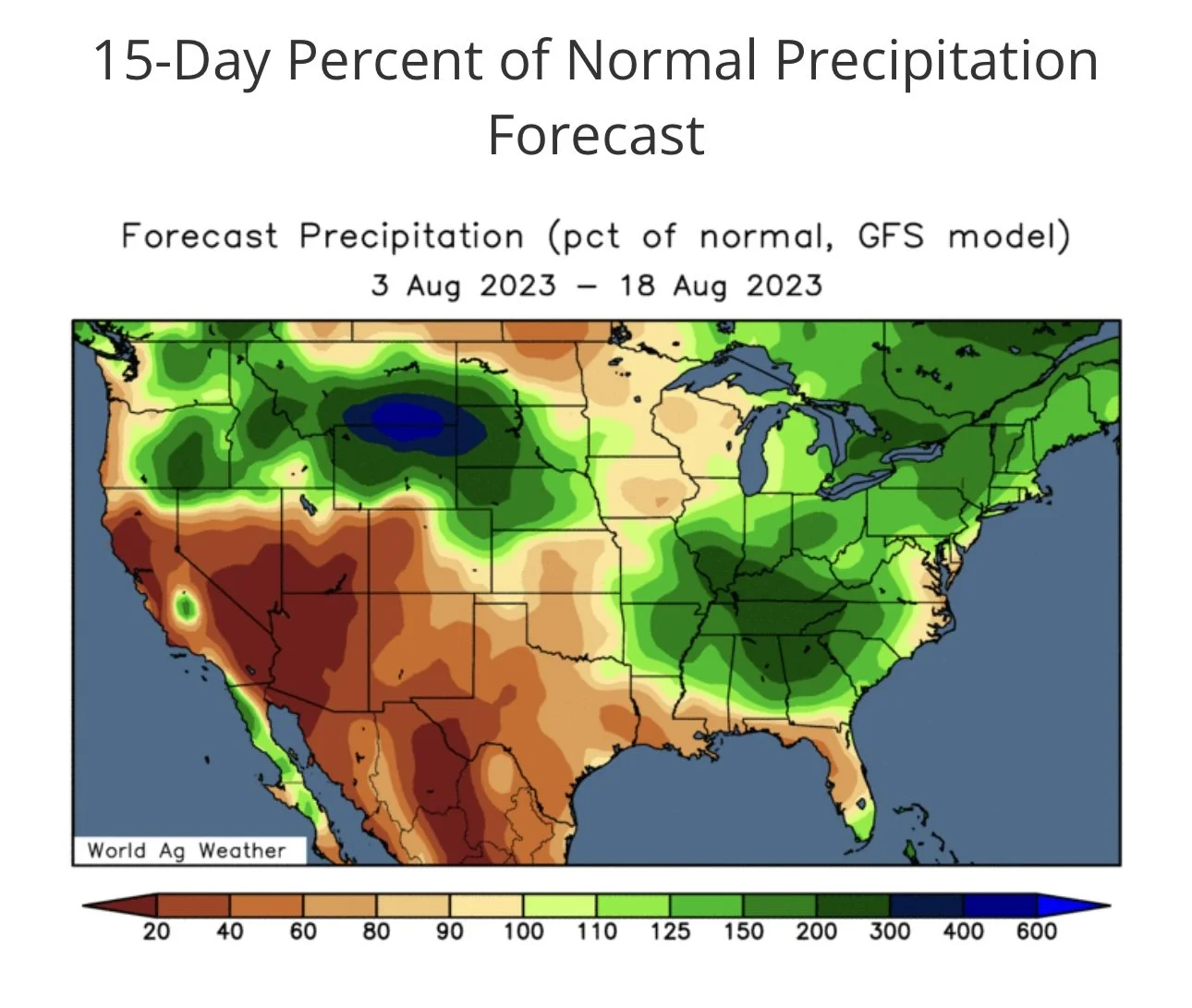

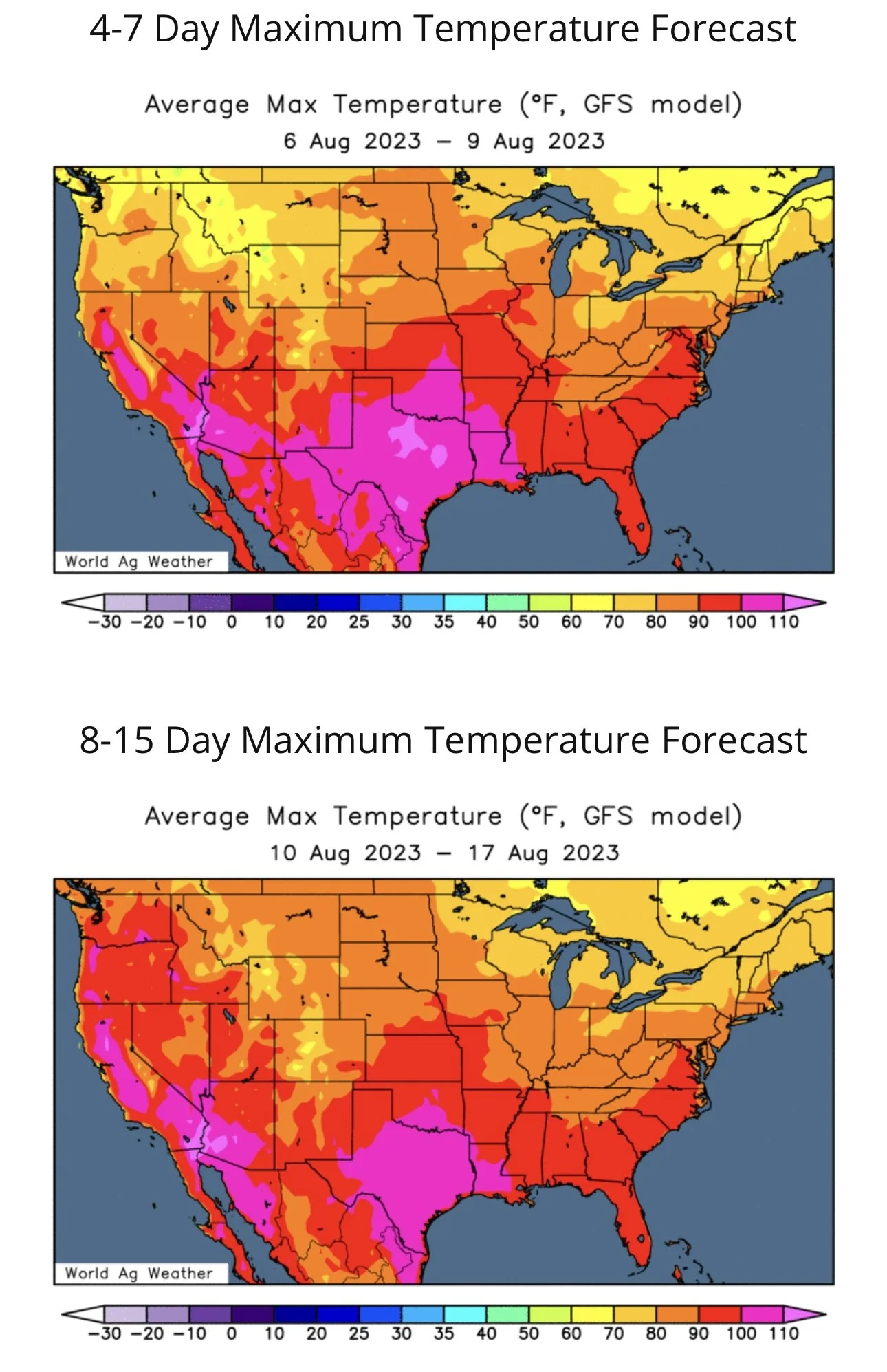

Below is the current forecasts.

Forecasts

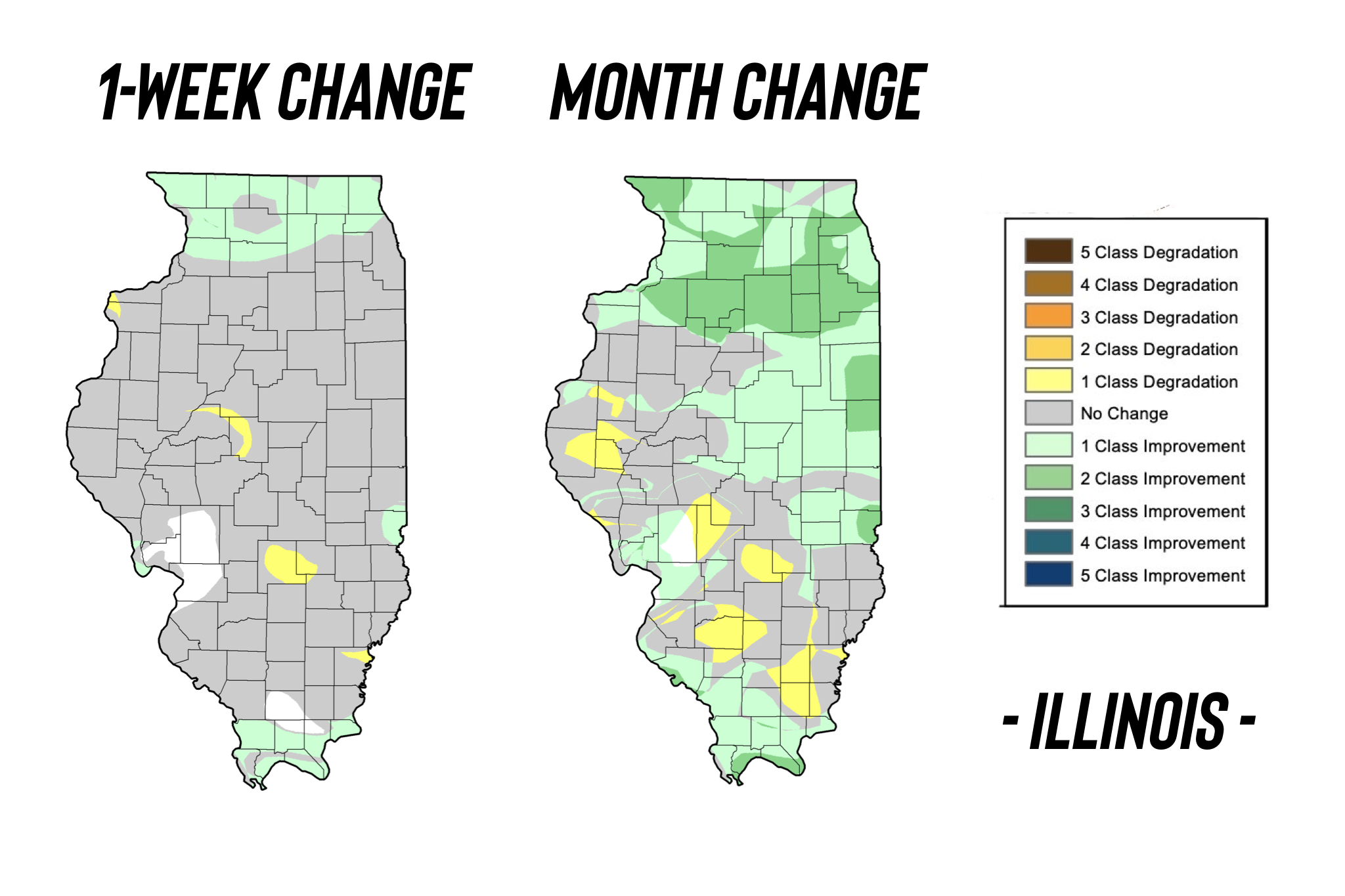

Drought Update

The newest drought monitors were on the bearish side. Now these weren’t a game changer, but the midwest had 3% less drought in the D1 category and 6% more in the no drought stress category.

Below is the weekly and month change for the midwest as well as Iowa and Illinois. Illinois saw improvement once again but Iowa saw some decline.

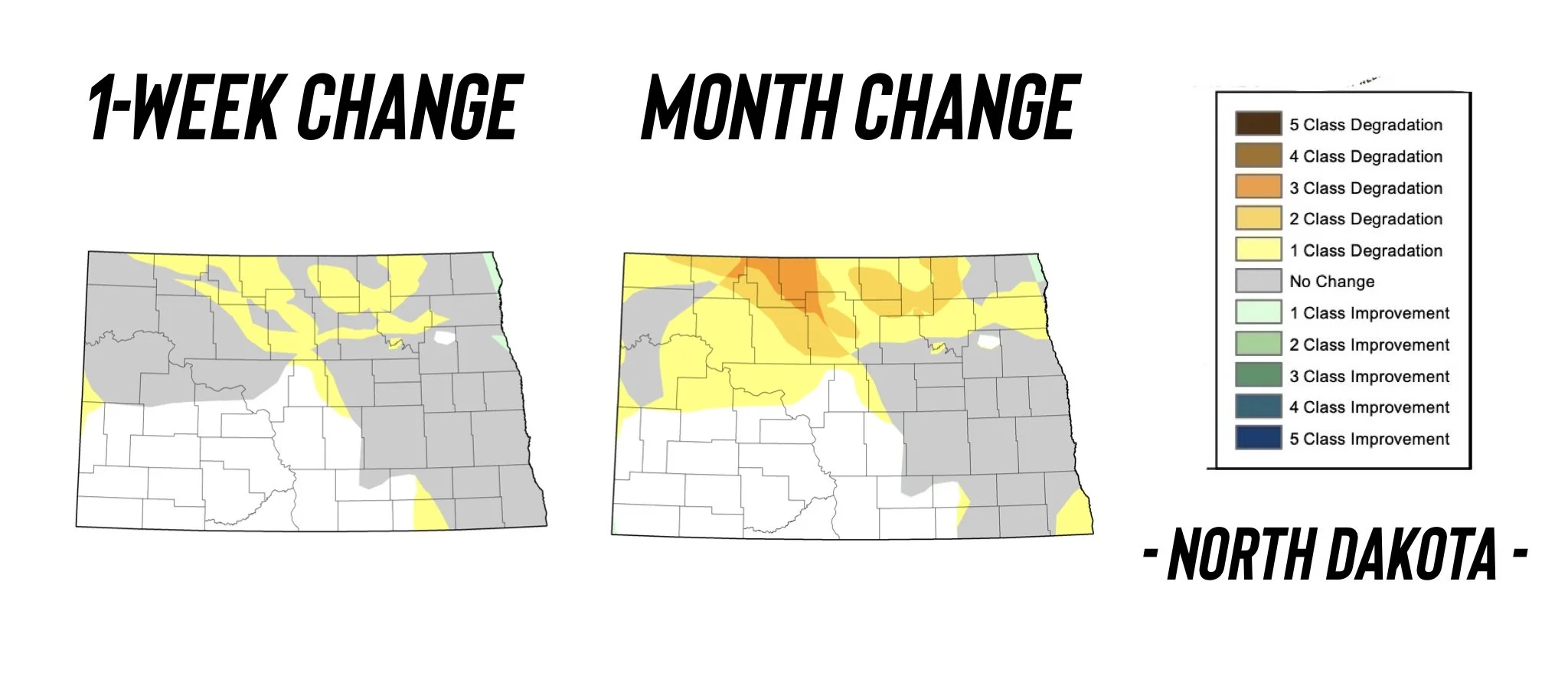

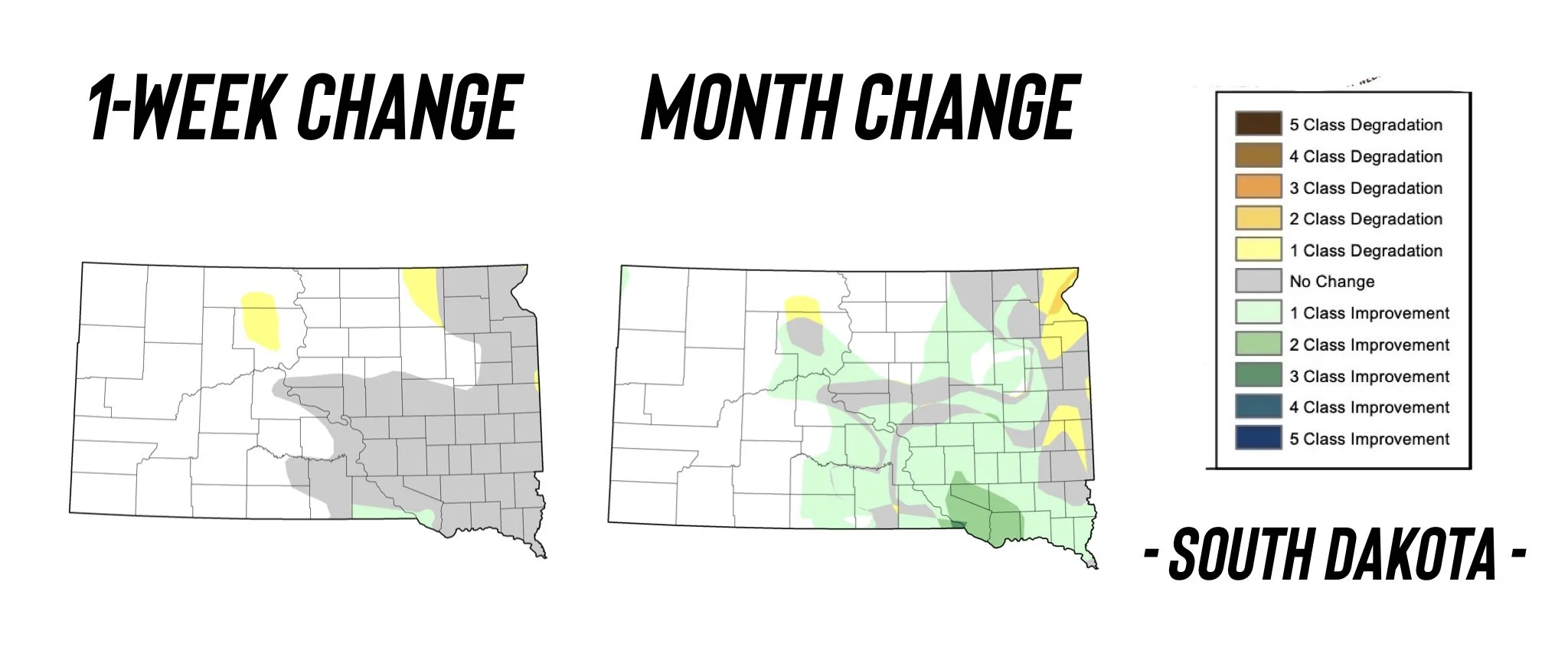

Minnesota, South Dakota, and North Dakota will be a few states that are being closely monitored in terms of potential damage and yield loss.

Here were their drought changes.

Today's Main Takeaways

Corn

Corn posts it's 8th consecutive day of losses, now trading back below $5 and 80 cents off of it's recent highs.

The focus has still been the bearish weather as well as some estimates raising their previous lower yield numbers.

Aside from weather, the macro markets have not helped on this sell off. With the recent surge in the dollar creating headwinds for exports. Exports sales this morning were okay, nothing special. All of this has led to the funds selling.

StoneX Brazil raised its corn production estimate to 139.23 million metric tons. Up 6.23 million metric tons (245 million bushels).

As mentioned, the StoneX survey came out with a 177 bpa yield for corn. A bearish number, and slightly below the USDA's 177.5 they had last month.

Next week we will get the USDA report. There is almost a zero chance that yield comes in unchanged or higher. Could it happen? I suppose it's possible, but not probable.

When we take a look at these surveys, we need to keep in mind that a lot of the numbers came from buyers, commercials, and elevators as we mentioned in this morning's audio. This is important because more often than not, buyers overstate yield, while farmers understate yield. Because buyers want the price to go down to buy grain as cheap as possible, while producers want to get the best price possible. So overall, these surveys aren't the most reliable thing in the world. So take them with a grain of salt.

Here was the results of the survey.

On the other hand, StoneX also released their yield estimates from their model. Their model showed a yield of 172.5 bpa. Which is nearly 5 bushels an acre less than the USDA currently has and far below what their surveys showed…….

The rest of this is subscriber-only content. Please subscribe to continue reading or try a 30-day Free Trial HERE. Get every single exclusive update sent via text & email.

Scroll to check out past updates you missed.

Become a Price Maker. Not a Price Taker.

IN THE REST OF TODAY’S UPDATE

Biggest concern for higher corn

When will we make our lows in corn and wheat?

Is it time to look at cheap calls?

Hedging, not chasing

Is the USDA remotely close on their yield?

What’s going on in the war

Full corn, bean, and wheat breakdowns

Updates You Might’ve Missed..

8/3/23 - Audio

BUYING RECOMMENDATIONS

8/2/23 - Audio

WEATHER & WAR VOLATILITY CONTINUES

8/1/23 - Weekly Grain Newsletter

WHEN WILL THE BLEEDING STOP?

7/31/23 - Market Update

WEATHER HAMMERS THE GRAINS

7/30/23 - Weekly Grain Newsletter

HOW MUCH DAMAGE WAS DONE FROM RECENT HEAT?

7/28/23 - Audio

DO CURRENT PRICES HAVE ENOUGH WEATHER & WAR PREMIUM BUILT IN?

7/27/23 - Market Update

GRAINS FADE OFF EARLY HIGHS

7/26/23 - Audio