GRAIN SEASONALS, GLOBAL OUTLOOKS & MORE

MARKET UPDATE

You can still scroll to read the usual update as well. As the written version is the exact same as the video.

Want to talk? (605)295-3100

Futures Prices Close

Overview

Grains mixed as corn posts it's 3rd highest close since June.

Wheat is now +24 cents off of it's lows from last Thursday.

While soybeans succumb to trade war fear. Down -19 cents since Monday and sitting just +14 cents off those recent October lows.

Fundamentally, soybeans have the least going for them.

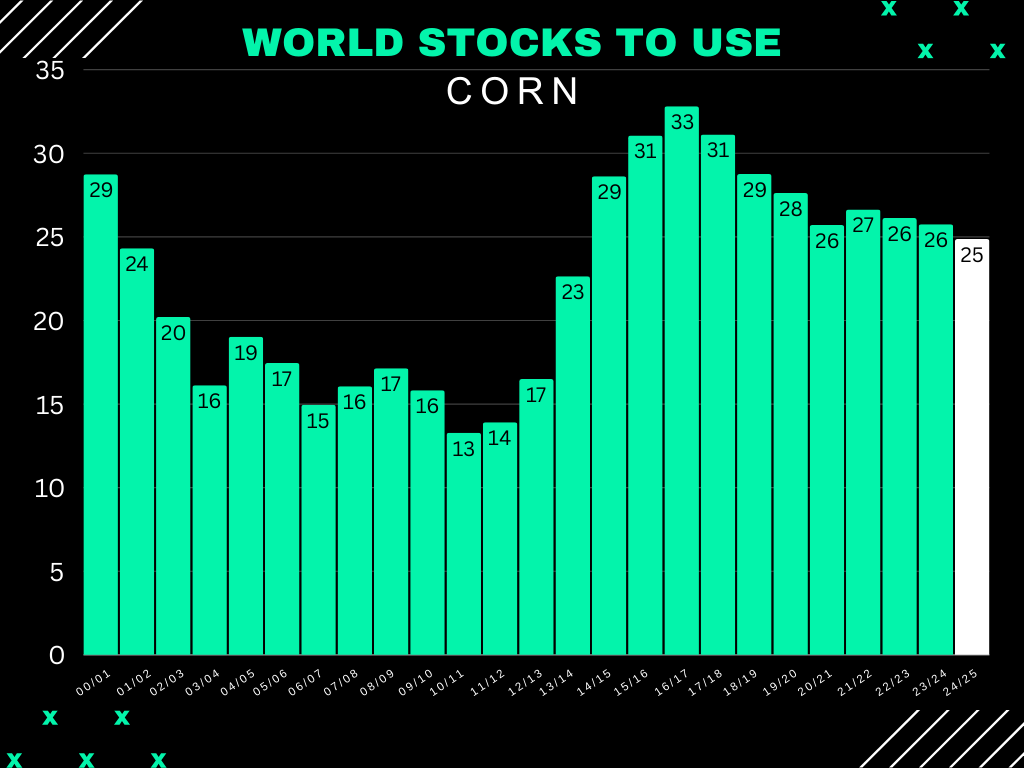

Corn has a demand story. With record ethanol numbers, stout exports, and the smallest world stocks to use ratio in a decade.

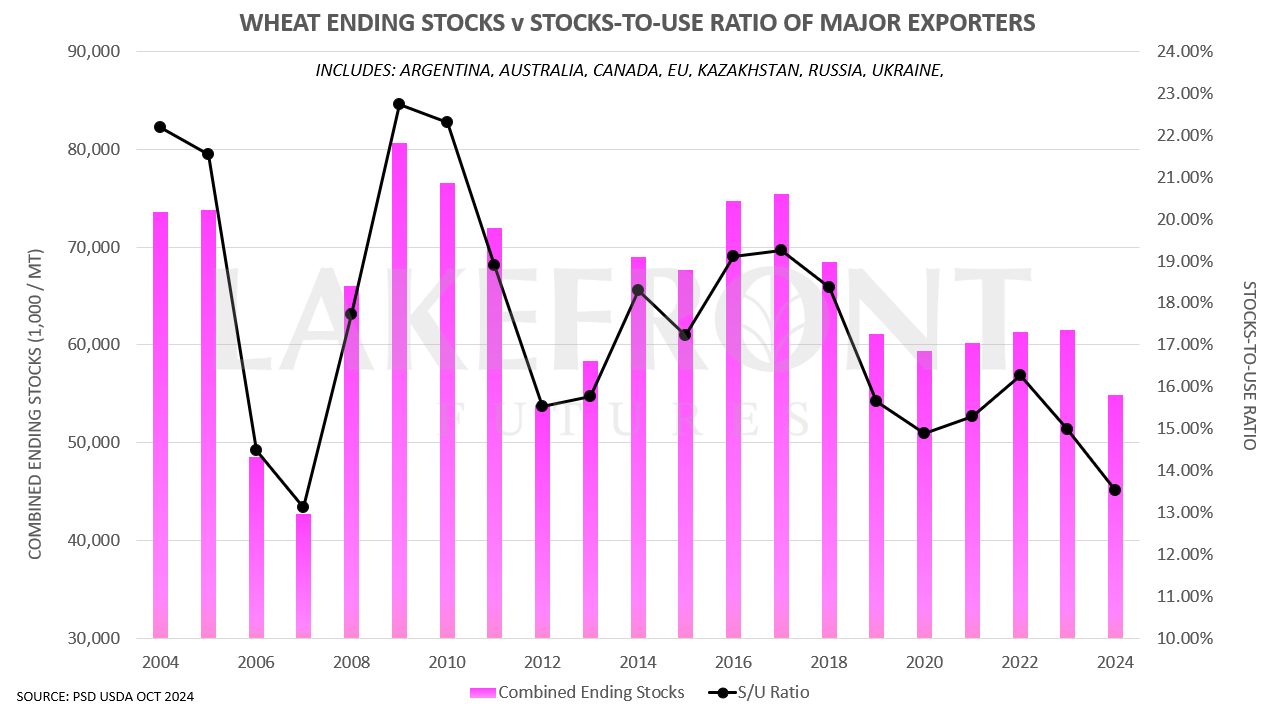

Wheat has the global issues including a poor Russia winter wheat crop along with the stocks to use ratio for major global exporters being the smallest since 2008 and the smallest carryout since 2012.

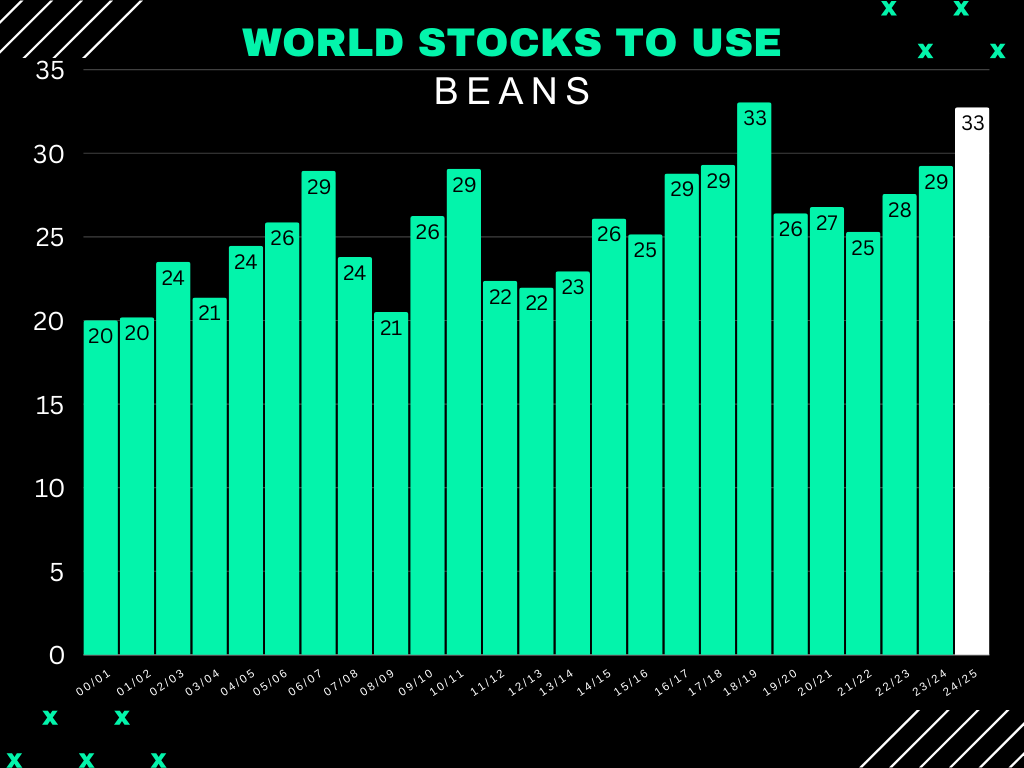

Soybeans on the other hand have one of the most bearish global balance sheets of all-time, barring Brazil produces what the USDA and everyone else thinks they will.

Today we saw a Brazil group named Abiove estimate Brazil bean production at 167.7 million. A huge +9.5% increase from last year's 153.3 million.

Meanwhile Dr. Cordonnier has his number at 166 and the USDA has 169 million.

That's what is weighing over beans head looking long term, but why the weakness today?

One key reason was likely the news that Trump has selected Howard Lutnick to oversee the tariffs and trade war agenda. He has a hawkish stance on China and is pro-tariffs, so this pressured beans a bit.

We also had news that Brazil had agreed to a trade deal with China.

The deal states that it will include sorghum amongst other farm products. But there is no details as to what "other" means. So there is no clarity if this includes grains or not.

Either way, it's not a super friendly headline as it takes some business from the US.

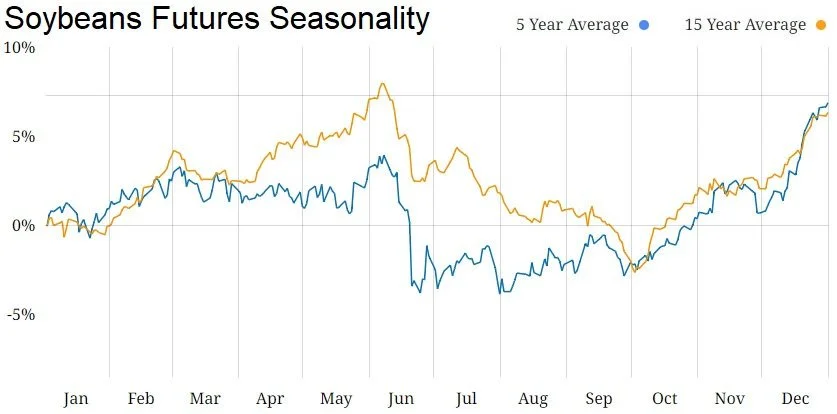

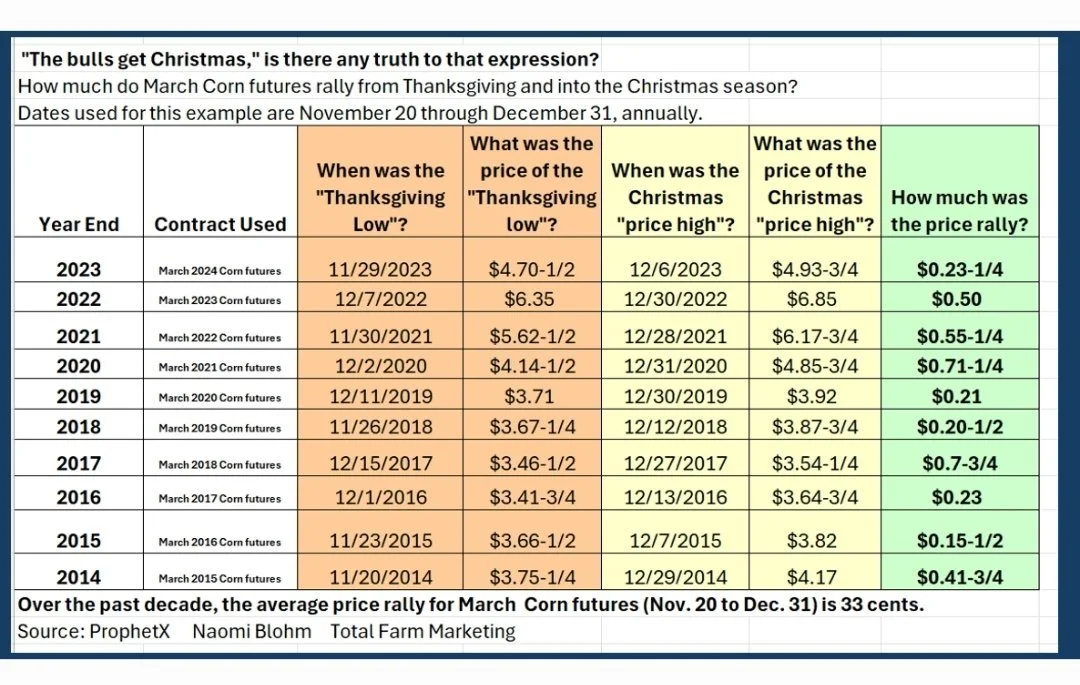

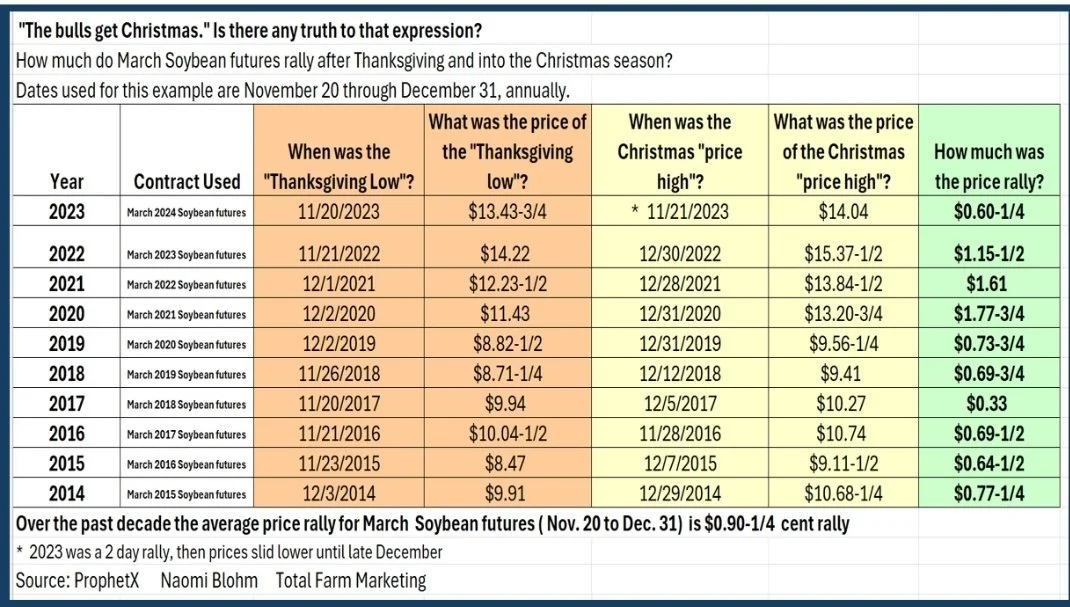

Seasonals Update

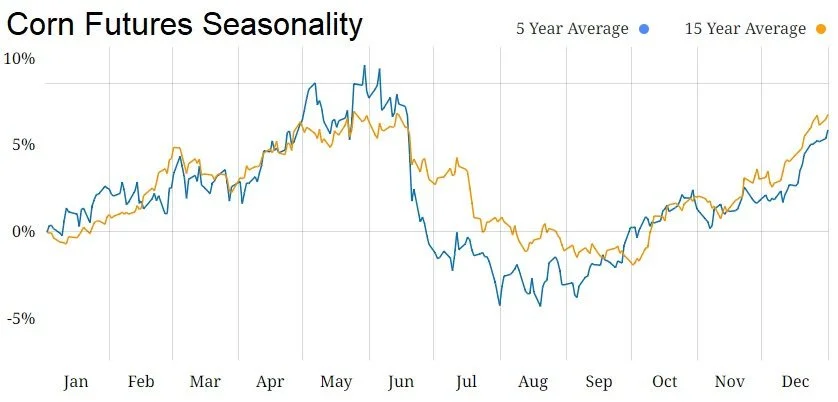

Seasonally, this is the time of year where corn and beans do trend higher.

Do seasonals always work? No.

But they give a good understanding of what "usually" happens and are good to follow.

How much do we usually rally from now until the end of the year?

Below are two great charts that Naomi Blohm put together. It show cases our rallies from Thanksgiving until the end of the year for the past decade.

Corn:

The average rally is +33 cents.

The biggest was 2020's +71 cent rally.

The smallest was 2017's +8 cent rally.

Soybeans:

The average rally is a staggering +90 cents.

The biggest was 2020's +$1.78 rally.

The smallest was 2017's +33 cent rally.

*Notes: Last year in 2023, we only saw a 2-day rally before prices slid lower until the end of the year. Years where we have larger US ending stocks, usually results in a smaller rally.

Does this mean we "have" to rally?

No of course not. It just shows that historically we tend to trend higher until the end of the year.

Take late last year and early this year as an example. We essentially went lower the entire year. It was the first time in 16 years where corn went lower from December until the January USDA report.

Personally, I am a little hesitant to think we will get a major rally out of beans. As this is one of those years we have a large US carryout, then we also have Brazil's monster crop. But that doesn’t mean we can’t get a pricing opportunity.

As for corn, I could very easily see us follow this trend, but we don’t have to.

Today's Main Takeaways

Corn

Another solid day for corn as we inch closer to those recent highs.

Ethanol production came out today. It was slightly lower than last week's all-time record, but it was still a whopping +8.5% higher than last year.

The consensus thought here is that the USDA is going to have to raise their ethanol numbers in the next USDA report.

If this pace continues, it could add a ton of extra demand to our balance sheets.

Very friendly.

Chart from GrainStats

Outside of that, not a ton new on corn.

My bias still leans higher, especially long term.

Short term, yes we do face the possibility that perhaps all of these basis contracts are going to pressure us short term. It depends on how much the farmer does or doesn't have sold. This is probably the biggest tailwind corn faces short term.

Long term, demand is still going to be what leads us higher. Ethanol is amazing. Exports are great.

Not to mention, the funds just flipped long for the first time in 480 days...

They didn’t flip long for no reason.

Looking at the chart, we still remain in an uptrend.

My next current target is still $4.39 to $4.46

Once we reach that level, it is a green light for some of you to re-hedge or make a few sales if you need to.

Soybeans

Soybeans continue to struggle relative to corn.

China bought 200k MT of beans this morning. The last time China bought beans was 12 days ago and it was half that size. The last sale before that was 21 days ago.

So the sale this morning was nice, but China is still taking an approach where they are purchasing the minimum necessary.

All the talk is about the trade war, but in all reality the trade war never went away to begin with.

Biden kept the Trump tariffs and even added more of his own. Does a trade war matter if China isn’t buying anyways?

Of course, it could wind up being really bearish. But it could just as easily create demand.

Personally, I am far more concerned with the monster crop out of Brazil.

If they produce what they are expected to, the world could be swimming in beans.

No one can outguess what Trump will do and how it will affect beans. But we do know that if Brazil has a massive crop it will pressure the market and create a very very bearish global balance sheet.

Short term looking at the next 1-2 months, there is a few things going in the bulls favor.

Seasonally we go higher from here. There shouldn’t be any farmer selling so soon after harvest and at these levels. The US is the only real supplier of beans until Brazil's product is available in late January.

Bottom line, I am looking to spread my risk out on any opportunities we get. As there is still downside risk in beans and not a ton of reasons to get super bullish.

I'd like to see us break that downward trend (blue line) otherwise we are just going to be catching a falling knife.

Wheat

Decent action in wheat, as it's our 4th day higher in a row following last week's lows.

I am not bullish enough short term to call last week's prices a bottom. As we could easily take them out.

But long term, I do still believe wheat has plenty of factors going for it.

From Reuters:

"Russian Farmers Ditch Wheat After Heavy Losses"

Russia has a ton of issues. Many well respected sources are saying their crop will be even smaller than the last.

After the US just supplied missiles to Ukraine. We saw news that Putin said he would consider a nuclear strike on Ukraine.

So perhaps some of this rally is due to war escalation.

Keep in mind, war rallies don’t last. Hence why I am cautious here short term.

Long term, we have the fact that the world has consumed more wheat than it has produced 4 straight years in a row now and world carryout has shrank year after year. The world balance sheet is friendly.

Short term, no this isn't the time of year where anyone needs wheat. So there isn’t really a reason for us to rally out of nowhere outside of an unseen wildcard.

Looking at the chart, so consider calling a bottom I need to see us close above $5.70

KC sitting right below that orange resistance and old support. A close above would look pretty friendly and perhaps spark the discussion of a possible bottom.

We are also poking our head out of this downward channel that we have respected for months now.

Past Sell or Protection Signals

We recently incorporated these. Here are our past signals.

Oct 2nd: 🌾

Wheat sell signal at $6.12 target

Sep 30th: 🌽

Corn protection signal at $4.23-26

Sep 27th: 🌱

Soybean sell & protection signal at $10.65

Sep 13th: 🌾

Wheat sell signal at $5.98

May 22nd: 🌾

Wheat sell signal when wheat traded +$7.00

Want to Talk?

Our phones are open 24/7 for you guys if you ever need anything or want to discuss your operation.

Hedge Account

Interested in a hedge account? Use the link below to set up an account or shoot Jeremey a call at (605)295-3100.

Check Out Past Updates

11/19/24

WHAT’S NEXT FOR GRAINS

11/18/24

WHEAT LEADS THE GRAINS REBOUND

11/15/24

BIG BOUNCE, FUNDS LONG CORN, DOLLAR & DEMAND

11/14/24

3RD DAY OF GRAINS FALL OUT

11/13/24

GRAINS CONTINUE WEAKNESS & DOLLAR CONTINUES RALLY

11/12/24

ANOTHER POOR PERFORMANCE IN GRAINS

11/11/24

POOR ACTION IN GRAINS POST FRIENDLY USDA

11/8/24

USDA FRIENDLY BUT GRAINS WELL OFF HIGHS

11/6/24

GRAINS STORM BACK POST TRADE WAR FEAR

11/5/24

ALL ABOUT THE ELECTION & VIDEO CHART UDPATE

11/4/24

ELECTION TOMORROW

11/1/24

GRAINS WAITING ON NEWS

10/31/24

ELECTION & USDA NEXT WEEK

10/30/24

SEASONALS, CORN DEMAND, BRAZIL REAL & MORE

10/29/24

WHAT’S NEXT AFTER HARVEST?

10/25/24

POOR PRICE ACTION & SPREADS WEAKEN

10/24/24

BIG BUYERS WANT CORN?

10/23/24

6TH STRAIGHT DAY OF CORN SALES

10/22/24

STRONG DEMAND & TECHNICAL BUYING FOR GRAINS

10/21/24

SPREADS, BASIS CONTRACTS, STRONG CORN, BIG SALES

10/18/24

BEANS & WHEAT HAMMERED

10/17/24

OPTIMISTIC PRICE ACTION IN GRAINS

10/16/24

BEANS CONTINUE DOWNFALL. CORN & WHEAT FIND SUPPORT

10/15/24

MORE PAIN FOR GRAINS

10/14/24

GRAINS SMACKED. BEANS BREAK $10.00

10/10/24

USDA TOMORROW

10/9/24

MARKETING STYLES, USDA RISK, & FEED NEEDS

10/8/24

BEANS FALL APART

10/7/24

FLOORS, RISKS, & POTENTIAL UPSIDE

10/4/24

HEDGE PRESSURE

10/3/24

GRAINS TAKE A STEP BACK

10/2/24

CORN & WHEAT CONTINUE RUN

10/1/24

CORN & WHEAT POST MULTI-MONTH HIGHS

9/30/24