CORN 4TH DAY HIGHER & KEY REVERSAL IN WHEAT

Overview

Overall solid day to start the new week. Wheat rallied despite the cancellations from China.

Corn posts it's 4th day higher in a row, and highest close in nearly a month.

Soybeans were down a nickel, but remain +50 off the lows from 2 weeks ago.

Export inspections were solid for corn, decent for wheat, and on the light side for soybeans. This was part of the reason for the weakness in beans today.

We had yet another flash sale cancellation of wheat to China. This marks 3 days in a row of cancellations, bringing the total to over 500k metric tons cancelled.

Why did wheat rally despite the cancellations?

The cash market mainly knew about these cancellations last week, meaning these cancellations were mostly old news. A bit of buy the rumor sell the fact.

We had very solid action in the wheat market. Friday we just missed the key reversal on the charts, today we had posted a great key reversal. Boucning +27 cents off the lows.

The CONAB report is out tomorrow. They think the Brazil crop is a lot smaller than the USDA does. Remember last month, our markets jumped when they saw these numbers but the USDA's larger numbers dropped us back down.

Last month CONAB had 114 MMT for their corn vs the USDA's 124 this month. For soybeans CONAB had 149.4 vs the USDA's 155 this month.

Today's Main Takeaways

Corn

Corn posts it's 4th green day in a row. We have now traded green the past 9 of 11 days since corn made it's low. Today marked our highest close in nearly a month.

Last week was our highest weekly gain in 5 months.

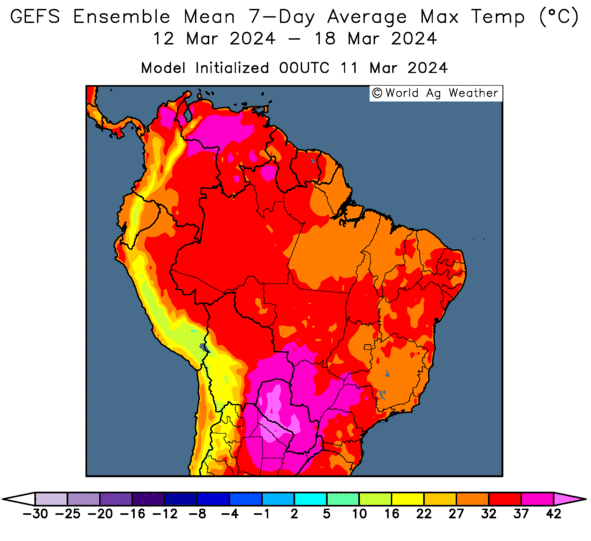

Corn futures in Brazil jumped today due to the weather. It looks like they will be seeing heat of over 104 degrees this week.

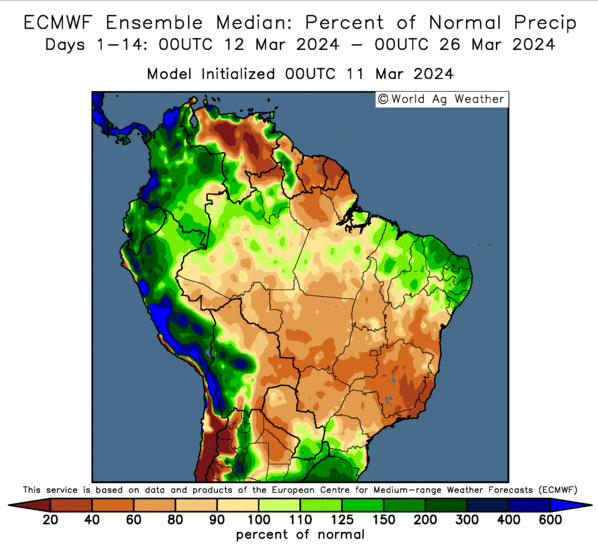

Along with that heat, the forecasts are showing a lack of rain for the next 2 weeks. Not a great look for that second crop corn.

Their second crop corn planting is 93% complete. Ahead of last year's 82% at this same time. I have said this time and time again.. what does a fast planting or fast harvest typically mean? It is dry.

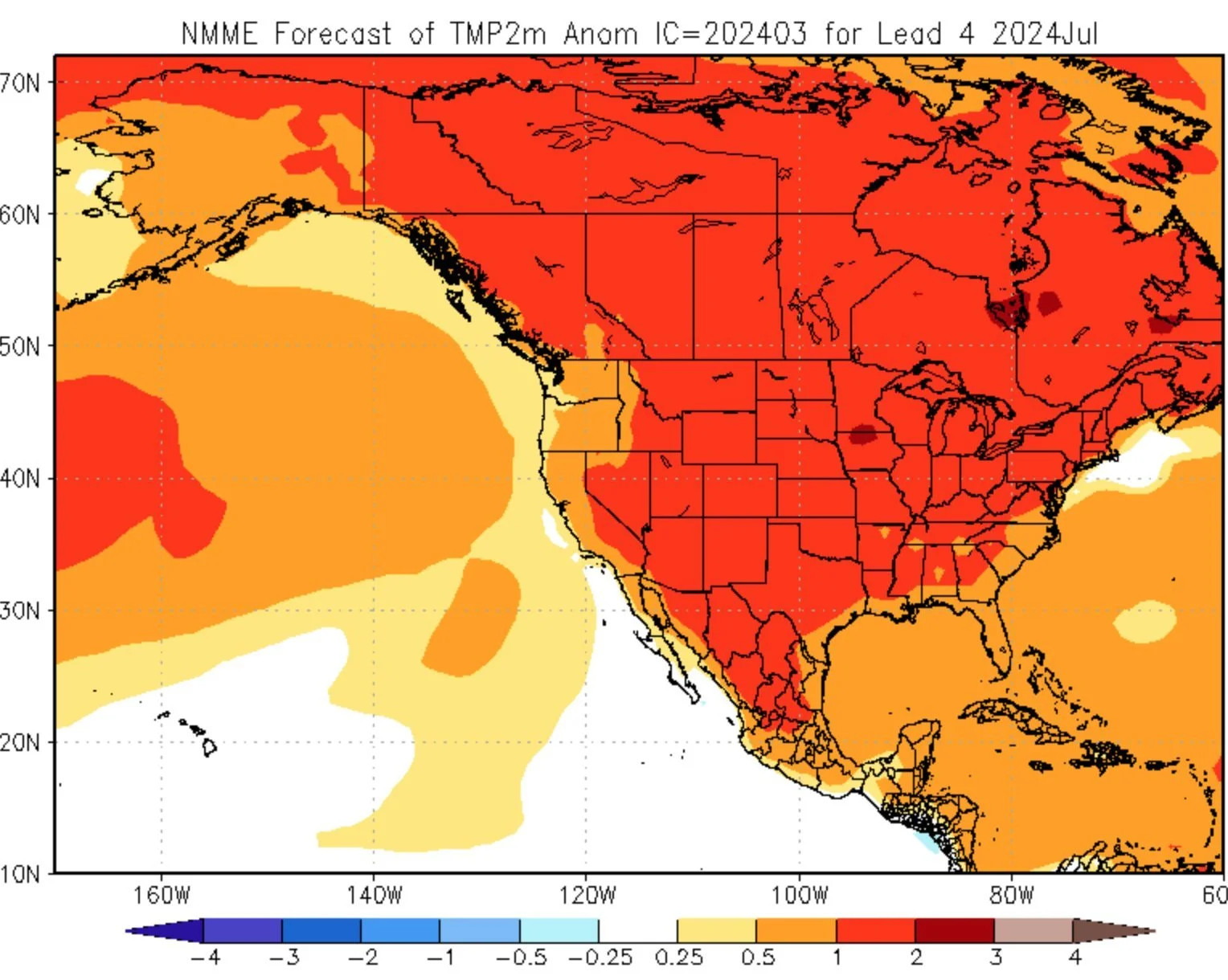

US weather is still seeing well above normal temps. Some areas are +30 degrees warmer than normal.

We have the acreage outlook and plantings report out on March 28th.

Most think we will see less corn and more beans planted, however if the weather stays good this thought process could change really fast.

Good planting weather almost always leads to more acres.

Here is a July heat map forecast from QT Weather.

I still believe we will start to see more short covering until around that March 28th report.

This report has a tendency to show big acres. The quarterly stocks have a history of being all over the board. This report can have a major impact especially if the acres come in big.

If weather stays warm and dry for planting, be prepared for this market to take it on the chin early April and into May. There is a real possibility we could even make new lows.

However, as I mentioned fast planting means it is dry. The focus from fast planting will quickly shift to drought talk come June into July if we don’t get rain and it stays hot. If you remember last year, we made our highs late June.

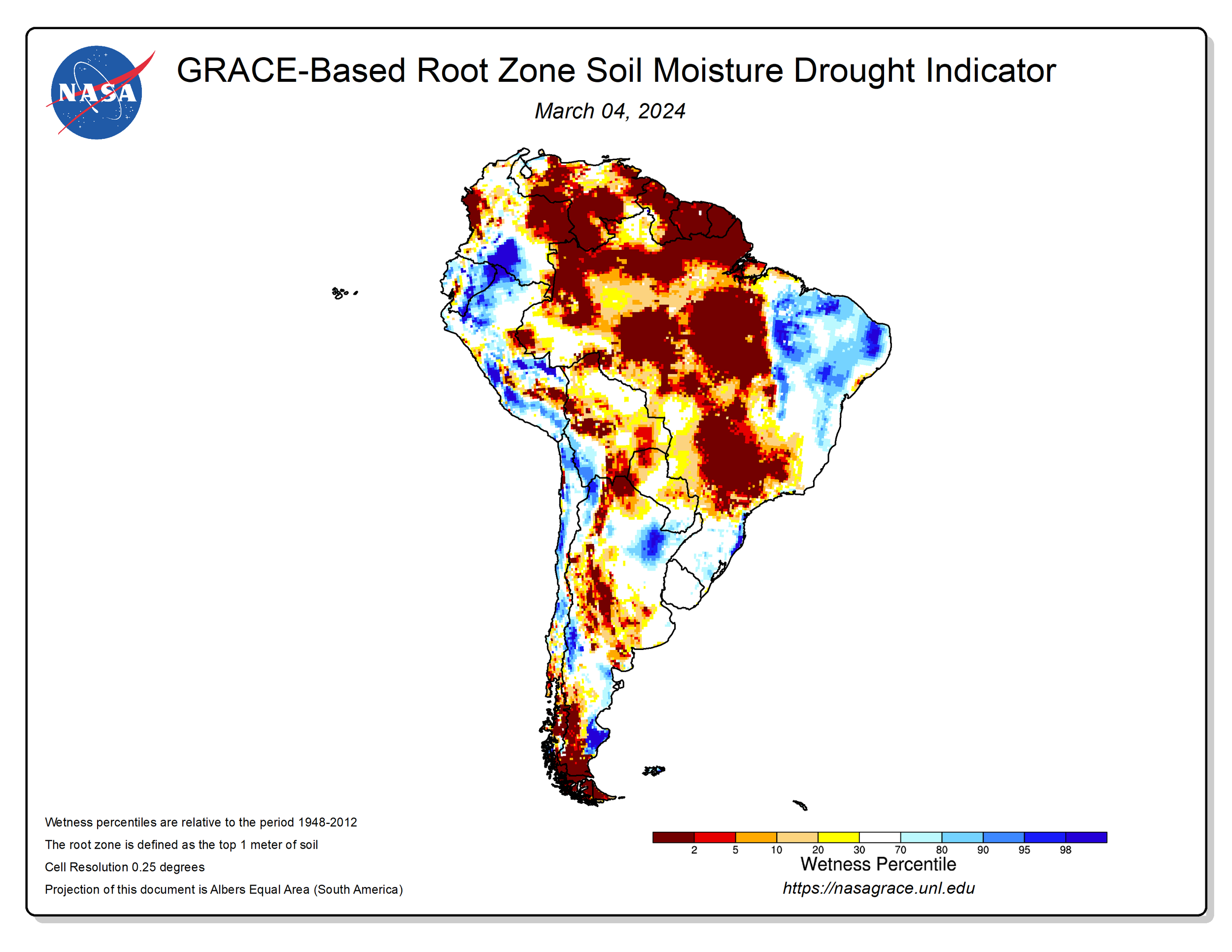

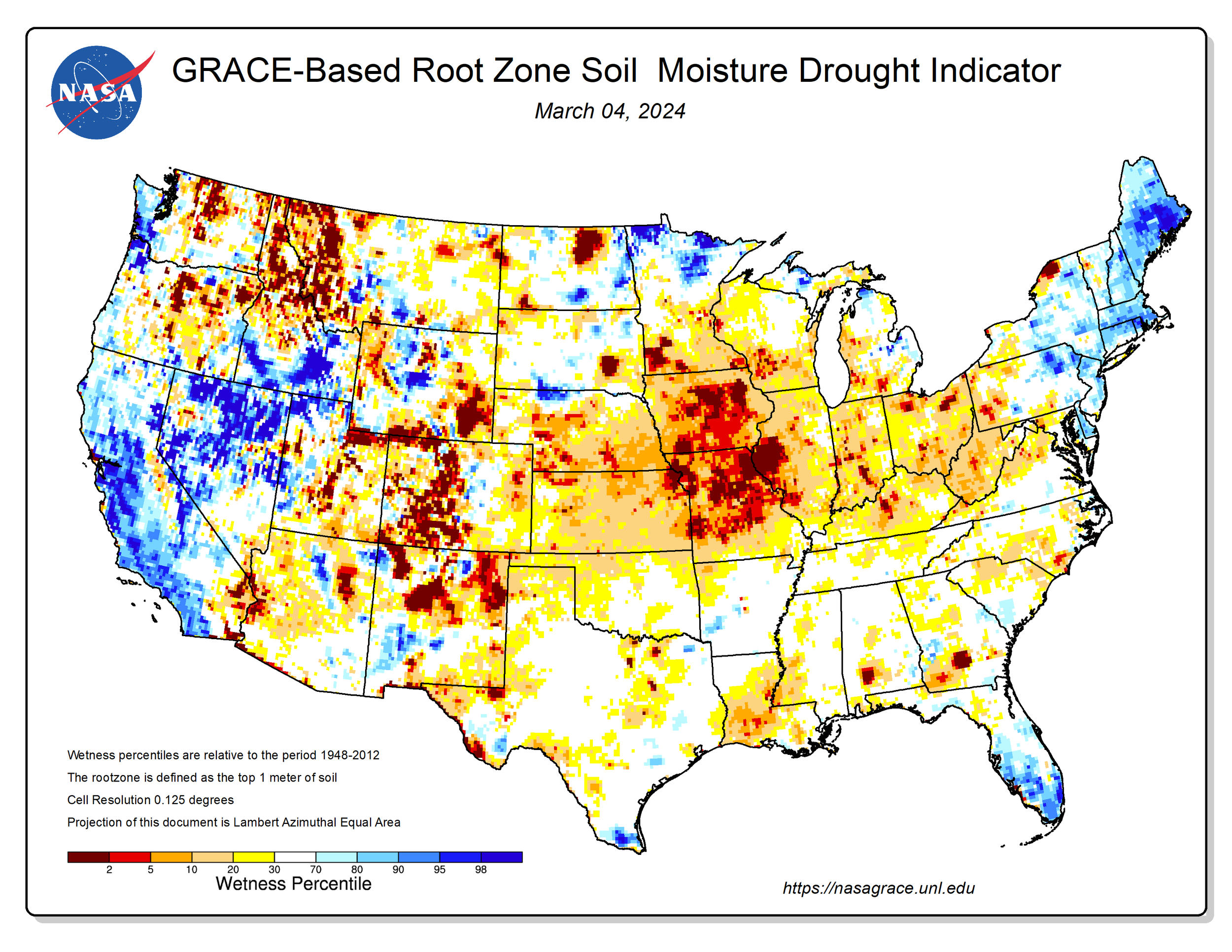

Our soil moisture situation is already suffering. Harvest was dry. Winter was dry. What happens if spring and summer are dry?

Courage calls:

For those of you that feel like you struggle to make sales when we get a rally and when you should be making sales, consider getting courage calls ahead of this potential rally.

We have been preaching courage calls the past few weeks. There is definitely still potential to see more upside. Courage calls will give you the courage to make a sale on a rally, while also adding to your bottom line if we rally.

These make a lot of sense for most operations, but not all. So give us a call if you want to discuss or see if this is a move you should be making.

Jeremey: (605)295-3100

Wade: (605) 870-0091

Bottom line, this is not the time to making sales. We want to be making them in spring or summer. Typically when you don’t know what you are going to raise.

Funds are still short 270k contracts, so there is plenty of room for them to buy more.

The chart looks very solid still. Closed well off our lows in back to back days. Above that downward trendline from June.

First upside target is $4.62, our 23.6% retracement.

Corn May-24

Soybeans

Soybeans give back some of the recent gains. We are still a whopping +50 cents off our lows from two weeks ago.

We opened strong, but the export inspections were weak. This was the main reason we were lower today. Along with the fact that the funds were probably buying some wheat and selling some beans.

Brazil's harvest sits at 55% complete. This means we will start seeing less harvest pressure in Brazil prices, which is beneficial for our prices.

Typically the second half of harvest in Brazil brings falling basis prices, rising freight costs, and a lack of storage.

However, what has happened in Brazil the past month is the exact opposite. Basis has been firming and freight has been falling. Could this crop be smaller than some think?

The weather is Brazil will start mattering less and less for soybeans. The focus is now the second crop corn. However, the recent dry weather could result in some of the later harvested beans yields trending lower.

Friday the USDA opted to ONLY lower the Brazil bean number by yet again 1 MMT to 155. Nobody aside from the USDA thinks the crop is that big, and it seems like the market is taking that with a grain of salt. However, this report did set the trend that this crop is getting smaller, not larger.

The interesting thing on this report was the fact that they lowered the world bean carryout. Now this wouldn’t be a big deal normally. But they lowered the carryout from the 2021/2022 year.

So they are stealing beans from years ago. They are doing this in order to keep the current carryout at a level that helps keep prices lower. Last time they did something like this and stole from previous years crops? The 2021-2022 rally.

Overall, I like the recent price action in soybeans. We are flirting with that downward trendline from November. We closed above the 20-day MA again for the first time since December.

As of March 5th, the funds were holding the all-time largest short position ever in soybeans. Short 172k contracts.

This is not the time to be making sales. If you are in a situation where you will be forced to move something or have questions about your marketing at all, please give us a call (605)295-3100.

Soybeans May-24

Wheat

Wheat was the leader today.

Opened lower and posted new contract lows of $5.23 1/2 before rallying +27 cents off the bottom.

As I mentioned, the recent Chinese cancellations were already priced into these markets. So today's rally was short covering, and buy the rumor sell the fact.

StatsCan reported their wheat seeding intentions at 27 million acres, This was slightly above the 26.7 million estimates which was about on par with last year's numbers. So slightly negative but nothing major.

The StatsCan report was a little bullish canola. The report basically said they think they are going to plant more soybeans and less wheat.

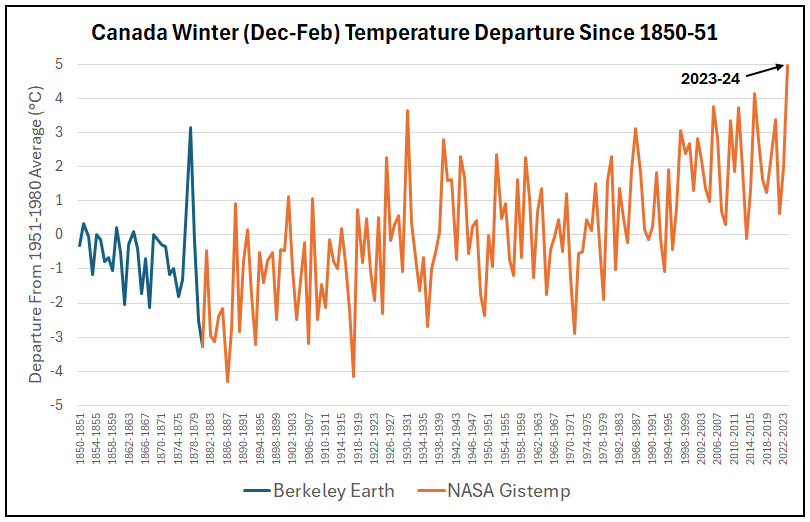

Just like the US, Canada is having the warmest winter on record.

This winter was a massive 34 degrees F (1.3 C) warmer than their previous warmest winter.

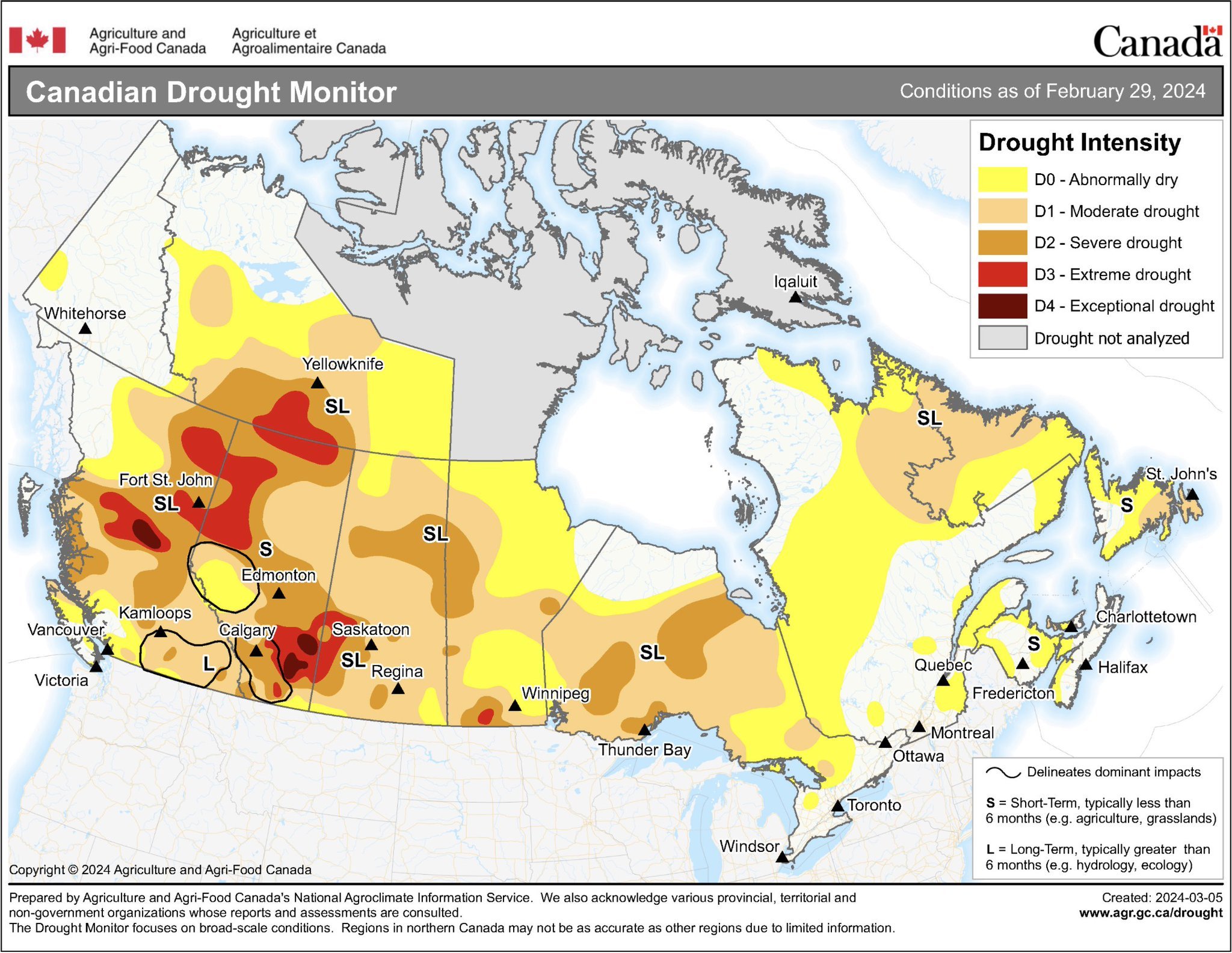

Here is their drought monitor. Will be something to watch.

In Friday's report, one the biggest things I noticed was the world carryout.

World carryout for wheat was the lowest in 8 years.

I have been saying this for a long time, but wheat is still a sleeper. It may not happen a week from now, a month from now, but eventually wheat will shock people. Remaining patient still.

Last written update I said that is we broke $5.50 we could see anywhere from 20 to 30 cents more downside. We got that exactly that, now we are back right around $5.50.

Today's candle is one of the more bullish ones I have seen in a long time.

Friday we just missed the key reversal. Today we got one of the best looking key reversals in a while. Let's see if it holds. Need follow through strength.

KC looking to break that trendline. Something we haven’t done since August.

May-24 Chicago

May-24 KC

Cattle

This market looks like one that could "potentially" be running out of steam.

On feeder cattle we broke the upward trendline. Some would look at that as a potential sell signal.

I still like taking advantage of the rally on paper. There is nothing wrong with taking risk off the table or adding a floor if you are nervous of prices falling from here.

Give us a call if you want to discuss. (605)295-3100.

Live Cattle

Feeder Cattle

Want to Talk?

Our phones are open 24/7 for you guys if you ever need anything or want to discuss your operation.

Hedge Account

Interested in a hedge account? Use the link below to set up an account or shoot Jeremey a call at (605)295-3100 or Wade at (605)870-0091

Check Out Past Updates

3/8/24

USDA RECAP: POOR REPORT, GREAT REACTION

3/7/24

CORN TECHNICALS TURNING BULLISH. PREPARING FOR USDA REPORT

3/6/24

CHINA CANCELS WHEAT? RUSSIA SELLING WHEAT TO FUND WAR

3/5/24

NEW LOWS IN WHEAT & USDA BRAZIL ESTIMATES

3/4/24

IS CHINA HUNGRY FOR CHEAP GRAIN?

3/1/24

FIRST HIGHER WEEK IN MONTHS

2/29/24

HOW TO USE TARGETS VS TRIGGERS

2/28/24

BIGGEST 3 DAYS IN CORN SINCE AUGUST

2/27/24

DID CHINA BUY CORN YESTERDAY?

2/26/24