OUTSIDE UP DAY IN ALL THE GRAINS

AUDIO & MARKET UPDATE

Listen to todays audio here where we go over how to manage your risk on days like today.

You only got to listen to 1:30min of today’s 9min audio. Subscribe to keep listening.

Overview

Turnaround Tuesday following corn posting a new contract low today and soybeans breaking below $12 for the first time since June.

However all of the grains, corn, soybeans, and wheat posted outside up days today. This means we took out yesterdays lows before closing above yesterdays highs. Which is typically considered a great sign and potential indication of a reversal.

Today soybeans rallied +33 cents off their lows, taking back roughly half of the recent sell off and are back above $12. Corn posted new contract lows before having it's best day since November after bouncing a dime off the lows and making what is called a "key reversal". While wheat rallied +20 cents off it's lows.

This type of action was something we have been mentioning we could see since last week. That we could see soybeans break below $12 and make a new low fractionally before reversing higher. Because that is what the algos and big money tend to do. Give us head fakes, hit the stops, and push prices just past the point of support and resistance before flipping the tables.

If you haven’t, make sure you go listen to today’s audio above. Essentially we in the audio we go over how you can manage your risk on days like today.

So why the rally?

Some are saying it was a simple technical driven rally. The funds are holding near record shorts and it is the end of the month. So perhaps a large part was profit taking.

However, the biggest headline the bulls are seeing right now is Argentina. The market is finally starting to pay attention.

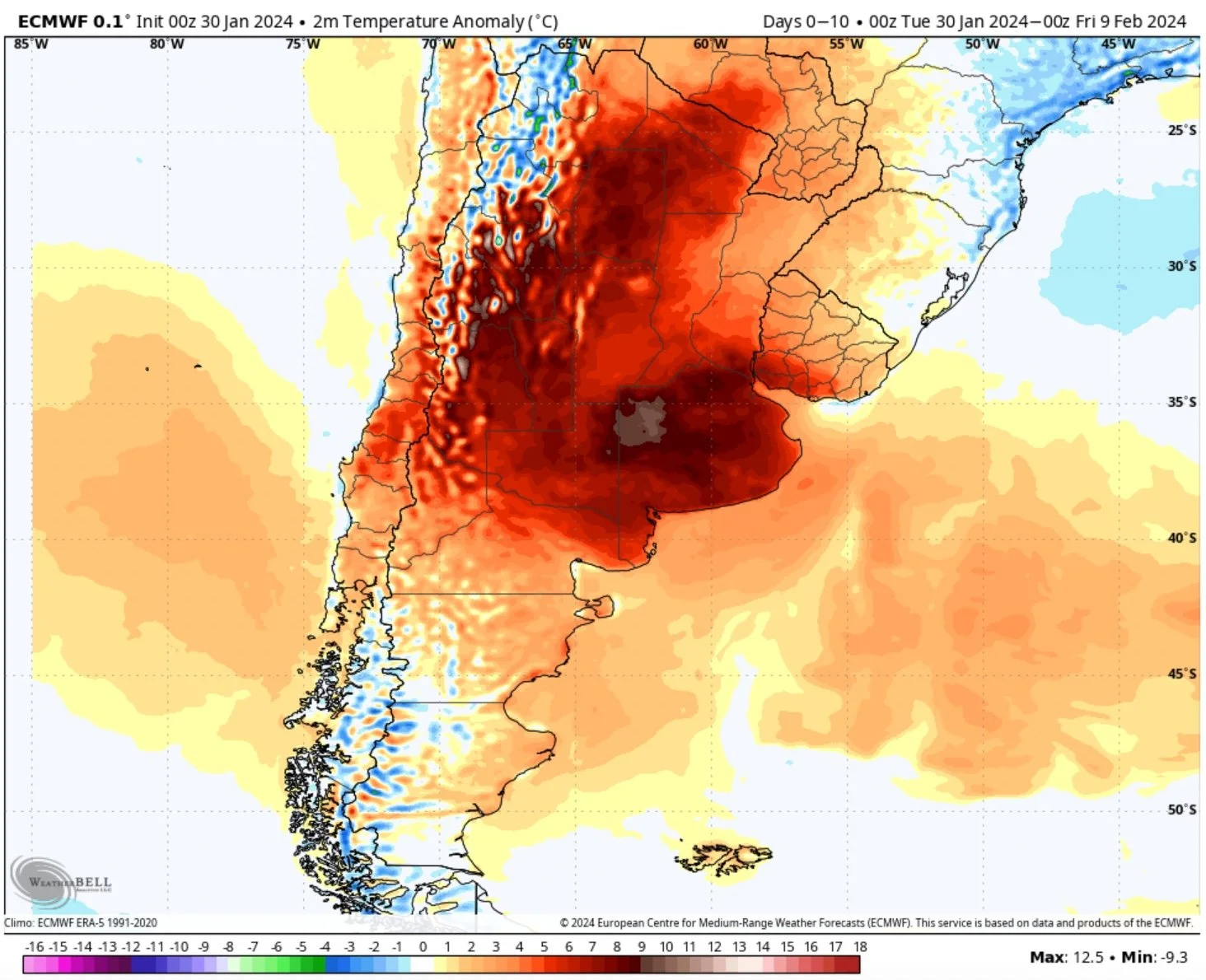

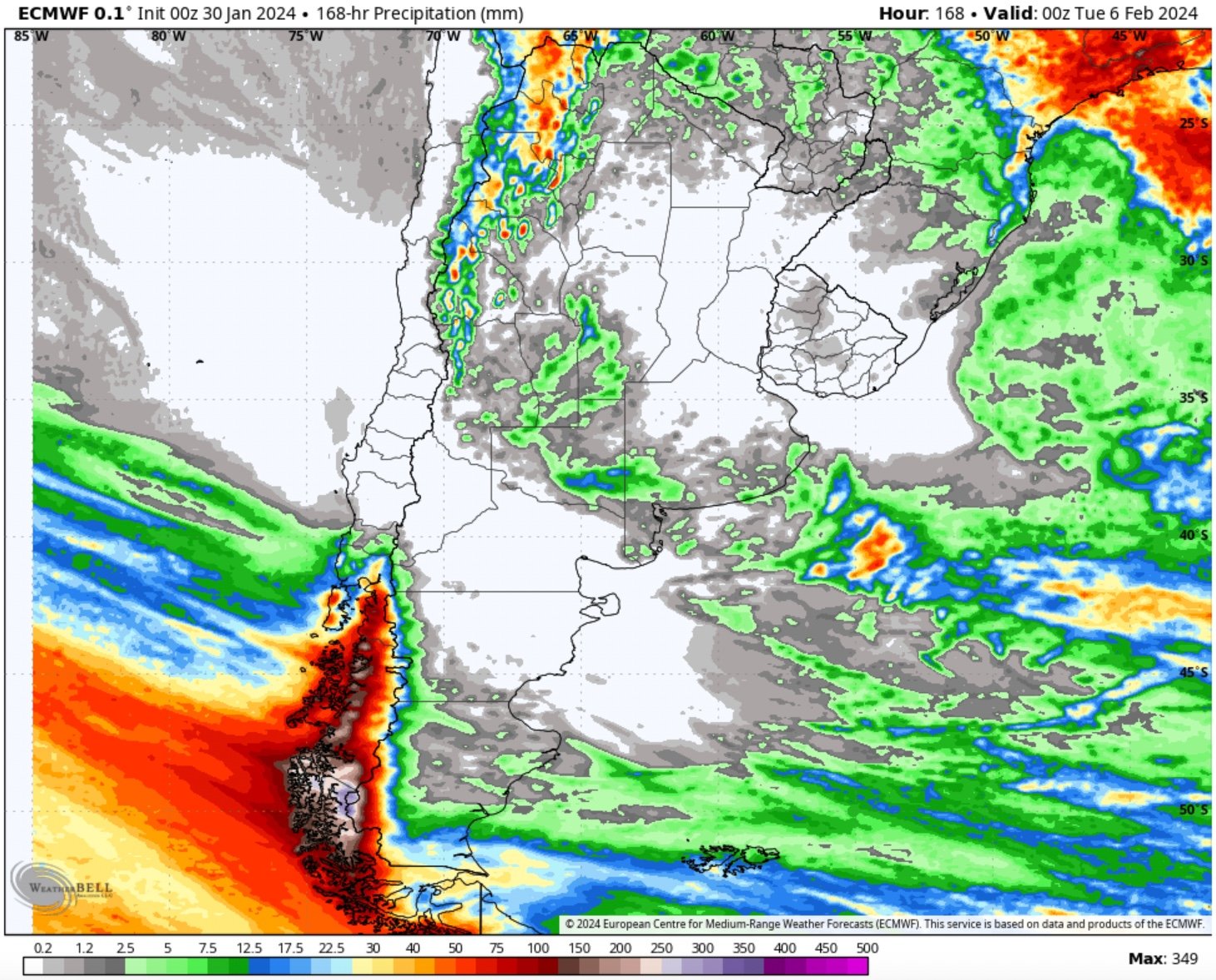

The two week forecasts are calling for scorching temps and the rains seem to disappear. If this continues, it could cause some issues to what most would consider a fantastic crop thus far.

Here is the forecasts:

So was this rally just a case of profit taking or was there more to it?

Let’s find out…….

The rest of this is subscriber only. Please subscribe to keep reading and get every update.

In the rest of today’s update we will go over: was this just profit taking, do the funds actually need a reason to cover, why did we rally today, what can we expect moving forward, when do we typically make lows vs highs & more.

KEEP READING FOR FREE

Get all of our exclusive updates completely free for 30 days.

Want to Talk?

Our phones are open 24/7 for you guys if you ever need anything or want to discuss your operation.

Hedge Account

Interested in a hedge account? Use the link below to set up an account or shoot Jeremey a call at (605)295-3100 or Wade at (605)870-0091

Check Out Past Updates

1/29/24

GEO POLITICS, CHINESE, BRAZIL, ALGOS, & BIG MONEY

1/26/24

SOLD RALLIES & HISTORICAL HIGHS

1/25/24

DEVELOPING A GRAIN MARKETING PLAN WITH TECHNICALS

1/24/24

5TH GREEN DAY IN A ROW: WAYS TO OUTPERFORM THE MARKET

1/23/24

GRAINS CONTINUE TO BOUNCE

1/22/24

HAVE MARKETS FOUND A BOTTOM?

1/19/24

FAILED REVERSALS & ELECTION YEAR RALLIES?

1/18/24

UTILIZING TRENDS & TECHNICALS IN YOUR GRAIN MARKETING PLANS

Read More

1/17/24

FUNDS & CHINA

1/16/24

BEANS TRY TO BOUNCE FOLLOWING BEARISH USDA

1/12/24

FULL USDA REPORT BREAKDOWN

1/11/24

USDA REPORT TOMORROW. ARE YOU PREPARED?

1/10/24

PREPARING FOR THE USDA

1/9/24

TURNAROUND TUESDAY & USDA PREVIEW

1/8/24

HOW TO GET COMFORTABLE AHEAD OF USDA REPORT

1/5/24

FIRST WEEK OF NEW YEAR FLOPS

1/4/24

REALIZING POTENTIAL UPSIDE BUT BEING AWARE OF RISKS

1/3/24

RAINS & BRAZIL ESTIMATES

1/2/24

UGLY DAY: BRAZIL, RISKS, & MARKETING STRATEGIES

Read More

12/29/23

SHORT TERM RISK & LONG TERM UPSIDE

12/28/23

BRAZIL RAINS?

12/27/23

EFFECTS OF US DOLLAR COLLAPSE ON GRAINS & STRATEGIES TO CONSIDER

12/26/23

GETTING COMFORTABLE WITH ALL POSSIBILITIES

12/22/23

BEAN BASIS RECOMMENDATION TO TAKE BACK CONTROL FROM BIG AG

12/21/23

COMMODITIES ARE DIRT CHEAP VS STOCKS

12/20/23

ARE YOU COMFORTABLE WITH $3 CORN OR $6 CORN?

12/19/23

CORN FIGHTING NEW LOWS & BRAZIL RAINS

12/18/23