WEEKLY WRAP

Overview

The seasonal harvest pressure continued to weigh on the grains this week. Not only do we have that harvest pressure, but grains have also been negatively effected by the funds selling, low river levels, and demand.

Grains all end the day slightly higher here on option experation day following our struggle yesterday and beans 20+ cent plunge. Here is the weekly price changes. Essentially a blood bath aside from corn who actually managed to close higher on the week despite hitting those 2-year fresh lows of $4.67 3/4, closing nearly a dime off those.

Today's price action wasn’t all bad. Most including myself thought we would see more pre-hedge pressure, as pre-hedges usually dominate late in the session on Friday's this time of year. So was positive we were able to close higher and hold the recent lows.

Why the sell off yesterday?

In Wednesday's update we said we should be expecting some short term pressure to close out the week. First off we had the Feds announcement. They paused rates but they also said rates will be higher for longer. This was negative for grains as higher interest rates makes grains a less appealing investment.

We also had options expiration today. Typically the last two days ahead of options expiration leads to lower futures prices. Which we mentioned Wednesday.

What to Watch Moving Forward

Harvest Results

Early results are showing some better than expected results. Which has had a negative effect on prices clearly. However, the areas that are getting these better results aren’t the major players that usually carry our nation's yield. The area's that we haven’t got a ton of results for are the areas that really felt that heat and struggle. We could be in for some surprises. I'm hearing more and more about a sub-170 corn crop and far sub-50 bean crop.

Quarterly Stocks & Wheat Acre Report

Friday we get this report. This will give an idea of how much demand is out here. Most people are looking for the stocks to be down a little bit. But we will have to see if the river levels have any effect on this. Could be in for a surprise one way or the other.

Demand

Will we see some export business? Demand has been one of the biggest things bears continue to point at.

US Weather

Weather here isn’t as major of factor as it once was. However, rain is now actually a bullish factor. For starters, it raises those river levels the bears have been talking about. It also has the chance to slow down harvest. An early freeze or snow would also be a potential factor in the next few months. The only crop that rain will improve here is winter wheat, thus rain is bullish most grains aside from winter wheat.

Government Shut Down?

This is one potential negative factor we need to be aware of. Rumors that Government may shut down on September 30th, the end of their fiscal year. If that happens we may not get the USDA production and supply & demand report on October 12th. The markets don’t like uncertainty.

South American Weather

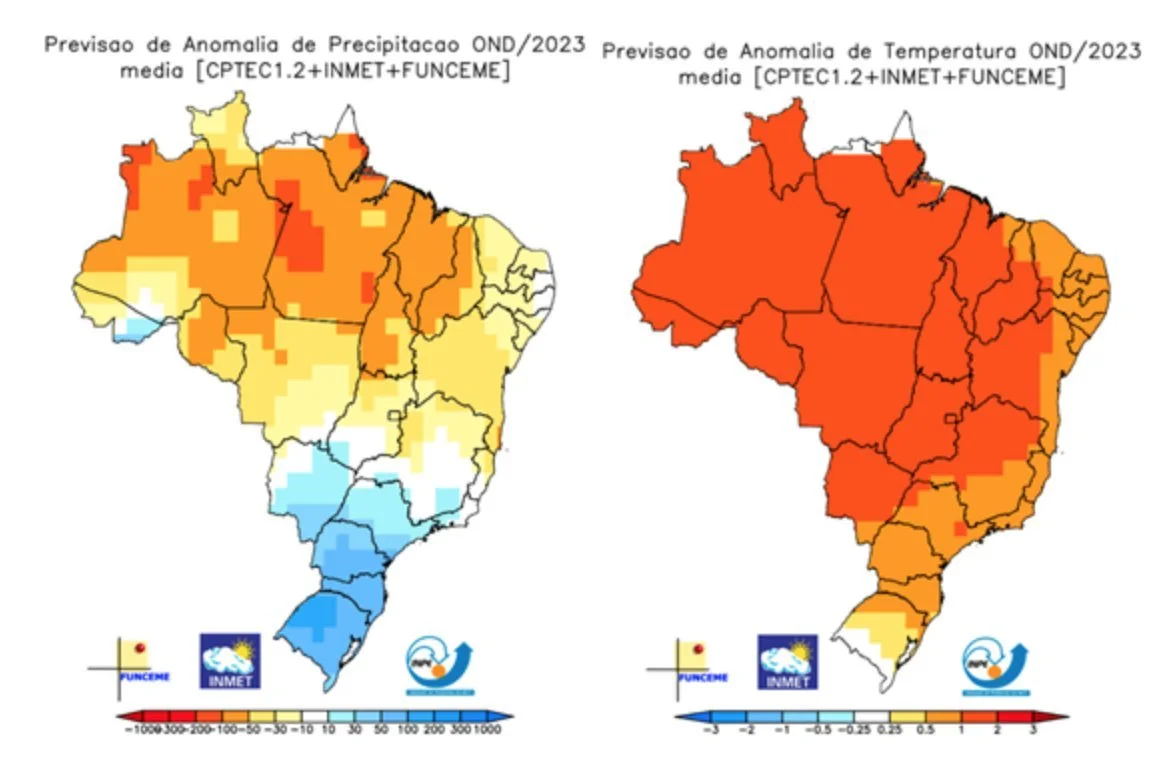

This will continue to play a bigger and bigger later in the year. The current outlook for the next 3 months? Overly dry north and 98% hitter than normal, while the south is simply too wet.

Currently Brazil is facing some extreme heat and lack of rain as the drought continues in major growing areas as their bean planting gets underway.

Typically wet season returns around September 26th. Farmers there heavily rely on these timely conditions. However, conditions have been dry and temps are 10 to 15 degrees hotter than normal.

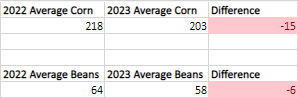

Darren Frye of Water Street Solutions in Peoria, Illinois (waterstreetag.com) had 33 growers report corn yields. 18 in Illinois, 7 in Iowa, 2 in Indiana, 4 in Nebraska, 1 in Ohio, and 1 in Kansas. Average yield for those growers came in at 203 bpa vs last year's 218, a -15 bushel decrease.

He also had 20 bean growers report. 5 in Iowa, 2 in Illinois, 5 in Indiana, 5 in Nebraska, 2 in South Dakota, and 1 in Ohio. Their average yield came in at 58 bpa vs last year's 64. A -6 bushel decrease.

From Mark Gold of Top Third:

"Overall Im looking for a spot to buy the grains. Is it this Monday or a week from Monday? I'm not sure, but I think somewhere in here you have to look at buying call options to keep the upside open on sales you've made. In addition we have the October time period for crop insurance, we've seen all too often that markets tend to rally in October and take away a lot of those payments. What you might have to do is look at buying a November call out here and try to keep the upside open."

Are The Lows In?

Is it hard to justify being bearish at these levels. But it's also hard to catch a falling knife. Seasonally, row crops make their seasonal lows between now and the start to October. Wheat's seasonal lows were a few days ago. Corn and beans are oversold.

Could we see more downside? Of course. We could definitely see more harvest pressure here short term. I believe we will be putting in bottoms soon if they are not already in place, but lower prices over the course of the next week or so shouldn’t surprise anyone if it happens. Especially with the stocks report Friday. When the combines get rolling, and if yields are not there like a vast majority are predicting, we will have a reason to rally. If yields are there, well it will take much more outside factors to justify a rally and keep these bottoms in place. We dive into each grain later in today's write up.

Today's Main Takeaways

Corn

Corn ends the day and the week higher, following our recent lows. Now roughly a dime off of those.

Bears argue that our exports remain weak. They also argue that even if we continue to lose yield, we are still looking at a pretty large ending stocks number which may make a massive rally hard without the help of some serious weather woes over in South America, more appetite out of China, or a shutdown of Ukraine exports. All of which are possible scernios.

Overall, there isn’t a ton that’s new. Corn is trying to put in those harvest lows we have been discussing over the past few weeks.

Seasonally, this is where we carve out those lows. Only once in the past decade have we not made our lows before October.

Could we trade lower and make yet another low? Certainly possible, and wouldn’t be all that surprising. But nonetheless, the bottom should be in soon and we should be looking at much higher prices later in the year if the yields are indeed not there. Of course there is also that possibility that we grind lower or chop until January if the yields are there. But I don’t see that as the most likely scenario.

I look for us to pick up some traction over the course of the next few weeks. I’m not expecting a huge rally, but should be enough to get us started in the right direction.

-

From Chris Robinson of the Robinson Report:

Harvest is about to ramp up.

Back to dance on the old low of $4.73 1/2.

Some got chopped up when we took it out on Monday and Tuesday-- only to watch corn "recover" a dime from 4.67 to $4.77. Mr. Market does not make things easy for bulls or bears.

The next "old low" the chart-traders are looking at? $4.62 1/2.

Keep your puts rolled down here. Keep your puts "cheap".

If the bulls are right and the "yield is not there" great, we'll rally.

If not we might be looking at a "re-do" of 2013 where we ground lower into January.

We hedge because we don't have the "6th sense". Keep your risk on paper.

Bullish? you need a settlement above the 20-day at $4.81 3/4 first. Then the 50-day at $4.98 1/2 and finally the 100-day at $5.14 3/4.

Corn Dec-23

Soybeans

Beans have a very rough week. Losing 45 cents as they fall under the harvest pressure. We mentioned dozens of times that it is often hard for beans to rally through out harvest. But that doesn’t mean we still don’t have a ton upside.

From Wright on the Market:

"The US has been selling beans to export buyers like hotcakes for seven weeks. The US soybean crop has been getting smaller for the past four weeks while crude oil has rallied $16, making biofuel more valuable. Yes,

the August NOPA crush was 5 million bushels less than expected, but crushers knew six months ago the US was not going to have any old crop beans to crush in August, so they scheduled some major maintenance down time. Last year, crushers got caught with their pants down and had to pay $1.50 to $2 over November in August and early September to keep their mills running.

November beans have lost 95¢ the past three weeks. Certainly, the fundamentals did not justify that price break. Did you notice the S&D we sent you on the 13th that the 2023 new crop carryover is considerably smaller than the 2022 old crop carryover? Yep, 30 million bushels less, which is 2½ days less use than the 2022 carryover. The USDA predicts the US will run out of beans on September 19th, 2024 and that is with the assumption we will export 200 million less bushels of beans than we did in the marketing year just completed on August 31st.

The nation’s soybean crush capacity is expanding every few months as new crush facilities are being constructed or expanded. The big money people are not building those soybean crush plants to set idle. The USA will need 115 to 118 million acres of beans to meet the crush demand in 2026 with no soybean exports allowed. The USA has planted more than 90 million acres of beans in only one year."

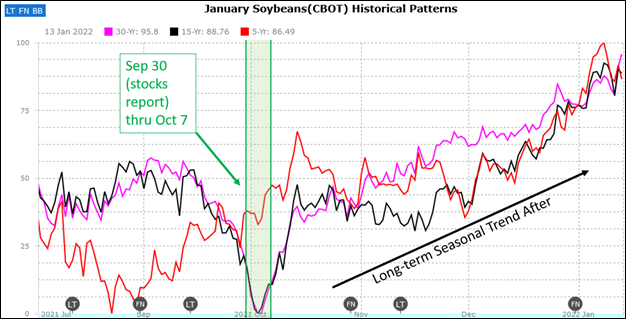

Will Beans Follow Historic Trends?

If you take a look at this chart from Roach Ag. It is a historical price pattern for beans. Highlighted green is when we typically have our Quarterly Stocks Report. As you can see, soybeans usually rally the rest of the year after this report. Will this year follow the trend? Reminder: this report comes out Friday, a week from today.

This is adds on to a long reason of why beans have so much upside potential.

If yields start showing damage, and we are sub 49, sub 48, we will rally. We can’t afford to lose bushels on an already tight situation. I would be astonished if yield is 50 or higher.

But that doesn’t mean the USDA is going to come out and say we are 49 or 48. There is also that chance they slow play this until January. By that time it is all about South American weather. If they have hiccups in their production to go along with our yields not being there, we could be looking at much much higher prices.

Or the yields could simply not be there. Time will tell.

Now of course, we aren’t saying this "will" happen. I am stating there is a way for soybeans to trade $15 to $16 if these dominos fall right.

Whether the market goes higher or lower, there are ways to make money and manage your risk. Because at the end of the day, none of us can control the markets.

If you made sales, especially north of $14, look at re owning while calls are on sale. You can use hedges to avoid paying storage and re own any harvest or past sales. Everyone is in a different situation and has different needs, so if you want specific advise don’t hesitate to shoot us a call at (605)295-3100.

I also noticed other advisors such as Roach Ag had placed buy signals in beans, where they also recommend re owning sales.

Bulls need to hold those August lows or we could see further downside.

Soybeans Nov-23

Wheat

Wheat futures also have a pretty disappointing week. Chicago did manage to barely hold it's lows from last week we have been talking about, but KC wheat did make another low.

Bears are looking at the US dollar which has been strong as of late. We had more weak export sales, and overall the funds just continue to strong hold their shorts with the poor global growth outlook. We also saw the first ship full of grain exports make it out of Ukraine.

Egypt is buying wheat from France and Bulgaria because a deal with Russia was blocked by the Russian government because the selling price was too low. A good indicator that Russia will no longer be the cheapest wheat on the street and will long term help our demand and wheat prices.

Then we have the global weather concerns. Australia has a crop that's getting smaller as they continue to battle drought. Canada, the EU, etc. all facing problems of their own.

We have India who is becoming a net importer. Bulls want to argue that China will start to buy and eventually the exports out of Russia are going to be limited. But for right now, Russia does have plenty of cheap product.

Currently there just isn't a ton of reason there yet for the funds to cover their shorts. But there will be.

Who knows if these recent bottoms hold. Seasonally lows are made a few days ago. We still don’t like making sales here. As a producer we're waiting for better pricing windows later in the year and into next, as we should almost certainly get some.

There are plenty of reasons to be bullish wheat. The biggest question bulls are asking themselves are when will they matter?

Chicago Dec-23

KC Dec-23

MPLS Dec-23

Other Markets

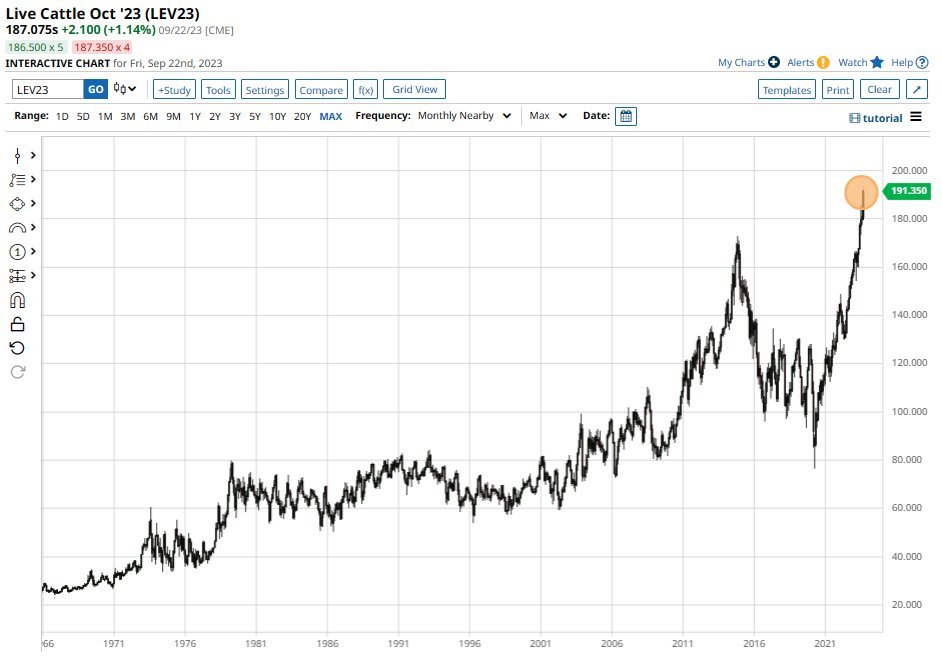

October Live Cattle closed the week at an all-time high.

Chart Credit: Barchart

The Dollar just had it's 10th consecutive green week. The longest streak in 9 years. Certainly not helping our exports.

Chart Credit: Barchart

Crude backed off of it's recent highs, but still trading at it's highest levels in nearly 10 months.

Hedging Account

No matter the situation you are in, our partners at Banghart Properties Grain Marketing can help you come up with a plan of attack to help you manage your risk. If you want help managing your risk you can give them a call anytime at (605) 295-3100 or set up a hedge account below.

Check Out Past Updates

9/21/23 - Audio Commentary

HARVEST BASIS THOUGHTS

9/20/23 - Market Update

BUYING OPPORTUNITIES

9/19/23 - Audio Commentary

CAN WE FIND DEMAND?

9/18/23 - Market Update

HARVEST PRESSURE

9/15/23 - Audio

BECOMING COMFORTABLE IN THE MARKETS

9/14/23 - Market Update