YIELDS, DROUGHT, & CHINESE APPETITE

Overview

Grains finish the day mixed. With soybeans leading the way while wheat sees a little bit of profit taking. The market tried to push Chicago lower, but we ultimately bounced over a dime off those lows to only lose a 3 1/2 cents on today's profit taking.

Overall, not a ton of news today.

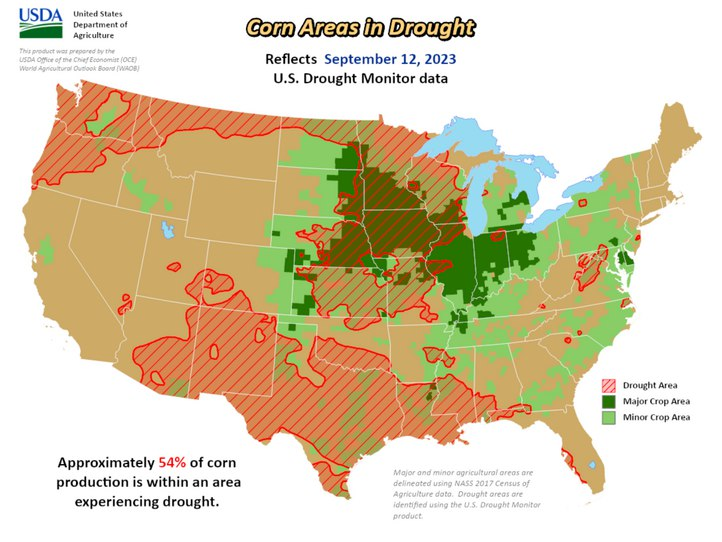

We got the newest drought update. Here is what it showed.

Areas Experiencing Drought (% Weekly Change)

Corn: 54% (+5%)

Beans: 48% (+5)

Spring Wheat: 59% (+3%)

Winter Wheat: 46% (0%)

Cotton: 46% (+2%)

Now does this increase to drought matter anymore? Well, not really. The weather game is essentially over here. We can’t do much more damage than we have and no amount of rain is going to save the crops either. The only weather headline here in the US that matters for now would be if we were to get an early freeze.

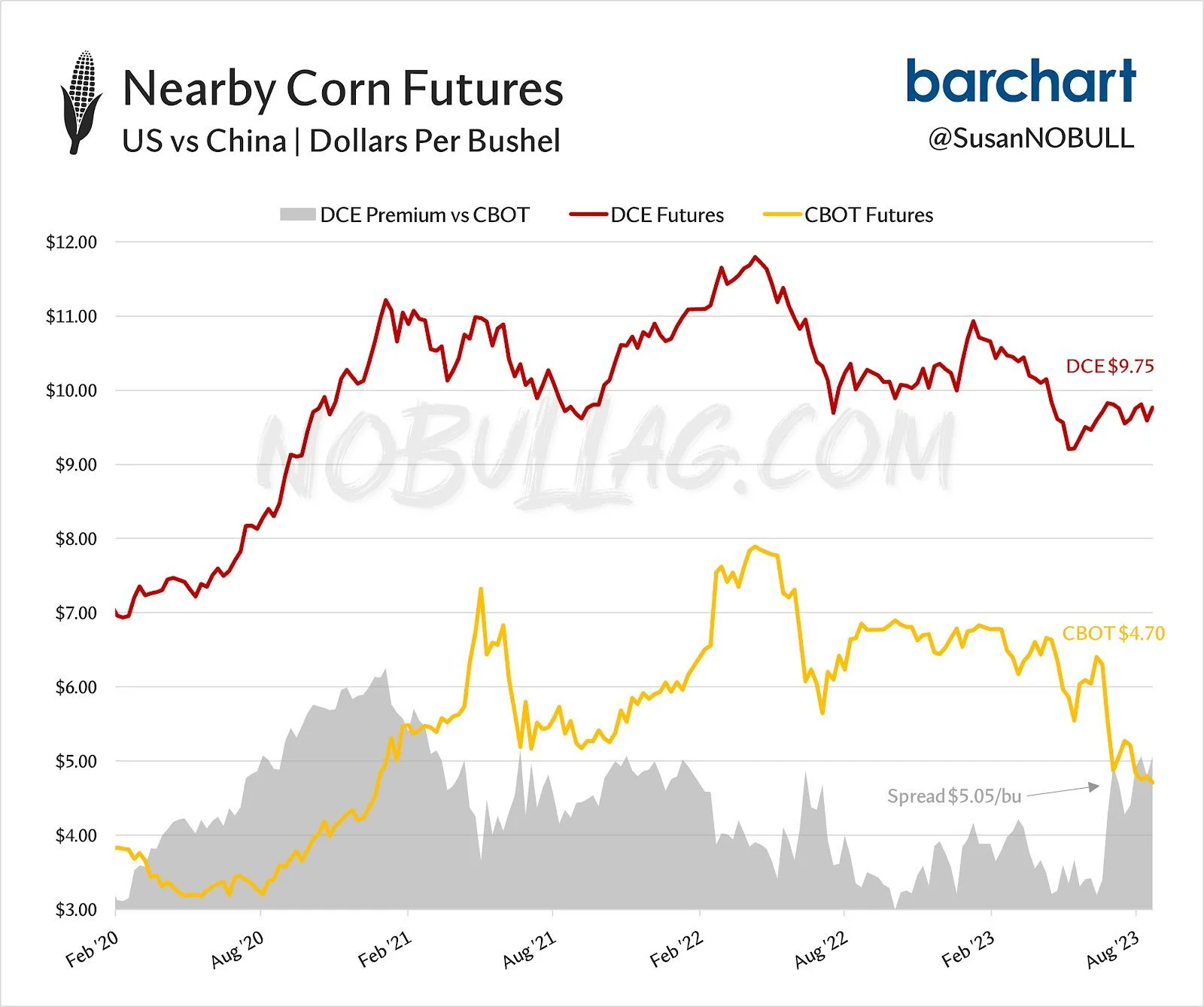

But here is something that does matter. Remember this chart from a few weeks ago from No Bull Ag that shows the spread between China vs US corn had reached over $5.00 a bushel. The largest since fall of 2021.

When we shared this we said: "Don’t tell me China won’t be buying our corn very soon..."

Why point this out? Because China is back in the market for US corn, as they just made their largest weekly purchase since April. With 6.8 million bushels.

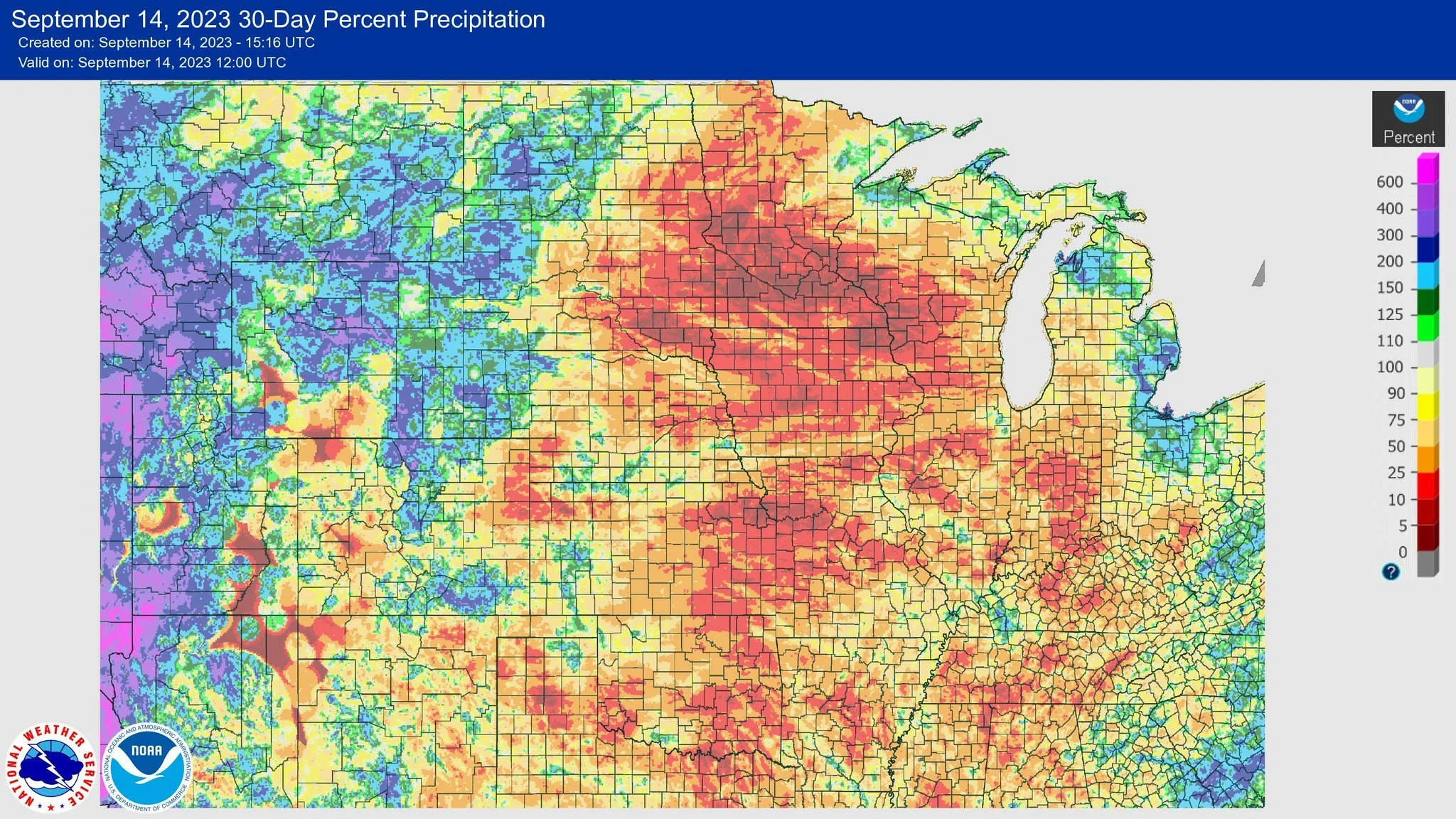

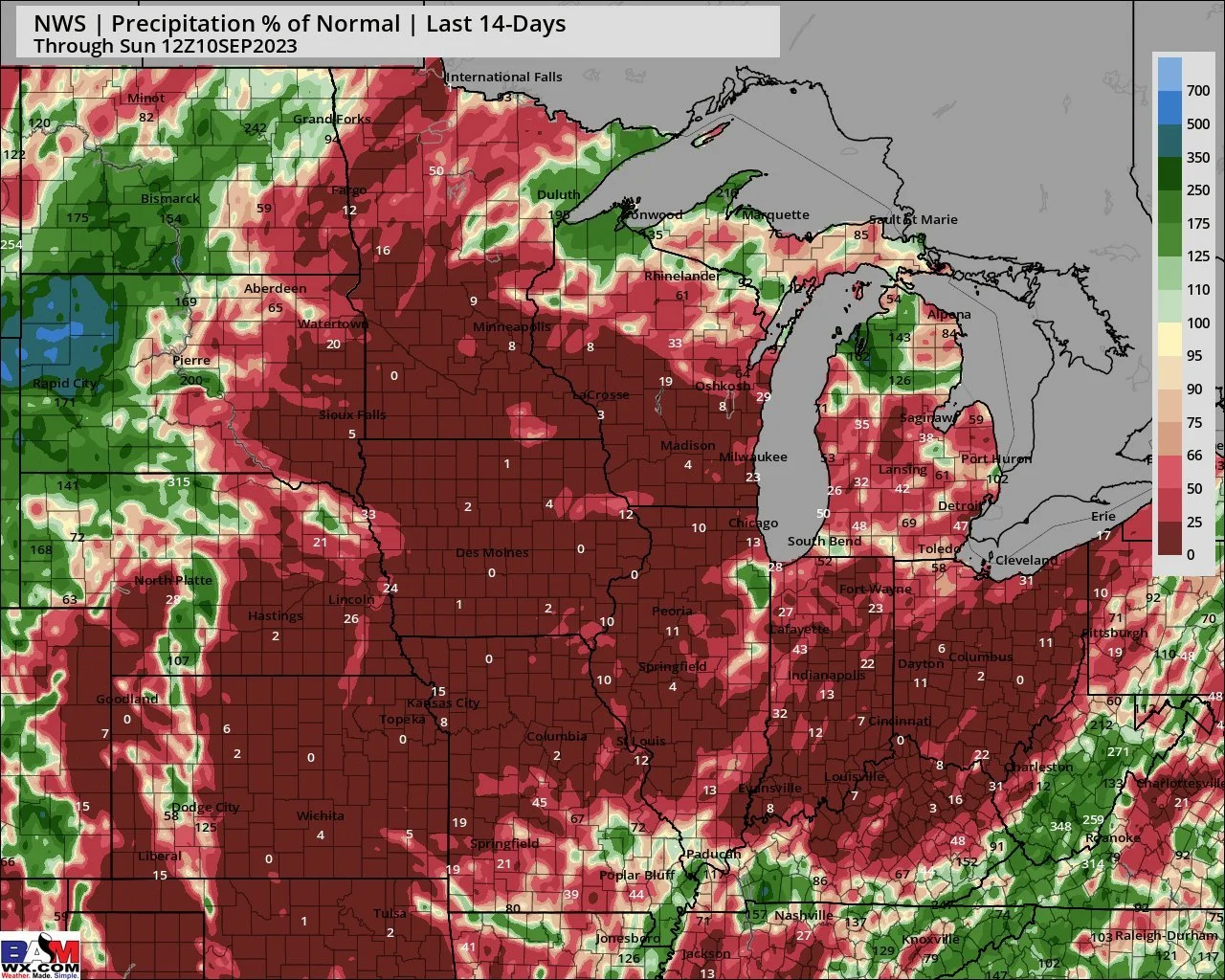

Future weather here might not matter, but our past weather does. Here is the past 30 days and past 14 days of precipitation compared to normal.

These crops took some serious damage. It will take the USDA some time to realize and see the full extend of the damage, but eventually they will.

Yields have dropped month after month. I look for them to continue to do so when the combines start rolling and unravel the whole story.

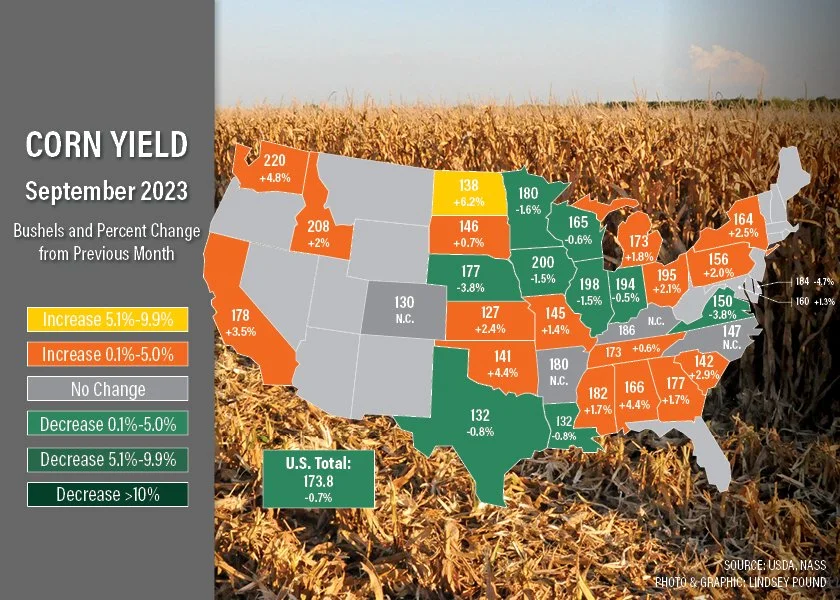

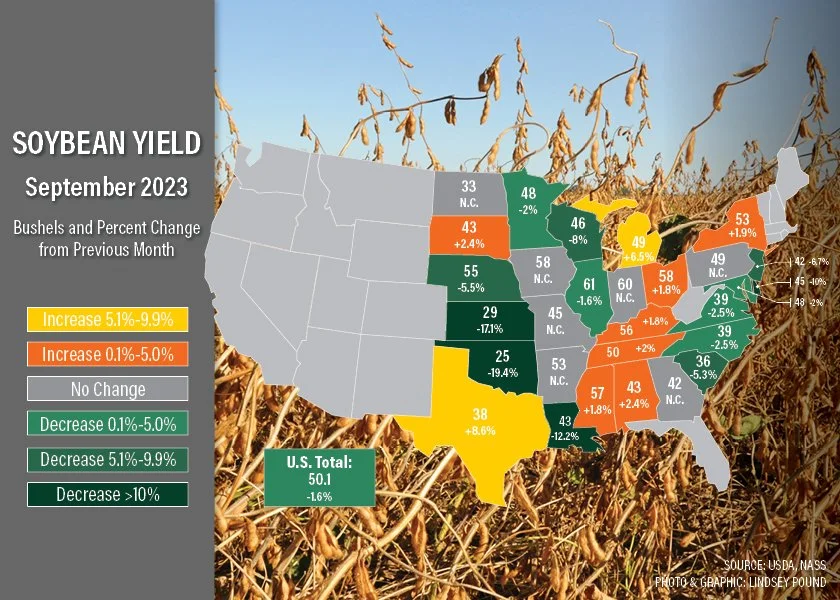

Here was a state by state breakdown from the USDA report. It shows what changes were made to yield in each state.

You can’t tell me that a good portion of the cornbelt and states like Iowa, who just saw the driest second half to August in 131 years, actually improved the past month with the brutal weather we just saw.

A lot of these states will not end up with yields this good.

Today's Main Takeaways

Corn

Corn ends the tight 6 cent trading range day down just 1 3/4 cents.

What impressed me yesterday and today was the fact that we got a pretty bearish report for corn. With the additional 800k acres and yield not falling as much as bulls would have liked. Yet, we were able to close higher yesterday.

This gives me all the more reason to believe we……

The rest of this is subscriber-only content. Please subscribe to continue reading and receive every exclusive update via text & email. Scroll to check out past updates you would’ve received.

Get 50% OFF Our Daily Updates

Subscribe now to save $400 a year.

Unsure? Try completely free 30 days HERE

Check Out Past Updates

9/13/23 - Audio Commentary

$10 WHEAT/$6 CORN/$15 BEANS BY THE END OF THE YEAR?

Read More

9/12/23 - Audio & Report Recap

BEARISH REPORT, BUT SETS THE STAGE FOR HIGHER PRICES

9/11/23 - Audio Commentary

CHEAP PRICES CURE CHEAP PRICES

9/10/23 - Weekly Grain Newsletter

PREPARING FOR THE USDA REPORT

9/8/23 - Audio Commentary

WILL USDA REPORT BOOM OR BUST?

Read More

9/7/23 - Market Update

BEANS GIVE BACK GAINS, TRADE PREPARES FOR USDA

9/6/23 - Audio Commentary

BE PATIENT MAKING SALES AT HARVEST TIME

9/5/23 - Market Update

WEATHER IMPROVING, BUT DAMAGE WAS DONE

9/1/23 - Audio Commentary

HOW MUCH DAMAGE WAS DONE & WHAT IS MARKET EXPECTING

Read More

8/31/23 - Audio Commentary

THIS CROP HAS MORE DAMAGE THAN MOST REALIZE. DON’T PANIC SELL

8/30/23 - Audio Commentary

THIS VOLATILITY ISN’T GOING ANYWHERE

8/28/23 - Market Update

WEATHER REMAINS BULLISH BUT CROP CONDITIONS DISAPPOINT

Read More

8/27/23 - Weekly Grain Newsletter

ECON 101 APPLIED TO GRAIN SALES

Read More

8/25/23 - Market Update

BEANS CONTINUE BULL RUN

Read More

8/24/23 - Audio

BEAN DEMAND STORY CONTINUES TO GROW AS CROPS GETTING SMALLER

8/23/23 - Market Update

CROP TOURS, BRUTAL HEAT, & NO RAIN

8/22/23 - Audio